The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

Government Plan 2024-27 Review

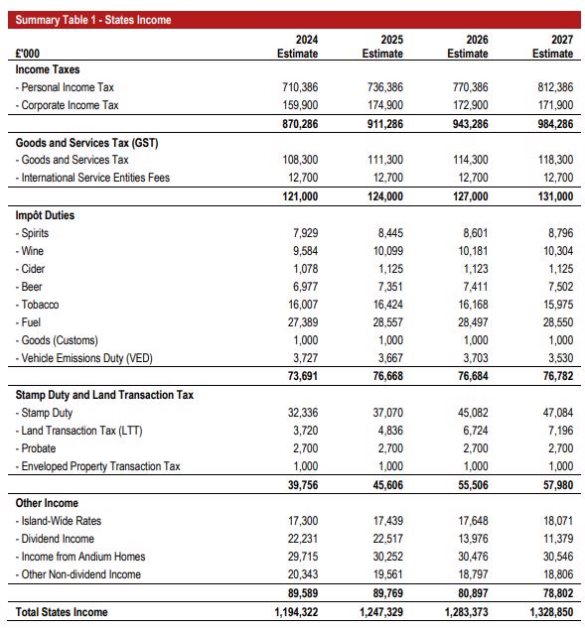

Corporate Services Scrutiny Panel

5th December 2023 S.R.4/2023

![]() Contents

Contents

Chair's Foreword ................................................................................................................................ 1 Executive Summary........................................................................................................................... 3 Key Findings ....................................................................................................................................... 7 Recommendations ........................................................................................................................... 12 Context ............................................................................................................................................. 15 Review Methodology ..................................................................................................................... 16

Report Structure ............................................................................................................................. 17 2 Government Programme ........................................................................................................ 19 Design .............................................................................................................................................. 19 Alignment ......................................................................................................................................... 19 Transparency and Accountability ................................................................................................. 22 Accessibility ..................................................................................................................................... 25 Legal Obligations ............................................................................................................................ 29

3 Financial Strategy - Income and Expenditure .................................................................. 33 Economic and Fiscal Context ....................................................................................................... 33 Income ............................................................................................................................................. 42 Expenditure ..................................................................................................................................... 74

4 Value for Money Programme ................................................................................................ 84 5 Projects and Revenue Growth Allocations ....................................................................... 86 Projects and Revenue Growth Allocations: Chief Minister ...................................................... 88 Projects and Revenue Growth Allocations: Minister for Treasury and Resources .............. 94

6 Balance Sheet and States Funds ....................................................................................... 100 Finance and Borrowing ............................................................................................................... 100 States Funds ................................................................................................................................. 104

7 Conclusion ............................................................................................................................... 111 Appendix 1 ....................................................................................................................................... 113 Appendix 2 ....................................................................................................................................... 116 Appendix 3 ....................................................................................................................................... 117

For this second review of a Government Plan in this term of office, the  Corporate Services Scrutiny Panel was able to pick up where we left off last year and hit the ground running. We have followed up on the recommendations from our report last year and examined how the Government Programme has developed in that time. We are pleased to present this second report, and hope that it will help inform the continued evolution of this process.

Corporate Services Scrutiny Panel was able to pick up where we left off last year and hit the ground running. We have followed up on the recommendations from our report last year and examined how the Government Programme has developed in that time. We are pleased to present this second report, and hope that it will help inform the continued evolution of this process.

Whilst some of our recommendations on the presentation of the Government Programme have been taken forward (such as the timing of the publication of the Annex and the production of a summary document), it feels like we are sadly still in a position where many Islanders are not as engaged with this process as we may hope for in a democratic system.

We found whilst engaging with Islanders at a pop-up stall in a local supermarket, it was clear that the Government Plan was not widely identified as the important annual political debate that it is. Once we had overcome the hurdle of explaining to people what the Government Plan is, they were not shy in giving us feedback on the proposals as they became aware of them. It is clear that more could be done to establish the Government Plan in the wider consciousness of the public.

Each Scrutiny Panel has reviewed the elements of the Government Plan that affect their portfolio areas, whilst the Corporate Services Scrutiny Panel has conducted the overarching review. Our report provides detailed commentary on many of the specific proposals which come under our remit for examining.

Whilst each of the individual proposals in the Plan will be subject to a variety of different political views, there is one area that remains a big concern to this panel which we hope the government will treat as seriously as possible, and that is the issue of efficiency savings. Nobody, no matter what their politics are, can make a credible principled argument in favour of inefficiency. We all want our government to operate efficiently, so that it can get the best value possible out of taxpayers' money to fund the best possible quality of public services for us all to enjoy. But it is important that any drive to deliver efficiencies is realistic and does not leave departments under pressure to cut back services if those efficiencies do not materialise.

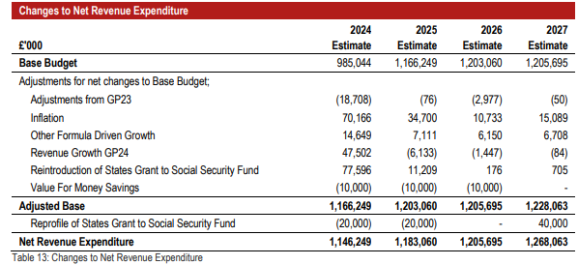

The latest iteration of an efficiencies programme in government is called the "Value for Money Programme". It aims to deliver £10m of savings in each year of the Plan. As with last year, this Plan only attempts to indicate what the distribution of savings across the different departments will be in the first year of the Plan, whilst keeping a £10m target for subsequent years with no detail whatsoever.

Last year, the Fiscal Policy Panel recommended against including speculative savings in the Government Plan, because of the risk it would pose to departmental budgets if those savings were not made. The Corporate Services Scrutiny Panel reiterated this recommendation to the Minister and are disappointed to find that the same approach has been adopted again this year, which has provoked the Fiscal Policy Panel to have to repeat their recommendation to the government again.

The Fiscal Policy Panel is an independent body made up of highly regarded and well qualified individuals whose expertise we should be grateful to benefit from. Their recommendation against including speculative savings in the Government Plan is sound, and it is our view it should be heeded. That is why we have lodged an amendment to the Government Plan to require the government to give much greater clarity on this programme and give confidence to States Members that we are not unwittingly approving cuts to services, but delivering on the genuine efficiencies that everybody wants to see.

Lastly, our Panel was very grateful to all the stakeholders we approached who provided specific responses to us, as well as members of the public who gave their feedback. Perhaps the most enjoyable and enlightening part of conducting this review was the time we spent one evening with members of the Jersey Youth Parliament. Their perspective was extremely valuable to us, and we hope to continue to include them when we review subjects which may be of interest to them.

It was disappointing to find out that they had not been proactively approached by the government whilst they produced the Plan itself and had only connected with them after we had met with them. This gave the impression of them being an afterthought. We have a special responsibility to Jersey's young people to build an Island society where they can all flourish. The Jersey Youth Parliament was set up to help transmit their views and aspirations directly to the heart of our government system. So, we should all ensure we work with them for that purpose.

![]()

Deputy Sam Mézec

Chair of the Corporate Services Scrutiny Panel

The proposed Government Plan 2024-2027 [P.72/2023] (hereafter the Government Plan) was lodged on 19th September 2023 for earliest debate on 12th December 2023. Accompanying this year's Government Plan are the Financial Annex 2024-2027 and Ministerial Plans 2024. The Delivery Plans 2024 are due to follow early next year. These components together make up the Government Programme, a fresh approach which commenced with the new Government term in 2022.

The Corporate Services Scrutiny Panel (hereafter the Panel') launched its review of the Government Plan on 4th October 2023. The Panel's focus has been, in the main, on reviewing the Proposition where relevant to the Panel's remit in respect of the responsibilities for the Chief Minister and Minister for Treasury and Resources. However, consideration has also been given to any overarching themes as appropriately identified during the review process.

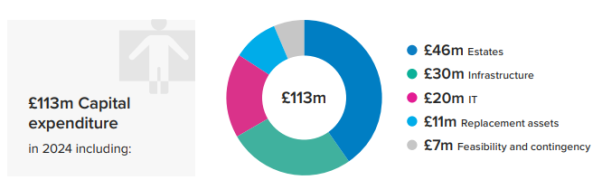

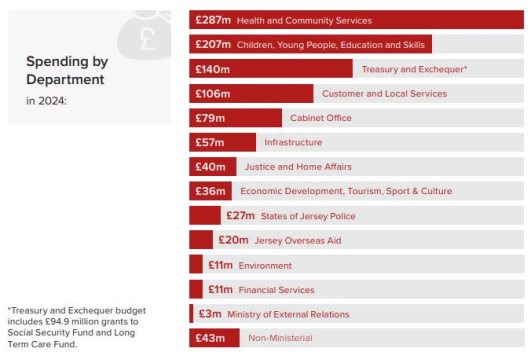

The review considered the Government Programme design, income and expenditure (for 2024), Value for Money Programme, funding proposals for Projects and Revenue Growth Allocations (under the Panel's remit) as well as States borrowing, investments and Funds. Moreover, due regard has also been given to the requirements of the Public Finances (Jersey) Law 2019 and the Draft Finance (2024 Budget) (Jersey) Law 202- which will give effect to the revenue measures proposed within the Government Plan.

Government Programme

One year on from delivering the Government's budget as part of a Government Programme, the Council of Ministers is content that the process is working well. The Panel observed that measures were being taken to improve the core outcome indicators of the Performance Framework, alongside providing support to departments to improve service performance measures. It is anticipated that collectively these improvements will deliver more focus when designing future Government Plans.

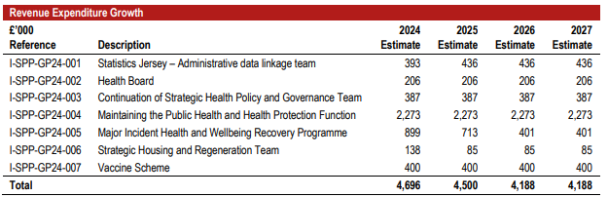

The Panel has observed that through the Revenue Growth Allocation – Statistics Jersey – Administrative Data Linkage Team, it is anticipated that statistics to determine duration-related data for low-income individuals and households may be possible. This would action a recommendation made by the Panel when reviewing the previous Government Plan and would provide a means to assess progress related to poverty in Jersey.

The Panel has identified that, although steps have been taken to improve the accessibility of the Government Plan, by providing a summary document – Government Plan in Brief, this measure was not appropriately promoted by the Government and has therefore not delivered on its aim to improve accessibility of the Government Plan to the public. The Panel was disappointed to observe that, although work had been undertaken to develop a child-friendly version of the Government Plan, it was not published at the time of presenting this report. Neither had the Government reached out to the Jersey Youth Parliament to engage with its members on the Government Plan or to hear its members' views on the proposals. As a result, the Panel has recommended that for future Government Plans, the Government must engage with Jersey's Youth Parliament in their capacity as a link between Jersey's young people and the Government on the Government Plan process and its purpose. Moreover, the Panel has recommended that the child-friendly version of the Government Plan must be published alongside the Government Plan and that appropriate measures must be taken to communicate and promote it to children and young people.

The Panel notes that some design improvements have been made in this Government Plan, including through the addition of a ministerial mapping table within the Financial Annex, which is intended to better align head of expenditures to ministers and strengthen ministerial lines of accountability. However, further improvements could be made by including narrative of ongoing expenditure and business-as-usual workstreams in the Government Plan and Delivery Plans. The Panel was disappointed to observe that the 2023 funding figures were not displayed against each item in all the tables within the Government Plan and highlights that this diminishes transparency and makes comparing budgets across the years for the Government term challenging. The Panel has therefore recommended that for all future Government Plans, all tables must include the figures of the preceding year to improve budget comparison, transparency and accountability. Also, that consideration be given to how narrative for ongoing expenditure and business-as-usual workstreams can be demonstrated within the Government Plan and Delivery Plans to provide further clarity.

The Panel was pleased to observe the presentation of the Minister for Treasury and Resource's report for the first Classification of Functions of Government (COFOG) on 21st November 2023, as this was highlighted in the Panel's previous review and delivers on the previous States Assembly's adoption of P.94/2029 – States' Expenditure Classification in Accordance with International Best Practice. Following best practice standards, this intends to improve transparency of resource allocation trends and Government expenditure to provide enhanced financial transparency and accountability.

Moreover, that the Minister for Children and Education presented report 174/2023 – Childs Rights Impact Assessments – Proposed Government Plan 2024-2027 to address the areas identified within the Government Plan for which a CRIA should be completed. The Panel emphasises the necessity for further commitment by the Council of Ministers and the States Assembly in this area to encourage the progressive realisation of children's rights as required by the United Nations Convention on the Rights of the Child and has therefore recommended that the Council of Ministers considers how CRIAs can be completed on the proposals for future Government Plans.

Financial Strategy – Income and Expenditure

When considering Jersey's economic and fiscal strategy, the Panel has observed that the outlook for global growth over the next few years has weakened with the ongoing geopolitical tensions creating risk and uncertainty. In addition, global inflation is declining more slowly than previously expected and rising interest rates have subdued global growth but have had a positive result on profits and growth for Jersey's banks. The elevated inflation is an ongoing risk for Jersey and is particularly affecting the most disadvantaged in our society. Furthermore, low productivity growth and an ageing population continues to place pressure on Jersey's fiscal position and the high cost of housing continues to inhibit economic growth and productivity and is also contributing to the challenges for recruiting and retaining workers in Jersey. The Panel has recommended that due regard be given to the sufficient provision of targeted support to Islanders significantly affected by the continuing cost-of-living crisis, with particular focus on the most disadvantaged of our society.

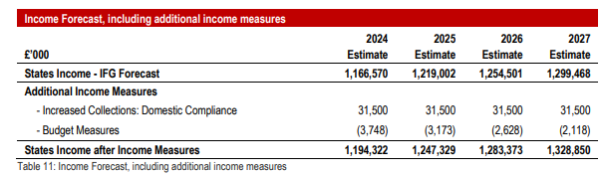

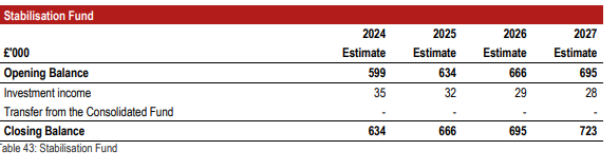

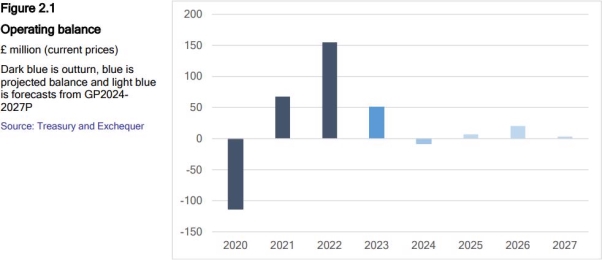

The Panel has identified on the basis of the Government's current spending commitments and forecast tax revenues that there will be a primary budget deficit in 2024 and 2025. It is highlighted that the Reserves (Stabilisation Fund and the Strategic Reserve Fund) are not at sufficient levels, despite the current and recent past strength of the Government revenues as noted by the Fiscal Policy Panel (FPP). Although, the Social Security Fund appears to be in a good position, the Long-term Care Funds are likely to be exhausted by 2040.

As significant uncertainty remains in relation to the increasing levels of inflation, the Panel has observed that the Government has allocated an additional £70 million for 2024 to address the inflationary pressures.

The Panel has found that the Covid-19 debt has been repaid in 2022, however, the financial and resourcing implications remain unclear in respect of the major emergency incidents that have occurred in Jersey in the past 11 months. It was the view of the FPP that any unspent balances as a result of repaying the Covid-19 debt early should be allocated to the Stabilisation Fund at the year end. However, the Panel has observed that a decision on how the unspent funds will be used will need to be considered in reflection of the forecast spend for the emergency incidents. Notwithstanding this, the Panel has recommended that consideration should be given to how unspent balances can be allocated to the Stabilisation Fund to replenish its much-depleted balance.

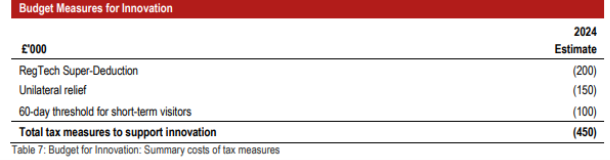

The Panel has observed that the proposals for new budget measures to support enterprise and innovation appear to be positively received by the financial services industry. Notwithstanding this support, the Panel has recommended that enhanced procedures are put in place to ensure that the existence of potential conflicts of interest and the mitigation actions taken are recorded. In addition, that proper monitoring and reporting for this pilot programme is undertaken. Concern has been raised regarding the proposals to increase alcohol duties under the current economic conditions in respect of the potential effect on the hospitality industry.

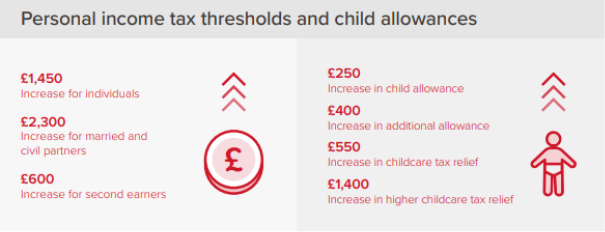

The Panel found that appraisals, in the main, are not undertaken on the budget measures including for the allowances thresholds implemented in the previous year to identify their outcome in that year or to inform the budget proposals to take forward in the subsequent Government Plan. This is concerning, so the Panel has recommended that modelling exercises to identify the outcomes of the revenue raising measures on businesses, the economy, Islanders and Island life should be undertaken by the Treasury and Exchequer ahead of delivering all future budget measure proposals. The Panel has also recommended the need for early stakeholder engagement on the proposals to appropriately inform them prior to the lodging of future Government Plans. Particularly, as concern has been raised regarding the considerations of future tax measures including the charges for liquid waste and their potential affect, should these not be appropriately informed.

Value for Money Programme

Last year, the previous Government Plan proposed a new Value for Money (VFM) Programme, aimed at delivering savings across Government departments. The Panel evaluated the proposed VFM Programme in the previous and this Government Plan considering, how the estimated savings are evidenced, the effect thereof, and how the Government proposes to deliver, monitor, and govern the Programme. The Panel identified that, similarly to the previous, this Government Plan also includes speculative savings amounts for 2025 and 2026 without any information on how these will be achieved. Considering that the Panel was neither satisfied with how its previous recommendations were addressed in 2023, nor within this Government Plan, the Panel has lodged an Amendment[1] to address its concerns. The Panel has also recommended that all future Government Plans must distinguish the specific areas and projects to which VFM savings are attached, include reporting on all VFM savings which were made during the duration of the Government Plan and identify and provide full details of the monitoring process that has been undertaken on the VFM Programme during the duration of the previous Government Plan.

Projects and Revenue Growth Allocation

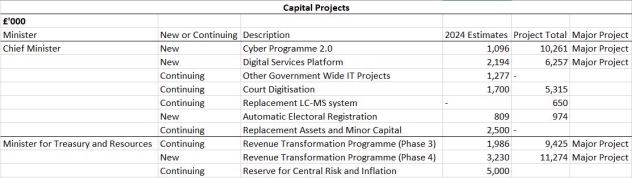

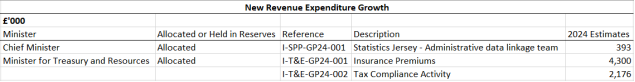

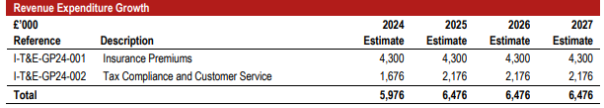

When undertaking high-level analysis of the Capital Projects and New Revenue Growth Allocations as appropriate to the remit of the Chief Minister and Minister for Treasury and Resources, the Panel considered the progress to date, rationale for changes in projected funding, tangible benefits to Islanders and Island life and any effect on departmental budgets and resources. This year, the Panel received the business cases for the Revenue Growth Allocation items in confidence prior to the lodging of the Government Plan. However, found that very limited detail of the proposals was provided within the Government Plan which effects the transparency of the Revenue Growth Allocations for 2024. As such, the Panel has recommended that the Council of Ministers must consider how to improve transparency of the Revenue Growth Allocations by including more detail on the proposals in the Government Plan and by publishing the business cases within the public domain, in a transparent manner, albeit, in a redacted form to maintain confidentiality when required.

The Panel observed that resourcing pressures continue across the Government departments and give rise to a level of uncertainty in the delivery of projects within the specified timeframes and the agreed funds. The Panel notes that these pressures are further exacerbated by the continuing cost-of-living and high inflationary pressures which require increased pay costs to recruit and retain the skills and expertise required within a competitive labour market.

Balance Sheets and States Funds

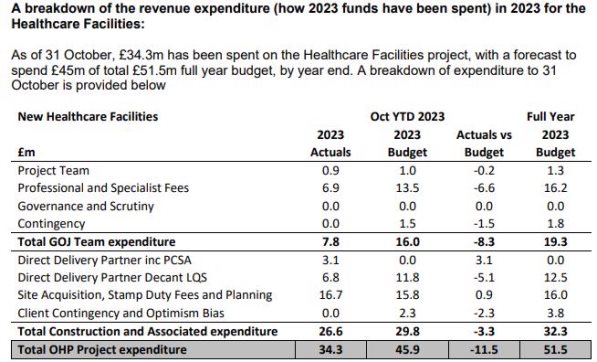

The Panel found that short term debt has been repaid as recommended by the FPP and that the debt for the New Healthcare Facilities project will be a long-term debt. The FPP highlights that although it is anticipated that the project will not cost more than £710 million, the funding strategy is due to be developed in 2024 and is not accounted for in the forecast for Jersey's debt-to-GDP ratio.

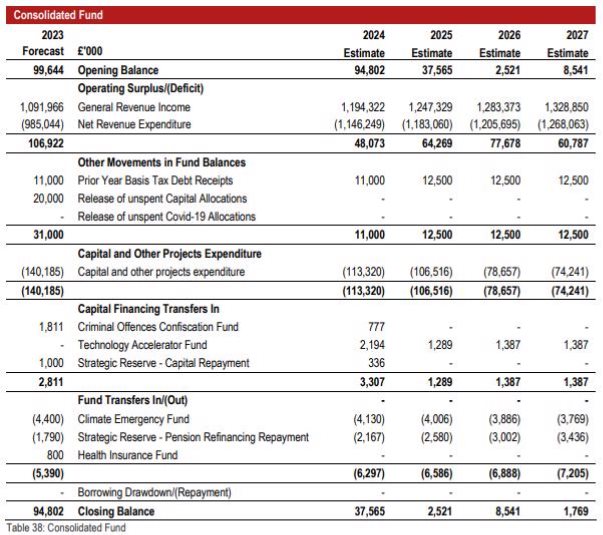

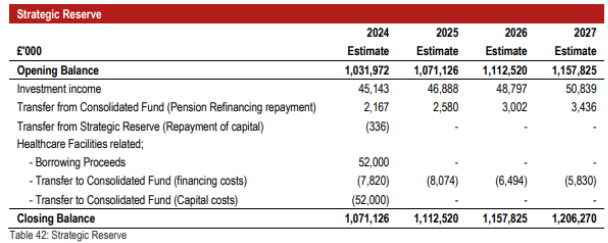

During its review the Panel focused its consideration on the Consolidation Fund, Stabilisation Fund and the Strategic Reserve Fund, in the main. The Panel identified that the FPP continues to raise concern regarding the depleted levels of the Stabilisation Fund and the Strategic Reserve Fund. The FPP also highlights its disappointment that a stronger commitment was not taken by the Government to replenish the Reserves during the current recent strength of the Government's revenues. The Panel notes that this Government Plan seeks approval for up to £25 million in 2024 to be transferred to the Stabilisation Fund, subject to the availability of funds. However, it does not commit to any transfers. In light of the above the Panel has recommended that the Council of Ministers must strengthen its commitment to prioritise the transfer of future surpluses to the Stabilisation Fund and Strategic Reserve Fund to rebuild the Funds to appropriate levels. Moreover, that a shorter term, renewed policy action plan must be developed to replenish the Stabilisation Fund and Strategic Reserve Fund and this must be addressed within the next Government Plan. In addition, all Prior Year Basis receipts must be ringfenced and transferred to the Strategic Reserve as they arise.

The Panel's review has resulted in one Amendment, which can be viewed in Appendix 2 of this report, 45 Findings and 25 Recommendations. 11 of the Recommendations made are overarching and are supported by the other four Scrutiny Panels. These can be viewed in the section below.

KEY FINDING 1: The view of the Council of Ministers is that the new Government Programme model for presenting the Government's budget is working well, however, focus is now being placed on how to improve the refinement of ministerial priorities to ensure their effective delivery.

KEY FINDING 2: The summary document – Government Plan in Brief – provided alongside the Government Plan sets out the themes and their deliverables to provide a more helpful, easy to follow and digest summary of the Government's aims and actions for delivery through the Government Plan.

KEY FINDING 3: The utilisation of the Performance Framework in the creation of the Government Plan was unchanged from how it was used to develop the previous Government Plan. However, further work is being undertaken to refine and improve the core outcome measures and indicators of the Framework. Alongside work to support departments to improve service performance measures, it is anticipated that collectively these improvements will deliver more focus and precision when designing future Government Plans.

KEY FINDING 4: Through the Revenue Growth Allocation – Statistics Jersey – Administrative Data Linkage Team - it may be possible to produce statistics on the patterns to determine duration related data for individual and household low income including by sex, ethnicity and/or nationality. This could be used for assessing progress related to poverty in Jersey.

KEY FINDING 5 A ministerial mapping table is included within the Financial Annex to the Government Plan to better align head of expenditures to ministers and to strengthen ministerial lines of accountability. However, narrative for ongoing expenditure and business- as-usual workstreams is not available in the Government Plan.

KEY FINDING 6: The 2023 funding figures are not displayed against each item in the tables within the Government Plan. This diminishes transparency and makes it challenging to compare budgets across the years for the Government term.

KEY FINDING 7: The rationale for presenting the Delivery Plans subsequent to the debate and approval of the Government Plan is an operational decision. It is the view of the Council of Ministers that proceeding in this way is the most respectful of the democratic process.

KEY FINDING 8: The annual progress reports are provided in confidence to each Scrutiny Panel in December of each year. These reports are not provided in the public domain. The provision of these in December provides no benefit to the Scrutiny process for the Government Plan which in undertaken prior to December each year.

KEY FINDING 9: Although progress has been made to enhance the accessibility of the Government Plan through the production of the summary document – Government Plan in Brief - and work is being undertaken to develop a child-friendly version (not published at the time of presenting this report), the Government Plan remains inaccessible to members of the public, including children and young people. The Government has not successfully communicated and promoted the Government Plan, therefore, any progress made through the production of the summary document, has not achieved its intended aim to improve accessibility.

KEY FINDING 10: Timely engagement with Jersey's youths to inform them of the Government Plan process and to provide an opportunity to hear their views did not occur.

KEY FINDING 11: The term Government Plan and its purpose is not widely understood by the public. The term Government Budget appears to be a more familiar and recognisable term.

KEY FINDING 12: The Minister for Treasury and Resources presented the first Classification of Functions of Government (COFOG) report on 21st November 2023, covering the spending in 2021 and 2022. This highlights resource allocation trends and Government expenditure to provide enhanced financial transparency and accountability. This delivers on the previous States Assembly's adoption of P.94/2029 – States' Expenditure Classification in Accordance with International Best Practice.

KEY FINDING 13: The statutory factual requirements of the Government Plan in respect of the Public Finances (Jersey) Law 2019 appear to be appropriately included. Narrative is included on pages 17-23 of the Government Plan to articulate the Government's approach to sustainable wellbeing, which is an improvement on how this information was delivered in the previous Government Plan. The information provided this year aims to demonstrate a broader perspective of how sustainable wellbeing cascades through the Government Plan.

KEY FINDING 14: The Minister for Children and Education has presented report 174/2023 – Childs Rights Impact Assessments – Proposed Government Plan 2024-2027. The report addresses the areas identified within the Government Plan for which a CRIA should be completed. The Minister emphasises her commitment to the progressive realisation of children's rights as required by the United Nations Convention on the Rights of the Child.

KEY FINDING 15: The outlook for global growth over the next few years has weakened slightly with ongoing geopolitical tensions creating risk and uncertainty. Global inflation is declining more slowly than previously expected and rising interest rates have subdued global growth but have had a positive effect on profits and growth for Jersey's banks. Elevated inflation is an ongoing risk for Jersey. Low productivity growth and an ageing population (looking to be addressed by the Future Economy Programme) will continue to place pressure on Jersey's fiscal position. High cost of housing continues to inhibit economic growth and productivity and is contributing to the challenges for recruiting and retaining workers in Jersey.

KEY FINDING 16: On the basis of the Government's current spending commitments and forecast tax revenues, there will be a primary budget deficit in 2024 and 2025. Jersey's net asset position as a percentage of Gross Value Added (GVA) has declined since the previous Government Plan and is expected to fall further by 2027. The Reserves (Stabilisation Fund and the Strategic Reserve Fund) are not at sufficient levels despite the current and recent past strength of the Government revenues. The Social Security Fund appears to be in a good position. However, the Long-term Care Funds are likely to be exhausted by 2040.

KEY FINDING 17: Global and United Kingdom inflationary pressures continue to affect the Jersey economy and are particularly impacting the most disadvantaged in society. This is a principal risk that the Government is aware of, thus ensuring that it remains on the Corporate Risk Register.

KEY FINDING 18: Significant uncertainty remains in relation to the increasing levels of inflation. In contrast to what was reflected in the previous Government Plan, the Government now expects higher levels of inflation to persist for longer which will result in additional improvement in forecasts for Government income, however, will also place pressures on Government expenditure and Islanders' finances. It appears that due regard has been given to the potential risk of prolonged high inflation and the impact thereof on Government, through the additional £70 million allocated to address inflationary pressures during 2024.

KEY FINDING 19: The Covid-19 debt was repaid in 2022 and the Fiscal Policy Panel has recommended that any unspent balances could be allocated to the Stabilisation Fund at the year end. There is estimated to be an £18 million underspend and considerations for how this underspend will be used will take place at the end of the year. Further, no funding allocation has been made in the Revenue Heads of Expenditure for 2024 for Covid-19 Response and Recovery. However, the forecast for emergency incidents-including operation Spire and Nectar - is forecast to exceed £16 million, which will need to be considered when reallocating any Covid-19 unspent balances.

KEY FINDING 20: The financial and resourcing implications remain unclear in respect of the major emergency incidents that have occurred in Jersey in the past 11 months.

KEY FINDING 21: Jersey's current economic position is impacting the most disadvantaged of our society.

KEY FINDING 22: The decision taken by the Council of Ministers to not halt the phased removal of mortgage interest tax relief to provide targeted support to Islanders was resultant of the view that mortgage tax relief fosters inflation in the housing market and runs contrary to equitable treatment of the tax system between homeowners and those renting homes.

KEY FINDING 23: Although Inflation has peaked and is forecast to fall steadily, higher prices are affecting households who face an elevated cost of living. With many mortgage holders protected by fixed rates the full effect of the interest rate rises has not been felt yet but will materialise as these fixed deals come to an end.

KEY FINDING 24: The Treasury and Exchequer department will undertake a formal policy evaluation of the rent-a-room tax relief in 2024, however, it requires data to be gathered which is not currently taking place.

KEY FINDING 25: Appraisals, in the main, are not undertaken on the budget measures. This includes how allowance thresholds are implemented in the previous year to identify their impact in that year or to inform the budget proposals to take forward in the subsequent Government Plan.

KEY FINDING 26: Significant concerns have been highlighted by the hospitality industry regarding the impact of the alcohol duties proposals on the industry. Particularly as the industry is expecting further significant cost increases in 2024 as a result of utility price increases, wage increases and increasing costs to recruit and retain staff.

KEY FINDING 27: It is the view of health professionals that increasing the cost of alcohol and tobacco products will help to advance the public health goals in reducing their consumption. Therefore, fiscal measures are being used to advance public health outcomes.

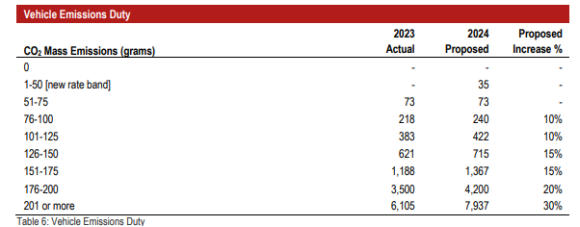

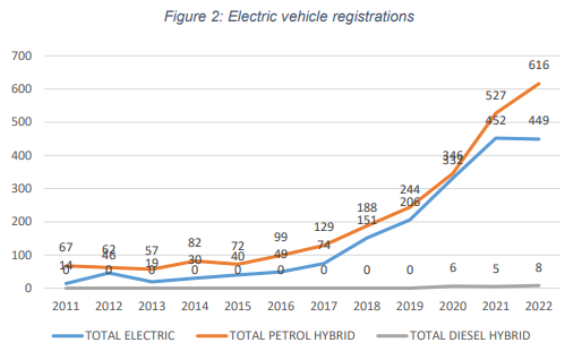

KEY FINDING 28: There appears to be stakeholder support for the proposal to include hybrid and electric vehicles that emit emissions within the Vehicle Emissions Duties framework.

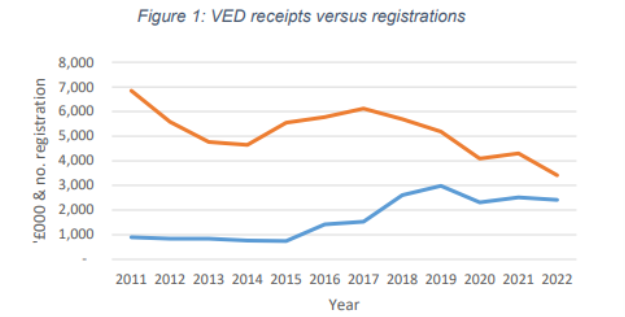

KEY FINDING 29: The causal relationship between the rising Vehicle Emissions Duties and the electric car shift is complicated by price and income factors. However, there appears to be an overwhelming shift toward smaller engine sizes and more fuel-efficient vehicles registered in Jersey.

KEY FINDING 30: Stakeholder engagement by Government was undertaken on the Regulatory Technology proposal. The adoption of Regulatory Technology is a priority for the financial services industry, however, several barriers to adoption exist (including cost). The industry is supportive of initiatives that seek to remove the barriers to adoption to support efforts in maintaining compliance, reducing and mitigating risk and improving operational efficiency.

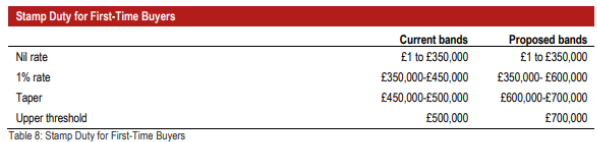

KEY FINDING 31: Some modelling has been undertaken to inform the Income Forecasting Group in identifying the stamp duty forecasts within the Government Plan. However, the forecasts for stamp duty are suppressed currently and the major changes being proposed for 2024 are for first-time buyers. The stamp duty review is very delayed. It will now include consideration for the wider Housing Strategy to identify any fiscal levers which could assist in achieving the aims of that strategy.

KEY FINDING 32: The review process to identify the taxation levels and changes for High Value Residents is not sufficiently evidenced and fails to convincingly substantiate the proposals. Neither does it measure the impact of the proposals, in particular their impact on the property markets and property price distortion, which remains unclear.

KEY FINDING 33: The hospitality industry is concerned about the potential significant impact of any future liquid waste charges on the industry, should the proposals not be appropriately modelled and evidenced, with regard to their impact on the economy and businesses.

KEY FINDING 34: A continued focus of the States Employment Board (SEB) will be strategic workforce planning, which will consider how any headcount implications of growth should be managed to reduce the impact on the wider labour market and to rationalise the number of funded posts that continue to remain vacant.

KEY FINDING 35: The use of any unspent reserve budgets at the end of 2023 will likely be allocated to cover the overspends within the department for Health and Community Services of up to £29 million.

KEY FINDING 36: As part of the Value for Money Programme, the Government Plan includes speculative savings amounts for 2025 and 2026 without any information on how these will be achieved, which directly contradicts the recommendations made by the Fiscal Policy Panel. The Panel has lodged an amendment to remedy this in future Government Plans.

KEY FINDING 37: Although the business cases were provided to Scrutiny in confidence for the Revenue Growth Allocations, very limited detail on these is provided within the Government Plan.

KEY FINDING 38: The Records Transformation Programme (formally known as Electronic Document Management Solution) is in the early stages of procurement, and whilst the estimated funds should be sufficient to complete the programme, the overall funding for the project was set prior to recent increases in inflation and so the programme is managing a risk that funding may be insufficient and determining mitigating actions. Furthermore, a risk of delay has been identified for this Programme, should the procurement process take longer than anticipated.

KEY FINDING 39: The detailed planning for Replacement Assets and Minor Capital for the Cabinet Office will commence in January 2024 as the budget is tight and prioritisation will need to take place.

KEY FINDING 40: Given that the renewal dates for the insurance premiums for 2024 are after the Government Plan approval there is a risk that adverse changes in market conditions may further affect the insurance premiums. It is highlighted that those currently unknown risks are difficult to quantify at this time. It is expected that insurance premiums will continue to have pressure applied to them during 2024.

KEY FINDING 41: Staffing and resourcing challenges across Government departments give rise to a level of uncertainty in the delivery of projects and programmes within the specified timeframes and within the agreed funds. These pressures are further exacerbated by the continuing cost-of-living and high inflationary pressures which require increased pay costs to recruit and retain the skills and expertise required also in a competitive labour market.

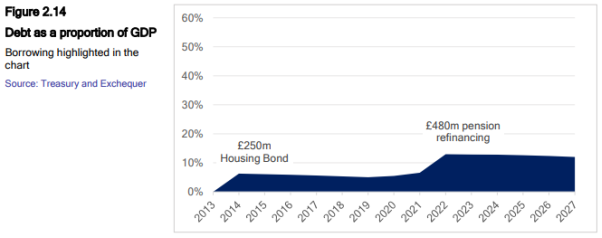

KEY FINDING 42: Short term debt has been repaid, as recommended by the Fiscal Policy Panel, and the debt for the New Healthcare Facilities project will be classified as a long-term debt. The FPP highlights that although it is anticipated that the project will not cost more than £710 million, the funding strategy is due to be developed in 2024 and is not accounted for in the forecast for Jersey's debt-to-GDP ratio.

KEY FINDING 43: The Government is undertaking work to ensure Funds' objectives are clear and that policies are adjusted in line with the objectives.

KEY FINDING 44: The Stabilisation Fund and Strategic Reserve are depleted and require urgent replenishing. The Government has not observed the recommendations made by the Fiscal Policy Panel in the 2021 and 2022 Annual Reports to build reserves through transfers to the Stabilisation Fund and Strategic Reserve. The Fiscal Policy Panel has emphasised its disappointment that a stronger commitment was not taken to replenish the reserves during the current recent strength of the Government's revenues. Although the Government Plan seeks approval for up to £25 million in 2024 to be transferred to the Stabilisation Fund, subject to the availability of funds, it does not commit to any transfers. The FPP strongly recommends that this commitment is strengthened and incorporated into the Government Plan.

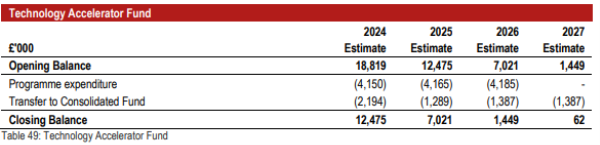

KEY FINDING 45: The transfer from the Technology Accelerator Fund into the Consolidated Fund to fund investment in the Government's Digital Services Platform may not be stipulated within the Terms of Reference of the Fund. However, it would be permissible for the States Assembly to decide to transfer money between the Funds, regardless of the Fund's Terms, as Public Finances Law provides that power to the States Assembly.

RECOMMENDATION 1 (OVERARCHING): The Council of Ministers must ensure that in all future Government Plans, all tables include the figures of the preceding year to improve budget comparison, transparency and accountability. Consideration should be given to how narrative for ongoing expenditure and business-as-usual workstreams can be demonstrated within the Government Plan to provide further clarity.

RECOMMENDATION 2 (OVERARCHING): The Council of Ministers should in the Delivery Plans for 2024 and all future Delivery Plans, include narrative of the workstreams of departments, including detail of ongoing expenditure and business-as-usual, so that the Government can transparently demonstrate how taxpayers' money is spent for delivering services and projects.

RECOMMENDATION 3 (OVERARCHING): The Council of Ministers must publish a mid-year progress report in future years prior to the lodging of the Government Plan by the deadline of 31st August each year. The report must include progress updates on all projects and programmes, detail on how the funding has been allocated to date, whether the delivery is on track and to be delivered by the identified timescale and within the budget allocated.

RECOMMENDATION 4 (OVERARCHING): The Council of Ministers must publish within the public domain the annual progress reports provided to Scrutiny Panels by Ministers by the deadline of 31st December of each year to improve transparency and accountability of the Government Plan process for the delivery of projects within the approved funding allocations.

RECOMMENDATION 5 (OVERARCHING): The Council of Ministers must consider how the accessibility of future Government Plans can be further enhanced for members of the public. Consideration should be given to the terminology used (including for the title) and how to improve the comprehension of it and its purpose.

RECOMMENDATION 6 (OVERARCHING): The Council of Ministers must engage with Jersey's Youth Parliament in their capacity as a link between Jersey's young people and Government on the Government Plan process and the purpose of the Government Plan. This should be done as soon as possible after the lodging of future Government Plans so that young people's views can be heard and used to inform any amendment process to the Government Plan.

RECOMMENDATION 7 (OVERARCHING): The Council of Ministers must ensure that the child-friendly version of the Government Plan is published alongside the Government Plan and Ministerial Plans for future Government Plans and that appropriate measures are taken to communicate and promote it to children and young people.

RECOMMENDATION 8: The Council of Ministers in future Government Plans should review the managing risk' section to ensure that it appropriately reflects the high-level risks to delivering priorities in the Government Plan rather than focussing, in the main, on a smaller sample of risks identified from the Corporate Register. As there are clear links between risks, priorities and the Government Plan response, especially regarding overarching sustainable wellbeing.

RECOMMENDATION 9 (OVERARCHING): The Council of Ministers must for future Government Plans consider how Children's Rights Impact Assessments can be completed on the proposals for which CRIAs should be completed due to their impact on children and young people. This will strengthen the commitment of the Council of Ministers and States Assembly by ensuring that the best interests of children and young people remain integral to the Government decision making process.

RECOMMENDATION 10: The Council of Ministers should consider allocating any unspent balances from the Covid-19 response and recovery allocations to the Stabilisation Fund at year end 2023 in accordance with the Fiscal Policy Panel's recommendation. The Stabilisation Fund is much depleted and must be replenished.

RECOMMENDATION 11: The Council of Ministers must ensure that due regard is given to the sufficient provision of targeted support as appropriate to Islanders impacted the most by the cost-of-living crisis, with focus on those Islanders that are most disadvantaged in our society.

RECOMMENDATION 12: The Council of Ministers must ensure that due regard is given to the sufficient provision of targeted support as appropriate to mortgage holders, should the full impact of the interest rate rises materialise and cause increased pressures.

RECOMMENDATION 13: The Treasury and Exchequer should undertake modelling exercises to identify the impacts of the revenue raising measures on businesses, the economy Islanders and Island life. This should be undertaken ahead of delivering all budget measure proposals in future Government Plans and should be evidenced within the Government Plan to demonstrate the impact of the proposals.

RECOMMENDATION 14: The Council of Ministers must ensure that early stakeholder engagement takes place (particularly with the hospitality industry) when considering alcohol duties proposals in future Government Plans. This will provide awareness of all current concerns facing the stakeholders and the opportunity to hear and address their views so that proposals are appropriately informed prior to the lodging of the Government Plan in respect of their impact on the economy, businesses, Islanders and Island life.

RECOMMENDATION 15: The Council of Ministers must ensure that analysis is undertaken to evidence the effectiveness of utilising fiscal measures (taxes) to impact Jersey's public health goals in respect of alcohol and tobacco consumption ahead of lodging of the next Government Plan. In addition, to identify how alternative programmes including education and support can assist in changing behaviours to impact Jersey's public health goals. Narrative to evidence this must be included in the next Government Plan.

RECOMMENDATION 16: The Council of Minsters must ensure that Vehicle Emissions Duties rates remain under continued review and should undertake the required work to support widespread adoption of more efficient vehicles and electric vehicles while ensuring to balance fair tax contributions with strategic incentives.

RECOMMENDATION 17: The Council of Minsters should consider the benefits for including parameters that also take into account the size and mass of vehicles when determining Vehicle Emissions Duties, to prioritise the reversal of the trend toward larger and heavier vehicles. These are inherently less efficient, exacerbate traffic congestion and impact road maintenance costs. This could assist in meeting Jersey's climate goals.

RECOMMENDATION 18: For the new Regulatory Technology proposal, the Council of Ministers must ensure that enhanced procedures are in place to ensure that the existence of potential conflicts of interest and the mitigation actions taken are recorded in minutes of all oversight and decision-making groups. In addition, that proper monitoring and reporting for this pilot programme must be undertaken so that the use of funds is appropriately tracked and evidenced as well as the outcomes of the initiative.

RECOMMENDATION 19: The Council of Ministers must ensure that prior to proposing the next changes to the High Value Residents scheme, consideration must be given to the review process so that any subsequent proposals are sufficiently evidenced to appropriately substantiate the proposed changes. The review process should include impact analysis of the proposals including on the property markets or property price distortion in Jersey. Stakeholder representation should be broader and more inclusive and should not exclusively involve internal Government evaluation and representation of stakeholders with a vested interest.

RECOMMENDATION 20: During the development of any future tax measures, the Council of Ministers must ensure that proper and timely stakeholder consultation takes place to ensure that any proposals brought forward in future Government Plans are appropriately informed. When developing new tax measures, modelling should be undertaken to identify the impact on businesses, the economy and Islanders.

RECOMMENDATION 21 (OVERARCHING): All future Government Plans must distinguish the specific areas and projects to which Value for Money savings are attached, include reporting on all Value for Money savings which were made during the duration of the Government Plan and identify and provide full details of the monitoring process that has been undertaken on the Value for Money Programme during the duration of the previous Government Plan.

RECOMMENDATION 22 (OVERARCHING): The Council of Ministers must consider how to improve transparency of the Revenue Growth Allocations by including more detail on the proposals in the Government Plan and by publishing the business cases within the public domain, in a transparent manner, albeit, in a redacted form to maintain confidentiality when required.

RECOMMENDATION 23 (OVERARCHING): The Council of Ministers must provide to Scrutiny a list of the Revenue Growth bids that were presented to the Treasury and Exchequer, however, were not successful for either business case commissioning and/or inclusion within the Government Plan. This information should be provided to Scrutiny each year at the time of lodging of the Government Plan.

RECOMMENDATION 24: In line with the recommendation made by the Fiscal Policy Panel, the Council of Ministers must ensure that the objectives of the States Funds are clear and that policies are adjusted in line with the objectives. This work should be carried out and reported on prior to the lodging of the next Government Plan.

RECOMMENDATION 25: The Council of Ministers must strengthen its commitment to prioritise the transfer of future surpluses to the Stabilisation Fund and Strategic Reserve to rebuild the Funds to appropriate levels and should observe the advice of the Fiscal Policy Panel. A shorter term, renewed policy action plan must be developed to replenish the Stabilisation Fund and Strategic Reserve, and this must be addressed within the next Government Plan. All Prior Year basis receipts must be ringfenced and transferred to the Strategic Reserve as they arise.

The Proposed Government Plan 2024-27 [P.72/2023] (Government Plan) was lodged on 19th September 2023 for earliest debate on 12th December 2023. The Financial Annex to the Government Plan 2024-27 [R.141/2023] was presented simultaneously (as recommended (3) by the Panel the previous year). As part of the Government Programme for 2024, the Council of Ministers also presented the Ministerial Plans 2024 [R143/2023] and it is anticipated that the Delivery Plans 2024 will be presented early next year.

The preceding Government Plan 2023-2026 (previous Government Plan) explained that the:

• Common Strategic Policy sets out the seven interlinked priorities for change.

• Government Plan sets out the funding position for Government.

• Ministerial Plans provide a clear focus for action and aid the in holding Ministers to account for their delivery.

• Delivery Plans support the above

The Common Strategic Policy was approved by the States Assembly on 23rd November 2022, this policy continues to demonstrate the Council of Ministers' shared priorities for its four-year Government term, which commenced last year.

This year's Government Plan follows the same format as the previous for 2023-26 and details the following:

• Estimated income and expenditure of the Consolidated Fund.

• Amounts to be internally transferred between States Funds.

• Any other proposed financing.

• Revenue Expenditure Growth and Projects and their proposed costs.

• Estimated income and expenditure from States Trading Operations to be paid into the States Trading Operations Fund.

• Amounts to be appropriated from the Consolidated and States Trading Operations Funds for the next financial year.

• Estimated amounts in States Funds at the start and finish of each financial year.

• Borrowing and Debt Management Framework.

The Proposition and the summary tables associated with the Government Plan and shown in Appendix 2 of the Government Plan, in accordance with the Public Finances (Jersey) Law 2019, seeks approval by the States Assembly each year. When considering the Proposition to the Government Plan, in addition to those elements that were included in the Proposition to the preceding Government Plan 2023-26 [P.97/2022] (comprising the appropriations from the Consolidated Fund, the movement between other Funds and reserves, parameters around income, expenditure estimates, budgets and borrowing), three further parts are included for 2024 for approval by the States Assembly. The additional parts (b, d, f) are as follows:

(b) to refer to their Act dated 30th September 2016 and to approve the application of existing resources for work on the development of user pays' charges in relation to all aspects of waste, including commercial and domestic liquid and solid waste.

(d) to approve the extension of the use of the existing Revolving Credit Facility to include the provision of funds that would otherwise be implemented through bank overdraft or bank overdraft facilities under Article 26 (1)(a) of the Law, should they be needed, subject to the limits outlined in that article.

(f) to approve a transfer from the Consolidated Fund to the Stabilisation Fund in 2024 of up to £25 million, subject to a decision of the Minister for Treasury and Resources based on the availability of funds in the Consolidated Fund as of 31 December 2023 in excess of the estimates provided in this plan, or from budgeted underspends identified before 31 December 2024.

The Public Finances (Jersey) Law 2019

When considering the Government Plan, it is important to note the statutory requirements of the Public Finances (Jersey) Law 2019[2] in the context of the content of the Government Plan.

Part 3 of the Public Finances (Jersey) Law 2019 sets out the statutory content and scope for the Government Plan. The Law requires certain specific information to be included within the Government Plan and also requires the Council of Ministers to provide any other information that it believes the States Assembly may reasonably expect to need in order to consider the matters required to be set out in the Government Plan. As such, this detail is set out in Appendix 3[3] of the Government Plan.

The requirements are predominantly factual. However, more judgmental requirements of Article 9 of the Law require that:

• the Government Plan includes other information that the Council of Ministers believes that the States may reasonably be expected to need in order to consider' the statutory factual requirements of the Government Plan; and

• the Government Plan sets out how the proposals in the Plan take into account:

- the medium-term and long-term sustainability of the States' finances and the outlook for the economy in Jersey'; and

- the sustainable well-being (including the economic, social, environmental and cultural well-being) of the inhabitants of Jersey over successive generations'.

The Draft Finance (2024 Budget) (Jersey) Law 202-

The Draft Finance (2024 Budget) (Jersey) Law 202-[4] (lodged on 31st October 2023 for debate alongside the Government Plan on 12th December 2023) will give effect to the revenue measures[5] proposed within the Government Plan and will also provide for administrative and technical amendments in respect of the Government Plan, as set out in Appendix 4[6] of the Government Plan. Therefore, any amendments to the revenue measures outlined in the Government Plan would require the appropriate amendments to be made within the Draft Finance (2024 Budget) (Jersey) Law 202- .

The Panel's review focus has been, in the main, on reviewing the Proposition[7] where relevant to the Panel's remit in respect of the initiatives and responsibilities led by the Chief Minister and Minister for Treasury and Resources whilst also reviewing the financial actions being proposed by Government. However, the Panel also considers any overarching themes as appropriately identified during the review process.

When scoping its review, the Panel identified the following key areas to address:

• Will the Government Plan meet the requirements of the Public Finances (Jersey) Law 2019?

• Is the Government Plan fiscally sound and economically sustainable?

• Does the Government Plan follow the advice of the Fiscal Policy Panel and align with the income forecasts advised by the Income Forecasting Group?

• What is the impact of the Government Plan proposals on departmental budgets and staffing levels?

• Does the Government Plan align with the objectives of the Common Strategic Policy and aims of the Ministerial Plans?

• Are the proposed Revenue Expenditure Growth and Projects appropriate and deliverable within the specified timeframe?

• Are the resources allocated to Revenue Expenditure Growth and Projects sufficient and the best use of public funds?

• Are the States Funds used in accordance with their terms of reference.

The main Funds allocated under the Panel's remit for consideration are as follows:

• Consolidated Fund

• Strategic Reserve Fund

• Stabilisation Fund

The Panel's full Terms of Reference for the review can be found in Appendix 1 of this report.

The Panel wrote directly to a number of targeted stakeholders for their views, and received several submissions, and these can be viewed here. Private meetings were also held with stakeholders.

The Panel held a pop-up stand in St Helier and a meeting with the Jersey Youth Parliament to engage with members of the public and young people.

Public Hearings were held with the Chief Minister and the Minister for Treasury and Resources in November 2023. The transcripts for these hearings can be viewed here.

The Panel also wrote to the Chief Minister and the Minister for Treasury and Resources on several occasions with additional written questions. The written responses can be viewed here.

The Panel's review has also been informed by the 2022 and 2023 reports published by the Fiscal Policy Panel and the Income Forecasting Group.

Chapter 2 of this report provides high-level analysis and commentary on the Government Programme Design and any changes and impacts on the preceding Government Plan for 2023. With the focus on:

• Common Strategic Policy, Performance Framework Indicators, Ministerial Plans (priorities) Government Plan and Delivery Plans

• Consideration for alignment and ministerial mapping, transparency, clarity, accessibility, communication and engagement

• Reflection on changes, progress monitoring and evaluation of impact

Chapter 3 of this report provides high-level analysis and commentary on the States Income and Expenditure as set out in the Government Plan to support the Common Strategic Policy and Ministerial Plans. Consideration is given to impact on departmental budgets, Islanders, resourcing, staffing levels and the delivery of public services. With focus on:

• Economic and Fiscal Context

• General Revenue Income

• Income Forecasts

• Public Sector Spending

• Public Sector Staffing and Headcount

• Impact of Inflation

• Impact of Covid-19 Pandemic

• Impact of Emergency Incidents

Chapter 4 of this report provides high-level analysis and commentary on the Value for Money Programme to deliver departmental efficiencies. With a focus on:

• Value for Money Programme in 2023 progress

• Thematic and Best Value Reviews for 2023 and 2024

• Delivery, monitoring and recording of value for money savings

• Governance of Value for Money Programme

Chapter 5 of this report provides high-level analysis and commentary on the projects and programmes as appropriate for 2023 and 2024, specific to the remit of the Panel. It highlights any identified concerns and considers:

• Whether the projects are appropriate and deliverable

• Whether the resources allocated are sufficient and the best use of public funds

• Alignment to Common Strategic Policy and the aims of the Ministerial Plans

• Impact on departmental budgets, staffing and States Funds

• Impact on Islanders

Chapter 6 of this report provides high-level analysis and commentary on States borrowing, debt management, investing, contingency, reserves and States Funds with the focus, in the main, on the Consolidated Fund, Strategic Reserve Fund and Stabilisation Fund.

All chapters draw from evidence received from the public hearings, responses to written questions and submissions from key stakeholders, members of the public and children and young people. The Panel's report is also informed by the reports published by the Fiscal Policy Panel and Income Forecasting Group, which advise the Minister for Treasury and Resources and States Members.

As part of the Panel's review of the Government Plan it sought to establish any design advancements made on the previous Government Plan[8]. Since the previous year was the first time that the Government presented a Government Plan as one component of a Government Programme (the umbrella term'), the Panel made several recommendations[9] at that time for improving the Council of Ministers' (COMs) fresh approach' for presenting the Government's budget. The Panel concluded from its review of the previous Government Plan, that further enhancements could be made, such as, amongst others, the provision of:

• an evident demonstrable link (golden thread) between all the components that make up the Government Programme

• detailed mapping of the Budgets that Ministers are responsible for and how the funding is split between projects, programmes and services

• an annual budget comparison to act as a reference point when reviewing the Government Plan funding proposals

• progress updates for continuing and business as usual projects and programmes

By delivering these design enhancements it was the Panel's view that transparency and accountability of the Government Programme would be improved. Therefore, the Panel made recommendations which encompassed these elements in order to initiate the changes within future Government Plans.

The Panel notes that this year, the Financial Annex to the Government Plan was presented in tandem with the Government Plan and Ministerial Plans as recommended by the Panel the previous year. This was a notable improvement on the previous year.

In particular, recommendations (see appendix 3 of this report) were made that addressed considerations for improving the alignment of the multiple components, which make up the Government Programme. Moreover, the Panel recommended (1) that an evident link should run through the components of the Government Programme to effectively demonstrate how the components: Common Strategic Policy, Ministerial Plans, Government Plan, Delivery Plans align. Furthermore, how the Jersey Performance Framework is used in the creation of the Government Programme.

Through accomplishing these improvements, the Panel envisaged that the Ministerial workstreams and policy initiatives laid out in the Ministerial Plans and appearing as funding proposals in the Government Plan would demonstrate improved alignment.

Considering that the recommendations detailing design considerations were accepted within the joint Ministerial Response from the Chief Minister and Minister for Treasury and Resources (Ministerial Response) to the Panel's report (S.R20/2022) for the previous review of the Government Plan, the Panel sought to understand what changes were made to this year's Government Programme and its components in actioning these recommendations. The Panel raised this with the Chief Minister during a public hearing[10] and also sought to understand whether the Chief Minister was content with the implementation and outcomes of the Government Programme model, a year on from its establishment.

Deputy S.Y. Mézec :

I wanted to ask about the government programme itself and its constituent parts; the Government Plan, the Ministerial Plan and delivery plans, which is different to what the previous Government did. Could you give us your assessment on the effectiveness of doing it that way, now that you have had one year with a government programme and are now in the stage of proposing the second part? Has that been as effective as you hoped it would? Are there any, perhaps, changes to that model of doing it that you might consider?

The Chief Minister:

Our focus is on encouraging consistency, resilience and maintaining a steady course with our public finances. The Government Plan is linked to individual Ministerial Plans, which I will go on to address shortly. They have each been developed to outline specific objectives and priorities for 2024. Of course, the purpose of that is to ensure that we provide a level of transparency and clarity for both yourselves and the public with which to hold ourselves to account on the delivery of those policies and priorities against their objectives. Our Ministerial Plans execute the broader vision of the Government Plan, which is to deliver tangible improvements to the lives of Islanders, and to create a community where families and everyone can thrive.

Deputy S.Y. Mézec :

Is that model of doing it as a government programme with its constituent parts working to your satisfaction, as you might have hoped it would when you deviated from the previous Government's model, which did not have the Ministerial Plans and delivery plans presented in this way? Is that working, and is there anything you might consider tweaking to improve it in future?

The Chief Minister:

I think it is working relatively well. Everything always needs tweaking as we progress, and I think, particularly now we are working with our interim chief executive, honing some of those priorities and really focusing so that we can ensure delivery of those is something that we are particularly focused upon.

![]() KEY FINDING 1: The view of the Council of Ministers is that the new Government Programme model for presenting the Government's budget is working well, however, focus is now being placed on how to improve the refinement of ministerial priorities to ensure their effective delivery.

KEY FINDING 1: The view of the Council of Ministers is that the new Government Programme model for presenting the Government's budget is working well, however, focus is now being placed on how to improve the refinement of ministerial priorities to ensure their effective delivery.

The Panel continued to ask what was done differently in the creation of this Government Programme and its components to tie them together in a way that improves clarity and comprehension, in particular, regarding the connection between the Government Plan and Common Strategic Policy priorities. The Chief Minister noted that the summary document provided alongside the Government Plan this year, sets out the themes and deliverables against each of them. It was her view that the document provides a more helpful, easy to follow and digest summary of what the Government is aiming to action and deliver through the Government Plan. [11]

![]() KEY FINDING 2: The summary document – Government Plan in Brief – provided alongside the Government Plan sets out the themes and their deliverables to provide a more helpful, easy to follow and digest summary of the Government's aims and actions for delivery through the Government Plan.

KEY FINDING 2: The summary document – Government Plan in Brief – provided alongside the Government Plan sets out the themes and their deliverables to provide a more helpful, easy to follow and digest summary of the Government's aims and actions for delivery through the Government Plan.

In respect of how the Jersey Performance Framework was utilised in the creation of this Government Plan in comparison to the previous, the Panel heard that the utilisation was very similar, however that its use has become more sophisticated and more informative as the Framework has continued to mature. It was further explained that Statistics Jersey[12] was undertaking work to refine and improve the core outcome measures and indicators of the Framework. In addition, it was undertaking work to support departments to improve service performance measures. It was the view of the Assistant Chief Executive Officer that collectively that work should deliver more focus and precision when designing future Government Plans.[13]

![]() KEY FINDING 3: The utilisation of the Performance Framework in the creation of the Government Plan was unchanged from how it was used to develop the previous Government Plan. However, further work is being undertaken to refine and improve the core outcome measures and indicators of the Framework. Alongside work to support departments to improve service performance measures, it is anticipated that collectively these improvements will deliver more focus and precision when designing future Government Plans.

KEY FINDING 3: The utilisation of the Performance Framework in the creation of the Government Plan was unchanged from how it was used to develop the previous Government Plan. However, further work is being undertaken to refine and improve the core outcome measures and indicators of the Framework. Alongside work to support departments to improve service performance measures, it is anticipated that collectively these improvements will deliver more focus and precision when designing future Government Plans.

In a submission[14] received from Statistics Jersey, it was noted that during 2023 it has reviewed the Island Outcome Indicators with a view to making them more relevant and meaningful, and to also present the indicators in a way that it is possible to get a clear overview of progress. It was further explained that Statistics Jersey's initial proposal sought to reduce the number of indicators and also to change the presentation of the Island Outcome Indicators so that it is easier to get an overview of progress on the sustainable wellbeing indicators. It was noted that the proposed new format for the Island Outcome Indicators[15] is still under development.

Statistics Jersey[16] also explains--in response to the Panel's previous recommendation (2) on gathering data on low income and its duration to assess progress of the Housing and Cost of Living priority--that although it has not been possible to produce the required statistics during 2023, the request for funding within the Government Plan for admin data linkage work by Statistics Jersey[17] would include a research project on low-income statistics from administrative data held by government.

It was noted that such data linkage has the potential to enable annual estimates of low income based on administrative data already held by Government. In addition, Community and Local Services data could enable Statistics Jersey to produce statistics on the patterns to determine duration related data. Furthermore, Revenue Jersey data, linked to other data, could provide statistics on those in low income by age, sex and ethnicity and/or nationality. It was further explained that it may be possible when producing statistics on duration in low income, to

determine whether cohorts of people cycle in and out of low income, subject to obtaining the data and researching its quality. Data on individuals in low-income should be possible from administrative data. However, it was noted that it would be more challenging to produce household level low-income data as this will require reliable formation of households based on administrative data. However, this is also a subject of research to be funded by this request.

KEY FINDING 4: Through the Revenue Growth Allocation – Statistics Jersey – Administrative Data Linkage Team - it may be possible to produce statistics on the patterns to determine duration related data for individual and household low income including by sex, ethnicity and/or nationality. This could be used for assessing progress related to poverty in Jersey.

Transparency and Accountability

Budget mapping

The Panel notes that early efforts were made last year to improve ministerial accountability in the previous Government Plan through changes to the proposed revenue heads of expenditure to align departmental budgets to ministerial remits, as required by P.52/2022 – Ministerial Priorities[18] and in accordance with the Council of Ministers' 100 Day Plan. However, clear ministerial mapping was absent within the previous Government Plan. To improve clarity, transparency and accountability for departmental budgets, it was the Panel's view that clearly mapping budgets to Ministers and their departments would better achieve this.

The Panel notes that, this year, the inclusion of the Ministerial Mapping - Table 4 in the Financial Annex[19] is an advancement on the previous year. However, although Table 4 was included within the Financial Annex to better align revenue heads of expenditure to Ministers and to strengthen ministerial lines of accountability, the Panel remains concerned that further clarity for ongoing expenditure is needed.

![]() KEY FINDING 5: A ministerial mapping table is included within the Financial Annex to the Government Plan to better align head of expenditures to ministers and to strengthen ministerial lines of accountability. However, narrative for ongoing expenditure and business- as-usual workstreams is not available in the Government Plan.

KEY FINDING 5: A ministerial mapping table is included within the Financial Annex to the Government Plan to better align head of expenditures to ministers and to strengthen ministerial lines of accountability. However, narrative for ongoing expenditure and business- as-usual workstreams is not available in the Government Plan.

Budget comparison

Therefore, during a hearing with the Chief Minister, the Panel questioned[20] whether changes were made to improve clarity of how ongoing expenditure and business-as-usual projects are demonstrated in this Government Plan in contrast to the previous, for easier identification and comparison of the changes in expenditure over the years. Ultimately, the Panel sought to understand what improvements had been made in this Government Plan to progress the transparency in relation to annual budget comparisons to clearly see how public money is spent in delivering public services over time.

The Panel notes, however, that the Chief Minister acknowledged, regrettably, that the inclusion of the 2023 expenditure line was excluded from this Government Plan, which makes comparing expenditure across years difficult.

The Chief Minister:

I have to admit that here, this is something that we have raised recently. What would be most helpful in this situation would be to provide the 2023 figures against each item in the tables, and that is something that we have not been able to achieve this year.

Deputy S.Y. Mézec :

Was that a conscious decision not to do that? The Chief Minister:

No, I do not think it was a conscious decision not to do that, but it is something that we would certainly like to be able to do next year.

Assistant Chief Minister:

We would certainly expect to see the 2023 figures feature far more frequently so you can compare like for like. Only on Monday we were having that discussion, looking at forecasts for the end of this year, for example, and wanting to see how it compared to last year.

![]() KEY FINDING 6: The 2023 funding figures are not displayed against each item in the tables within the Government Plan. This diminishes transparency and makes it challenging to compare budgets across the years for the Government term.

KEY FINDING 6: The 2023 funding figures are not displayed against each item in the tables within the Government Plan. This diminishes transparency and makes it challenging to compare budgets across the years for the Government term.

![]() RECOMMENDATION 1: The Council of Ministers must ensure that in all future Government Plans, all tables include the figures of the preceding year to improve budget comparison, transparency and accountability. Consideration should be given to how narrative for ongoing expenditure and business-as-usual workstreams can be demonstrated within the Government Plan to provide further clarity.

RECOMMENDATION 1: The Council of Ministers must ensure that in all future Government Plans, all tables include the figures of the preceding year to improve budget comparison, transparency and accountability. Consideration should be given to how narrative for ongoing expenditure and business-as-usual workstreams can be demonstrated within the Government Plan to provide further clarity.

The Panel recalls in the Ministerial Response following its review of the previous Government Plan that its recommendation (8) was accepted, and it was commented that:

It is vital that Government can transparently show how taxpayers' money is spent, both delivering services and projects. This is delivered through the suite of Ministerial Plans, Delivery Plans, the Government Plan and the Annual Report and Accounts. Government will continue to look to improve these documents. Specifically, Delivery Plans should describe the work of departments, including ongoing Expenditure and BAU projects.[21]

The Panel sought to further understand whether the Delivery Plans for 2024 will include descriptions of the departments' work and their ongoing expenditure and business-as-usual projects for improved transparency and accountability. The following was explained:

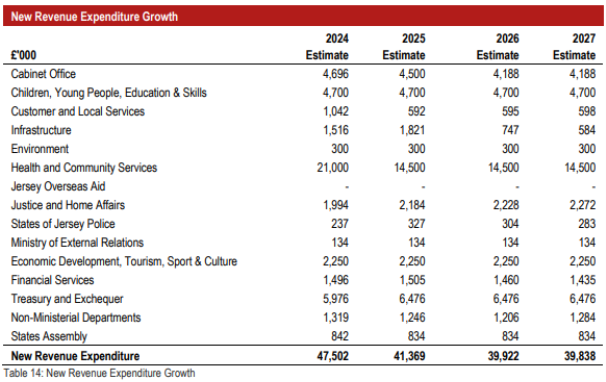

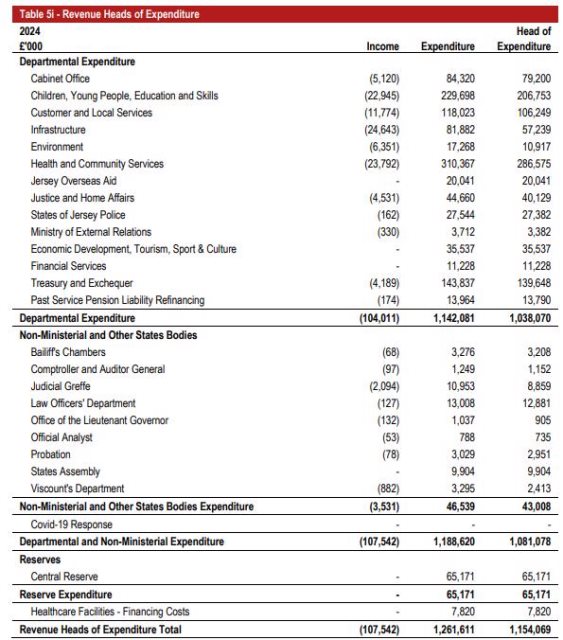

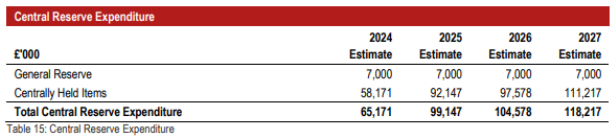

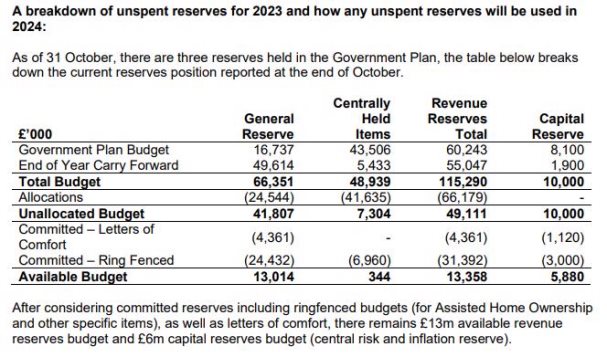

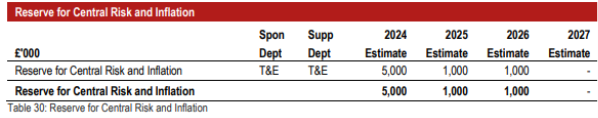

Assistant Chief Executive Officer: