The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

2

1240/5(8700)

WRITTEN QUESTION TO THE MINISTER FOR TREASURY AND RESOURCES BY DEPUTY G.P. SOUTHERN OF ST. HELIER

ANSWER TO BE TABLED ON TUESDAY 24th MARCH 2015

Question

Following the Minister's response on 9th December 2014 to question 8570, which revealed that the proportion of taxpayers paying tax at the 20% rate has fallen from 32% to 14% over the period 2007 to 2013, will the Minister inform members what proportion of overall income tax revenues were paid over this period by those on the 20% and those on the marginal (27%) rate?

Will the Minister further show how individual changes to allowances and the introduction of "20 means 20" measures has affected both numbers of taxpayers and revenues collected over this period?

Can he also state the extent to which the loss of 8,500 taxpayers at the standard (20%) rate is a reflection of increased numbers of low-skill, low-paid employment rather than high?

Can the Minister further account for the reduction in the overall number of taxpayers from over 47,000 to 44,700 in a period when population continued to grow, despite the recession?

Given the above changes in tax revenues can the Minister provide the full update of all States income forecasts following the provisional 2014 outturn figures, and if not, when will he be in a position to do so?

Answer

Following the Minister's response on 9th December 2014 to question 8570, which revealed that the proportion of taxpayers paying tax at the 20% rate has fallen from 32% to 14% over the period 2007 to 2013, will the Minister inform members what proportion of overall income tax revenues were paid over this period by those on the 20% and those on the marginal (27%) rate?

Analysis of Individual Taxpayers:

Year of Assessment | Proportion of individual taxpayers benefitting from the 27% Marginal Relief calculation | Proportion of income tax revenues paid by Individual Taxpayers benefitting from the 27% marginal relief calculation | Proportion of individual taxpayers taxed at the 20% standard rate | Proportion of income tax revenues paid by individual taxpayers taxed at the 20% standard rate |

2007 | 68.4% | 31.8% | 31.6% | 68.2% |

2008 | 77.5% | 42.3% | 22.5% | 57.7% |

2009 | 81.4% | 47.3% | 18.6% | 52.7% |

2010 | 83.7% | 49.9% | 16.3% | 50.1% |

2011 | 85.3% | 52.7% | 14.7% | 47.3% |

2012 | 85.1% | 52.8% | 14.9% | 47.2% |

2013 | 85.6% | 53.6% | 14.4% | 46.4% |

The above data was extracted from Taxes Office systems on 18 March 2015

Individual Taxpayers include:

- Single individuals.

- Married couples / civil partnerships that have not opted for separate assessments (these count as one taxpayer)

- Married couples / civil partnerships that have opted for separate assessments (these count as two taxpayers)

Will the Minister further show how individual changes to allowances and the introduction of "20 means 20" measures has affected both numbers of taxpayers and revenues collected over this period?

20 means 20' involved the gradual withdrawal of certain tax allowances from taxpayers with higher incomes between 2007 and 2011. This did not affect the total number of taxpayers.

There were almost 15,000 taxpayers (standard rate taxpayers) who would have been affected by'20 means 20' in 2007, the first year in which the withdrawal of allowances commenced. A significant number of these taxpayers switched from being standard rate taxpayers to being marginal rate taxpayers (from which point they kept their allowances and deductions) between 2007 and 2011. These movements are outlined in the answer to question 8570 (and repeated above).

'20 means 20', bearing in mind the compensating increases in the exemption thresholds at the same time, aimed to increase the amount of income tax revenue collected by about £10m by 2012. (Budget 2007)

Can he also state the extent to which the loss of 8,500 taxpayers at the standard (20%) rate is a reflection of increased numbers of low-skill, low-paid employment rather than high?

The movement of taxpayers between the standard rate (with few allowances) to the marginal rate (with a broader range of allowances and deductions) was mainly due to 20 means 20' and to a lesser extent the annual increases in the exemption thresholds. (See Appendix A for an illustration of a taxpayer transitioning from paying tax at the standard rate to becoming a taxpayer that benefits from marginal relief).

Changes in the number of people employed or the mix of employment between 2007 and 2013 have been much less significant. Total employment increased by 1,180 over this period, with growth concentrated in sectors of the economy where average earnings are close to the average (as measured by the median) for the economy as a whole such as private education and health, other services and computer related activities. These trends in employment are likely to have increased the number of marginal rate taxpayers and not had a significant effect on the number of standard rate taxpayers.

Can the Minister further account for the reduction in the overall number of taxpayers from over 47,000 to 44,700 in a period when population continued to grow, despite the recession?

For the avoidance of doubt in answering this question and question 8570 an individual taxpayer is an individual or married couple/civil partnership who has a positive liability in Jersey for the tax year based on their income, allowances and deductions.

Single persons and married couples/civil partnerships that have not opted for separate assessment are counted as one individual taxpayer. Married couples/civil partnerships that have opted for separate assessment will count as two individual taxpayers.

The total number of people paying income tax is affected by many factors, the most important being:

- How fast incomes are increasing (typically earnings but also pensions and investment income, for example).

- How fast the exemption thresholds are increasing.

- Changes in the number of employed people and those earning income. The number of employed people increased in 2008 and remained broadly flat thereafter.

In 2008, 2009, 2012 and 2013, the exemption threshold increases were 6.5%, 5%, 4.5% and 3.0% respectively, which were higher than earnings growth in each year. This would have meant that some taxpayers with a small tax liability in the previous year became "non-taxpayers", dropping out of the income taxpayer number totals in these years.

In 2007, 2010 and 2011, the exemption threshold increases were 2.5%, 0% and 1.1% respectively, which were less than earnings growth in each year. In these years, taxpayers with small tax liabilities were less likely to become non-taxpayers because their incomes were more likely to increase in line with (or above) the increase in the exemption thresholds.

In 2008 (and 2011) the number of income taxpayers increased slightly. The increases in employment in these years would have contributed to this, alongside the income and exemption threshold effects described above. Similarly, in the years when employment fell slightly it is likely to have put downward pressure on the number of tax payers.

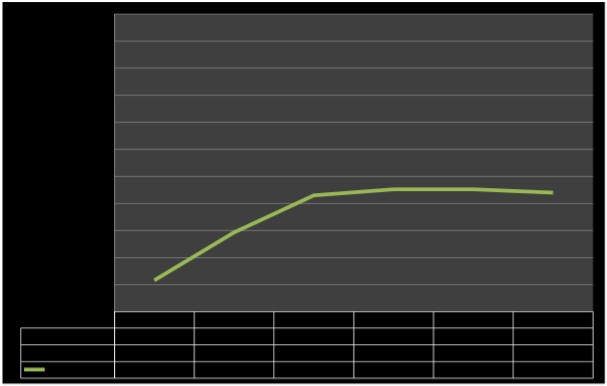

Total employment and number of income taxpayers (with a tax liability) 2007-2013

60,000

Total employment, annual average (FTEs) 58,000

Income taxpayers with a tax liability 56,000

54,000

52,000

50,000

48,000

46,000

44,000

42,000

40,000

2007 2008 2009 2010 2011 2012 2013

Percentage increase on previous year

Year of assessment 2007 2008 2009 2010 2011 2012 2013 Exemption threshold increases 2.5% 6.5% 5.0% 0.0% 1.1% 4.5% 3.0%

Given the above changes in tax revenues can the Minister provide the full update of all States income forecasts following the provisional 2014 outturn figures, and if not, when will he be in a position to do so?

Although provisional outturn data for 2014 has been received it is still subject to audit. The Income Forecasting Group (IFG) are reviewing the 2014 outturn, as part of a range of relevant data, as they prepare their recommendation for future States Income forecasts that will be used in the MTFP 2016- 2019. The Minister is therefore not in a position to be able to elaborate on these draft forecasts but will do so as soon as he is satisfied that they have been fully validated.

Appendix A

The following chart helps to illustrate how an individual taxpayer (subject to a specific set of circumstances – i.e. income £100,000, married, 2 children, mortgage interest of £13,500) transitions from being a standard rate taxpayer to a taxpayer that benefits from the marginal relief calculation as a result of the phasing out of allowances for standard rate taxpayers over the period from 2006 to 2011.

Individual Taxpayer: Income £100,000 Married, 2 children, mortgage interest of £13,500

![]()

![]()

£19,500.00 £19,000.00 £18,500.00 £18,000.00

£19,500.00 £19,000.00 £18,500.00 £18,000.00

![]()

![]() £17,500.00

£17,500.00

![]()

![]()

![]()

![]()

![]()

![]() £17,000.00

£17,000.00

![]()

![]()

![]()

![]()

![]()

![]() £16,500.00

£16,500.00

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]() £16,000.00

£16,000.00

![]()

![]()

![]()

![]() £15,500.00

£15,500.00

£15,000.00

![]()

![]()

![]()

![]() £14,500.00

£14,500.00

£14,000.00

2006 2007 2008 2009 2010 2011

![]() Standard £14,580.00 £15,464.00 £16,148.00 £17,032.00 £17,916.00 £18,800.00

Standard £14,580.00 £15,464.00 £16,148.00 £17,032.00 £17,916.00 £18,800.00

![]() Marginal £17,231.40 £17,109.90 £16,521.30 £16,259.40 £16,259.40 £16,197.30

Marginal £17,231.40 £17,109.90 £16,521.30 £16,259.40 £16,259.40 £16,197.30

![]() Actual tax paid £14,580.00 £15,464.00 £16,148.00 £16,259.40 £16,259.40 £16,197.30

Actual tax paid £14,580.00 £15,464.00 £16,148.00 £16,259.40 £16,259.40 £16,197.30

Tax threshold increase: 0% 2.5% 6.5% 5.0% 0.0% 1.1%

Notes on chart:

- The effects of the phasing out of allowances for standard rate taxpayers under 20 means 20' over this period are clearly illustrated by the blue bars on the chart. This demonstrates that the standard rate tax calculation in respect of this taxpayer increases in steps as the allowances are withdrawn.

- The movement in the marginal tax calculation (red bars) reflects the movement in the tax exemption thresholds over this period.

- The specific effect on this taxpayer is:-

- 2006 to 2008: The taxpayer is a standard rate taxpayer affected directly by 20 means 20' with an increasing annual tax liability reflecting the phasing out of his allowances.

- In 2009 for the first time the taxpayer benefits from the marginal tax calculation. Whilst he is still paying more tax in 2009 than in the previous year, marginal relief is beneficial to him as the allowances in 2009 have increased the standard rate tax to a figure that is higher than the tax due in accordance with the marginal tax calculation.

- 2010 and 2011: The taxpayer, now firmly in the marginal relief band, is no longer affected by the phasing out of allowances in 2010 and 2011. The variation in his tax liability is therefore solely a consequence of the changes in the income tax exemption thresholds.