The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

WQ.439/2024

WRITTEN QUESTION TO THE MINISTER FOR SUSTAINABLE ECONOMIC

DEVELOPMENT

BY DEPUTY K.M. WILSON OF ST. CLEMENT

QUESTION SUBMITTED ON MONDAY 2ND DECEMBER 2024 ANSWER TO BE TABLED ON MONDAY 9TH DECEMBER 2024

Question

"Will the Minister detail how the £20m approved in the Budget (Government Plan) 2025-2028 to support the transition to a living wage will be targeted, and how he intends to measure the impact of the spend on the economy and levels of poverty?"

Answer

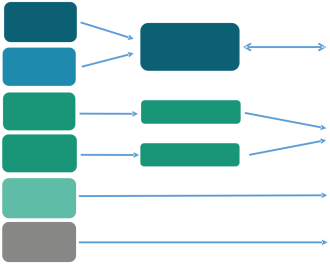

The Better Business Support Package has been targeted to support those sectors most significantly impacted by the rise in the minimum wage and so includes the following per year in 2025 and 2026:

• £2.3m Productivity Grant - to help any employer invest in a product or process improvement

• £2m Skills Grant - to help any employer invest in apprentice and skills training

• £1.1m Rural and Marine Grant – top up funding to the existing rural and marine support schemes

• £1m Visitor Economy Development Grant – a productivity grant ring-fenced for visitor economy employers

• £2m Destination Marketing Grant – top up grant for Visit Jersey to increase tourism demand

• £1m Route Development Grant - a contract for Ports of Jersey to increase connectivity

• £0.3m Additional Employee Support – to support lower-income workers who have lived in Jersey less than five years

Further details on the eligibility criteria for each Grant Schemes are set out in the annex below.

Monitoring and evaluation for each Grant Scheme and the overall impact of the Support Package have been a focus throughout the design phase. Now with States Assembly approval, these are being finalised over the coming weeks ahead of the launch in early 2025.

The £20m Better Business Support Package is focussed on supporting organisations to become more productive, resilient and competitive over the next two years and therefore will not measure levels of poverty.

Annex

Better Business Support Package - Further Details

The schemes within the package have been designed to support improvements in productivity for all employers in Jersey whilst helping those sectors impacted most by the increase to the minimum wage. The impact of each scheme will be reviewed at the end of 2025 for improvements to be made for 2026.

The schemes within the package have been designed to support improvements in productivity for all employers in Jersey whilst helping those sectors impacted most by the increase to the minimum wage. The impact of each scheme will be reviewed at the end of 2025 for improvements to be made for 2026.

Productivity, Skills and Visitor Economy Development Grants

Primary eligibility criteria for all applications:

• Business must be registered in Jersey and hold a business licence (includes charities who employ paid staff)

• Business must employ at least 1 person (owner/s + 1) for at least 3 months who are paid a minimum of £128 per week

• Business must be up to date with tax contributions or on a repayment plan

Secondary eligibility criteria for grant applications:

Each grant package can be applied to for either:

• Major Grants - £5000 to £75,000 - Business must have been operating for 18+ months

• Minor Grants - £1000 to £5000 - Business must have been operating for 6+ months

• [Apprenticeship Grants – A £2,000 grant per apprentice, per year will be treated as part of the Skills Grant package but with a separate approval process]

Project eligibility:

• Businesses may apply for one grant, per calendar year, per grant scheme that they are eligible for

• Grants must be for different projects that cannot have started before grant approval

• Grant projects must show a measurable benefit to one or more factors of productivity: input costs; process efficiency; output and revenue

• Grants are up to 50% of the project costs, the business must cover a minimum of 50%

Visitor Economy Development Grant – this ring-fenced package will be available to businesses that can be defined as part of the Visitor Economy which will be assessed during the application process. Example I

A construction business operating for over 6 months but less than 18 months in 2025, can apply for up to £160k in total:

• 1 x £5k Productivity Grant with Project A in 2025

• 1 x £5k Skills Grant OR Apprenticeship Grants in 2025

• 1 x £75k Productivity Grant with Project B in 2026

• 1 x £75k Skills Grant OR Apprenticeship Grants in 2026

Example II

A hotel operating in the visitor economy for over 18 months can apply for up to £450k in total:

• 1 x £75k Productivity Grant with Project C in 2025

• 1 x £75k Visitor Economy Development Grant with Project D in 2025

• 1 x £75k Skills Grant OR Apprenticeship Grants in 2025

• 1 x £75k Productivity Grant with Project F in 2026

• 1 x £75k Visitor Economy Development Grant with Project G in 2026

• 1 x £75k Skills Grant OR Apprenticeship Grants in 2026

Jersey Business will deliver the above grants through a new online portal to streamline the application process for employers, ensure the security of the process, and assess the impact of each grant. Further details on the application process will be announced by the end of the year.

Destination Marketing

• Outline – a top up grant for Visit Jersey to boost their promotional activity of Jersey and measurably increase tourism to the Island

• Example – increased media activity (e.g. digital media adverts) and develop collaborations with third-party brands and distribution partners

Route Development

• Outline – a contract for Ports of Jersey to increase air connectivity

• Example – negotiating a new regular flight connection to a major European city over a multi- year period

Rural and Marine Grant Development

• Outline – a top up to the usual credit-based Support Schemes, targeted to businesses impacted most by the minimum wage increase

• Eligibility – employers who are part of the Rural and Marine Support schemes

Additional Employee Support

Outline – support lower-income workers who have lived in Jersey less than five years

Eligibility

• be aged 18 or over

• have been be resident in Jersey for less than 5 years

• have Control of Housing and Work Law Registered' status

• not live in a household that meets the residency condition for the Income Support scheme

• have contribution earnings declared in every month for Quarter C of 2024 i.e. July, August and September

• be resident in Jersey and have a Jersey or other accepted UK bank account in their own name