The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

Jersey Post Postal Headquarters

JERSEY JE1 1AA

T +44 (0) 1534 616616 F +44 (0) 1534 871629

E customerservices@jerseypost.com

www.jerseypost.com

Sent by email 13 August 2021

Dear Senator Steve Pallett,

Corporate Services Scrutiny Panel: Goods and Services Tax – Personal Importation Review

Before replying to the questions asked, please note that Treasury and its project team have engaged with us and the points raised below have been raised with them in one way or another. We look forward to seeing the detailed process designs from the team, including requirements for development of Caesar which will inevitably be needed.

Our comments are:

• We support the collection of GST at checkout by UK GST registered retailers. However, for this to succeed, we must go beyond considering tax collection and ensure the entire supply chain can correctly recognise and communicate the GST status of individual parcels. Without this, unnecessary detentions will occur, driving additional costs for importers and dissatisfaction from islanders.

• Marketplaces such as Amazon must not be regarded as a single block in respect of checkout GST payment. Amazon is comprised of its own retail organisation, 3rd party logistics services provided to other retailers (fulfilled by Amazon or FBA) and a marketplace not dissimilar to eBay, where retailers are wholly responsible for their own tax registration and collection, be that GST or VAT. Each of the many organisations under this umbrella will likely be separate regarding GST collection, registration and status.

• We believe that GST collection at source will only be practical and cost-effective for the largest of UK retailers. To ensure other smaller UK retailers continue to sell to their Jersey customers without charging GST, they must not incur significant administrative burdens or customs related performance issues that might cause them to withdraw from Jersey as a marketplace. Such retailers are essential to consumer choice and provide access to goods not available in the local market.

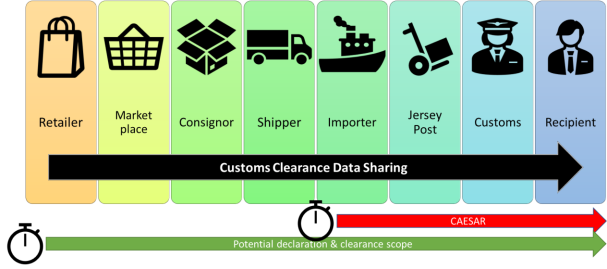

• In the context of these non-GST registered UK retailers, for a de minimus reduction to be successful, we would have to reduce the proportion of post-arrival detentions by streamlining the process whereby islanders can, and do, declare/pay GST immediately after checkout. At the moment goods can only be cleared once they have left the UK on their way to Jersey. If this is stretched back to the point of purchase then there is more time for a recipient to clear GST as illustrated in the diagram below.

Cont.

• Over time, we expect manifesting levels to increase gradually. However, we will need to deal with high levels of un-manifested items in the medium term.

• As an island, we must design our GST declaration and collection processes and associated IT systems considering stakeholders' capabilities and existing data constraints. We should not engineer GST and duty collection to suit existing systems in isolation.

• It should be noted that existing supply chain elements and relationships are not setup to track and communicate the GST status of parcels reliably.

• Last year we handled c5 million packets and parcels. For 64% of these (those that come via Royal Mail) there is no pre-advice. From April 2022 Royal Mail is due to provide this but it will only include the value of the goods and not the cost of delivery. If we fail to achieve pre-arrival declaration and payment of GST on items where GST is not charged at checkout,

we believe this will result in:

- A requirement for significant new operating space, at cost, to store detained unmanifested traffic that comes from Royal Mail. Subject to the exact de minimus value chosen, we estimate this is somewhere between 500m2 and 800m2.

- A significant increase in our staffing to manage the detention, processing and release of these items.

- Delays in the import clearance process.

- Consumer dissatisfaction with Jersey Post, Customs and the Government.

• Furthermore, with a low de minimis value and no manifest, little or no information will be available to decide if the value of a given parcel exceeds the de minimis limit. Who will determine value, and will we need to detain all shipments on a precautionary basis until the consignee has declared their value? If so, the storage and processing costs will be further exacerbated.

• The assertion that GST on imports is a tax on wealthy islanders is wrong. Nearly all islanders use UK retailers, including those on lower incomes, and many rely on them for good value essential items along with items not readily available in the local marketplace. Many of these purchases will be brought into scope for GST with a reduced de minimis.

• Any changes to GST must be considered in the whole and nett a meaningful increase in government revenue, without offsetting this value by creating extra costs outside of government.

Cont.

• The current customs process of aggregating consignments from the same consignor on the same day is arbitrary and unfair to consumers. With a reduction in de minimis, the likelihood of consumers splitting their orders with a retailer to avoid the payment of GST will, in most cases, be outweighed by the resulting increase in shipping costs. Conversely, many unconnected consignments will be aggregated and unnecessarily detained because consignors like Amazon use different shipping methods with varying transit times. Thus, Customs aggregation is a blunt tool that already causes unnecessary detentions.

• Consideration must be given to the burden of GST reclaim processing caused by returns.

You also asked for additional data. As 64% of packets and parcels come via Royal Mail (for which we receive no pre-advice) the data below is based on a sample of Amazon parcels. Care needs to be taken in extrapolating further as anecdotally items via Royal Mail tend to be of lower weight and value. If required, we can provide the source information on a confidential basis and in the past have shared this with Treasury, but in summary:

• 80% of items are less than £25 in value.

• 90% are less than £130.

• The average parcel value is £21.

The recent reduction from £240 to £130 has added in staff costs alone some £30,000 a year or around £1 a parcel which we currently do not charge the customer for. This does not include our need to relocate some of our operations to other facilities to provide space for the processing and storage of parcels awaiting collection.

In summary, we understand the desire to bring more inbound parcels into scope for GST but would urge that this is not before the required processes and systems are in place. To bring it forward too early runs the real risk of causing significant disruption. We would recommend a joined-up approach, which we believe is taking place, and decisions be taken on milestones achieved (such as percentage of parcels for which pre-advice is received, Caesar system able to cope, etc.) rather than an arbitrary deadline set. Having said that, the sooner the Government sets out its decision and intentions then the sooner we, and others, can have discussions with retailers about complying with the requirements and putting systems in place.

We are more than happy to respond to any questions you may have. Yours sincerely

Tim Brown

Chief Executive Officer