The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

Corporate Services Scrutiny Panel

Review of GST Personal Importation Review (Phase 1

The Jersey Chamber of Commerce Retail and Supply Committee has engaged with senior Treasury officers and the Minister with regard to GST on several occasions this year, notable in May and June.

Our meetings with Government drew two main conclusions:

The first was our challenge to the suggested timing to implement changes – with the clear implication from Chamber that the Government should act early to secure change in respect of major offshore retailers.

This led to the second conclusion of this Chamber working group, that the delay to 2023 appeared more to be based on the unpopularity of making any change.

The Chamber Group has looked at the implications for the local retailer in Govt. not taking action sooner and measured these against the Global Online Tax Timelines, as set out below.

1 January 2021 1 July 2021 2017 2019 1 April 2020 UK Tax Market EU VAT full

1 January 2021 1 July 2021 2017 2019 1 April 2020 UK Tax Market EU VAT full

USA USA 2% DST UK Places at LCVR removal ( Marketplace Tax Marketplace source 22 before)

Tax States law

18 December 29 March 2019 May 2021 2023

18 December 29 March 2019 May 2021 2023

2018 UK LCVR Chamber Jersey reduction

Removal Comptroller &

UK LCVR Law £15 before Chamber discuss to £40 - £60

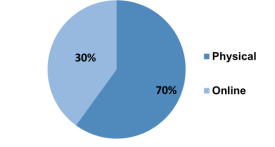

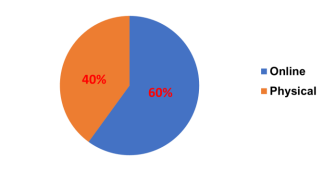

The Chamber work also looked and the shopping changes between now, with a 70% physical shopping habit and 30% online with the predicted changes to 2023, with 60% online and 40% in store. These can be compared below. On the left 2021 and on the right 2023.

The conclusions to this for physically shopping locally are:

• Less stores and over spaced retail units in Jersey

• Less employees (7185 people employed)

• Less choice for consumers

• Drives online participation further

• Less revenues and Tax (direct and in direct)

• Less customers and footfall

• Re Purpose of the High Street

The Implications of online (transactional) retails are:

• More freight and logistics

• No direct tax benefit

• Less Jersey Co benefits

• Emergence of online operators in Jersey physical estate?

In asking whether 2023 was too late, Chamber considered and offered an alternative approach.

• June 2022 Full De minimis Removal

• 2022 Onwards Benefits:

• Retail Jersey Level Up on pricing

• Tax globally on online and operators is at G7 levels

• Many Countries have already acted

• Slows the online shift a little but continues to balance the shift

• Tax benefit on the growing online %

• Time to fund change for retailers and government

What other blockers are there, other than the pollical reluctance to do something based on unpopular changes to inhibit this?

• Greater work is required to define whether the current Govt. thinking of the maths and collection costs and whether they are correct. Chamber would challenge these.

• This change would require investment in the required systems that are fit for purpose. Chamber would agree with Government that they are not fit for purpose but would suggest that investment should be sought and that several solutions could be found.

Chamber would strongly challenge any perception taken that Retail and Wholesale is not a highly important sector of the economy, alongside fulfilling the essential supply of goods, as the Retail Economic Data below outlines clearly.

The Retail and Supply Chair alongside those that working group are highly experienced retailing experts from both the physical and online sector, and would be very keen to meet with the Corporate Services Scrutiny Panel at its earliest convenience to discuss this further.

Murray Norton

Chief Executive, Jersey Chamber of Commerce.