The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

CITIMA, chris@directinput.je

13th September 2024

Dear Deputy Miles ,

CITIMA submission to the Proposed Budget 2025-2028 Review

Thank you for this opportunity to submit comments on behalf of CITIMA which I hope will assist you and your panel in your review of the Proposed Budget.

As I am sure you will be aware, CITIMA (the Channel Islands Tobacco Importers and Manufacturers Association), is made up of Fox Trading, Liberation Group, BAT and Imperial.

We were invited to make a submission to the Treasury Minister earlier this year and following the substantial increase in excise duty in last year's budget and the ongoing pressures facing households due to the cost-of-living crisis, CITIMA urged the Minister to exercise restraint. We also took the opportunity to set out our views on the role of taxation on vaping and the general direction of legislation in the Channel Islands. We note that there are no plans to include a levy on vaping this time but welcome your interest in our views as we expect to see firm proposals in the future.

I will restrict our submission to address the three areas you have highlighted, but I would also like to arrange to speak to the Panel in person.

- Increasing tobacco duties

The planned increase in tobacco duty of 8.6% is significantly lower than the increase currently being applied to the price of tobacco products. However, once again the Treasury has used the June RPI figure as its base figure. The same move was made last year, with tobacco duties set when RPI was at or near its highest level.

In previous years, the Treasury had used the December RPI and only switched to using the June figure in last year's budget. At the time, we echoed the point made by the Fiscal Policy Panel that while inflation would begin to come down in 2023, it was expected to fall at a much slower rate than experienced in the UK. It therefore seems clear to CITIMA that while the addition of 5% was a predictable escalator, the Government looked at maximising the return it would receive from islanders who buy tobacco from retailers rather than from duty free sources.

The travel restrictions during the pandemic in 2020 provided an opportunity to see the impact that duty free has on excise revenues, with an increase of £8.5m in receipts for 2019. That has now stabilised, returning to long term pre-pandemic trends, but it gave a clear picture of how much is lost to duty free every year.

CITIMA has long argued that higher increases in duty are pushing a large and growing proportion of adult smokers to switch to more affordable channels, and that's made clear in the States of Jersey Group 2022 Annual Report and Accounts. [1]They revealed that when travel resumed following the lifting of Covid-19 restrictions there was an £11.9m (46%) drop in revenue from tobacco duty. Although the report notes that it is " products and public health policy on the consumption of duty paid tobacco products," the spike in excise duty collected during the pandemic would suggest that smokers are indeed seeking more affordable sources when those are available.

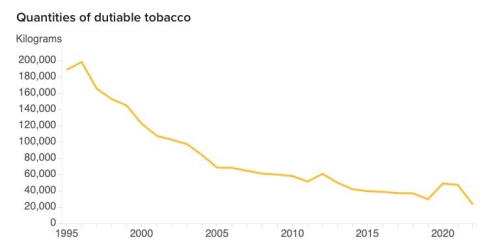

In our submission to the Treasury, CITIMA repeated its view that the upward trajectory of excise duty is not producing the health policy aim of reducing smoking prevalence among the adult population. This argument was once again born out in the figures collected by Jersey Statistics in its 2023 Jersey Opinions and Lifestyle Survey2. With one in seven adults reported as being smokers, the figure has changed little since 2018 (Figure1).

Figure 1, Percentage of adults who smoke. Source 2023 Jersey Opinions and Lifestyle Survey

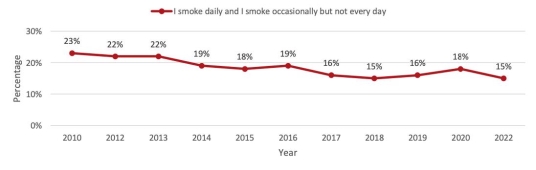

Although the volume of tobacco imported, along with other goods, has declined over an extended period (as illustrated in the figures below), receipts from impôt duties are consistent, suggesting a level has been reached which the government can reliably predict. Straying further upwards in setting a rate that will push more people who do smoke to choose alternative ways of sourcing products will reduce the long-term revenue that the government receives from tobacco sales.

Figure 2 below is included in this submission to illustrate the spike in tobacco imports during the pandemic when duty free sales dropped due to travel restrictions. And Figure 3 shows the volume of tobacco imported in kilograms up to 2022. A further search on the Government of Jersey website [2]shows an increase in the amount of tobacco imported from 23,346kgs in 2022 to 26,964kgs in 2023.

Figure 2, Year on Year tobacco industry volume for Jersey

Figure 3, Quantities of dutiable tobacco imported, thousands of kilograms, 1995-2022. Source: Jersey Customs and Immigration Service.

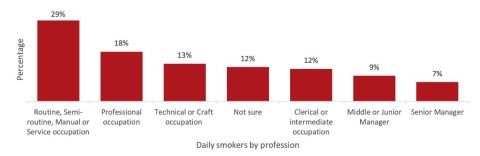

Further evidence that the policy of excessive increases in excise duty is not working was illustrated in the Jersey Health Profile 2022 (Figure 4) which showed the number of adults that smoke daily or occasionally has had no meaningful change since 2018.[3]

Figure 4, Percentage of adult who smoke daily and smoke occasionally but not every day (2010 – 2022) Source: Jersey Health Profile 2022.

It is worth noting that the burden of paying tobacco duty tends to fall on those who can least afford it. Figure 5 below illustrates that people that work in manual and routine occupations are ranked as the highest proportion of smokers at 29%.

Figure 5, Prevalence of daily smoking by profession (2021) Source: JOLS 2022.

CITIMA would urge you to consider that a substantial proportion of smokers who buy duty- paid tobacco products are from lower socio-economic groups and will be more likely to seek opportunities to buy from other sources where the price may be on average 50-60% lower. As more consumers are incentivised to buy from other sources, the revenue from duty-paid tobacco products will decrease and the Customs team will need to devote more resources to prevent abuse.

- The higher increase for cigars

CITIMA has no views to offer on this topic.

- Taxing vaping products

Since e-cigarettes became more widely available, vaping has made a positive contribution to public health in Jersey, enabling many smokers to switch to a reduced-risk alternative to smoking tobacco.

CITIMA has looked for opportunities to meet ministers and government officials to discuss regulations and policies and in 2022, met the previous treasury minister to discuss taxation of tobacco products and the potential to extend the regime to vaping. At the time we were given assurances that CITIMA would be informed about changes to taxation policy and other developments that may be of interest to the Association.

Unfortunately, we have not been kept up to date about intended policy changes and it's only on rare occasions that our requests to keep channels of communication open are replied to. It's often only been through our persistence and by monitoring various channels that we learn about planned changes. Communication with individual ministers has improved in the last twelve months, but we receive little or no contact from officials.

When the governments of both Bailiwicks planned to introduce plain or standardised packaging for tobacco products, there was a period of constructive dialogue between the industry and government officials. It meant that the introduction of standardised packaging with new health warnings and images was coordinated across the Channel Islands.

Now that Jersey and Guernsey are intending to introduce regulations on vaping, we are concerned that they are moving at different speeds and are not coordinating their actions. We are urging them to work together, and we have submitted a lengthy set of comments to both governments. I have reproduced those in this submission, and I hope that these additional points about vaping will be of interest to the panel as our view is that these are not being coordinated and risk causing confusion.

To address the specific question about excise duty on vaping products, we asked the treasury team to consider the introduction of a low excise duty on vaping products. By bringing vaping into the excise duty regime, scrutiny of the category will be improved, and the administration costs of an excise regime should be met. Most importantly, CITIMA feels it should be sufficiently low to avoid disincentivising consumers switching from combustible tobacco to vaping products.

Ideally, there should be no excise on e-cigarettes given the available evidence on their role in tobacco harm reduction, but CITIMA considers that, if it is possible to do so without undermining the legitimate e-cigarette market, further measures to monitor and control the category are needed and would be beneficial. As a part of this, CITIMA recommends that

the Government of Jersey should consider the introduction of an excise on e-cigarettes that:

- is set at a de minimis level or at a low level fixed to liquid volume per millimetre, such that it does not materially affect the price of legitimate e-cigarette products and, as such, consumers' incentive to switch to them from combustible tobacco; but,

- requires all participants in the supply chain to comply with the administrative requirements of an excisable product.

CITIMA welcomes the review into a tax on vaping but would strongly urge the Government to consider introducing comprehensive legislation to cover all aspects of vaping at the earliest opportunity.

Currently in the Channel Islands, the only law that applies to vaping is in Jersey where sales are banned to those under the age of 18. CITIMA believes that steps should be taken to introduce further regulations and would like to take this opportunity to put on the record its views on why and how vaping should be regulated.

CITIMA's position on vaping is summed up as follows -

• That both islands should follow the same rules and regulations.

• That the UK regulations are mirrored and adopted to provide consistency and keep the established supply route from the UK.

• As the public health aim of reducing smoking by encouraging smokers to vape remains a government policy, the use of e-cigarettes as a means of quitting should not be discouraged.

• That both islands introduce UK regulations before implementing bans on categories, such as disposable vapes.

• As stated above, that a small excise duty on vaping products is introduced in both islands.

As there are concerns over the quality of products imported from elsewhere, the governments of both islands should consider following the UK legislation which is already in place. The main elements, which incorporate minimum standards for the safety and quality of all e-cigarettes and refill containers, as set out by Tobacco Products and Nicotine Inhaling Products (Amendment Etc.) (EU Exit) Regulations 2019 and 2020, are:

• 10ml bottle limit

The maximum volume of nicotine-containing e-liquid for sale in one refill container is restricted to 10ml.

• 2 ml fill limit

E-cigarette tanks are limited to a capacity of no more than 2ml.

• English health warning

A health warning covering 30% of the surfaces of the unit packet and any outside packaging stating, "This product contains nicotine which is a highly addictive substance."

• Information leaflet requirements

Provided so that consumers can make informed choices, stating all substances contained in the product, and information on the product's nicotine strength, on the label; displaying instructions for use, information on addictiveness and toxicity on the packaging and accompanying information leaflet. This should include a reference that the product is not recommended for use by young people and non-smokers, as well as warnings for specific risk groups and possible adverse effects.

Further requirements

• restrict e-liquids to a nicotine strength of no more than 20mg/ml

Follow the UK regulations as the main supply route will be from the UK.

• require nicotine-containing products or their packaging to be child-resistant and tamper evident

CITIMA is aware that separate picture warning requirements on packaging were introduced for Northern Ireland and Great Britain. The different approaches were due to the arrangements put in place for the UK's exit from the EU. CITIMA would urge the governments in the Channel Islands to remain with the English packaging and health warning requirements, as that would support a consistent approach across both Bailiwicks. The Channel Islands are too small a market to call for separate packaging requirements.

We would suggest that a clampdown on non-compliant brands, and commissioned testing in the UK of rival devices to check whether they were being overfilled, would be a useful step in evaluating how widespread the sale of what would be deemed non-compliant vapes is in nearby jurisdictions.

I am grateful for this opportunity to make CITIMA's positions clear on these important issues, and I would welcome further discussion at a time convenient for you.

Your sincerely, Chris

Chris Rayner,

On behalf of CITIMA.

[1] States Annual Report and Accounts, Impôt Duties page 88.

2 2023 Jersey Opinions and Lifestyle Survey - https://www.gov.je/SiteCollectionDocuments/Government%20and%20administration/Opinions%20and%20Lif estyle%20Survey%202023%20Report.pdf

[2] Quarterly excise duty statistics - https://www.gov.je/SiteCollectionDocuments/Travel%20and%20transport/Excise%20Quantities%202023%20 Q4.pdf

[3] Jersey Health Profile 2022, page 89. https://www.gov.je/SiteCollectionDocuments/Government%20and%20administration/Jersey%20Health%20Pr ofile%202022.pdf