The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

From a bleak future to confidence and stability The story of beer duty: 2008 to 2016

We will now scrap the beer duty escalator altogether.

We will now scrap the beer duty escalator altogether.

And instead of the 3p rise in beer duty

tax planned for this year I am cancelling it altogether.

That s the freeze people have been campaigning for.

But I m going to go one step further and I am going to cut beer duty by 1p.

We re taking a penny off a pint.

Rt Hon George Osborne MP, Budget Speech 2013

From a bleak future to confidence and stability Foreword

From a bleak future to confidence and stability Foreword

Whilst some may think a penny or two off beer duty is simply a good headline, or a political gimmick even, nothing could be further from the truth. When an important industry is struggling under a tax burden considerably greater than its European counterparts, and with significant rises each year leading to thousands of community pubs closing for good, even the smallest of respites can make a huge difference. Repeated again and again, as will be demonstrated here, the effects can be extraordinary.

The UK brewing and pub sector is an integral part of the nation's social, economic and cultural identity. The footprint of the sector covers every region and constituency across the country. Across the nation 30 million people visit Britain's pubs each month, with over 15 million sampling one of the country's great beers.

The sector supports nearly 900,000 jobs across the country in a vast range of positions, from farmers to brewery technicians to head chefs and into managerial and entrepreneurial roles. One in thirteen young people currently in work are employed in our sector.

The Great British pub and British beers are also strong symbols of this country, both domestically and overseas. The pub is a tourist icon, being the fourth most popular attraction for visitors. Our beers are recognised as high- quality with a strong heritage coupled with cutting-edge innovation. Beer is also worth over half a billion in export value and is consumed in 100 countries around the globe.

This brief report articulates the two different approaches to beer duty between 2008 and 2016. It demonstrates how the action taken since 2013 has led to a major turnaround in the beer and pub sector, setting it up to be an important engine for growth as the UK prepares to leave the EU - providing of course the action taken continues, even if it is one penny

at a time.

Brigid Simmonds OBE Chief Executive, BBPA

Colin Valentine

National Chairman, CAMRA

Mike Benner

Managing Director, SIBA

2008 to 2012: An industry undervalued and under attack

2008 to 2012: An industry undervalued and under attack

Despite its importance to consumers and the economy, the sector has felt under attack and undervalued at times and an easy target for Governments seeking extra tax.

This manifested itself

most prominently with

an unprecedented 9.1 per cent increase in beer duty

in March 2008 and the introduction of what became known as the beer duty escalator' – a mechanism that increased beer duty by 2 per cent above inflation each year.

In December 2008 beer duty was then hiked by a further

8 per cent at the time of the temporary cut in VAT. Suffice to say the increase in beer duty was not temporary.

The escalator' continued up to and including Budget 2012, by which point

beer duty had increased

a staggering 42 per cent. In this time VAT had also increased, adding further to the cost of beer to the consumer and burdening Britain's pubs and brewers.

![]() Table 1: Beer duty policy 2008 - 2012

Table 1: Beer duty policy 2008 - 2012

Beer duty increased by |

| 42% |

Beer duty revenues increased by only |

| 12% |

Total beer consumption fell by |

| 16% |

Beer sales in pubs fell by |

| 24% |

Pubs closed |

| 3,700 |

Jobs lost |

| 75,000 |

Whilst, of course there were other factors impacting the sector such as the economic downturn, the smoking ban and broader social changes, compounded by these duty changes the effects were devastating and indeed largely self-defeating. Less and less additional revenue was raised as demand fell sharply with each additional tax rise. Table 1 summarises what occurred during

![]() this period.

this period.

Along with other cost

rises, beer duty increases ultimately feed through to pub prices and hence to what people have to pay

for their pint. The years

of the beer duty escalator saw some of the highest increases in pub beer prices for decades, as shown below.

Between 2008 and 2012 the duty on beer increased by

15 pence per pint. For beer drinkers this was an extra tax of £1.1 billion per annum (based on 2013 consumption levels).

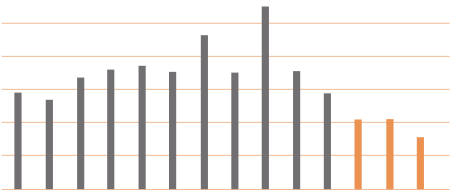

Chart 1: Change in pub beer prices, 12-month change:

6.0%

6.0% ![]() 5.0%

5.0%

4.0%

3.0%

2.0%

1.0%

0.0%

![]() 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016

A change in tack and a revival: 2013-2016

After a long campaign by consumers, brewers and publicans, at Budget 2013 the duty escalator was finally abandoned and instead beer duty was decreased by 2 per cent, or a penny off a pint . The Government then proceeded to cut beer duty by a penny per pint in the next two Budgets, before freezing duty in Budget 2016.

![]() This change in policy from Budget 2013 onwards sparked a surge in confidence in the sector, reversing falling beer

This change in policy from Budget 2013 onwards sparked a surge in confidence in the sector, reversing falling beer

sales and generating much needed investment in pub estates and breweries. For the first time in many years it looked like Government had recognised the importance of the industry and was willing to

support it.

The integral link between beer and pubs

The British pub sector of the modern day has changed dramatically from that of previous generations. There is now a wide range of pub types, offering a very broad range of products and

services to their customers. For example, pubs now serve over 1 billion meals per year.

The one factor that has remained consistent is the importance of beer to the pub. There are very few people who would

agree that an outlet is a pub if it does not offer beer. Draught beer, and cask ale, in particular, are unique selling points of the British pub. The latest data shows that nearly seven out of every ten alcoholic drinks sold in pubs are beer.

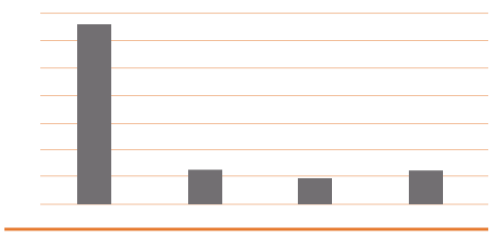

Chart 2: Drink type sold by pubs

Chart 2: Drink type sold by pubs

70% 60% 50% 40% 30% 20% 10%

0%

Beer Spirits Cider Wine

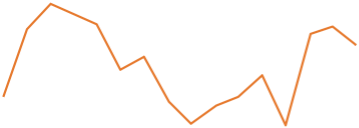

Between 2007 and 2012 annual beer sales fell a staggering 18.5 per cent, with the associated loss

of employment, business closures and reduced revenue to Government from declining sales taxes and increased social security payments.

![]() In contrast the abolition of the beer duty escalator and the decision to reduce beer duty by a penny per pint has contributed strongly to turning this trend around.

In contrast the abolition of the beer duty escalator and the decision to reduce beer duty by a penny per pint has contributed strongly to turning this trend around.

Having seen falls in sales of between 3 and 5 per cent in each year that the beer duty escalator was in place, the subsequent three years have seen a period of stability, including the first year of beer sales growth in a decade in 2014.

In 2014, CAMRA commissioned The Centre of Economics and Business Research to estimate the impact of two successive duty cuts. The report concluded that "an additional 1,047

pubs would have closed by the end of 2014 if the beer duty escalator had remained in place instead of beer duty being cut by 2p over the last two years."

The same report was commissioned in 2016 to look at a scenario where duty is cut by a penny with a subsequent freeze the year after rather than inflationary increases. In this scenario "just under 550 pubs (would be saved) over the course of the parliament".

Chart 3: Beer sales, 2000 - 2015

60,000 40,000 20,000

![]()

6.0% 4.0% 2.0% 0.0% -2.0% -4.0% -6.0%

6.0% 4.0% 2.0% 0.0% -2.0% -4.0% -6.0%

|

|

|

|

|

|

|

| ||||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

-

2000 | 2001 | 2002 | 2003 | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

-20,000 -40,000 -60,000

Beer sales ( 000 hls) % change

The benefit to pubs of the end of the beer duty escalator

![]() As the predominant outlet for beer in the UK the pub sector has been the hardest hit by increases in beer duty. Whilst the brewer pays the duty, this then forms part of the wholesale price of beer. The chart below shows the duty costs for a pub selling 200 barrels of beer per year (around 150 pints per day). In 2000 this was just over £15,000 but by 2012 had risen by almost £10,000. The subsequent duty cuts have reduced this bill by over £1,500. Compared to

As the predominant outlet for beer in the UK the pub sector has been the hardest hit by increases in beer duty. Whilst the brewer pays the duty, this then forms part of the wholesale price of beer. The chart below shows the duty costs for a pub selling 200 barrels of beer per year (around 150 pints per day). In 2000 this was just over £15,000 but by 2012 had risen by almost £10,000. The subsequent duty cuts have reduced this bill by over £1,500. Compared to

previous policy (the escalator was scheduled to be in place until 2015 followed by RPI), pubs are now paying £5,000 per year less than would have been the case -

a major saving.

The consumer impact

With a beer with friends

and family in the pub

in danger of becoming unaffordable for many, this galvanised the public. In 2012, this culminated in over 100,000 signing an official Government e-petition in opposition to further tax increases, a mass lobby of Parliament by CAMRA

and public opinion being strongly against the escalator.

Due to the change in policy from Government beer duty is now 6 per cent lower than at its peak in 2012/13. This adds up to a reduction of £211 million per annum

in beer duty being levied

on Britain's beer drinkers. The savings are greater

still if considered against increases previously planned for. Indeed, since 2013 beer prices have increased at their lowest levels since the 1980s (see chart 1).

Chart 4: Duty cost for an average pub

£35,000 ![]() £30,000

£30,000

|

|

|

| |||||||||||||||

|

|

|

|

|

|

|

| |||||||||||

|

|

|

|

|

|

|

|

|

|

| ||||||||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

£25,000

£20,000

£15,000

£10,000

£5,000

0

![]() Actual duty on beer sold Additional duty under initial policy

Actual duty on beer sold Additional duty under initial policy

Economic impact of duty reductions

Oxford Economics has forecast the impact of the changes compared to previous policies.

By 2016/17 there will be 21,000 more jobs compared to the previous policy of the escalator up to 2015 and inflationary increases thereafter.

Whilst this has led to some decline in beer duty revenue, this is less than the Government estimated and around half of this is being recouped in other taxes and social security savings through the subsequent boost to sales and employment.

![]() As already highlighted it has also led to more small businesses surviving and thriving and consumers

As already highlighted it has also led to more small businesses surviving and thriving and consumers

facing lower cost pressures in order to enjoy the simple pleasure of a pint in the pub with friends.

Investment

The turnaround in confidence since 2013 has also spurred a huge range of investment projects. There

is now more than £1 billion being invested by brewers and pub owners each year, ranging from state-of-the-

art technology in breweries - contributing to reducing the sector's environmental footprint - to refurbishments of Britain's much loved-pubs as well as building new ones.

A small sample of investment projects undertaken since the 2013 Budget are highlighted towards the end of

this report.

Government revenues

The rationale for increases in beer excise duty was to raise Government revenue from the industry to support public spending plans. However, a critical

factor was overlooked – that beer duty increases were failing to deliver the expected revenues and were contributing to a reduction in Government revenues elsewhere.

On the flip-side, subsequent duty cuts have cost the Treasury very little and provided a major boost to jobs, investment and wider revenues from a stabilised beer and pub sector.

Table 2: Impact of duty policy since 2013 compared to beer duty escalator and inflation increases previously planned.

On-trade (m pints) | Off-trade (m pints) | Total (m pints) | Jobs | Lost duty | Additional taxes | Net cost |

Yr 13/14 91 Yr 14/15 186 Yr 15/16 246 Yr 16/17 335 | 103 238 350 447 | 194 424 596 782 | 6,987 14,410 19,288 21,255 | £119 £240 £363 £398 | £118 £181 £182 £195 | £1 £59 £181 £203 |

2017: Uncertainty, rising costs

and the ongoing challenges of

high taxation

The very high levels of duty in the UK continue to inhibit the growth potential of both brewers and pubs. Research shows that the average brewer is making just one to two pence per pint in profit, compared to nearly £1 that goes

to the Government. Equally the pub sector

is held back paying one pound in every three

![]() of total turnover to the Exchequer.

of total turnover to the Exchequer.

The high level of taxation (and regulation) imposed

on the sector holds back investment and hampers advances in productivity. The most notable evidence of the unfair taxation burden on UK brewers and pubs

is the comparison with our neighbours in Europe.

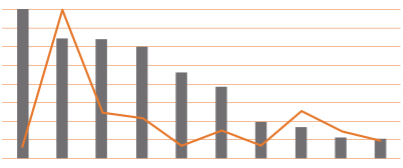

Compared to other major beer producing countries in Europe, the UK beer drinker pays between 3 and 12 times more beer duty.

Exiting the European Union

The referendum result

to leave the EU creates uncertainty for business. This is particularly a factor in terms of British beer exports and access

to a skilled workforce, particularly in the pub trade The potential knock-

on impact on consumer confidence, though

limited to date, could also impact this sector with its dependence on discretionary spend.

Chart 5: Production and duty rates in top ten European beer markets

90,000

90,000 ![]() 60.0 80,000

60.0 80,000

50.0 70,000

60,000 40.0 50,000

30.0 40,000

30,000 20.0 20,000

10.0 10,000

0 0.0

UK

Italy

Spain

Germany France Poland Romania Belgium

Netherlands

![]()

![]() Production ( 000 hls)

Production ( 000 hls) ![]() Duty (p per pint) Czech Republic

Duty (p per pint) Czech Republic

The industry is engaging with stakeholders to outline its priorities for negotiations with the EU and post- Brexit. This includes a

![]() more competitive tax and regulatory environment with the opportunity to review the structure of beer duty to further boost beer exports, support the consumption of lower strength drinks and Britain's pubs and benefit consumers.

more competitive tax and regulatory environment with the opportunity to review the structure of beer duty to further boost beer exports, support the consumption of lower strength drinks and Britain's pubs and benefit consumers.

Headwind of business costs on the brewing and pub sector

The sector is already facing increased regulatory costs and taxation over the next few years. In combination these measures will add hundreds of millions in costs to the sector – the equivalent of a 10% increase in beer duty by 2020. The prime drivers of this are business rates, the Apprenticeship Levy, the National Living

Wage, auto-enrolment pensions, as well as an increase in energy costs. Though not included below, energy policy changes announced at Budget 2016 will affect the way that business energy taxes

are levied.

Whilst these are designed to be broadly revenue neutral this will shift the burden from larger retail businesses, such as supermarkets, to small, independent ones

like pubs.

Table 3: Impact of changes to employment regulation and business rates revaluation on pubs by 2020

|

| Total cost (£m) | Cost per pub | Equivalent beer duty increase (p per pint) | Equivalent beer duty increase (%) |

Apprenticeship levy |

| 5 | 103 | 0.07 | 0.15 |

National Living Wage |

| 222 | 4,271 | 2.79 | 6.36 |

Auto-enrolment pensions |

| 102 | 1,961 | 1.28 | 2.92 |

Total employment changes Business rates revaluation Total |

| 330 44 374 | 6,334 844 7,178 | 4.71 0.55 5.3 | 9.43 1.25 10.7 |

What future for beer and pubs?

The public has consistently supported action on beer duty to help pubs. The most recent poll carried out ahead of the 2016 Budget by YouGov found that almost three-quarters (72%) of the public supported a further cut or freeze.

There is very good reason for this support as this report has sought to demonstrate

by contrasting two very different approaches to

beer duty since 2008. It

![]() is clear why Government should follow the course taken in recent years rather than revert to punitive duty increases, even more so at this important time with the uncertainties and major

is clear why Government should follow the course taken in recent years rather than revert to punitive duty increases, even more so at this important time with the uncertainties and major

regulatory cost increases now upon the sector. Indeed, looking to the future it is vital that the Government delivers

a competitive tax and regulatory regime for UK businesses to allow them to thrive and compete on the global stage.

Therefore, as a minimum,

it is imperative that there is a freeze in beer duty in the Autumn Statement of 2016. Following this we believe that the Treasury needs to look at how it can support the beer and pub industry

to recover and grow, adding further to the UK economy. This should involve supportive measures on beer duty, with an ambition that

beer duty is lower at the end of this Parliament

than at the beginning, and starts to move closer to our European competitors.

Finally, broader measures need to be considered, such as a reduction in business rates for pubs, which on average pay five times more than other sectors as a proportion of turnover. The recent revaluation increased the sector's bill by a further 6 per cent. Measures

to mitigate increased employment costs and an overall reduction in red tape, including licensing, will also be vital for pub businesses, where up to 30 per cent of turnover is labour costs.

***

Chart 6: Public view of excise duty changes

|

|

|

|

|

|

|

|

|

|

| 31 |

|

|

| 41 |

|

| 18 | 11 |

|

|

|

|

|

|

|

|

|

|

![]()

![]() Make going out to the pub more affordable by cutting beer tax Keep beer tax the same

Make going out to the pub more affordable by cutting beer tax Keep beer tax the same

![]()

![]() Increase beer tax to generate more money for Government Don t know

Increase beer tax to generate more money for Government Don t know

As part of a global business we have to compete for capital with our operations across the world, including in markets that are seeing significant growth compared with the decline we have seen in the UK beer market. The removal of the duty escalator and consecutive years of duty cuts has increased confidence that the UK market is a good place to do business, despite continuing tough conditions.

As part of a global business we have to compete for capital with our operations across the world, including in markets that are seeing significant growth compared with the decline we have seen in the UK beer market. The removal of the duty escalator and consecutive years of duty cuts has increased confidence that the UK market is a good place to do business, despite continuing tough conditions.

We have made significant investments in our brewing operations in Manchester, Hereford, Tadcaster and Edinburgh over the last few years, with a total projected investment of £20 million in 2016 alone. Following an investment of around £45 million in our Star Pubs and Bars estate since 2014, we are spending a further £20 million improving our pubs before the end of 2016. Almost 64% of our 1,100 pubs will have benefitted from this fund since 2014 and around 1,500 jobs will be created

as a result.

HEINEKEN UK

This second successive reduction in beer duty, which has been passed on in its entirety to our licensees, will make a significant contribution to our ongoing efforts to support talented, hard- working licensees as they seek to sustain community pubs up and down the country. In these difficult economic times it has been encouraging to see the Government rein in the punitive taxation of one of Britain s oldest industries and in doing so start the process of creating a tax regime that allows well-run pubs to not just be sustained but prosper and thereby promote investment and job creation. ADMIRAL TAVERNS (2014) |

|

Following the abolition of the beer duty escalator which decimated beer volumes over a difficult five year period, the successive reduction in beer duty has allowed us to approach the future with renewed optimism. This has resulted in a number of high profile acquisitions but more importantly has led to record levels of capital investment resulting in circa 250 new jobs. The reduction in duty has also given our self-employed tenants the possibility of achieving greater success in their pubs. FULLER, SMITH & TURNER (2014) |

We have a number of supply chain programmes under development which would not have been considered prior to the positive duty policy changes. These include investments which help to drive long term environmental sustainability and efficiency which are good for the business, employees and the community in which we operate.

We have a number of supply chain programmes under development which would not have been considered prior to the positive duty policy changes. These include investments which help to drive long term environmental sustainability and efficiency which are good for the business, employees and the community in which we operate.

Confidence and investment in the brewing industry has been bolstered with investment at our Burton brewery reaching record levels this year. However, there is still some way to go as UK beer drinkers still pay an excessive amount in tax on beer compared with Europe.

MOLSON COORS (2014)

A er many years of ever increasing tax burdens, it is most encouraging that the current Government recognises the importance of the pub industry and the many people we employ. Without doubt over the longer term its initiatives will collect at least the same amount of revenue as our business grows.

YOUNGS (2013)

We welcome the reduction in duty as it enables us to continue to deliver value to our guests and supports pubs as the best place for people to drink responsibly.

MITCHELLS & BUTLERS PLC (2013)

A one penny cut in beer duty may not sound like much, but the cumulative effect of three of them in a row, plus the abolition of the beer duty escalator, is definitely something to be grateful for. The escalator was doing untold damage to breweries of all sizes and scrapping it put a huge amount of confidence back into all sectors of the brewing industry, from cra microbrewers to traditional regional brewers. At Exe Valley Brewery, we have certainly started to feel more confident about the future, to

A one penny cut in beer duty may not sound like much, but the cumulative effect of three of them in a row, plus the abolition of the beer duty escalator, is definitely something to be grateful for. The escalator was doing untold damage to breweries of all sizes and scrapping it put a huge amount of confidence back into all sectors of the brewing industry, from cra microbrewers to traditional regional brewers. At Exe Valley Brewery, we have certainly started to feel more confident about the future, to

the extent that earlier this year, we moved our one part-time worker onto full-time hours, and we are finding plenty for him to do in keeping up with increased customer demand.

EXE VALLEY BREWERY, DEVON

We ve expanded massively since 2013. Our production is up by 40% and we ve invested in new casks, tanks, cold storage and vehicles to cope with increased demand for our beers. We ve also recruited three members of staff - a full-time sales manager, a part-time brewery assistant and an apprentice assistant brewery, who started with us at the start of this year and is being trained up. It s hard to say what contribution the changes in duty will have made to this, but they certainly won t have done any harm.

REVOLUTIONS BREWING COMPANY, CASTLEFORD, WEST YORKSHIRE

At Brecon Brewing, we ve taken the view that the Government s three successive cuts in duty, and more importantly, the end of the duty escalator, show that they have belief in how brewers can contribute to economic growth. As a result, we ve taken the decision to invest in our business, and have recently purchased a machine for bottling and kegging beers, which will enable us to supply UK customers and to approach other export markets with much more confidence. Earlier this year, we joined a Welsh Government trade mission to Taiwan and secured further orders and business from both our existing and new customers in that region, and later this year we ll be part of another mission to Scandinavia. We are also starting down the line of acquiring a retail outlet in the centre of Brecon to act as a bottle shop and bar.

At Brecon Brewing, we ve taken the view that the Government s three successive cuts in duty, and more importantly, the end of the duty escalator, show that they have belief in how brewers can contribute to economic growth. As a result, we ve taken the decision to invest in our business, and have recently purchased a machine for bottling and kegging beers, which will enable us to supply UK customers and to approach other export markets with much more confidence. Earlier this year, we joined a Welsh Government trade mission to Taiwan and secured further orders and business from both our existing and new customers in that region, and later this year we ll be part of another mission to Scandinavia. We are also starting down the line of acquiring a retail outlet in the centre of Brecon to act as a bottle shop and bar.

BRECON BREWING

Lincoln Green started with just two employees in 2012, but has since expanded to a team of six full-time and two part-time workers. We have also opened two pubs locally, employing a total of 19 people, and plan to grow our estate to five sites over the next five years. All these jobs have been created in an ex- mining area.

We have invested heavily in the brewery over the past

three years, acquiring additional space from the adjacent industrial unit, installing new cold storage, fermenters and conditioning tanks, as well as opening a brewery shop. Now, we re in a consolidation phase and are progressing with SALSA and developing standard operating procedures for both brewery and pubs that will lay solid foundations for the future. Maintaining a fair level of taxation in our industry will continue to help us achieve our goal.

LINCOLN GREEN BREWERY, HUCKNALL, NOTTINGHAMSHIRE

For Purple Moose, the second cut in beer duty has, like the first one, inspired some confidence to invest in the future of the business, rather than just trying to get by. In particular, we ve seen an upturn in trade at the alehouse in Conwy we operate with three other local brewers. Buoyed by its success, we are looking for a second pub and hope to create another great showcase for locally produced alcoholic drinks.

For Purple Moose, the second cut in beer duty has, like the first one, inspired some confidence to invest in the future of the business, rather than just trying to get by. In particular, we ve seen an upturn in trade at the alehouse in Conwy we operate with three other local brewers. Buoyed by its success, we are looking for a second pub and hope to create another great showcase for locally produced alcoholic drinks.

PURPLE MOOSE BREWERY, GWYNEDD (2014)

The further penny off a pint has continued to help us to limit price increases to our customers and cemented our confidence in the future plans we have for the business. We have carried on investing in the brewery systems, making modifications which help us to maintain the quality and consistency of the brews. The cut in duty is obviously of benefit to us in these endeavours.

LUDLOW BREWING COMPANY (2014)

Last year s cut in the misguided, counterproductive beer taxation was most welcome and won t be forgotten quickly. It was also a crucial factor in our decision to purchase a site for our second pub. This is now open, employing lots of people, contributing to its community and paying taxes. This year s cut will help to secure the future of our now nearly 50 employees and is hopefully an indicator of a business-friendly government to come.

SPITTING FEATHERS BREWERRY, CHESTER (2014)

3 Lower beer prices for Britain s pub goers 3 Thousands of vital new UK jobs

3 Lower beer prices for Britain s pub goers 3 Thousands of vital new UK jobs

3 Millions of pounds of new investment in UK brewing and Great British pubs

3 Exciting new product innovation 3 Major boost to UK beer market 3 Tax revenues increasing

3 Hugely popular with the public

British Beer &

British Beer &

Pub Association Ground Floor Brewers' Hall Aldermanbury Square London EC2V 7HR

T: 020 7627 9191

F: 020 7627 9123

E: info@beerandpub.com www.beerandpub.com

Registered in London Company number: 1182734

CAMRA

CAMRA

230 Hatfield Road St Albans AL1 4LW

T: 01727 867201

E: camra@camra.org.uk www.camra.org.uk

SIBA

SIBA

The National Brewery Centre Horninglow Street Burton-On-Trent Staffordshire DE14 1NG

T: 08453 379158

E: secretariat@siba.co.uk www.siba.co.uk