The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

WQ.240/2022

WRITTEN QUESTION TO THE MINISTER FOR TREASURY AND RESOURCES BY DEPUTY R.S. KOVACS OF ST. SAVIOUR

QUESTION SUBMITTED ON MONDAY 24th OCTOBER 2022

ANSWER TO BE TABLED ON MONDAY 31st OCTOBER 2022

Question

In respect of the Government’s revenue forecasts for each year from 2023 to 2026, will the Minister –

- provide a detailed breakdown of the total including any reserve funds left after considering the budget allocations in the proposed Government Plan 2023-2026; and

- identify all lines of forecast income or estimated taxes to be collected, separately highlighting any areas of considered overachievement that have been included and the level of inflation (as a percentage) that was used in those calculations?

Answer

- provide a detailed breakdown of the total including any reserve funds left after considering the budget allocations in the proposed Government Plan 2023-2026; and

The forecast balance in the Consolidated Fund across the Government Plan period is set out on page 74 of the Government Plan (reproduced below).

This includes the forecasted total revenue to be received into the Consolidated Fund, and the budget allocations for both revenue and capital expenditure from the fund, as well as transfers into and out of the Consolidated Fund. The closing balance reflects the estimated remaining amount held in the fund at the end of each forecasted year.

Under Article 9 of the Public Finances Law: "The Council of Ministers must not lodge a government plan that shows a negative balance in the Consolidated Fund at the end of any of the financial years covered by the plan." and the balance left in 2023 will be used to fund capital expenditure in 2024 and 2025.

- identify all lines of forecast income or estimated taxes to be collected, separately highlighting any areas of considered overachievement that have been included and the level of inflation (as a percentage) that was used in those calculations?

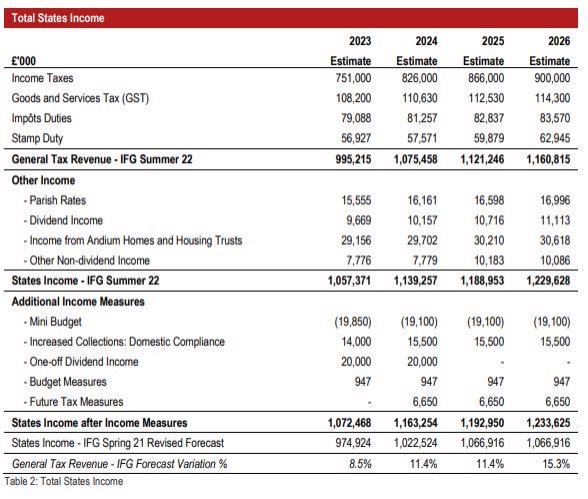

The estimate for total States Income is broken down in the General Revenue Income section of the Proposed Government Plan within table 2, on page 26 (reproduced below). This is based upon the latest forecast from the Income Forecasting Group, produced in Summer 2022. A link to the latest Income Forecasting Group report is found here.

Details of the assumptions used in producing the income forecasts are provided in the latest Income Forecasting Group report, which uses the independent Fiscal Policy Panel (FPP) economic assumptions published in their Medium Term Report - July 2022, reproduced below. The inflation (RPI) assumptions are also included on page 5 of the Income Forecasting Group – Summer 2022 Forecast.

The Income Forecasting Group, produce a forecast range using higher and lower adjustments to the FPP economic assumptions, this is set out in section 5 of the IFG report. The forecast used in the Government Plan is the central scenario.