The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

States Greffe

Deputy Ian Gorst

Minster for Treasury and Resources 19-21 Broad Street

St Helier

Jersey

JE2 3RR

BY E-MAIL

2nd October 2023

Dear Minister,

Corporate Services Scrutiny Panel Government Plan 2024 - 2027

I write to inform you that the Corporate Services Scrutiny Panel has agreed to undertake a review of the Proposed Government Plan 2024-2027 [P.72/2023]. Attached to this letter are the Terms of Reference for the Panel’s review, and a list of the revenue expenditure growth and capital and other projects allocated to the Panel’s remit.

We intend to begin our work immediately and shall hold public hearings with you and the Chief Minister. In addition, we shall seek the views of industry professionals and the general public to collect evidence and insights into the Proposed Government Plan 2024-2027.

We hope that the evidence we gather, and our final output will help inform the work of Government for the Proposed Government Plan 2024-2027. I would be happy to address any questions you may have regarding the Panel’s work for this review.

Yours sincerely,

Deputy Sam Mézec

Chair, Corporate Services Scrutiny Panel

Government Plan 2024 – 2027 Scrutiny Review Corporate Services Scrutiny Panel

Terms of Reference

- To review components of the Government Plan 2024-2027 Proposition [P.72/2023] which are relevant to the Corporate Services Scrutiny Panel to determine the following:

- The impact of the Government Plan proposals on departmental budgets, savings and staffing levels.

- Whether the revenue expenditure growth, capital and other projects are appropriate and likely to have a positive impact on Islanders and Island life.

- How the proposed revenue expenditure growth, capital and other projects align with the Common Strategic Policy to deliver on the priorities, and with the objectives of the Ministerial Plans.

- Whether the resources allocated to revenue expenditure growth and capital and other projects are sufficient, ensure value for money and demonstrate best use of public funds.

- To assess the expected impact on the ongoing delivery of public services, by Minister, through rebalancing of Government finances.

Budget

• To examine income raising, borrowing and debt management proposals.

• To explore how spending will be funded.

• To clarify how States expenditure has materially evolved.

• To ascertain individual departmental budgets and their feasibility based on future spending.

• To examine the deliverability of capital projects.

• To consider rebalancing and borrowing plans being sufficient or excessive to meet stated aims.

• To examine the use of the Revolving Credit Facility.

Financial, economic and growth forecasts

• To examine the levels of income against expenditure.

• To examine the assumptions made for the economic forecasts.

• To explore the impact of the financial and economic forecasts in the Proposed Government Plan on the Stabilisation Fund.

• To explore any continued impact of Covid-19 on the ‘financial envelope’.

Design and implementation of the Government Plan

• To assess reserves; their use, and how they are allocated.

• To consider how the treatment of contingencies/reserves, or any other areas of non-routine proposals have evolved in respect of the Proposed Government Plan.

• To consider the overall fiscal soundness of the Proposed Government Plan.

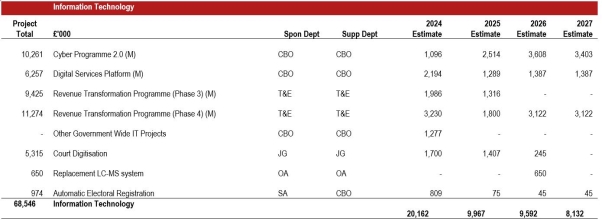

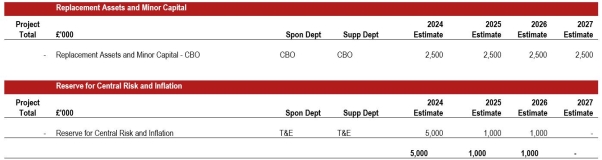

Government Plan 2024 – 2027 Capital and other Projects and Revenue Expenditure Growth