The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

1240/5(2296)

WRITTEN QUESTIONS TO THE PRESIDENT OF THE FINANCE AND ECONOMICS COMMITTEE

BY DEPUTY G.P. SOUTHERN OF ST. HELIER

ANSWERS TO BE TABLED ON TUESDAY 18th JANUARY 2005

Question 1

Will the President –

( a ) c o n firm that the tax increases resulting from his "20% means 20%" proposals will take place over

the ranges indicated below for the examples given?

( b ) co m plete the table with the additional tax proposed for each salary point (i ) in a bsolute terms, and

(ii) as a percentage of current tax paid?

Answer

- I am afraid that I cannot give the Deputy the confirmationheseeks.The tax increases under the 20% means 20% proposals will alsooccuron incomes above the ranges givenby the Deputy inhis examples because there isnoupperincomelimit for the tax increases under these proposals. In otherwords,those with high disposable incomes, currently paying tax at thestandardrateof tax of20%, will allhave to pay additional tax and there is noupperincomecutoffpointwhen such people will notbe paying additional tax under the 20% means 20%proposals. It is also very important to bear inmind that itis only those with the highest incomes in relation to their particular personaland individual circumstances that will pay any additional tax at all under these proposals. Indeed, it might be best to categorise such individuals as those with high net disposable income rather than ashavinghighincomes.Forexample,it is difficult toargue that a single individual, with no children, nomortgageand no othercommitments, earning £45,000 a year,doesnot have a high net disposable income.Itis right andproper,inmyview, that such an individual should pay anextra £1,200 a year in additional tax, phasedin over 3 years,to help preserveour economic well-being and to safeguard Jersey's high standardof living for future generations. The additional tax that we are seekingto collect from such individuals will also ensure that, even after these tax increases, they will still be considerably better off living in Jersey than many other placesthroughout the world, and, as they grow old, will enable them to benefit from a systemof benefits and pensions whichisalsoconsiderablymore generous than in othercomparable jurisdictions. On the other hand, a married man with 2 childrenatschooland a working wife, a £200,000 mortgage and paying contributions into an occupational pension scheme,couldnot be considered,on an incomeof£45,000,tohave a high net disposableincome,so he will not have topayany additional tax at all under the 20% means 20% proposals. These proposals have, unfortunately, been completely misunderstoodbysome people which is why the Committee decided to defer them atthe time of last year's Budget;but I dohope that there is now some more understanding oftheseproposals as there is no wish,whatsoever,onmy part or that of the Committee,toarguefor and introduce tax proposalswhich perhaps only I and the Committee understand andwhichMembersof this Assemblydonot fully understand. To help Members and others get a fuller understandingof these proposals, the Committee will shortly make available a comprehensive and detailed schedule with many examples ofdifferenttaxpayer types, detailing the impact, ifany,on them under these 20% means 20% proposals. Theseexamples will be available onboth the gov.je and theIncomeTaxOfficeweb-sites.

- I attach tables with the information requested. I should advise the Assembly that the exampleswhich have been chosen by Deputy Southern are highly selective showing increases in tax liability for all of the householdtypes listed. This is not, and I repeat not, a true representationofhow all households will be

affected by the proposals. I must emphasise that 70% of households in Jersey will not be affected by these

proposals. In order to demonstrate this more clearly, I attach, as an annex, further examples of how households may be affected by the proposals, which give a more representative picture. As I have already said, an extensive and comprehensive schedule will shortly be made available on the States website.

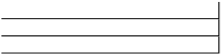

SINGLE No children No mortgage

Salary £ | Year | £ Additional Tax from 2005 | % increase from 2005 |

30,000 | 2006 | 324.60 | 6.76 |

| 2007 | 324.60 | 6.76 |

| 2008 | 324.60 | 6.76 |

|

|

|

|

37,500 | 2006 | 400.00 | 6.35 |

| 2007 | 800.00 | 12.70 |

| 2008 | 849.60 | 13.49 |

|

|

|

|

42,500 | 2006 | 400.00 | 5.48 |

| 2007 | 800.00 | 10.96 |

| 2008 | 1,199.60 | 16.43 |

|

|

|

|

100,000 | 2006 | 400.00 | 2.13 |

| 2007 | 800.00 | 4.26 |

| 2008 | 1,200.00 | 6.38 |

MARRIED No children No mortgage Wife earning

Salary £ | Year | £ Additional Tax from 2005 | % increase from 2005 |

85,550 | 2006 | 873.33 | 6.03 |

| 2007 | 1,746.67 | 12.05 |

| 2008 | 2,619.90 | 18.08 |

SINGLE PARENT 1child £120,000 Mortgage (interest rate 5. 3%)

Salary £ | Year | £ Additional Tax from 2005 | % increase from 2005 |

60,000 | 2006 | 1,290.67 | 15.88 |

| 2007 | 1,489.40 | 18.32 |

| 2008 | 1,489.40 | 18.32 |

|

|

|

|

94,000 | 2006 | 1,290.67 | 8.65 |

| 2007 | 2,581.33 | 17.29 |

| 2008 | 3,869.40 | 25.92 |

MARRIED 2 children £120,000 mortgage (interest rate 5. 3%) Wife earning

Salary £ Year £ Additional Tax from 2005 % increase from 2005

Salary £ Year £ Additional Tax from 2005 % increase from 2005

80,000 2006 1,436.20 12.93

2007 1,436.20 12.93

2008 1,436.20 12.93

100,000 2006 1,630.67 10.79 2007 2,836.20 18.77

2008 2,836.20 18.77

129,370 2006 1,630.67 7.77 2007 3,261.33 15.54

129,370 2006 1,630.67 7.77 2007 3,261.33 15.54

2008 4,892.00 23.32

MARRIED 2 children £200,000 mortgage (interest rate 5. 3%) Wife earning

Salary £ | Year | £ Additional Tax from 2005 | % increase from 2005 |

80,000 | 2006 | 1,139.40 | 11.11 |

| 2007 | 1,139.40 | 11.11 |

| 2008 | 1,139.40 | 11.11 |

|

|

|

|

146,000 | 2006 | 1,913.33 | 8.16 |

| 2007 | 3,826.67 | 16.31 |

| 2008 | 5,740.00 | 24.47 |

Question 2

Will the President inform members whether any further progress has been made in the Committee's attempts to recover the tax lost from non-Jersey resident shareholders via a look-through' mechanism, and if not, will he -

( a ) e xplain what additional measures the Committee proposes to put in place to raise the additional £20

million required? and,

( b ) assure members that the Committee will not propose that the level of a Goods and Services Tax be raised

above the 5% currently indicated?

Answer

I assume that the question in part (a) is referring to some form of withholding tax on non-finance sector, non- resident shareholders rather than a look-through' mechanism. Thelook-through' arrangements are only intended to apply to Jersey resident shareholders.

- I c an confirm that the Committeehas indeed spentconsiderable effort in investigating whether a selective tax couldbeimplementedwhich would help restore a Jersey tax liability to Jersey fornon-finance sector companies that are owned by non-resident shareholders. These companies will be subject to a zero corporate profit taxrate in Jersey. I wish toemphasise that most, ifnot all, of these companies will notbe paying less tax in future; they will merelybe paying the sameamount of taxbut in another jurisdiction rather than inJersey.Any additional tax liability imposed on them will usually bean additional costof doingbusiness in Jersey.

In developing any additional taxes that would apply to these companies, but would not impose additional costs on either Jersey owned companies or financial services companies, and which would meet non- discrimination requirements, any new tax must be applicable to all companies. However, by making payment of this new tax off-settable against any Jersey corporate profits tax liability, and capping it at a maximum of 10% of profits, it would be possible to ensure that no additional tax liability would fall to Jersey-owned companies, or financial services companies. It is also necessary to ensure that non-trading Jersey companies which form the corporate vehicles for the customers of the international financial services provided in Jersey do not acquire a tax liability. If they did, Jersey would become uncompetitive in much of its main export market.

Broadly speaking three possible options have been identified: a tax based on number of employees, total cost of payroll, or on property occupied (some form of commercial rate). Whilst all three options are technically feasible in terms of implementation, they all suffer from undesirable economic consequences for the people of Jersey. To varying degrees they would be likely to lead to job losses, and increases in prices locally.

In addition the technical complexity of all three taxes, which would have to be both capped and off- settable, so as not to impact adversely on locally owned businesses, would, unfortunately make them relatively easy to avoid.

Not only that, but there is a possibility that the damage to the competitive environment may disadvantage Jersey residents more than any additional tax revenue generated. Furthermore, it is estimated that the maximum level of tax revenue that could be raised from any one of the three options under consideration is in the order of £5 million to £6 million per annum.

I should advise the Assembly that the figure of some £20 million to £25 million previously quoted is misleading. Following further extensive research, the Committee is now advised that the reduction in tax revenues from non-finance sector, non-resident companies, as a result of the move to 0/10% is in the order of £10 million to £12 million, and not £20 million to £25 million. The reason for the revision to this estimate is that the original estimate included around £10 million to £12 million of tax revenues from a small number of specialist non-resident, non-finance companies, which will be leaving the Island before 2008 for reasons unconnected to the move to 0/10%. In the initial calculations this tax revenue was incorrectly included in the amount that would be lost as a result of 0/10%. In reality, whilst it will still be lost, it would be lost irrespective of the change.

Final decisions on which of the three options, if indeed any, are in the best interests of the Island have yet to be made. However, the Committee will advise the Assembly of its views when it lodges its fiscal strategy proposals.

- A s for the possibleintroductionof a Goodsand Services Tax(GST), I can assure Members that the Committee is determined that therate should be as low as possible, even if possiblebelow a rate of5%.

The Committee is also determined that not only should GST be introduced at a low rate, but also that this rate should be guaranteed not to increase for a number of years.

However, I would like to take this opportunity to make it clear that the reason we are making these proposals is because, like it or not, the Island must balance its books; we must, as an Island, pay for the services we receive from the States. We are moving to 0/10% because thisminimises the loss of tax from corporate profits, and maintains the economic foundation of the Island, i.e. the financial services sector. Without the financial services sector the loss of tax revenue would be much greater, and the economic activity on the Island to support our public services would be considerably smaller, implying much higher tax rates if States services were to be maintained.

The question is, therefore, not one of introducing GST because it is, in itself, a good thing. It is because to maintain government spending on such things as health, education, pensions and the like, more tax revenue is required because it is no longer possible, in this internationally competitive world, to get the financial services sector to pay as much as it did. It will still pay a lot, and the tax paid by Jersey residents will still be low compared to the benefits they receive. But if we try to maintain the current levels of tax they will simply re-locate, taking their jobs and their corporate tax with them, which is just what Guernsey and the Isle of Man would like.

The real issue is whether GST is a better, or worse, way of raising the additional revenue compared to the other alternatives such as payroll taxes, income taxes, or other taxes paid by Jersey residents. The question is not really whether 5% is the right rate, but what is the rate, and coverage, required to generate the income needed to pay for States' services. I would prefer lower taxes to higher taxes, but I would also prefer paying more taxes to ensure that the States can continue to function, to continue to provide education, health and other services to our people and, such things as, continued assistance to those on low incomes. To pretend that these services can, somehow, be provided for nothing, is tantamount to putting one's head in the sand.

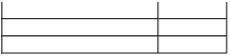

Tax paid after full

implement- Total tax 2005 ation of

Description of Household due for Effective 20% means Household income 2005 rate 20% (2008)

Single, no

children, no £25,500 £3,900 15.3% £3,910 mortgage

Single, no

children, no £30,000 £4,800 16.0% £5,125 mortgage

Single, no

children, no £37,500 £6,300 16.8% £7,150 mortgage

Single, no

children, no £42,500 £7,300 17.2% £8,500 mortgage

Single, no

children, no £100,000 £18,800 18.8% £20,000 mortgage

Single, 1 child at

school, mortgage £40,000 £4,128 10.3% £4,217 £120,000

Single, 1 child at

school, mortgage £50,000 £6,128 12.3% £6,917 £120,000

Single, 1 child at

school, mortgage £60,000 £8,128 13.5% £9,617 £120,000

Single, 1 child at

school, mortgage £94,000 £14,928 15.9% £18,797 £120,000

Married, wife

earning, no £50,000 £7,380 14.8% £7,511 children, no

mortgage

Married, wife

earning, no

children, no £60,000 £9,380 15.6% £10,211 mortgage

Married, wife

earning, no

children, no £85,550 £14,490 16.9% £17,110 mortgage

Married, wife

earning, 2

children, £60,000 £7,108 11.8% £7,144 mortgage

£120,000

Married, wife

earning, 2

children, £70,000 £9,108 13.0% £9,844 mortgage

£120,000

Married, wife

earning, 2

children, £80,000 £11,108 13.9% £12,544 mortgage

£120,000

Married, wife earning, 2

Effective

rate after 2008 full Increase

implement- in tax ation of 20% paid

means 20% from (2008) 2005

15.3% £10 17.1% £325 19.1% £850 20.0% £1,200 20.0% £1,200 10.5% £89 13.8% £789 16.0% £1,489 20.0% £3,869

15.0% £131 17.0% £831 20.0% £2,620 11.9% £36

14.1% £736 15.7% £1,436

2008 Increase

% in

Increase effective

from rate from 2005 2005

0.2% 0.0% 6.8% 1.1% 13.5% 2.3% 16.4% 2.8% 6.4% 1.2% 2.2% 0.2% 12.9% 1.6% 18.3% 2.5% 25.9% 4.1%

1.8% 0.3% 8.9% 1.4% 18.1% 3.1% 0.5% 0.1%

8.1% 1.1% 12.9% 1.8%

children, mortgage £120,000 Married, wife earning, 2 children, mortgage £120,000 Married, wife earning, 2 children, mortgage £200,000 Married, wife earning, 2 children, mortgage £200,000 Married, wife earning, 2 children, mortgage £200,000 Married, wife earning, 2 children, mortgage £200,000 Married, wife earning, 2 children, mortgage £200,000 Married, wife earning, 2 children, mortgage £200,000

£100,000 £15,108 £129,370 £20,982

£70,000 £8,260 £80,000 £10,260 £90,000 £12,260 £100,000 £14,260 £110,000 £16,260 £146,000 £23,460

15.1% £17,944 16.2% £25,874

11.8% £8,699 12.8% £11,399 13.6% £14,099 14.3% £16,799 14.8% £19,499 16.1% £29,200

17.9% £2,836 20.0% £4,892

12.4% £439 14.2% £1,139 15.7% £1,839 16.8% £2,539 17.7% £3,239 20.0% £5,740

18.8% 2.8% 23.3% 3.8%

5.3% 0.6% 11.1% 1.4% 15.0% 2.0% 17.8% 2.5% 19.9% 2.9% 24.5% 3.9%

Notes: Where examples for single parents are given the calculations assume additional personal allowance is due. Where wife working this assumes income over £4500. Where child allowance given this assumes any income in the child's own right does not exceed £2500.

Allowable Mortgage interest calculated at 5.3%.

The effective rate is the percentage of your income you pay in tax.