The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

WQ.342/2021

WRITTEN QUESTION TO THE MINISTER FOR TREASURY AND RESOURCES BY DEPUTY G.P. SOUTHERN OF ST. HELIER

QUESTION SUBMITTED ON MONDAY 12th JULY 2021

ANSWER TO BE TABLED ON MONDAY 19th JULY 2021

Question

Further to the response to Oral Question 153/2021, in which the Minister stated that the ratios quoted by the question in respect of the relative tax take from individuals and companies were not recognised, will she provide members with the correct ratio, which she undertook to provide, to include the items she listed when answering the question; and will she explain how Social Security contributions can be regarded and treated as comparable with taxation, given that such contributions are not considered to be taxation revenue and that the income is ring-fenced for the Social Security Fund?

Answer

The ratio that is used internationally for revenue mix is the OECD standard, which includes taxes on personal income, corporate profits, property, goods & services and employer/employee social security contributions.

Personal income taxes apply to business profits and dividends as well as salary. A Jersey individual shareholder of a 0% company pays personal income tax on the total value of dividends received from that company, without the usual tax credit that would apply to dividends paid from a positive rate company. Therefore, tax on such dividends is reflected fully as personal income tax rather than as a mix of personal and corporate income tax.

Tax on property is defined as recurrent and non-recurrent taxes on the use, ownership or transfer of property. It would include stamp duties or annual property taxes but not income tax on property rentals.

Social Security contributions are included as revenues in this OECD benchmark because they are compulsory payments made to Government by both employers and employees.

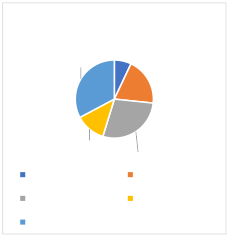

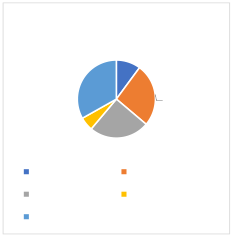

Based on the OECD international standard, the comparative revenue mix figures for Jersey v the UK and OECD average are as follows:

Jersey OECD Average UK

Jersey OECD Average UK

9% 12% 10% 33% 7%

4%

20%

33%

25% 26%

6%

50%

25% 12% 28% Corporate Profits Soc. Sec. & LTC Corporate Profits Social Security Corporate Profits Social Security Personal Tax Property Personal Tax Property Personal Tax Property Goods & Services Goods & Services Goods & Services

These charts demonstrate that:

- The 12% ratio of corporate income tax in Jersey is higher than both the UK and OECD average comparable figures.

- The Goods & Services Tax (GST) ratio of 9% in Jersey is significantly lower than the equivalent returns from consumption taxes in the UK and OECD, which are both 33%.

- Property taxes in Jersey (4%) are also lower than the UK (12%) and the OECD average (6%).