The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

CITIMA, 5, Bond Street, St Helier, Jersey.

JE2 3NP

Friday 11th November, 2016.

Dear Deputy Le Fondre,

Re: CITIMA comments on Budget 2017.

Thank you for the opportunity to submit these comments on Budget 2017 to the Corporate Services Scrutiny Panel.

They are sent on behalf of my client CITIMA, whose members include Fox Trading, Liberation Group, British American Tobacco, Imperial Tobacco, Philip Morris Limited and Japan Tobacco International.

Having carefully reviewed the Budget 2017 proposals, as they relate to tobacco impot, CITIMA remains deeply concerned by the proposed increases for the following reasons:

- Firstly, there has been no consultation with the industry. This subject arises at Budget time every year, and several years ago, States members asked for closer consultation with the industry through the months preceding the Budget; their intention, as I'm sure you recall, was to perhaps ameliorate the often significant differences of opinion which emerge at this time. That has not happened, and we believe it is an opportunity missed.

Had we been consulted, we would have re-submitted our proposal for an annual duty escalator,' which is how this issue is managed in Guernsey. For example, the Treasury could ask States Members to agree that for the next five (say) years, tobacco duty will be increased by the December RPI figure, plus 2%.

That keeps the domestic cost of tobacco rising at a rate significantly above inflation (in line with the States Tobacco Strategy), while also giving the industry visibility, and certainty, over future duty rises – the net effect is that this particular difference of opinion, which has almost become part of the festive calendar, is avoided.

- Secondly, it should be remembered that consumers have a choice about whether to purchase more expensive products, or not. A significant duty increase simply makes it more likely that those consumers will source tobacco from channels in which no tobacco duty has been paid.

In this scenario, it is both the legal domestic market, and the Treasury itself, who will lose out.

A quick market research exercise will show that consumers can easily save up to £6.00 per pack of 20 cigarettes by doing this.

- Thirdly, if consumers are encouraged to purchase outside of the domestic duty-paid market, there is a resource implication for the Customs department in preventing abuse.

It's not thought that the Island currently has a significant problem with tobacco smuggling, but there have been a number of high-profile cases this year, and the further tobacco tax is pushed up, the greater the incentive for smugglers.

- Fourthly, the increase in tobacco duty is once again justified on health grounds, but the evidence doesn't support that argument. For example, if large domestic price increases were really effective, we would expect to see a direct correlation between a large duty rise, and a consequent drop in tobacco consumption. However, that does not happen.

In fact, while the tobacco duty increases significantly, it seems consumption actually remains relatively static; and it is actually the volume of tobacco imported, and on which local duty is paid, which falls.

That point is evidenced with the following graphics:

- This chart shows that the volume of tobacco imported, and on which duty is paid, is falling:

Source: States of Jersey Treasury

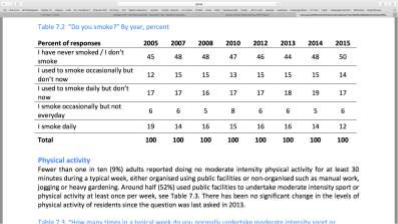

- But while the volume of dutiable tobacco being imported has fallen by 42% since 2005, actual tobacco consumption has only declined a little, and not by anything like the same proportions. Here's the data from States-own Jersey Opinions and Lifestyle Survey' for tobacco consumption over the same period:

Source: States of Jersey Opinions and Lifestyle Survey, 2015.

- Finally, over the same period (2005 to 2015), the steeply increasing duty on a packet of 20 cigarettes (we have used B&H as an example) has pushed up the domestic price from £4.49 (RRP excluding GST) to £7.45 (same basis). That is an increase in RRP, excluding GST, of 67% for the domestic consumer!

Also, between 2005 and 2015, the proportion of a pack price made up of government impot duty has gone up from 58% to 68%.

So, putting those points together, you can see that while duty has gone up significantly between 2005 and 2015, there hasn't been a concurrent reduction in consumption – moreover, while the amount of dutiable tobacco has dropped considerably in the same period, consumption has remained relatively static.

In summary, we believe that the point of diminishing returns has been reached, and that large duty increases, such as the ones being proposed in Budget 2017, are now counter-productive, in that they don't achieve their stated health objectives.

Instead, we suggest that a reasonable duty-escalator is brought in, to bring clarity to this issue, and remove this annual budget dispute.

With that in mind, we propose the States are asked to agree to increase tobacco duty by RPI + 2% for each of the next five years.

We believe a more modest increase of that nature will prove less of an incentive to consumers to change their purchasing habits for non-duty paid sources, while also allowing the States to follow its agreed Tobacco Strategy, and maintaining an important source of revenue for the Island.

It is a difficult balance to strike – but in the case of Budget 2017, as proposed, the Treasury has failed to achieve it.

Your sincerely, James Filleul, CITIMA.