The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

6 March 2015

Deputy J Le Fondré

Chairman, Corporate Services Scrutiny Panel Scrutiny Office

States Greffe

Morier House

St Helier

JE1 1DD

Dear Deputy Le Fondré

Review into the Jersey International Finance Centre (JIFC)

Thank you for your letter dated 5 February 2015 and for providing the opportunity for Jersey Finance Limited (JFL' or we' as appropriate) to comment on the important areas under review.

Introduction

In a report commissioned in response to concerns raised by the Mayor of New York that New York's competitiveness was being eroded, McKinsey, the global consulting firm, undertook a survey of global executives which sought to measure the relative importance of 18 different factors of competitiveness on a 7 point scale. This would then be used to determine the attractiveness of international finance centres (IFCs).

The better Jersey is able to score against each of these factors, the more likely the finance industry is to achieve growth and prosperity through expansion of existing businesses on the island and the attracting of new entrants.

As can be seen four factors rated above 5.5 and are therefore considered the most fundamental components of competitiveness; a professional workforce, the legal environment, the regulatory environment and government and regulatory responsiveness. For Jersey to remain competitive as an IFC it is important to score as highly as possible in relation to these, the most critical, success factors.

Jersey Finance Limited

Sir Walter Raleigh House, 48-50 Esplanade, St Helier, Jersey, Channel Islands JE2 3QB E: jersey@jerseyfinance.je T: +44 (0)1534 836000 F: +44 (0)1534 836001

www.jerseyfinance.je

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

Source: McKinsey Financial Services Senior Executive Survey

Government and regulator responsiveness to business needs ranks joint third most important factor on the competitiveness ranking. In addition it is worth noting that the Global Financial Centres Index also features infrastructure in its top 5 competitiveness criteria.

We, through discussions with industry, and validated by external consultants, have identified a real business need for increased and better quality office accommodation, and in this regard it is vital that Government acts responsively.

We believe that the continuing debate about the future of the JIFC is damaging to the islands growth prospects and reputation. We have real concerns that the current lack of Grade A office accommodation is, and will be, a limiting factor with regard to inward investment. This, coupled with a corporate drive to secure cost-efficiencies, may result in existing industry players in Jersey choosing to exit the island in favour of a more appealing business environment offered in a competitor jurisdiction.

Having a clearly identifiable financial services centre will be a core marketing attribute for the island. It will act as a valuable business attraction tool that will powerfully underpin Jersey's pre-eminence as a leading IFC. The JIFC brand manifested in a clearly identifiable and discreet finance centre will act as a hub, attracting high quality businesses and high value employers. It will be far more preferable to firms than being disparately spread over St Helier, or the incremental piecemeal development of the waterfront area. This concept is reinforced by the success of the Dubai International Finance Centre.

There has been a view expressed that a relocation of existing financial services businesses to the JIFC would lead to other areas of St Helier becoming vacant and neglected which would in turn have a detrimental impact on other business sectors such as retail and hospitality. However, we consider that this would present an opportunity for urban regeneration with, for example, the possibility of new housing developments. Indeed this very matter is something that the Government are already addressing through the St Helier development and regeneration strategy, and the Council of Ministers have recently announced St Helier as being one of their four strategic priorities for the period 2015-18: Ministers will work closely with the parish and residents to develop a new plan for St Helier, to incorporate the new finance centre, decent homes, parks, a distinctive retail centre centre and a clear transport plan'.[1]

The JIFC is a long term investment in Jersey's future and should not be considered in the context of short term horizons. An investment of this kind will demonstrate conviction and confidence in the industry's future success in a highly visible way.

The Value of Jersey's Finance Industry

JFL was established to represent and promote Jersey as an international financial centre of excellence. Our membership is constituted from a broad spectrum of an industry which employs 12,500 people[2] – approximately 25% of the island's workforce – and accounts for more than 40 per cent of all economic activity in the island[3].

Whilst we do not have access to detailed statistics regarding tax contributions, we believe that the finance industry accounts for a substantial proportion; from informal discussions with the Statistics Unit, we understand the industry may account for approximately 50% of total tax revenue in Jersey.

The industry also incurred total on-island expenditure on goods and services of £310 million in 2013[4], much of which will have been payments to local non-financial businesses, generating further economic activity – and ultimately tax revenue – in the island.

The above statistics highlight the importance of the finance industry to the economic success of the island, and therefore demonstrate that maintaining a supportive and attractive business environment in which the industry can flourish is of crucial importance to Jersey's long term prosperity.

Economic Context

The performance of Jersey's finance industry is inextricably linked with global economic activity and, in particular, that of the UK.

We are seeing encouraging growth in the UK and there was further good news when, during the recent Autumn Statement, the Office for Budget Responsibility released the following positive GDP growth predictions for the period 2014 – 2019:

Table 1: UK - GDP growth forecast, percentage change from previous year

2014 | 2015 | 2016 | 2017 | 2018 | 2019 |

3.0% | 2.4% | 2.2% | 2.4% | 2.3% | 2.3% |

Source: HM Treasury Autumn Statement 2014

We are confident that, if the UK succeeds in achieving such growth, Jersey's finance industry will stand to benefit from a commensurate increase in activity, as international investor activity into the UK increases.

In our target markets (listed in Table 2, below) growth expectations remain positive and, with low oil prices expected to persist at least through 2015, net importers such as China and India have an excellent opportunity to flourish, though this of course comes at the expense of other markets such as Russia.

Table 2: JFL target markets - GDP growth forecast, percentage change from previous year

| 2014 | 2015 | 2016 | 2017 |

World | 2.6% | 3.0% | 3.3% | 3.2% |

China | 7.4% | 7.1% | 7.0% | 6.9% |

India | 5.6% | 6.4% | 7.0% | 7.0% |

Middle East high income oil exporters | 4.7% | 4.1% | 4.2% | 4.3% |

Nigeria | 6.3% | 5.5% | 5.8% | 6.2% |

Russia | 0.7% | -2.9% | 0.1% | 1.1% |

South Africa | 1.4% | 2.2% | 2.5% | 2.7% |

Source: World Bank Forecast Table and Global Economic Prospects, January 2015

We are undertaking concentrated actions to develop business links in these markets, including targeted campaigns, overseas business development delegations - such as the Jersey Finance Asian Roadshow – and the maintenance of on-the-ground representation in India, China, and the Middle East.

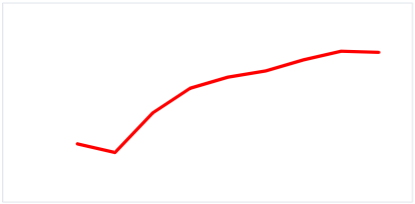

Promoting the island in these jurisdictions opens opportunities for our members to win business from high-growth markets whilst simultaneously reducing the industry's reliance on traditional markets. We have seen particular success from the Middle East, where the proportion of bank deposits sourced from the region have been steadily increasing for a number of years.

Middle East bank deposits as % of total (2006 - 2014)

Middle East bank deposits as % of total (2006 - 2014)

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]() 14.00%

14.00% ![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]() 12.00%

12.00% ![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]() 10.00%

10.00% ![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

8.00% ![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]() 6.00%

6.00% ![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]() 4.00%

4.00%

Jan-06 Jan-08 Jan-10 Jan-12 Jan-14 Source: Jersey Finance Quarterly Statistics

At the global level, the World Bank continues to forecast a slow but steady economic recovery, though its recent downgrading of global growth predictions (shown in Table 2) along with the Eurozone's slip into deflation serve to highlight the fragility of this recovery. Despite there being uncertainties, the positive economic performance and forecasts of key markets, particularly the UK, is good news for Jersey's finance industry and we are already seeing this filter through to our members. The 2013 Jersey Financial Institutions Survey showed that the fund management sector recorded an increase in net profit of more than a third, with the net profit of the trust and company administration sector rising for the third consecutive year.

The 2014 year end figures for all sectors of Jersey's finance industry are reflective of an overall good performance. The funds sector is leading the way recording its fourth consecutive quarter of growth to reach its highest level in seven years. Not only has the value of funds business reached its highest level since 2008, the sizeable annual increase of almost 20% is particularly pleasing in a global fundraising environment that is still challenging. Although bank deposits fell slightly they remain stable.

Similarly, the December 2014 Business Tendency Survey showed 98% of respondents being either more than or equally as optimistic as they were three months previously.

This context is relevant to the discussion regarding the JIFC as it demonstrates that market conditions are broadly favourable and that there are good, strong opportunities for the finance industry to prosper and indeed grow. Growth in the industry, both organic and resulting from new entrants, will have an impact on the infrastructure requirements of businesses going forward.

Positive economic conditions are no guarantee of success

The aforementioned economic trends and forecasts indicate a positive future for Jersey's finance industry. However success is not guaranteed. Since the financial crisis businesses are increasingly cost conscious, with efficiency being a key business decision driver.

Jersey hosts a number of global and international businesses, many also with operations in competitor jurisdictions. As a result of the corporate drive to achieve cost-savings many have, are, or will be, assessing the need to continue to operate across multiple jurisdictions and may be considering consolidation into a smaller number of platforms, particularly where they are currently operating in more than one Crown Dependency.

We have seen this recently with a number of leading global banks. One of which consolidated their Private Banking operations into Guernsey, and another is reported to be consolidating

their operations into Jersey. Whilst many factors will have been taken into account when deciding where to consolidate, we expect the ability to secure new, large, and modern and fit-for-purpose office space was of importance.

As these strategic decisions continue to be made it is important to recognise that perceptions of the business environment within jurisdictions plays a large part. If a business feels that the environment is supportive and welcoming they will be more inclined to invest and commit to that jurisdiction on a long term basis. Conversely, if the business environment appears unsuitable, unstable or unwelcoming businesses are less likely to see themselves succeeding within that framework.

The availability of suitable office accommodation is a core component of the business environment and it is our view that the historic and continuing debate surrounding the development of the JIFC has and is creating market uncertainty and is damaging to Jersey's reputation. We are convinced that further delay and debate over this project will have a detrimental long term effect on the islands economy.

Government responsibility for the business environment

We believe it is critical that Government acts as a facilitator for growth through providing a competitive and attractive operating platform and business environment on the island.

The Finance Industry Strategic Jurisdictional Review (the strategic review) undertaken in conjunction with McKinsey in 2013 identified enhancing the business environment as a core policy enabler to sustain and grow the finance industry in the long term. They highlighted that to stand out as a finance centre in today's global industry Jersey must excel in areas that determine investors' choice of location: the legal, regulatory and business environments, becoming renowned for, amongst other things, its high-quality infrastructure. The strategic review notes that successful IFCs place emphasis on the importance of these enhancing enablers.

The strategic review recommended that upgrading Jersey's business infrastructure, with particular focus on air transport and office accommodation should be prioritised, as interviews undertaken with industry participants as part of the project suggested clear appetite for larger floor plan office spaces and improved office development.

In total, the strategic review identified more than 20 initiatives' to sustain the industry and support growth, and responsibility for each was attributed to either Industry, the Government or the Regulator. It is telling that the initiative in relation to enhancing infrastructure was assigned to Government to lead.

Future Demand

In terms of demand there are two distinct aspects to consider. The first centres around demand from existing businesses on the Island. The second addresses the potential office accommodation requirements emanating from new entrants to the island.

Starting with the former it is critical to the island's economy to ensure that there is sufficient suitable office accommodation in St. Helier to allow existing businesses to consolidate, operate and grow in a modern and efficient environment. This will provide a tangible benefit to businesses not only from a cost perspective, resulting from more effective use of space and lower overheads, but from a client experience perspective. These combine to provide a compelling rationale for continuing with a Jersey base.

We understand that regarding the JIFC the Jersey Development Company (JDC) are in detailed negotiations with three prospective tenants for first office building, and that there are a further ten on-island financial services companies that are looking for new office space in the coming 2 to 5 years. Based on these expressions of interest, the cumulative requirement for new Grade A office space is estimated to be in the order of 330,000 sq. ft. over the next 5 years.

We understand that there is only between 15,000 and 20,000 sq. ft. of Grade A office accommodation currently available, representing only 2% of total stock, and that this is split across a number of buildings.

If established businesses cannot see a way to expand or upgrade from their current office accommodation they may well reassess whether Jersey is the best long term base for them in the future, particularly if competitor IFCs in which they may also currently be operating are able to offer this.

In terms of new entrants, 2014 saw some great successes, with businesses relocating to the island. One of the core drivers for business decisions for new entrants relocating was Jersey's deep pool of talent, a factor which is facilitated by Government through their immigration, population and skills policies. This demonstrates the importance of the business environment, a tone set by Government, in businesses decision making. However, to facilitate one company's move from another jurisdiction, suitable office accommodation could not be found to meet the company's requirements from available stock. As a result, and in order to secure a successful relocation, JDC vacated their office premises to allow the company to move in.

On this occasion we were lucky that suitable accommodation was able to be found in a timely manner, this may not be the case in the future and it would be deeply disappointing if this were to be the determining factor in whether a business decided to relocate to Jersey.

Future Supply

Figures from Locate Jersey, which include Jersey Finance's inward investment successes, show that for 2014, of the new entrants that Locate Jersey are aware of, 43 business licences were approved resulting in 368 job opportunities. Of those 368 jobs 83% were for local residents. The remaining 17% were individuals relocating to the Island for work purposes, into new i.e. not pre-existing or replacement roles. This equated to 63 jobs in 2014.

We currently have a very active pipeline of inward investment potential, with an engagement programme covering 90 businesses in the banking and funds sectors alone.

It is our understanding that for the Grade A accommodation currently available in St Helier, of which there is 15,000-20,000 sq. ft., 130 sq. ft. would be required per staff member. On this assumption, should there be the same level of new entrants each year as there were in 2014, the Grade A accommodation currently available would be fully utilised in approximately two years – purely for new entrants. However, what is apparent, is that the stock currently vacant is secondary accommodation at best with the majority being unsuited to modern office requirements of leading financial services businesses.

Under construction at Weighbridge House is an additional 10,000 sq. ft. of Grade A accommodation, and there is a further 25,000 sq. ft. remaining available to be let at 66/72 Esplanade once this development is completed. Whilst not an exhaustive list it is more than apparent that this in no way will address the shortfall that will arise given the figures outlined above in terms of existing businesses on the Island looking for new accommodation combined with the requirements of new entrants.

In this regard Jersey plc needs to demonstrate a joined up approach. With both ourselves and Locate Jersey actively promoting to businesses and individuals the attractiveness of the Island as a relocation destination, it needs to be ensured that for those expressing an interest there are modern, efficient and available office facilities to ensure a smooth relocation process which will underpin and reinforce that their decision to move to Jersey was right for them.

As already discussed, the JIFC is a significant long term investment in the future of the island. Developing infrastructure takes time, it is not the right approach to wait for new entrants to commit to the jurisdiction before investing in high quality office accommodation; indeed the investment must be made in order for Jersey to be initially attractive.

Quality of office accommodation and surroundings

The development proposed for the JIFC has been specifically designed with the user in mind, and from conversations we have had with members and businesses relocating to the Island we think that the features the development will be able to offer, including very good natural light, regular floor plate shapes without internal structural columns, and an on-site back-up generator, are ideally suited to the needs of financial services businesses.

The JIFC buildings will have a BREEAM Excellent' environmental rating. BREEAM stands for Building Research Establishment Environment Assessment Method. It allows buildings to be rated against established benchmarks on criteria such as specification, design, construction and use. There are currently fewer than five BREEAM rated office buildings in Jersey.

It is the availability of this quality of accommodation that is currently lacking in the Island. Developing infrastructure excellence to facilitate growth in the finance industry is essential if we want to be able to continue to attract businesses of global caliber as they expect this level of accommodation as standard.

The development of the JIFC will also provide for a new public park which will act as a valuable amenity for the wider community, and enhance the setting in which the buildings are landscaped.

Case Study – The Dubai International Finance Centre (DIFC)

The DIFC is a purpose built financial centre established in 2004. The mission of the DIFC is to promote the growth and development of financial services and related sectors within the UAE economy and to provide state of the art infrastructure and competitive services to our stakeholders'[5]

In the DIFC's promotional literature it is explained that The quality and range of DIFC's independent regulation, common law framework, supportive infrastructure and its tax- friendly regime make it the perfect base'[6].

Jersey has sound and progressive regulation, world-renowned financial services products supported by a robust, modern and sophisticated legal framework, as well as a tax neutral regime – what it is currently lacking from its toolkit is high-quality infrastructure.

The office space available within the DIFC was designed to exceed the demands of the world's most sophisticated financial institutions, and the professionals who work for them. All of the office space is Grade A quality offering flexible layout opportunities and state of the art connectivity. In aggregate the DIFC offers approximately 1.3 million sq. ft. of commercial office space.

What is evident is that the development of the DIFC has been a success. In 2004, 19 companies were registered in the DIFC, and by 2014, its ten year anniversary, there were 1,039 companies registered. By 2005, only one year post-launch, global names including Barclays, Bank of America, Clifford Chance, ICICI Bank, KPMG and Credit Suisse had established a presence.

In 2004 seventy five individuals worked within the DIFC, and by 2014 this figure stood at 15,600. 22 of the world's top 30 banks are represented in the DIFC, 11 of the world's top money managers and 7 of the world's top 10 law firms.

Additionally, and as a result of its ongoing success, the DIFC launched a Centre of Excellence in 2006 offering several professional education programmes complemented by an Executive MBA programme, demonstrating the wider attributes that a cluster effect can have on development of other sectors.

The DIFC contributed 12.1 per cent to Dubai's gross domestic product in 2013 with the contribution of financial services sector being over 15 per cent.'7 This is quite an achievement given that the DIFC did not exist ten years previously.

It is also testament to the success of the DIFC that Dubai's near neighbour Abu Dhabi is this year launching a competitor centre, the Abu Dhabi Global Market. It is our firm belief that there are parallels that can be drawn between the DIFC and the potential future success that would come from establishing the JIFC.

Conclusion

The Finance Industry Strategic Jurisdictional Review provided a comprehensive framework for improving competitiveness to which JFL, Government and the JFSC remain committed. The review's recommendations included upgrading Jersey's business infrastructure, with particular focus being given to office accommodation.

The improving global economic outlook is positive news for Jersey's finance industry and some sectors are already seeing that growth potential come to fruition. However whilst we remain optimistic about the long-term future of the island's finance industry Government must not be complacent and must continue to invest in the business environment that makes Jersey attractive as an IFC. Government responsiveness to business needs is one of the core factors that makes IFCs stand out within a crowded market place.

Government investing in high-quality infrastructure is a positive sign to the market, it demonstrates commitment and the expectation of future success with the additional certainty that comes from a public sector investment. This will be important in ensuring that the existing financial services businesses on the Island can see themselves thriving in Jersey in the long term.

When considering relocation, businesses will be looking at a number of jurisdictions and weighing up the pros and cons for each. Having suitable office accommodation will be a primary factor in their decision making and it is concerning that we are receiving an increasing number of comments about of a lack of fit-for-purpose office space in Jersey. If Jersey is not able to offer the kind of office space businesses are looking for but another jurisdiction can, this may well be the swing factor as to where they decide to operate and this would be deeply disappointing. Therefore the consequences are far reaching. If suitable office accommodation is unavailable, this will have long term consequences for the economic health of the island.

We believe that Government investment and support will pay long-term dividends and that a recognisable financial quarter clustered around the JIFC will be a fantastic asset whose long term value should not be underestimated.

I trust that the above comments are helpful and I should be pleased to elaborate on this submission in person should the Panel deem this to be helpful. Meantime if you have any questions on our submission then please do not hesitate to contact me should you wish to discuss the matter further.

Yours sincerely

Geoff Cook Chief Executive

![]() Please note, content has been redacted to remove commercially sensitive information.

Please note, content has been redacted to remove commercially sensitive information.

7 http://www.emirates247.com/business/economy-finance/12-of-dubai-gdp-from-difc-2014-02-04-1.537222