The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

1240/5(6547)

WRITTEN QUESTION TO THE MINISTER FOR ECONOMIC DEVELOPMENT BY DEPUTY M.R. HIGGINS OF ST. HELIER

ANSWER TO BE TABLED ON MONDAY 12th SEPTEMBER 2011

Question

In light of the current turmoil in international money and capital markets, the problems in the Eurozone, the United States economy and elsewhere, will the Minister inform the Assembly whether all the recommendations of the International Monetary Fund in their report on Jersey entitled IMF Country Report No. 09/282 - Jersey: Financial Sector Assessment Program UpdateFinancial System Stability Assessment' dated September 2009 have been accepted, and, if not, why not, and would he also give members a detailed update on the progress to date of implementing each of the recommendations that have been accepted?

Answer

IMF Country Report No. 09/282 – Jersey: Financial Sector Assessment Programme Update – Financial System Stability Assessment includes a list of the main recommendations arising from the International Monetary Fund's assessment of Jersey in the last quarter of 2008. Recommendations are also made in other reports:

• IMF Country Report No. 09/280 - Jersey: Financial Sector Assessment Program Update Detailed Assessment of Observance of AML/CFT

• IMF Country Report No. 09/281 - Jersey: Financial Sector Assessment Program Update Detailed Assessment of Observance of the Basel Core Principles for Effective Banking Supervision

• IMF Country Report No. 09/283 - Jersey: Financial Sector Assessment Program Update Detailed Assessment of Observance of the Insurance Core Principles

Action plans for all of the recommendations made in these reports were published on the website of the Jersey Financial Services Commission (the "Commission") in March 2010.

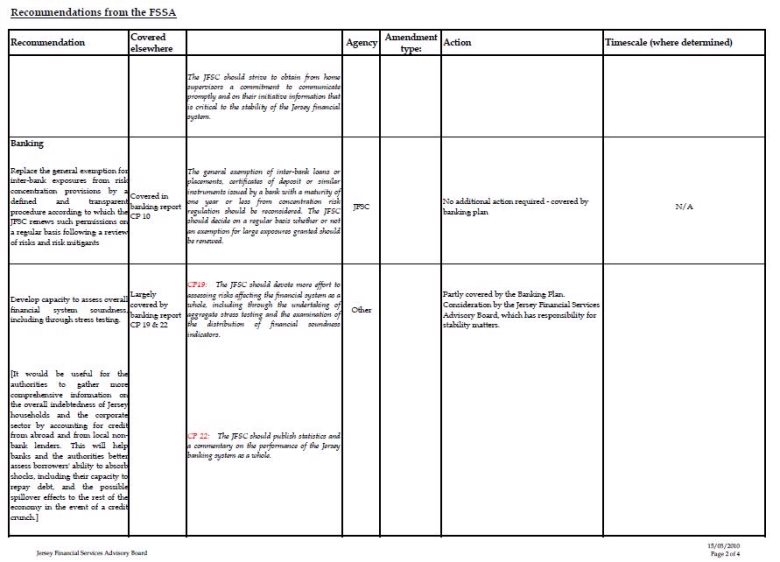

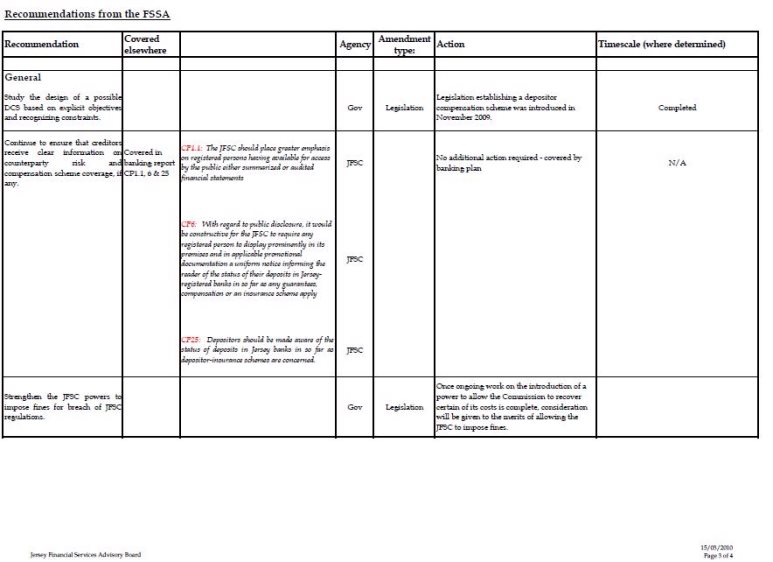

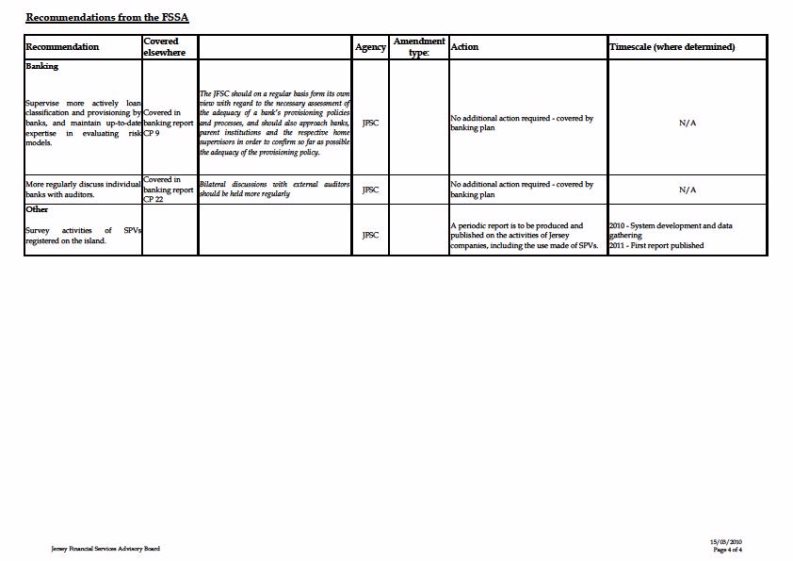

It is clear from the published action plan for report 09/282 (attached to this response) that action was agreed for each of the main recommendations. Good progress has been made with implementing these recommendations. An updated action plan is expected to be published before the end of 2012 and this will provide further detail on progress as requested by the Deputy .

Action taken to date in addressing the main recommendations includes:

• Continued proactive dialogue between the Commission and other regulators, including the attendance of regulatory colleges. The Commission also continues to provide other supervisors with details of banking business undertaken in Jersey and related regulatory issues and seeks assurances that relevant developments will be proactively advised to it by other supervisors.

• Consultation by the Commission on proposals to withdraw the blanket exemption from its large exposure reporting regime of inter-bank exposures under 12 months' duration. These proposals will be finalised soon.

• Commissioning a report on developing the Island's capacity to assess wider financial system risks affecting Jersey.

• Publication by the Commission of more data on the performance of Jersey's banking sector.

• Consultation by the Commission on proposals to improve the availability of financial information on banks, which proposals are expected to be finalised later this year.

• The introduction of a depositor compensation scheme and requirements to disclose its applicability.

• Initial work by the Commission designed to form the basis for consultation over proposals allowing the Commission to impose civil penalties for breaches of regulatory requirements.

• A themed examination programme conducted by the Commission on the adequacy of credit provisioning, the findings of which were subsequently published.

• More formalised dialogue between the Commission and auditors of banks.

• The commencement of a "root and branch" review of the Commission's sensitive activities policy, intended better to highlight those higher risk activities where enhanced due diligence measures will be necessary.