The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

1240/5(5730)

WRITTEN QUESTION TO THE MINISTER FOR SOCIAL SECURITY BY DEPUTY G.P. SOUTHERN OF ST. HELIER

ANSWER TO BE TABLED ON TUESDAY 19th OCTOBER 2010

Question

Will the Minister confirm that the net investment income for the Social Security funds (page 90 Social Security Report & Accounts – 2009) has increased substantially in 2009 from an average of £5m - £8m to £107 million and, if so, state whether this level of interest is expected to continue, and if so, what implications this has for the future of the funds?

Answer

The Net Investment Income of the Social Security Fund and Social Security (Reserve) Fund have not increased significantly in 2009 as reported in Statistical Appendix 2 of the Social Security Report & Accounts – 2009 (the "Accounts") .

The Department took the decision during the preparation of the Accounts to provide greater clarity of the returns being generated by the funds from all sources. Consequently, the Net gains on investments during the year of £107,294k as reported in the Social Security (Reserve) Fund's Statement of Total Return, page 34, were included within the Net Investment Income reported in Statistical Appendix 2.

The Department did not update the Net Investment Income amounts for each of the prior years in Statistical Appendix 2.

The Department has however provided an amended format of Statistical Appendix 2 for the Deputy to enable him to consider appropriate comparisons.

During 2010 Net Investment Income will remain a minor component of income because the Fund's investments are in a pooled fund policy which does not make distributions. Investment return will be achieved through the rising value of the investment units in the pooled funds.

Statistical Appendix 2

Five year summary of the Social Security Fund and the Social Security (Reserve) Fund

2005 INCOME £000

Contributions 117,136 Supplementation 50,776 Net Investment income 5,302 Bank interest & other income 1,490

2006 2007 £000 £000

123,954 133,913 56,567 58,627 8,671 7,001 2,070 1,887

2008 2009 £000 £000

144,634 151,787 61,842 64,995

2 (11) 2,005 350

Total Income 174,705 191,262 201,429 208,483 217,121

EXPENDITURE

![]() Benefits 140,209 148,225 155,428 164,565 172,091 Administration 5,164 5,512 5,341 6,124 5,770 Depreciation 2,159 2,267 2,061 1,906 1,906

Benefits 140,209 148,225 155,428 164,565 172,091 Administration 5,164 5,512 5,341 6,124 5,770 Depreciation 2,159 2,267 2,061 1,906 1,906

![]()

![]() Total Expenditure 147,533 156,004 162,830 172,595 179,767 NET SURPLUS 27,172 35,258 38,598 35,888 37,354 NET GAIN/(LOSS) ON 81,586 45,177 31,005 (107,746) 107,294 INVESTMENTS

Total Expenditure 147,533 156,004 162,830 172,595 179,767 NET SURPLUS 27,172 35,258 38,598 35,888 37,354 NET GAIN/(LOSS) ON 81,586 45,177 31,005 (107,746) 107,294 INVESTMENTS

![]() NET ASSETS 560,148 641,680 711,031 637,173 781,822

NET ASSETS 560,148 641,680 711,031 637,173 781,822

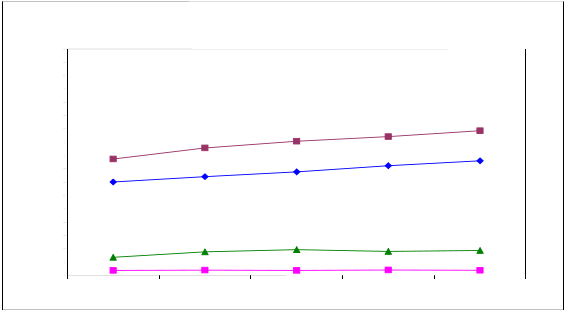

Social Security Fund Summary 2005 to 2009

Social Security Fund Summary 2005 to 2009

340

320

300

280

260

240

220

200 Income

180

160 Benefits

£ Milli 140

120

100

80

60 Net Surplus 40

20 Administration

0

2005 2006 2007 2008 2009 The above information is for the benefit of the user and is not part of the audited financial statements.