The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

Deputy J Maçon

Education and Home Affairs Scrutiny Panel Scrutiny Office

States Greffe

Morier House

St Helier

JE1 1DD

Jersey

6 January 2016

Dear Deputy Maçon, Student Financing

I am writing in response to your letter addressed to Geoff Cook, dated 17th November 2016, regarding student financing in Jersey. I would like to thank you for providing Jersey Finance ("JFL") with the opportunity to contribute to a subject which is of unquestionable importance to the finance industry and to the Island as a whole.

In addressing your questions, I would like to first provide an overview of the finance sector in Jersey and the importance placed on the educational attainment of its current and future workforce. I would then like to outline the feedback we have received from our Members in relation to current and future employment needs, both generally and specifically in respect of the balance between graduate and school leaver trainees. Additionally, I would like to summarise the key findings from a report entitled "Jersey Finance Sector. Employment and Recruitment Paper", which was commissioned by JFL in 2015. The report provided additional information about potential skills gaps and sought to assess the intentions of young individuals in terms of their propensity to seek employment in the finance industry and/or attend university.

Jersey's finance sector

The finance industry is a vital part of Jersey's economy, employing more than 13,000 people, accounting for 25% of total private sector employment and contributing 42% of total GVA.

The presence of the financial services industry in Jersey generates economic activity and supports jobs across the Island and not limited to the sector alone. Including all impact channels (direct, indirect and induced), an independent economics consultancy firm has estimated that financial services firms supported nearly 26,500 jobs in Jersey in 2014. This means that almost half of all employment on the Island was in some way dependent on the industry's presence.

Over the years, the financial services sector has developed an enviable reputation and Jersey is recognised as one of the world's leading international finance centres. For Jersey to retain its position and to further grow the industry, the Island needs to ensure it has a workforce with the right skills to service the ever-changing needs of the sector's clients. Furthermore, the limited size of the Island means we must develop local talent via a world class education system so that the industry may recruit local individuals to the greatest extent possible.

Each year, the finance industry employs a significant number of graduates and school leavers. The accountancy firms are one of the biggest recruiters at this level as they seek individuals to join their trainee programs. By way of example, PwC C.I. recruited almost 250 school leavers and graduates across Jersey and Guernsey between 2010 and 2016.

With ever-increasingly complex legislation and regulation to deal with, combined with operating in an internationally competitive industry, our members are, more than ever, seeking the best qualified trainees possible. This naturally leads to a greater desire to recruit graduates to fill entry-level roles. Even with the full changes of influencing factors such as tuition fee increases not yet being felt, we are already observing a supply shortage of local degree holding candidates.

For the finance sector and wider economy to continue to thrive, there is a definite need for a flourishing education sector that can continually provide future talent to an international finance centre which prides itself on expertise and quality of service. We are therefore delighted to hear of the work that the Scrutiny Panel is undertaking to review the current policies in Jersey relating to student financing and whether they meet the needs of the Island.

Members' views

On a bi-annual basis, JFL run an online "Employment and Growth Survey" of our members. Through this research, we obtain the finance industry's views on current employment trends and the expected future needs of the sector.

Now in its third year of running, results have been consistently positive. The most recent survey closed in October 2016 with the majority of respondents indicating they expect to grow their businesses in the next 12 months and 5 years. Most new hires are anticipated to be administration professionals, accountants and trust/company services professionals at officer level, with graduate and manager opportunities also likely to be prominent.

Some of our respondents, mainly from accounting firms, have started to observe a shift in entry level employment from graduates to school leavers due to the short supply of the former. The training schemes accountancy businesses run are often open to school leavers, so this is a trend that some businesses can adapt to. However, such training flexibility is not universal with, for example, law firms likely to have a much stronger preference for individuals with degree-level or even postgraduate qualifications.

Even for businesses which are able to recruit school leavers rather than graduates, such a changing dynamic does present challenges, including:

- some individuals may not be ready for a career in finance at 16 or 18. The extra time at university often teaches life skills as well as academic development. This is of particular importance in dealing with colleagues and clients in what is very much a personal and service driven industry;

- living elsewhere for a period of time can make an individual appreciate the Island

more and be more likely to come back and stay in Jersey long term, providing employers with a potentially longer period of continuous employment and development; and

- because many school leavers haven't 'left' the Island, they are more likely to go travelling or seek to work elsewhere when they have obtained a professional qualification. This is beneficial for their personal development but can make planning difficult for employers.

Based on our experience of people employed by the finance industry, those with tertiary level education are often better suited, and therefore preferred candidates for roles due to academic and soft skills acquired through higher education. The latter may include writing, problem solving, teamwork, interpersonal and presentation skills.

It is worth noting that graduates entering the finance industry come from various backgrounds and, with many employers requiring trainees to undertake professional qualifications upon commencing employment, it is not necessarily a requirement that they hold finance/business related degree.

Regardless of whether a person starting their career in finance has a degree or not, there are numerous professional qualifications that they may be expected to undertake to progress their career further. Examples of qualifications commonly undertaken in Jersey's finance industry include ACA, ACCA, Investment Management Certificate (IMC) and the Certificate in Securities & Financial Derivatives.

Is it also important to highlight that opportunities to pursue tertiary level education exists on the Island. Examples include the Foundation Degree in Financial Services at Highlands College and the BSc (Hons) International Financial Services at Jersey International Business School (JIBS). There may be advantages to studying locally, including affordability, smaller classes, being able to live at home and the ability to work at the same time. Many local courses are a great way for students to experience work and to continue their education, combining integrated and balanced academic learning with work-place learning.

However, local studying will not be a solution to those who desire to live away from Jersey for a period of time and the Island will never be able to offer the depth of courses available in, for example, the UK.

Commissioned work

Jersey Finance had concerns that the finance sector skills required in the present may significantly differ from those required in the future, and we wanted to understand how to ensure that these demands and the expectations of Jersey's residents can be met in this regard. JFL commissioned Island Global Research to study and quantify the aims and aspirations of the population as a whole with regard to employment and training in the finance sector.

The evidence suggested that much is already being done by local employers and educational establishments to train and up-skill staff in the local economy, including finance. Although gaps were identified, Island residents wanting to follow a career path locally are able to benefit from numerous initiatives and opportunities already in place.

There are also a wide range of specific qualifications that Jersey's residents can seek to obtain (employer sponsored, privately and publicly available) prior to and/or after entering employment in the finance sector.

However, increasingly the finance sector needs to employ at trainee level, with around 350 individuals being recruited into trainee positions each year, the majority of whom hold at least degree-level qualifications (see Figure 1, below). Consequently, there are already obvious supply and demand issues when looking at the pool of new local graduates, with a potential annual shortfall of 150 persons if all the demand side was purely filled from this source.

This shortage is potentially exacerbated as the research undertaken by Island Global Research indicated that half of local students who are currently in – or are about to go into – further education aspired to work in the UK or overseas after they have qualified.

Figure 1 - Local staff recruited from school and university

![]() 350 300 250 200 150 100 50 0

350 300 250 200 150 100 50 0

2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014

![]() School

School ![]() University

University

In most years the number of graduates recruited is between two and three times the number of school leavers (with 2008 a notable exception). If employers are to continue having access to a pool of graduates, academically strong school leavers must be able to access higher education. It is essential that our most promising students aren't priced out of university.

The results of our bi-annual "Employment and Growth Survey" indicate that, over the next five years, we could see an increase in financial services headcount of more than 1,000. It is at graduate and administrator/officer level (i.e. junior roles) that most positions will arise. This trend, if realised, would put further pressure on recruitment shortages at the trainee level.

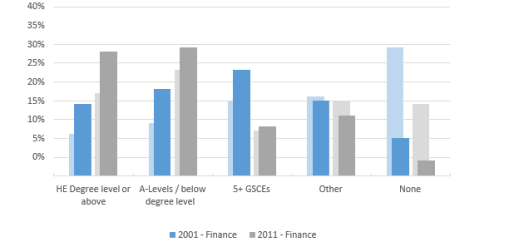

The level of qualifications held by employees in the finance sector in Jersey has changed in recent years. The chart below shows employees' highest qualification in 2011 against 2001. The data in Figure 2, below, has been taken from the Jersey census.

Figure 2 - Local staff recruited from school and university

In 2011, around two in three people in the finance industry held qualifications at A-level or higher. This compares to around only two in five in 2001. The "shadow" bars shown in the background give the figures for Jersey's population in general and show that employees in the finance industry generally hold higher-level qualifications than Jersey's overall average.

Looking ahead

We consider student financing imperative to support those wanting to pursue higher education. Despite the options available on-island, most students still choose to attend university off-island, the majority of whom study in the UK. With the cost of studying in the UK increasing considerably over recent years, and limited financial support currently available, there is a risk that the already present graduate supply-demand gap will increase further. Shortage of local graduates could have a detrimental impact on Jersey's employment market, potentially resulting in increased demand for off-island recruitment and in businesses not being able to meet their clients' demands or expected service levels.

I hope you find the above overview informative and useful. Thank you again for providing the opportunity to contribute to this discussion and please do not hesitate to contact me should you have any questions.

Yours sincerely

![]()

Thomas Cowsill

Head of Technical Jersey Finance Limited