The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

16

1240/5(9586)

WRITTEN QUESTION TO THE MINISTER FOR TREASURY AND RESOURCES BY DEPUTY M.R. HIGGINS OF ST. HELIER

ANSWER TO BE TABLED ON TUESDAY 13TH SEPTEMBER 2016

Question

Will the Minister, by way of a table and graph, advise Members in respect of income tax for each year between 2008 and 2015 (or the last year for which full figures are available):

(a)

- The total number of taxpayers in each year;

- The number of taxpayers who paid tax at the marginal rate;

- The number of taxpayers who paid tax at the 20% rate.

(b)

- The percentage of the total personal income tax take paid by taxpayers in the marginal band;

- The percentage of the total personal income tax take paid by taxpayers on the 20% rate.

(c)

- The average rate of tax paid by those in the marginal band;

- The average rate of tax paid by those on the 20% tax rate.

(d) The number of taxpayers in each year who paid no tax.

Answer (a)

Count |

|

|

|

|

|

|

|

Year | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 |

| (000) | (000) | (000) | (000) | (000) | (000) | (000) |

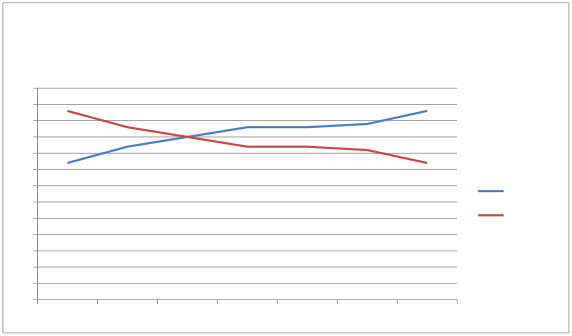

Marginal | 36.8 | 37.4 | 38.5 | 39.7 | 38.5 | 38.2 | 39.8 |

Standard | 10.7 | 8.5 | 7.5 | 6.8 | 6.7 | 6.3 | 5.3 |

Total | 47.5 | 45.9 | 46.0 | 46.5 | 45.2 | 44.5 | 45.1 |

NUMBER OF PERSONAL TAX PAYERS 2008 - 2014

45,000

40,000

35,000

30,000

25,000

Marginal 20,000 Standard

15,000

10,000

5,000

0

2008 2009 2010 2011 2012 2013 2014

Notes:

- A Personal Taxpayer is defined as an individual/married couple/civil partnership that pays tax, based on their own liability, in Jersey, for the year. Personal Taxpayers whose liability was less than £50 are counted as Personal Non-Taxpayers. This is consistent with the Taxes Office historical position on gathering tax data.

- Over the period covered by this question the number of standard rate taxpayers has decreased and the number of marginal rate taxpayers has broadly increased by the same number, this transfer between categories is due to a combination of factors which include:-

- The effects of the "20-means-20" policy implemented between 2007 and 2011 where allowances were gradually withdrawn from standard rate taxpayers (meaning that some of those taxpayers whose income was just sufficient to make them standard rate taxpayers in 2006 (when full allowances were available) will have become marginal rate taxpayers as the allowances were withdrawn from standard rate taxpayers

- The reduction in the marginal rate of tax in 2014 from 27% to 26%

- The increases in the exemption thresholds over the relevant period

- The increase in higher child allowances available to marginal rate taxpayers with children attending higher education introduced in Budget 2014

- Despite this transfer between categories, the proportion of income tax paid by the top quintile of taxpayers has remained consistent over the period.

(b)

TAX % |

|

|

|

|

|

|

|

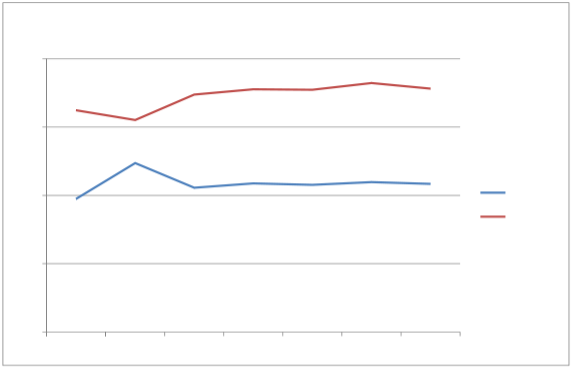

Year | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 |

| % | % | % | % | % | % | % |

Marginal | 42 | 47 | 50 | 53 | 53 | 54 | 58 |

Standard | 58 | 53 | 50 | 47 | 47 | 46 | 42 |

|

|

|

|

|

|

|

|

Total | 100 | 100 | 100 | 100 | 100 | 100 | 100 |

Percentage of total Income Tax Paid By

Percentage of total Income Tax Paid By

Marginal and Standard Tax payers

65

60

55

50

45

40

35 Marginal 30

25 Standard 20

15

10

5

0

2008 2009 2010 2011 2012 2013 2014

Notes (continued):

- The gradual increase in marginal rate taxpayers over the period (see (a) above) will have a corresponding effect on the percentage of total personal income tax paid by marginal rate taxpayers.

(c)

Average Rate of Tax Paid |

|

|

|

|

| ||

Year | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 |

Marginal | 9.7 | 12.4 | 10.6 | 10.9 | 10.8 | 11.0 | 10.8 |

Standard | 16.2 | 15.5 | 17.4 | 17.8 | 17.7 | 18.2 | 17.8 |

AVERAGE RATE OF TAX PAID 2008 - 2014

AVERAGE RATE OF TAX PAID 2008 - 2014

20.0

15.0

10.0 Marginal Standard

5.0

0.0

2008 2009 2010 2011 2012 2013 2014

Notes (continued):

- The average rate of tax paid for each specific taxpayer is calculated by reference to the total income (including taxed at source income) and the tax payable (the amount the taxpayer is required to pay after all tax credits have been deducted).

- The average rate of tax paid by marginal rate taxpayers has gradually increased over the period, this has been predominantly caused by some taxpayers with higher incomes transferring from being a standard rate taxpayer to a marginal rate taxpayers (see the explanation for why this has occurred in (a) above).

(d)

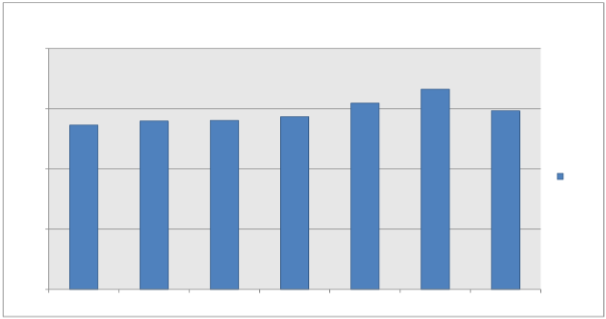

Year | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 |

| (000) | (000) | (000) | (000) | (000) | (000) | (000) |

No tax | 13.6 | 14.0 | 14.0 | 14.3 | 15.4 | 16.6 | 14.8 |

NUMBER OF NON-TAXPAYERS 2008 - 2014

NUMBER OF NON-TAXPAYERS 2008 - 2014

20,000

15,000

10,000

No tax 5,000

0

2008 2009 2010 2011 2012 2013 2014

Notes (continued):

- A Personal Non-Taxpayer is defined by the Taxes Office as an individual/married couple/civil partnership who has completed an income tax return and does not have a positive income tax liability for the tax year, based on the income, allowances, reliefs and deductions for the year. The data above does not therefore include individuals/married couples/civil partnerships that do not receive a tax return (such as students that register for holiday job purposes only and therefore have annual income well below the exemption threshold and other members of the population where their income has consistently been below the exemption threshold and their specific circumstances dictate that it is unlikely they will pay tax in the future).

- The number of "non-taxpayers" (in accordance with the current Taxes Office definition set out above) will vary for a number of reasons which include:

- Annual changes to the income tax thresholds approved by the States in the annual Budget process

- Targeted use of resources by the Taxes Office to reduce the number of taxpayers that receive a tax return each year. When resource is available the Taxes Office will review cases where the taxpayer's income has been consistently below the tax exemption thresholds and is likely to remain that way. The last such review will have impacted on the 2014 figure shown above.

Additional Notes:

- The data provided is by reference to each year of assessment.

- Data based on the 2015 year of assessment will not be available until 2017

- Personal Taxpayers and Personal Non Taxpayers include

- Single individuals.

- Married couples / civil partnerships that have not opted for separate assessments (counted as one Personal Taxpayer or one Personal Non- Taxpayer).

- Married couples / civil partners that have opted for separate assessments (counted as two Personal Taxpayers or two Personal Non-Taxpayers).

- Non resident personal taxpayers and non-taxpayers are excluded.