The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

Shown below is a response to the questions raised by the Environment Scrutiny's Panel in its letter dated 17th June 2009:

- A copy of the current Business Plan for the Waste Recycling section.

Shown below is an extract from the TTS 2009 Business Plan relating to the Waste Recycling Section.

. Key Objective | 3. Key Performance Indicators | 4. Target | 5. Imp Year | 6. Key Risk | RAG Status/ Comment |

mplement the solid waste strategy o minimise and manage waste roduced. | Waste Strategy Projects | February 2009 February 2009 Q1 2009 December 2009 by December 2009 achieve: 7,800 tonnes 200 tonnes 1000 tonnes 50 tonnes 7,000 tonnes 60,000 tonnes 570 tonnes 250 tonnes of WEEE (Waste Electrical and Electronic Equipment) and batteries diverted 6 32% by 2009 Q1 2009 | 2007- 2011 2007-2009 | Planning approval process causes delays Contractual and cost issues delay contract commencement Site or sites selected fail to obtain political approval Preferred site solution or technology is unaffordable Change in market for recyclates Fail to develop major infrastructure such as public green waste reception Funding diverted to higher priorities Lack of support from Parishes to implement kerbside collection. Unable to achieve 32% unless permanent funds available Increase in quantity of hazardous waste leads to shortage of storage space Lack of funding | Green Amber |

Pre-construction Works for new Energy from Waste facility completed Energy from Waste contractor established on site Satellite green waste reception facility established New In-Vessel Composting contractor appointed Recycling Projects | |||||

Increase Island's recycling activities as follows:

Removal of high emission waste from EfW plant in order to minimise pollution Number of Parishes operating scheme Overall recycling rate Compliant shipment and disposal of backlog of hazardous waste | |||||

Work with P&E and the Treasury to dentify a permanent funding stream to enable increased ecycling | Funding stream identified | May 2009 | 2009 | No suitable funding stream found Lack of acceptance to proposals | Green Subject to funding |

Foster positive community attitude owards responsible waste management | Increase recycling rates Maintain high quality of materials collected Awareness monitored in survey results Procure and operate new recycling awareness roadshow trailer for schools and events Number of school visits/events | 32% by end of 2009 Improved awareness recorded 24 school visits 10 public events | 2008- 2009 | Kerbside schemes lead to drop in quality of materials Lack of resource reduces number of visits | Green |

- A financial report covering:

- Specific details of how the £0.5m allocation in 2009 Business Plan is to be spent this year.

Recycling

The monies allocated in the 2009 business plan were only secure for 2009 and conditional on the approval and introduction of a new environmental tax thereafter, the Department therefore did not consider it appropriate to enter into long term commitments while funding is not secure.

It was agreed that the following one off projects to be funded by the additional monies in 2009. Further longer term initiatives will be proposed once future funding is secure.

| Project | Cost |

1 | Domestic green waste operational costs – required due to temporary relocation of domestic green waste site. (Note 1) | £170,000 |

2 | Process backlog of WEEE (waste electrical and electronic equipment) - accumulated in 2008 due to funding shortfall. | £85,000 |

3 | Extra costs of recycling 2009 WEEE | £70,000 |

4 | Cardboard recycling subsidy shortfall – anticipated continuation of poor market conditions in 2009. | £60,000 |

5 | Packaging wood recycling. | £35,000 |

6 | New Recycling Exhibition Trailer | £20,000 |

7 | Parish kerbside project pump prime – if long term recycling funding is secured in 2009 | £30,000 |

| Total | £470,000 |

| To be allocated | £30,000 |

Note 1 – The proposal is to fund the temporary relocation of domestic green waste in 2009 from recycling funding. The cost of funding the reception facility in the long-term will be met from reprioritising the Department's 2010 revenue cash limit.

These activities tie in with specific objectives of the Solid Waste Strategy.

- Specific proposals showing how the requested additional funding in 2010 and 2011 would be used

The funding for the replacement Energy from Waste plant has been agreed by the States on the basis that the final capacity of the plant will not exceed 105,000 tonnes of waste. In order to achieve this, recycling rates must increase from the target of 32% by 2009 set in the Solid Waste Strategy to 36% by 2018. Critical to achieving and perhaps exceeding this more challenging target is the implementation of an Island-wide kerbside collection system.

The Island wide bring bank system will require considerable expansion and an increase in the capacity Re-use and Recycling Centre will be required. Finally the commercial sector must recycle more waste than is achieved currently; this will require investment in facilities, education and possible legislative changes.

- Previous year's actual departmental spending on waste recycling.

Total Waste recycled | 2007 Tonnes | 2008 Tonnes | 2008 Actual Costs £ |

Waste recycled |

|

|

|

Green Waste Received | 14,997 | 11,239 | 764,000 |

Paper and cardboard | 7,654 | 7,985 | 348,000 |

Electrical and Electronic Equipment | - | 148 | 175,000 |

Packaging Wood | 1,000 | 1,000 | 85,000 |

Fridges |

|

| 27,000 |

Oil |

|

| 21,000 |

Batteries | - | 5 | 2,000 |

Plastic | 484 | 503 | (0) |

Aluminium cans | 16 | 29 | (0) |

Textiles | 507 | 499 | (0) |

Glass | 7,719 | 8,490 | (0) |

Household Metals | - | 849 | (0) |

Total Waste recycled | 32,377 | 30,747 | 1,422,000 |

- Previous years' and current departmental income from all recyclable materials (including Tipping charges at La Collette) giving evidence of trends in prices being achieved for recyclables

Income received from recyclable material | 2008 £ | 2009 To date £ |

Tipping Fees | 2,049,000 | 756,900 |

Asbestos | 15,800 | 13,200 |

Green Waste Recycling - Sale of 39,800 22,200 Goods

Wood Shreddings 14,600 4,500 Total Income received 2,119,200 796,800

Trends on Tipping Fee Income:

The Department is currently forecasting a shortfall in Tipping Fee Income totalling approximately £200,000 which reflects in part, the economic downturn and contractors using private tips. Shown below is a graph comparing actual v. budget in 2009.

Tipping Fees 2009 Budget v. Actual

Tipping Fees 2009 Budget v. Actual

Month

| ||||||||||||||||||||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

| ||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||

| ||||||||||||||||||||||||||||||||||||

Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |||||||||||||||||||||||||

2009 Actual | -96.0 | -133.1 | -155.9 | -152.3 | -98.5 | -120.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | ||||||||||||||||||||||||

2009 Budget | -146.0 | -146.0 | -146.0 | -146.0 | -146.0 | -146.0 | -146.0 | -146.0 | -146.0 | -146.0 | -146.0 | -146.7 | ||||||||||||||||||||||||

2009 Actual 2009 Budget

Tipping Fees Actual Income 2007 - 2009

Tipping Fees Actual Income 2007 - 2009

Month

| ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

|

|

| ||||||||||||||||||||||||

|

|

|

| |||||||||||||||||||||||

| ||||||||||||||||||||||||||

| ||||||||||||||||||||||||||

Jan | Feb | Mar | Apr | May | Jun | Jul | Aug | Sep | Oct | Nov | Dec | |||||||||||||||

2007 | -115.4 | -227.3 | -132.9 | -124.1 | -120.4 | -147.0 | -134.7 | -131.4 | -108.7 | -122.9 | -113.5 | -114.9 | ||||||||||||||

| 2008 | -123.1 | -200.4 | -314.1 | -208.9 | -92.6 | -127.7 | -174.3 | -137.0 | -125.9 | -260.5 | -171.2 | -113.1 | |||||||||||||

2009 | -96.0 | -133.1 | -155.9 | -152.3 | -98.5 | -120.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | 0.0 | ||||||||||||||

£'00

2007 2008 2009

We are particularly interested in exploring the costs and benefits relating to the following schemes:

- The parish kerbside collection scheme including the extent of the support provided by your Department and the extent to which a market exists for recyclable materials collected in this process.

The 2005 Solid Waste Strategy recommended the introduction (following a pilot) of doorstep collections in all Parishes for the key target materials by 2009. 4 Parishes now have a basic doorstep system in place collecting paper, cans, glass and plastic bottles with St. Lawrence also collecting card.

The operational costs of these services are borne by the Parishes themselves. The details are not known to TTS but are thought to be in the region of £8-£10 per household per year. The only direct costs the Department has incurred are a contribution to the initial equipment purchase (boxes) in the St. John pilot shared with a commercial sponsor. The latest 3 Parishes introducing a system have had all the start-up costs covered by sponsorship.

In broad terms the schemes appear to have been successful to date. Based on data for St. John , which is the only scheme with a full year of records, a recycling rate of 18% has been achieved. This is reasonable considering the collections are only monthly, card is not collected and that green waste recycling is not included in this figure. 2 full surveys have been completed on the St John service each showing a 70% participation rate which is respectable compared to UK schemes.

TTS provides the outlet for the materials collected in the Parishes but, as described above, only paper products have a cost impact – for St. John this was approximately £1,600 for 2008.

The view of the Waste Strategy team at TTS is that an Island-wide doorstep service, for at least the key materials, is required to reach the current recycling target of 40%. Whilst successful and cost effective, the bring system, requiring people to take their materials for recycling will only generate a limited yield. The convenience of a doorstep service brings many more households into recycling.

- The inert waste recycling scheme at La Collette and the extent to which the States currently subsidises this scheme.

The aggregates recycling facility, currently operating on the La Collette II reclamation site, is based on a 5 year contract, let to a private company following an open market tender process in 2006. As there is a local market for recycled aggregate the contract was drawn up on the principle that the operator would not require a direct subsidy.

To provide an incentive to maximise levels of recycling, a land rental rebate scheme was built into the contract. The rental market value for the land, which was unsurfaced and included no services, was set as a gross annual charge'. A model was then drawn up which provides up to a 75% rebate to the operator if certain sales tonnage targets are achieved – these targets become more challenging as the contract years advance.

- The scheme for processing hazardous waste electrical and electronic equipment.

Due to the complex nature and lack of a local market for most of this equipment, the recycling process requires significant financial input from TTS. Waste display screens (TV's and monitors) require careful palletising and export to a specialist recycling facility off- island where a fee is paid for each screen processed. This cost is increased by the requirement of a special hazardous waste license from the local waste regulator and the UK Environment Agency to ship these items across an EU frontier.

For non-display WEEE such as videos, computers, music centres etc., TTS have set up a dismantling system with HM Prison which results in items being stripped down into metals, plastics and circuit boards. Some of these commodities have a precious metal content and are hoped to provide a sales revenue – the level of this income will not been known until the end of the year when enough of the materials will be segregated to justify a shipment.

The overall cost of recycling WEEE can be seen in the 2008 expenditure table provided in this response.

We also wish to consider the following general issues related to recycling:

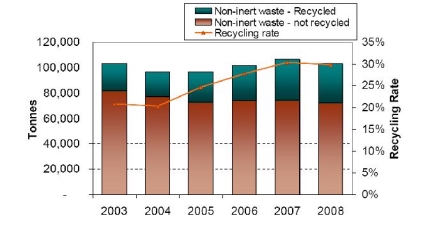

- Current progress in reaching overall recycling targets

As the graph shows progress in the overall recycling rate since 2003 has been steady broadly increasing from 20-30%. The target set for 2009 was 32%. 2008 showed a slight drop on the previous year which is attributable to a reduction in green waste received. As this is a significant total tonnage the rate is very sensitive to these fluctuations. It actually masks a 12% increase in the overall tonnage of recycling compared to 2007 if green waste is excluded.

Interestingly the 2009 recycling rate is forecast to be back above 30% based on figures to half year end helped by new doorstep schemes and increases in green waste received.

It is worth pointing out that the Department expect the recycling rate to stabilise due to most existing schemes having matured. To reach the 36% target by 2015 investment is needed in more doorstep services and a sustained education programme.

- The state of the market for the range of potentially recyclable materials, including those currently accepted at the recycling centre as well as others which may not currently be recycled locally, together with identification of materials which are

considered uneconomic to recycle,

- The market for the disposal of cars and their components and other scrap metal

- The extent to which the States provides financial subsidies, if any, to private recycling operations and initiatives.

As the majority of new recycling services have been introduced during the last decade in which States policy has generally discouraged introducing new services requiring further manpower, many are outsourced to private sector partners.

The financial relationship within these contracts is generally based on the operator selling materials and using this revenue to offset their costs. Some form of price mechanism is then used for the benefits of these sales to offset the cost to the States.

Summary of arrangement for key material streams: Scrap metal

A 3 year, renewable Service Level Agreement (currently in year 3) with an open book accounts system. A reasonable price per tonne is agreed as base income for metal sales – in years where this price is exceeded the company pay into a strategic reserve' to cover years when the price falls below the threshold. This system has resulted in no payments being made by the States since 2003 and the current strategic reserve being healthy.

Vehicle Spares

The company operating the scrap metal yard (Picot and Rouille Ltd.) have seen a steady decline in the demand for car parts in recent years. They attribute this to modern vehicles being less owner serviceable, more reliable and increases in general affluence.

Paper and Card

These materials are received bulked, exported and sold by a private company. A 5 year contract exists (currently in year 2) which includes a payment per tonne for paper and card based on an annual review of the cost of recycling. The reference for the price review is based on weekly figures published in a national publication called Materials Recycling Weekly averaged over the year. The price paid for the year following the anniversary of the contract is based on the previous year.

Typical rates for paper (mainly newspaper and magazines) is £25/tonne and cardboard £30/tonne although this has fluctuated in recent years.

Plastic Bottles

Plastic bottles are handled in the same way as paper and card but at the time of tender submission, no payment was required by the contractor. As the tonnages will always be relatively small (10's of tonnes rather than 1000's) no price mechanism was put in place for this 5 year contract. Despite a 70% drop in plastic bottle values this year the contractor currently receives no payment for this material.

Cans

During 2007, when the new Island-wide recycling collection points were introduced, to help simplify things for the public it was decided that mixed cans' would be collected. This requires the local sorting of steel and aluminium cans before export for sale. There is currently no contractual arrangements for can recycling. Some aluminium cans are collected by a private company and are densified, exported and sold. The mixed cans from the TTS recycling sites are collected under contract by a private company who have the choice of delivering the cans to the TTS licensed scrap yard or sorting, baling and exporting and selling themselves – the latter is the current arrangement.

Glass

Glass is currently received by the aggregates contractor at La Collette for crushing. The cullet is used for a variety of civil engineering processes, mostly within the La Collette 2 site. Although glass has a sales value to container manufacturers off-Island the market is dependent on colour sorting and is felt to bring little environmental gain compared to an on-island solution.

Uneconomic Materials

Economics has not been a key factor in strategic thinking on recycling. Greater weighting has been given to environmental performance, practicality and readiness of outlets in choosing which materials we pursue. The only materials that are actually economic' ie generate a profit after accounting for collection and handling costs are high grade paper, aluminium cans and scrap metal. Hence these being operated primarily by private firms.

Materials not currently being recycled such as low grade plastics (non-bottle food packaging), tyres, treated timber and bulky fibres (carpets, mattresses) are all felt to be most suitable for energy recovery at the moment– the Department continues to monitor these outlets and will introduce new schemes as robust outlets arise, subject to availability of funding.

- The feasibility of possible alternative funding mechanisms eg whether a charge might be levied on imported goods (eg TVs, cars, fridges) to fund their final disposal

Alternative funding mechanisms for recycling were investigated as part of a piece of work carried out by the Environment Department in 2007. The outcome of this process was that a tax on fuel or on the purchase of a new vehicle based on CO2 emissions was the favoured option – the Panel will be aware that this process is currently out to consultation.

- Potential impact of a States decision not to provide additional ongoing funding for the identified recycling initiatives

The impact of further funding not being agreed for 2010 will be explained in the forthcoming presentation to the panel. Broadly speaking one of the key recycling services will have to be discontinued – the most appropriate target is currently being reviewed but to meet the expected shortfall the Department would have to withdraw one of the following:

- Paper and card recycling

- E-waste (electronic waste such as TV's, computers etc)

- Green waste (public reception)

- Further potential recycling initiatives which may have been considered but are currently unfunded, or which could be considered in the future.

The Department has focused mostly on a list of key materials which will bring demonstrable environmental gain. The key steps moving forward are to increase the yield of these materials not necessarily add new streams.

However we have always recognised that advances in technology will bring new opportunities which may open the door to new local initiatives for low grade plastics, food waste, tyres and treated wood. Also key will be initiatives to try and reduce overall waste production in the domestic and commercial sectors.