The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

19-21 Broad Street | St Helier Jersey | JE2 4WE

By email

22nd November 2023

Dear Chair,

Thank you for your letter of 20th November, in which you provide a number of questions in relation to the Government Plan. I have set out answers to each of these in turn below:

I-DFE-GP24-001 Implementation of Digital, Visitor Economy and Elite Sport Strategies

- How was the required revenue expenditure for the Implementation of the Digital, Visitor Economy and Elite Sport Strategies calculated and quantified, given that the application would have been undertaken prior to the completion and publication of those strategies?

As set out in my letter of 13th November, at this stage the breakdown of spend against each strategy is indicative based on the anticipated demands of each strategy and are subject to change.

It should be noted that the Performance Sport Strategy was published earlier this month.

- Will this funding provide for recruitment of staff or additional grants to delivery arms?

- You mentioned funding to Visit Jersey in our hearing of the 25th October: please can you identify if this is related to the proposed revenue expenditure for these strategies?

It is anticipated that a small part of the funding earmarked for the implementation of the Performance Sport Strategy will be used to recruit a “Performance Manager” to coordinate grant funding, establish pathways, lead on training and deliver against the strategy.

Excluding this position no additional FTEs are anticipated and the funding is not an uplift to the budgets of ALOs. Spend will be carefully targeted to achieve maximum impact to deliver against the three strategies mentioned above.

- Will additional funding be made to Digital Jersey through this proposed increase in revenue expenditure?

No.

I-DFE-GP24-002 Rural and Marine Economy

- Noting the adopted proposition P.74/2023 Funding to agriculture and fisheries, can you please outline implications to the proposed Rural and Marine Economy expenditure?

a. You identified in your letter of the 13th November that of the originally proposed £1.15 million, £850,000 was apportioned for the Rural Support Scheme, and £300,000 was apportioned for the Marine Support Scheme, roughly a 74-26 percent split. What is the anticipated distribution proportion between agriculture and fisheries of the additional funding to be made available following P.74/2023?

The breakdown will be as follows:

Rural Support Scheme (RSS): £6,000,000 Marine Support Scheme (MSS): £700,000

- The financial and staffing implications of the third amendment identify that £3 million would need to be found, mentioning the “Value for Money” target. Can you identify what measures are being considered in meeting the funding requirement?

The Council of Ministers will shortly be bringing forward an amendment to the Government Plan to give effect to P.74/2023. This will outline the funding proposals for the additional £3 million required.

- The recent Fiscal Policy Panel identifies that the Stabilisation Fund and Strategic Reserve should be replenished leaving Jersey increasingly vulnerable to a serious economic downturn, what actions will the Economy Department be taking to minimise the use of the Strategic Reserve as a source of the additional Funding to agriculture and fisheries?

i. Would a reduction in the strategic reserve for use in this manner risk a reduction in the Islands credit rating, further impacting upon the economy?

Further to the above, funding proposals will be outlined in the amendment to the Government Plan.

- Has consideration of amending the proposed Government Plan to lower other proposed Revenue Expenditure bids been considered? If so, in what way?

The amendment to P.74/2023 made clear the need to increase the value for money targets to offset the additional expenditure required by the proposition. No revenue expenditure bids are due to be withdrawn as a result of this decision and further to the answer to question 4, individual Departments will be seeking to deliver against their value for money targets.

- Last year the Panel received an anonymous submission highlighting that the necessity for membership of UK farming bodies such as LEAF and Red Tractor acted as a barrier for entry for many small farmers as the membership costs were “extortionate”. Has consideration been given to providing grants in order for smaller farmers to attain these accreditations in the first instance prior to further grants through the Rural Initiative Scheme?

LEAF and Red Tractor memberships are competitively priced and offset by the credits available under the Rural Initiative Scheme, as an example, Red Tractor memberships start at £64 and would make a business eligible for £1,462.50 in rural support credits.

LEAF memberships start at £121 and provide for £3,705 in rural support credits.

Additional credits worth over £4,000 are offered for the completion of the integrated farm management plans which are offered by Red Tractor and LEAF.

Officers have also been in discussions with LEAF to explore establishing a new membership category for small and micro farms with further announcements anticipated in 2024.

I-DFE-GP24-003 Jersey Business – Core Grant Funding

- Can you confirm that Jersey Business has met or exceeded its stated KPIs for 2022 and 2023 to date?

The Jersey Business Annual Report for 2022 outlines the KPI framework and associated outcomes. JBL RAG-rates its KPIs and provide rationale for any amber or red items. JBL continues to review activity and establish continued need/demand for specific support – where necessary reducing or re-designing support aligned to need/demand and targeting resource to other areas. As at Q3, JBL is on track with the majority of its KPIs, as outlined above, some will not fully meet the target aspired to at the start of the year as activity and resource is re-focused during the course of the year to better meet emerging need and better reflect demand.

- In your letter of the 13th November you identify that Jersey Business can offer support in reshaping business plans to downsize or safely close. How do you know that the businesses would not have learnt to save costs in other ways and that funds are not being used to support ‘zombie’ companies?

a. Does support of such businesses tie up staff members that could otherwise be beneficial to successful companies struggling to recruit in the tight labour market?

The services provided by Jersey Business are across the entire lifecycle of a business and conducting a Business ‘health check’ at any point in that cycle is the right and responsible thing to undertake. This ensures the advice and support provided is appropriate for the need of the business at that point in time, and in the future. Ultimately a business would not approach JBL for help and support to downsize or close if it was not required, there is no incentive for doing so, but it is entirely right that support should be provided to these businesses to downsize or exit ‘safely’ given the catastrophic impact it can have on livelihoods and families, not only of the business owner, but equally of any employees. This represents a small number of businesses as a proportion of the total supported by JBL and therefore does not ‘tie up staff’ to the detriment of other businesses.

- A recent Government of Jersey blog identifies that there was a negative 4% growth in the Island’s productivity outside monetary intermediation (rise in interest rates) in finance, does this suggest that Jersey Business is producing no meaningful change in GVA?

As the panel will recognise, the impact of interest rates on productivity growth produces a disproportionately positive effect in the financial services sector, more specifically as you have outlined, in banking. This growth is driven predominantly by external factors and it is recognised that wider productivity issues outside of this outlier (including other areas of financial services) are not performing as we would like and also are not a short-term fix.

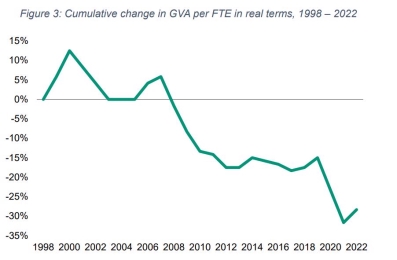

The below graph, taken from the Strategy for Sustainable Economic Development, shows that productivity has fallen across all sectors since 1998 and indeed (outside of the COVID pandemic) the sharpest decline in productivity was between 2006 and 2011, immediately before the establishment of Jersey Business.

Jersey has predominantly relied on increased labour to continue economic growth and, as outlined in the Future Economy Programme, that is unsustainable. Jersey Business supports all businesses, regardless of sector, size or maturity to be able to adopt technology, adapt and innovate, becoming more efficient and productive. In doing so it enhances the resilience of local companies, develops leadership skills and delivers meaningful change programmes.

- In your letter you identify that Jersey business has a mailing list reach of circa 2500 contacts: can you outline how it interacts with the roughly 8200 businesses in Jersey, the majority of which will not be part of that contact list?

- As you identify 89% of the Island’s businesses have fewer than 9 employees, which it is believed to be the target of Jesey Business (i.e., small/medium enterprises), why do you believe they may not be interacting with the organisation?

Over 60% of JBL’s clients have fewer than 9 employees.

The most recent Labour market statistics from June 2023 outline that there are 8310 ‘active’ undertakings that employ staff, including single-person undertakings (which make up 57%). What those figures are not able to provide however is the number of unique ‘UBO’s of those undertakings (Ultimate Beneficial Owner). It is entirely likely that a number of the 8310 undertakings are owned/managed by the same UBO, or, for example, a number of the single-person undertakings will be ‘lifestyle’ or ‘hobby’ businesses and not the main source of income or livelihood of an individual. Therefore the addressable ‘market’ for JBL’s support amongst that 8310 number may be significantly reduced. It should also be mentioned that for many businesses, their circumstances will dictate whether they seek out support – when the ‘going is good’, they will not proactively look for help.

JBL already has a reach of approximately 2500 businesses and in many cases will work with both Government and other business forums such as the Jersey Chamber of Commerce to increase its reach as well as holding ‘industry’ sessions in particular work areas, where industry leaders will represent a number of businesses and provide feedback to the industry – good examples of this include its work on Productivity and Barriers to Business.

- Can you identify what is an addressable business in regard to Jersey Business?

Jersey Business will support any business which requests support, regardless of sector and at any point in its lifecycle.

- Given that, in a recent survey, results of which are available on their website, Jersey Business identified, that most companies (52.3%) already feel they are optimising opportunities to increase productivity and that the greatest potential for improvement within their organisation is to motivate staff to engage, motivate and empower staff, to what extent is investment in Jersey Business realistically (a) capable of reversing decline in productivity in the economy outside finance and (b) running counter to the message to companies to invest in technology to product growth?

The statistic that is referred to, from the results of the 2023 Productivity Survey identifies that 53% of the respondents thought their organisation was optimising opportunities to increase productivity. That is to say just over half of respondents’ organisations had been able to identify some opportunities and optimise those identified opportunities. What that does not confirm is whether those organisations have identified all of the possible opportunities nor how they first identified opportunities – they may in fact have been supported in this by Jersey Business. The statistic also makes it clear there remain a significant proportion (just under half) of businesses who may not be optimising opportunities and therefore still require support and guidance in how to do so.

The same survey outlined two areas as offering the largest potential for improvement – engaged employees and process efficiency. This is precisely where Jersey Business’ support is targeted and where it adds value through programmes such as Leading Growth and Business Improvement, supporting staff to identify improvements, implement change, maximise opportunities and develop leadership skills to be able to take staff on the journey. Businesses need to be in a position that they can make and embrace changes with confidence and skill and many still require the support of Jersey Business to do so.

The Jersey Business website provides a number of case studies that support the positive outcomes delivered for businesses by JBL.

- In your letter of the 13th November you identify that Jersey Business will be exploring additional avenues for supplemental funding outside of its government grant. Please can you confirm if no alternative funding from commercial partners, sponsors or business relationships was included in consideration of the proposed revenue expenditure?

Government determines policy and strategy aligned with Ministerial priorities and ALOs such as Jersey Business are ‘commissioned’ to deliver against those priorities, on Government’s behalf. JBL is fully funded by Government to undertake the agreed work programme each year as part of the Business Planning process. The consideration of other avenues of funding, such as sponsorship or partnership in 2024 is not intended to supplement its Government funding but support it to be able to maximise both activity and funding.

Jersey Opera House

- It appears there has been some delay in the Jersey Opera House project given that the expenditure is now anticipated to continue to 2025 when it was previously anticipated to be completed during 2024; what are the reasons for this?

The contract with the main contractor was signed on 21st November 2023, with a completion date of 21st December 2024. Assuming no delay, this is when the property will be handed back.

At the time of drafting the Government Plan the 2024 completion date was considered to be at risk however it is now anticipated that the full amount will be drawn down, and work completed, by the end of 2024. Officers will work with Strategic Finance to bring forward the funding allocated for 2025 into 2024.

- The Project total of £11.731 million remains unchanged; can you confirm that inflationary, or other further costs, will not create a need for an increase in funding?

The agreed project total is now £12,731 million. This takes account of an increased element of mechanical and electrical works, covering such items as decarbonisation measures and additional works which came to light following further investigation of existing building services by the design team. The additional £1m has been secured by the Minister, from the Department for the Economy’s 2023 existing budgets

- The Economy Department was the supporting Department identified in last years plan: this is now indicated as the Infrastructure and Environment Department; can you outline the reasonings for this change?

The Department for the Economy remains the Sponsoring Department and the Department for Infrastructure and Environment the Supplying Department

Sports

- The Panel has received a submission from the Jersey Sports Association for the Disabled which identify lack of provision for gymnastics, indoor football, martial arts and wheelchair basketball. How are these gaps to be addressed?

Having reviewed the response by the Jersey Sports Association for the Disabled, responses to each point raised are set out by the Sports Division below.

- Since the start of 2023 a dedicated space within the Queens Hall at Fort Regent was created for the sole use of Jersey Special Gymnastics Club. Storage space was also included in the offering. Jersey Special Gymnastics Club requested being able to use the facility for 12.5 hours which was granted in their agreement but no restriction was applied to this being increased if they so wished. All aspects of safeguarding were discussed with Jersey Special Gymnastics Club at the time and additional infrastructure was purchased and installed for this space to satisfy the club.

Additionally, the Government has a new dedicated gymnastics facility being installed as part of the plans for the refurbishment and improvements to Oakfield Sports

Centre. Jersey Special Gymnastics Club has been offered the use of this facility once completed.

- Whilst not indoors, there are now multiple artificial football pitches on the island both in the facilities run by the Government, those run by schools and in the private sector. In addition to this most indoor football is played in sports halls of which many exist again in the facilities run by the Government, those run by schools and in the private sector.

- No evictions have taken place at Fort Regent.

- Wheelchair Basketball is presently played at Les Quennevais Sports Centre on a Monday evening between 8pm & 9pm. There is no hire charge levied by Active to the JSAD for the Sports Hall . There is opportunity within the current sports hall programming at Les Quennevais Sports Centre for this to increase but no request has ever been received for additional evenings or daytime use.

The trampoline store at Les Quennevais Sports Centre has been utilised by the JSAD for the storage of basketball wheelchairs, balls and other equipment for many years, again without charge. Wheelchair basketball is now also being played at the new sport hall at

Beaulieu Convent School.

- What is status of Inspiring Active Places, noting the lack of proposed funding in the previous Government Plans and the funding granted last year?

Once the new sports hall at Oakfield is built this will complete the projects that were funded within the original Inspiring Active Places strategy.

A new interim plan (IAP2) is currently being drafted. This will prioritise further work within the context of the current economic climate. IAP2’s focus will be on maintaining and enhancing our current sports facilities stock and using on island talent and resources to deliver this.

Technology Accelerator Fund / Impact Jersey

- The Panel understands that there is a proposed transfer from the Technology Accelerator Fund to the Consolidated Fund: can you please outline the purpose of that transfer?

Transfers out of the TAF are proposed to fund the Government’s Digital Service Platform, which aims to support further digital transformation of customer facing public services, including the creation of an online service hub and integration of online government systems. Council of Ministers agreed that the TAF would be an appropriate funding source for the Digital Service Platform, with the intention that transfers are paid back to the fund at a later date (beyond 2027).

- There is also proposed programme expenditure of circa £4.1 million per year to 2026. Can you confirm that this is enough to enable the success of the Technology Accelerator Programme, Impact Jersey?

A 3-year programme of £12.5 million expenditure for the TAF has been forecaste by the delivery partners Digital Jersey with a review in 2026 to assess the next phase of the programme and arrange transfers back to the Technology Fund in future Government Plans to match when they are needed.

- The 2027 estimate for the fund anticipates no spending on the programme and a £1.3 million transfer to the consolidated fund: can you please identify the reasoning behind this?

Please see answer to question 16a.

- Would this funding not be better used in meeting the CSP 2023-2026 priority to: “Develop a more sustainable, innovative, outward-facing and prosperous economy”?

The programme of expenditure for the TAF will enable Impact Jersey to deliver against this CSP priority with future transfers back into the TAF intended to ensure the full £20m committed to within P.75/2022 is delivered.

- Will the Impact Jersey programme be wound up in 2026?

No.

- As you hold overall political responsibility for the Technology Accelerator Fund, can you please confirm that the transfer of to the Consolidated Fund is in line with the agreed Terms of Reference of the Fund as identified in P.75/2022?

I believe that this transfer is not outside of the agreed Terms of Reference and am content that it will not impact the delivery of the Impact Jersey programme and that future transfers back into the TAF will ensure that the full £20m committed to in P.75/2022 is delivered by Impact Jersey.

Unsuccessful bids

- The Panel questioned unsuccessful bids identified in WQ.371/2023. Can you confirm that to your knowledge this included all bids, or were those that were purely inflationary grant requests by Arm’s Length Organisations excluded?

The answer to WQ.371/2023 was prepared by the Department for Treasury and Exchequer but to my knowledge it included all growth bids.

- In your correspondence of the 13th November you identify that the unsuccessful bid “Development of Jersey as a Regional Economic Hub” sought funding to build upon existing work to enhance Jersey’s economic and connectivity links with the near abroad and particularly Northern France. Can you please outline the existing work that had been undertaken?

Commercialising Jersey’s strong international connectivity regionally – by way of a so-called “hub” model – was developed conceptually through a high-level of engagement with regional governments in northern France early in 2023. It is critical that any tactical interventions towards this objective are fully analysed and set within the context of an overarching strategic vision. To that end, the Ports Policy Framework (PPF), published for consultation on 10th October 2023, now provides a platform to “position Jersey Airport as a Regional Hub within the Channel Islands and Northern France”.

Details of specific discussions with specific partners are commercially sensitive.

- Why was the Jersey Heritage Trust Pre -87 Pension Deficit not funded given the potential ongoing cost to Jersey Heritage and the concerns it expressed in its submission regarding covering inflationary costs, which you identify as a significant portion of its annual grant?

In reaching their decisions the Council of Ministers have had to balance the competing needs of different departments with the availability of resources and the deliverability of priorities. In this particular case, the Pre-87 debt, whilst a long-term risk to Jersey Heritage Trust, is not an immediate threat to the sustainability of the ALO. It is therefore anticipated that a similar bid will be made in a future Government Plan when the availability of resources allows for this long-term issue to be addressed.

Duty

- The Panel has been in correspondence with Randalls who have questioned the reasoning behind the rise in alcohol duty, we also understand the Jersey Hospitality Association has raised concerns. What actions have you undertaken to ascertain and mitigate the impact upon the Island’s economy for duty increases?

I have been engaging closely with the hospitality sector to understand their concerns around the proposed increase in duty. I have also taken these discussions forward with the Minister for Treasury and Resources to explore options for duty relief, these options remain under consideration by the Council of Ministers.

Beer in the UK incurs 50p of alcohol duty on a standard pint (at 4.2% alcohol by volume), as well as 20% VAT on the selling price. The same pint in Jersey incurs 40p of duty and 5% GST on the selling price (if the beer has been imported from larger producers). Locally-produced beer benefits from a 50% reduction in the duty rate – so pays just 20p in alcohol duty on a standard pint.

In 2024, the Government Plan proposes that an imported pint from a larger brewer will bear 44p duty; and a locally-brewed pint will bear 22p.

- Should the Council of Ministers separate the way alcohol duty is charged to allow for exemption or lower rates to be imposed on the hospitality sector (or a rebate to be available to hospitality businesses)?

Ministers have been considering what duty relief might further help the hospitality sector in addition to the generous relief provided for locally-produced wines, spirits. beer and cider. Excise duty is charged relatively soon after production (at the “brewery gate” or on importation) and is blind to its end use which makes it a highly efficient tax. Any rebate system based on end use (eg sale in an “off-licence” or in a public house) would likely require a repayment scheme involving compliance costs for businesses and administration costs for Government.

- Similarly, should exemption of duty increases be provided to businesses on other duties, such as fuel, in order to support the Island’s economy?

Similarly, fuel duty is charged at importation and any rebate scheme would involve compliance and administration costs of the sort we see with “red diesel”. The Council of Ministers and States Assembly further have to balance competing priorities around reaching “net zero” while supporting businesses.

I hope the above provides clarity to the areas you have raised. Yours sincerely,

Deputy Kirsten Morel

Deputy Chief Minister

Minister for Economic Development, Tourism, Sport and Culture E k.morel2@gov.je