The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

Deputy S Ahier

Deputy S Ahier

Corporate Services Scrutiny Panel Scrutiny

Morier House

St Helier

Jersey, JE1 1DD

27 January 2022

Dear Deputy Ahier

Dear Deputy Ahier

Enveloped Property Transactions Tax Consultation

I write further to your letter of the 24th January and have set out below our submission in respect of the above.

At the beginning of November 2021 we received an e-mail announcing that The Revenue Policy Development Board had recently decided that the proposed new tax on enveloped property transactions should be introduced as soon as possible with a view to debate in the Assembly in February 2022. This was following a "consultation" exercise in April / May 2021 albeit we understand that the draft legislation circulated in November was largely unchanged from that which was originally presented.

At the beginning of November 2021 we received an e-mail announcing that The Revenue Policy Development Board had recently decided that the proposed new tax on enveloped property transactions should be introduced as soon as possible with a view to debate in the Assembly in February 2022. This was following a "consultation" exercise in April / May 2021 albeit we understand that the draft legislation circulated in November was largely unchanged from that which was originally presented.

It is interesting to note that that report prepared for the Government of Jersey Economics Unit by London Economics which was presented to the States of Jersey on the 21st January is caveated by stating:

It is interesting to note that that report prepared for the Government of Jersey Economics Unit by London Economics which was presented to the States of Jersey on the 21st January is caveated by stating:

"The work was undertaken over a short period in December 2021 and January 2022 and the scape and depth of the feasibility analysis has been limited by those timescales.

The London Economics report further states:

"We are economists with wide experience of applying economic thinking and analysis to policy issues, including tax policy, but we are not experts in tax law or property markets, including the Jersey property market"

"We are economists with wide experience of applying economic thinking and analysis to policy issues, including tax policy, but we are not experts in tax law or property markets, including the Jersey property market"

We are concerned by the pace of the legislative process and the lack of proper consideration given to the impact on affected parties.

Direct Impact

The London Economics report correctly observes that "those who have purchased enveloped property prior to the introduction of the EPTT would receive a lower price when they came to sell the enveloped property".

The London Economics report correctly observes that "those who have purchased enveloped property prior to the introduction of the EPTT would receive a lower price when they came to sell the enveloped property".

It is important to quantify the potential level of this impact. In recent years there have been a number of significant commercial investment transactions of larger landmark office buildings. For a commercial investment with a value of £50m the stamp duty would be in the region of £2.46m and this will directly negatively impact the value of the asset. Investors will have purchased assets based on projected returns and may have borrowings based on these returns and certain loan to value ratios. To suddenly impose a new tax which would significantly reduce the asset value could have far-reaching implications for these investors.

It is important to quantify the potential level of this impact. In recent years there have been a number of significant commercial investment transactions of larger landmark office buildings. For a commercial investment with a value of £50m the stamp duty would be in the region of £2.46m and this will directly negatively impact the value of the asset. Investors will have purchased assets based on projected returns and may have borrowings based on these returns and certain loan to value ratios. To suddenly impose a new tax which would significantly reduce the asset value could have far-reaching implications for these investors.

This alone appears to be contrary to the Island's taxation principle to be "simple and fair".

This alone appears to be contrary to the Island's taxation principle to be "simple and fair".

We are also concerned that there has been a lack of consideration given to the impact that the changes could have on the commercial property development market. This point is somewhat underestimated in the London Economics paper (page 12).

We are also concerned that there has been a lack of consideration given to the impact that the changes could have on the commercial property development market. This point is somewhat underestimated in the London Economics paper (page 12).

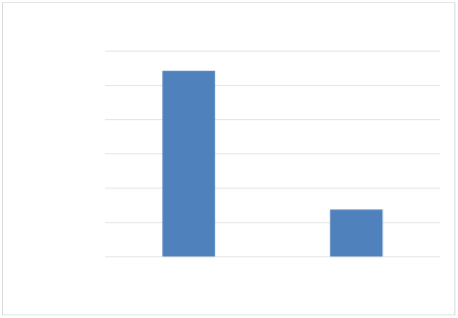

Owners of land will actually be faced with a "perfect storm" where the value of their land is reduced and rents are stagnant (primarily as a result of the Covid-19 pandemic) at a time when building costs are increasing by circa 6.5% per annum and ever evolving ESG requirements are also imposing an additional tier of cost. We are aware that this is negatively impacting the viability of some developments.

Construction Costs v's Rental Growth

Construction Costs v's Rental Growth

60.00% 50.00% 40.00% 30.00% 20.00% 10.00% 0.00%

60.00% 50.00% 40.00% 30.00% 20.00% 10.00% 0.00%

Jersey Build Costs St. Helier Rental Growth Source: Colin Smith Partnership & D2 RE

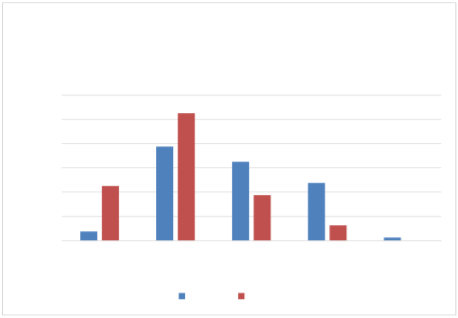

Looking at ESG in more detail, property contributes 40% to global carbon emissions. If the Government is serious about "net zero" then the cost to deliver environmentally sustainable buildings will only increase and developer's margins will come under more pressure. In terms of occupier sentiment towards ESG in the Channel Islands our latest research is very telling, so costs are only going to rise at a time when margins are coming under increasing pressure.

Looking at ESG in more detail, property contributes 40% to global carbon emissions. If the Government is serious about "net zero" then the cost to deliver environmentally sustainable buildings will only increase and developer's margins will come under more pressure. In terms of occupier sentiment towards ESG in the Channel Islands our latest research is very telling, so costs are only going to rise at a time when margins are coming under increasing pressure.

Relevance of ESG policy in shaping the way you use your office space - current / 5 years

Relevance of ESG policy in shaping the way you use your office space - current / 5 years

time?

time?

60.00% 50.00% 40.00% 30.00% 20.00% 10.00% 0.00%

60.00% 50.00% 40.00% 30.00% 20.00% 10.00% 0.00%

Critical Important Moderate Limited Irrelevant

Impact

Current 5 years

Current 5 years

D2 Real Estate Survey Results: 2022

D2 Real Estate Survey Results: 2022

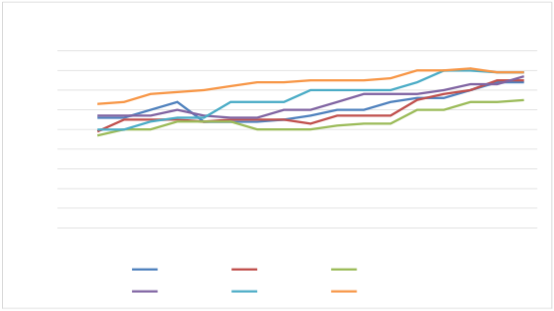

At the same time rents, one of the primary drivers for performance/viability, are under pressure.

Indeed, they are above the UK's Big 6, potentially making the jurisdiction uncompetitive. Two large local fiduciary businesses have recently reported they have opened offices in Southampton for back-office functions and we expect to see this trend continue. Although the multipliers applied to income streams (Net Initial Yields) have risen, they are still below the equivalent paid in the UK, so viability for commercial development is under real strain.

London Economics state "We do not anticipate that property developers will be significantly deterred from being active in Jersey, since it is likely that land prices will fall to compensate them for any reduction in selling price". This is oversimplifying the issue and doesn't appreciate the unique market dynamics in Jersey or likely future trends. Historically property developers would have sought a profit on cost ratio of circa 20% to compensate for the risk but this has been significantly eroded.

London Economics state "We do not anticipate that property developers will be significantly deterred from being active in Jersey, since it is likely that land prices will fall to compensate them for any reduction in selling price". This is oversimplifying the issue and doesn't appreciate the unique market dynamics in Jersey or likely future trends. Historically property developers would have sought a profit on cost ratio of circa 20% to compensate for the risk but this has been significantly eroded.

Prime Headline Rents

Prime Headline Rents

£45.00 £40.00 £35.00 £30.00 £25.00 £20.00 £15.00 £10.00 £5.00 £0.00

£45.00 £40.00 £35.00 £30.00 £25.00 £20.00 £15.00 £10.00 £5.00 £0.00

20052006200720082009201020112012201320142015201620172018201920202021

Birmingham Bristol Leeds

Birmingham Bristol Leeds

Manchester St. Helier St. Peter Port

Source: D2 and BNPP 2022

Jersey has been very successful in recent years attracting investment from a range of overseas investors which has underpinned the delivery of much of the new office stock which is providing the nature and quality of accommodation that most corporate occupiers now require. It has been observed that Jersey is attractive as a jurisdiction for investment due to a number of reasons including the prevailing lease structure, resilience of the Island's Finance Industry and the income security provided by quality occupiers. It is also important not to underestimate the attraction of Jersey as a stable jurisdiction with a simple and fair tax regime. We believe that the proposals will tarnish this perception and undermine investor confidence in Jersey as a jurisdiction. It should be noted that in Jersey investors currently pay document duty on loans, which is not the case in Guernsey, so Jersey is already at a competitive disadvantage albeit we understand that as part of the introduction of EPTT this might be removed.

Jersey has been very successful in recent years attracting investment from a range of overseas investors which has underpinned the delivery of much of the new office stock which is providing the nature and quality of accommodation that most corporate occupiers now require. It has been observed that Jersey is attractive as a jurisdiction for investment due to a number of reasons including the prevailing lease structure, resilience of the Island's Finance Industry and the income security provided by quality occupiers. It is also important not to underestimate the attraction of Jersey as a stable jurisdiction with a simple and fair tax regime. We believe that the proposals will tarnish this perception and undermine investor confidence in Jersey as a jurisdiction. It should be noted that in Jersey investors currently pay document duty on loans, which is not the case in Guernsey, so Jersey is already at a competitive disadvantage albeit we understand that as part of the introduction of EPTT this might be removed.

Other Impacts

It is understood that the proposed introduction of the EPTT is to close a "loophole" in the current system and prevent a perceived means of tax avoidance. However, the proposals will also apply to changes of ownership of corporate structures that hold Jersey commercial property. It is highly unlikely that these structures would have been created for tax reasons but if EPTT is introduced corporate transactions will be saddled with an additional layer of cost and complexity.

It is understood that the proposed introduction of the EPTT is to close a "loophole" in the current system and prevent a perceived means of tax avoidance. However, the proposals will also apply to changes of ownership of corporate structures that hold Jersey commercial property. It is highly unlikely that these structures would have been created for tax reasons but if EPTT is introduced corporate transactions will be saddled with an additional layer of cost and complexity.

Resourcing

It seems inevitable that the proposals will create a requirement to demonstrate the value of the underlying property asset. The resource of RICS Registered Valuers in the Island with the expertise to provide such valuations is limited and in the region of 15 individuals. The valuation sector is already challenging with most of the active valuers working at or near capacity providing valuations for secured lending and accounting purposes and this could be further compounded. The potential requirements for an asset valuation will add a further cost to transactions of this nature which could be significant for larger properties or trading portfolios.

It seems inevitable that the proposals will create a requirement to demonstrate the value of the underlying property asset. The resource of RICS Registered Valuers in the Island with the expertise to provide such valuations is limited and in the region of 15 individuals. The valuation sector is already challenging with most of the active valuers working at or near capacity providing valuations for secured lending and accounting purposes and this could be further compounded. The potential requirements for an asset valuation will add a further cost to transactions of this nature which could be significant for larger properties or trading portfolios.

Alternative Solutions

If the EPTT proposals are to be adopted we would strongly recommend that consideration be given to the incorporation of some sort of "grandfathering" provisions so that owners of properties currently held in a corporate structure that were purchased in good faith are not suddenly penalised and suffer significant reductions in the values of their assets. This could go some way to mitigating the reputational damage that could otherwise be caused.

If the EPTT proposals are to be adopted we would strongly recommend that consideration be given to the incorporation of some sort of "grandfathering" provisions so that owners of properties currently held in a corporate structure that were purchased in good faith are not suddenly penalised and suffer significant reductions in the values of their assets. This could go some way to mitigating the reputational damage that could otherwise be caused.

I hope that this adequately sets out our concerns but should you have any queries or if we can be of any further assistance please do not hesitate to contact me.

Yours sincerely

Christopher Daniels BSc MRICS Director

Christopher Daniels BSc MRICS Director