The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

Response to draft Budget 2017 dated 9 November 2016

In considering how to respond to the invitation to make a submission to the Corporate Services Scrutiny Panel, the JCSA/Prospect Union firstly considered the Panel's terms of reference for its review:

- To consider the proposals of the Minister for Treasury and Resources in the Draft 2017 Budget Statement in respect of:

- Income Tax;

- Goods and Services Tax (GST);

- Impôts;

- Property Tax; and

- Other tax proposals;

- To consider the Capital Programme for 2017 as presented in the Draft 2016 Budget Statement;

- To consider any transfers which the Minister may propose in the Draft 2017 Budget Statement between the Consolidated Fund and other Funds and reserves and in particular the overall impact on the Strategic Reserve (taking into account all transfers to/from the Strategic Reserve since the commencement of the first MTFP in 2013);

- To consider the updated financial forecasts and the economic implications of the Minister's proposals in the Draft 2017 Budget Statement.

The Panel has requested,

"any views or information relating to the Draft Budget 2017 proposals which you would like to submit."

However the Union will restrict itself to such matters that might impact only on its members. To that effect, there will be no comment on matters which impact on the general population of the Island as it is considered that might be entering a political arena which may be beyond the remit of the Union.

Whilst there are areas within Terms of Reference number 1, 2 and 3 which impact on Union members, they impact equally on all other members of society.

However, ToR 4, which deals with financial forecasts and the economic implications of the proposals impacts heavily on our members in the following manner:

- EMPLOYMENT TRENDS

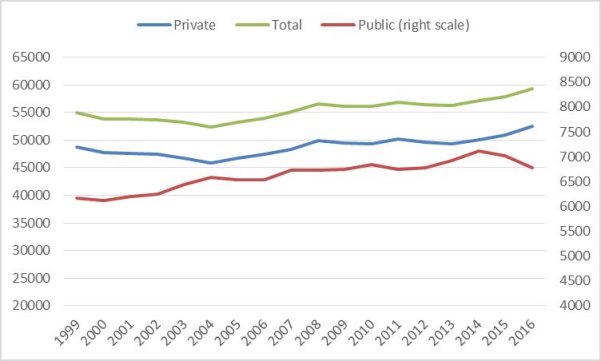

Figure 31 on page 68 deals with employment trends. As can be clearly seen, the trend within the private sector has been increasing over the last two years. This increase has been reflected in the total number employed. Ministerial policy has applied severe pressure on the public sector to reduce numbers, to do more with less and to squeeze out inefficiencies where ever possible. In doing so, the numbers of States Employees has been reduced as shown in the graph.

Fig 31 – Employment Trends Draft Budget Statement 2017.

It is those very staff who are being cut down on that are expected to make the savings, cuts and efficiencies that the Council of Ministers are requiring. Public services and the goals within the strategic priorities need, not only the staff to undertake the work but a focussed and keen workforce to achieve the high standards currently being enjoyed by the Island population. Pages 5 and 67 of the Draft Budget points out that public sector employment was 3.8% lower than in June 2015 and this was the second consecutive annual fall.

The Union is concerned that enforced job losses reduces provision to the public, creates poor morale and distracts workers from their core tasks by inducing a survivor syndrome'. The loss of knowledge and experience is significant but does not appear to be relevant to the employers thinking. It should be born in mind that outsourcing of revenue earning services makes it increasingly difficult for the remaining public sector to show efficiencies. Cost cutting is not the same as efficiency.

- AVERAGE EARNINGS

Page 69 of the Budget document states:

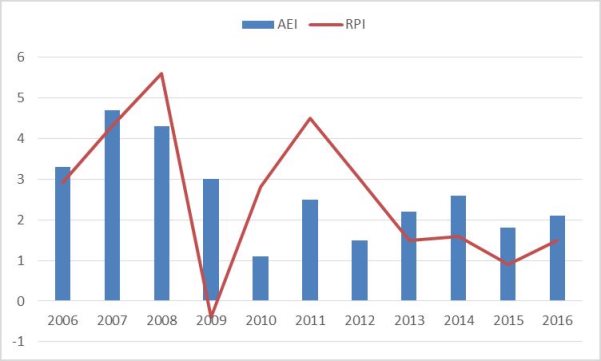

"Average earnings increased by 2.1% in the year to June 2016." And includes the following graph:

FIGURE 33 – Average earnings and inflation

% change on year ago, June each year

It should be born in mind that the employer of our members has not entered negotiation on pay for 2015 and no increase in pay has been received by our members since January 2014. Therefore the above graph is inaccurate and irrelevant in respect of a sizable proportion of the Islands workforce, i.e. our members. This is confirmed on page 69:

"Public sector earnings increased at a rate below inflation for the second consecutive year."

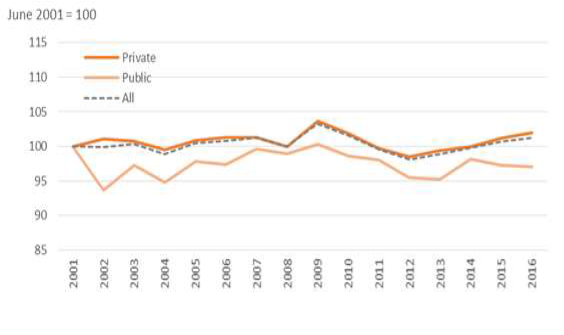

A far more realistic graph is Figure 7 of the States of Jersey Statistics Unit "Index of Average Earnings: June 2016"

Figure 7 – Index of Average Earnings in real terms for the public and private sectors from 2001 to 2016

This graph clearly shows not only that in 2016 average earnings within the public sector was kept below that of the private sector, but that the employer has maintained a lower level of pay since 2001 when the records started for this graph.

The graph clearly shows the average earnings within the public sector has dropped in real terms over the last two years. It has been noted that page 65 of the draft Budget states that the FPP Annual Report shows that economic growth for 2015 was 2.2%, more than double that expected by the FPP.

This Union cannot understand why its members have been treated like this by the employer. The MTFP 2013-2015 had money agreed by the States and set aside for a wage increase of up to 1.5% for 2015. Additionally, Figure 21 shows a significant difference between the States Income Forecast for 2015 in the 2016 budget and the outturn 2015, which would surely allow wriggle room for negotiations in an otherwise tight financial environment. The workforce has not seen any of that money and the employer has refused to discuss it with representatives. In fact, the employer currently refuses to enter into arbitration to resolve the matter.

Up until this 2015 pay round, the membership of the JCSA/Prospect Union have respected the economic difficulties and agreed to take the financial hits asked of them. This can be clearly seen by the lower graph line which represents so many years of lower public sector pay. By failing to even negotiate in relation to pay, the employer has shown a complete disrespect for its workforce and by insisting that the 2015 pay round is connected to the 2016 – 2019 MTFP, is creating an impossible situation for its staff.

Nowhere in the Draft Budget Statement 2017 is the true picture relating to public sector earnings explained. Neither is there any reference to outstanding pay issues which may impact on the budget for 2016, 2017 and onwards depending on the results of the current impasse.

It has been noted that page 57 states:

"Average earnings – 2017 expected to be slightly higher (in nominal Terms, due to higher inflation)."

In addition, figure 28 shows that measure of GVA has increased for the last three years at an average rate of 3% and is now above its previous peak in 2008.

- ECONOMIC IMPLICATIONS

The graph, figure 7 above shows the difference between private and public sector pay on a yearly basis. Figures provided by the employer suggest that one percentage point of pay for public sector workers is about £3.5m. It can be seen that year on year, the employer has made savings in the millions of pounds on the back of its staff. The union has not done the maths here but considering that these are compound savings, the sums concerned are very significant. Although the staff may have been content to tolerate this due to the financial circumstances facing the Island, this is no longer the case.

The Union has to recognise that the amount of money that has been withheld from staff can only have negative economic implications to the economy in many ways. For example,

- Most of the staff are local and pay local taxes. Less now because of the policy of the employer.

- Most of the staff use local restaurants, shops and services. Less now because of the policy of the employer.

- Most of the staff buy holidays and other luxury items, often from local sources. Significantly less now because of the policies of the employer.

All of these problems are specific to our members, are real and have a negative impact on the individual, their families and the general society in which we live.

WORKFORCE MODERNISATION

It is not just how the budget deals with matters relating to union members that is of concern. The Draft Budget Statement 2017 completely fails to deal with the financial issues involved in the Workforce Modernisation project, which is currently being undertaken by the employer. This is a huge piece of work which will impact on every States employee. The Chief Executive has assured the Union that this is the most important piece of work undertaken relating to States staff in generations, yet there is not one mention within this strategic document of the forecast ranges of the financing provision required. The absence of any funding provision for this project suggests to the Union that there is actually no funding for it and that is a significant concern.

The Draft Budget Statement 2017 covers numerous capital expenditure projects, including those such as the Office Consolidation Project of which there are no details yet. However, these things are contained within the pages and have been financially catered for. The Workforce Modernisation project is the largest project to be undertaken relating to the nature of the workforce for many years, perhaps of all time, and there is no visible budget provision for it. How is it being funded?

This raises questions for the union as to how the members will be treated. If no money is to be available for the project, how can the concept of equal pay for equal work be instigated without some significant financial penalties for some workers? Perhaps time will tell. The exclusion of this from the budget document is of the gravest concern.

CONCLUSIONS

The current policies of the Council of Ministers in relation to many aspects of the financial contributions made by islanders are currently very contentious. However, maintaining focus on the interests of members, the Union cannot support this budget statement because it:

- Clearly shows the employment trends of our members,

- Clearly shows the average earnings of our members,

- Is silent on future pay negotiations

- Ignores the workforce modernisation project; one of the biggest projects facing the States workforce.

JCSA Unit 10, Elizabeth Terminal, La Route du Port Elizabeth, St Helier, Jersey, JE2 3NE Internal phone: 47695 External :01534 734676 Mobile: 07797 710912 Email: jcsa@prospect.org.uk