The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

1240/5(5184)

WRITTEN QUESTION TO THE MINISTER FOR SOCIAL SECURITY BY DEPUTY G.P. SOUTHERN OF ST. HELIER

ANSWER TO BE TABLED ON TUESDAY 9th MARCH 2010

Question

Following his answer to written question 5130 on 23rd February 2010, will the Minister now give the results of the losses and gains in the ranges requested, of just over 800 reviews of Income Support (IS) conducted this year?

Would he state how many of the 393 applicants whose payments were reduced were on Transitional Protection and have seen their payments reduced without the phasing provided by the Income Support (Transitional Provisions) (Jersey) Order 2008?

Will the Minister explain under what circumstances such a reduction in income at short notice can be justified in the light of the clear intention of the abovementioned Order to protect benefit recipients from such financial shocks?

Answer

Written question 5130 provided an analysis of claims already open on 4th November 2009 that remained open on 2nd February 2010, including those reviewed between 4th January 2010 and 1st February 2010. The extraction of data in the form specified by the Deputy is a manual process and this work has not yet been undertaken in respect of claims reviewed between 2nd February and 19th February.

The data provided in the previous answer relating to claims already open on 4th November 2009 that remained open on 2nd February 2010, indicated that 615 claims have been reviewed and now receive a higher amount compared to November 2009. Of the 393 claims whose payments were reduced, 38 were in receipt of protected transition payments.

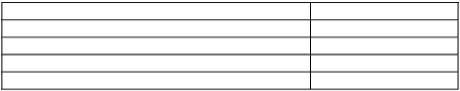

Table – Reduction in weekly payments for claims with transition protection

Change in total weekly payment Number of claims Reduced by £90.00 or more 8 Reduced by £60.00 - £89.99 5 Reduced by £30.00 - £59.99 5 Reduced by £ 0.01 - £29.99 20

Change in total weekly payment Number of claims Reduced by £90.00 or more 8 Reduced by £60.00 - £89.99 5 Reduced by £30.00 - £59.99 5 Reduced by £ 0.01 - £29.99 20

The answer to question 5130 confirmed that the phasing included in the Income Support (IS) (Transitional Provisions) (Jersey) Order 2008 has not yet been applied because households currently in receipt of IS transition are all still receiving 100% protection of their legacy benefits, where they continue to be entitled to the legacy benefits. This does not apply to individuals who are no longer entitled to those legacy benefit.

The clear intention of the IS (Transitional Provisions) (Jersey) Order 2008 is to provide a phased transfer from previous benefits to IS provided that entitlement to the previous benefit remains. There is no intention for the Transitional Order to continue to make payments once entitlement to the legacy benefit has lapsed.

The Income Support (Transitional Provisions) (Jersey) Order 2008 states - Change in entitlement to a protected payment

(1) Where –

- a household is entitled to a protected payment; and

- the circumstancesof the householdchangeso that any replaced benefit,if it had not ceased to be

payable on the appointed day, would nevertheless because of that change of circumstances cease to be

payable,

The top-up sum shall be recalculated by means of the formula –

RRB – RADIS

Where –

RRB is the weekly amount of replaced benefits to which the household would have been entitled immediately before the appointed day had the circumstances giving rise to the recalculation existed on the appointed day;

RADIS is the amount of income support (if any) to which the household would have been entitled on the appointed day had the circumstances giving rise to the recalculation existed on the appointed day.'

The Income Support (Transitional Provisions) (Jersey) Order 2008 is being applied correctly to all IS claims. As the circumstances or income of a household changes it is appropriate for their benefit entitlement to be reviewed. It would not be appropriate for the household to continue to receive the legacy benefit when there is no longer any entitlement under the previous scheme. When there is a change in circumstances this must initiate a review of the claim with benefit levels set appropriately according to current circumstances.