The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

1240/5(5392)

WRITTEN QUESTION TO THE MINISTER FOR SOCIAL SECURITY BY DEPUTY G.P. SOUTHERN OF ST. HELIER

ANSWER TO BE TABLED ON TUESDAY 25th MAY 2010

Question

"Further to his response to a question on 20th April 2010 regarding impairment (personal care) components in Income Support and, given that the personal care component is paid as compensation for increased costs associated with an impairment, does the Minister not consider that to reduce transition protection negates any compensation received?"

Answer

The calculation of Income Support is based on the financial needs of the household being identified through a number of components. Each component is in respect of a particular aspect of the circumstances of the household - for example, a child joining the household gives rise to an additional child component. In the same way, the deterioration of someone's health leading to the need for additional personal care gives rise to eligibility for a personal care component.

Every component of Income Support could be classed as a "compensation" for the increased cost associated with that component. In this respect there is no difference between the personal care component and any other component within the system.

As previously explained, there are three elements of the Income Support (IS) impairment component which provide financial assistance at different levels, depending on the nature and severity of the person's condition, towards the following costs:

Clinical cost

General practitioner visits for people with chronic or progressive medical conditions

Personal care

Care needs, for example: washing, dressing, cooking

Mobility

Transport for people with a medical condition that seriously affects their ability to get around outdoors The table below details the component type and the weekly rate from 1 October 2009.

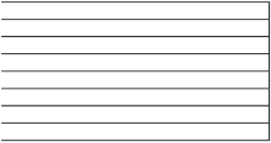

Impairment component types Weekly rate

Impairment component types Weekly rate

Personal care level 1 £22.26

Personal care level 2 £98.14

Personal care level 3 £140.91

Mobility (working person) £44.52

Mobility £22.26

Clinical cost level 1 (5+ annual consultations) £2.87

Clinical cost level 2 (9+ annual consultations) £5.74

In my answer to question 5298 on 20 April 2010 I explained that transition protection exists to provide a phased transfer between previous benefit entitlement and Income Support (IS) entitlement.

![]() To re-iterate, all transition protection is paid above current IS entitlement.

To re-iterate, all transition protection is paid above current IS entitlement.

If IS is increased, the need for transition protection reduces. A successful applicant for an additional impairment component (or any other type of component) will have their Income Support entitlement adjusted in respect of the full value of their new component. In some cases this will result in an adjustment of transition protection.