The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

Deputy Chief Minister

Minister for Economic Development Tourism, Sport and Culture

27 August 2021 Senator Kristina Moore

Chair of the Future Hospital Review Panel

By email

Dear Senator Moore ,

Thank you for your letter dated 13 August 2021 which set out the questions that the Panel were unable to ask due to the time constraints of the Public Hearing held on 11 August 2021. Please accept my apologies for the slight delay in response, this was merely due to the volume of questions. I have responded to each of your questions in order below.

- Why do designs include elements like atriums when this could drive price up and reduce optimisation of space?

a. Would removing elements like this in design lead to a smaller impact on the island's skyline?

The atrium maximises natural light, light is a healing force, it regulates the body's circadian rhythms and enhances emotional health, the design takes advantage of the benefits of natural light whilst combating the negative impacts associated with it such as heat gains, transmission of UV rays and glare. Natural lighting boosts employee productivity and mood and helps them feel more energised. In a hospital environment, employees with access to natural light and views of nature have lower levels of stress and health related absenteeism, which ultimately benefits patients. The atrium forms an important part of the welcoming space as well as the drop off and pick up points for patients and the public. An atrium also enables effective separation of the inpatient, outpatient, emergency and staff pathways. It is inevitable that a hospital at Overdale will have some impact on the island skyline, however work is being undertaken to ensure that any impact is minimised.

- The information provided to support the costs tables within the OBC for the preferred option are based on a Gross Floor Area (GFA) adjusted for "Opportunities for reduced GFA arising from clinical brief review exercise at end of Stage 2" which equates to a 4,282m2 reduction to the GFA stated in the RIBA Stage 2 Design Report. Please provide a schedule evidencing where this reduction has been achieved across the departments. What is the status of this area reduction, has it been agreed and signed off by clinical user group teams?

Where areas may be reduced in size, these have been discussed and accepted by clinical user groups and the Health and Community Services Executive team.

The Design and Delivery Partner has continued to explore the opportunities identified to develop an updated Schedule of Accommodation in collaboration with the Clinical Director. The design evolution is ongoing and final approval for any changes in floor area will be sought from the Clinical and Operational Client Group. The opportunities for area reduction as identified at the end of the Royal Institute of British Architects (RIBA) Stage 2 are set out in the list below.

• Requirement for Automated Guidance Vehicles omitted – the Design and Delivery Partner (DDP) to consider flexibility for future introduction in flexibility review

• Emergency Department: Could be reduced by 1x resus and 2x majors cubicles

• Urgent Treatment Centre: Could be reduced from 11 to 6 minors' cubicles

• Theatres: Move of Interventional Radiology Suite to Radiology and conversion of 2 Minor Operations Suites into 1 theatre – Mobile Operations Suites to relocate from Outpatient Department to Theatre floor which will assist with staffing concerns/utilisation

• Intensive Treatment Unit: Reduction in bed base from 12 to 10 with x 4 en-suite (2 x isolation) and 2 x 2 bed bays

• Renal: Reduction in 2 side rooms

• Oncology: Reduction in 3 chairs

• Pharmacy: Reduction in fluid store from 6 to 2 weeks on site – team to continue to review area

• Medical Day Unit:Merge with Ambulatory Emergency Care (removal of 8 trollies and increased beds)

• Pharmacy fluid store (weeks 3-6): To go to purposely adapted stores at Five Oaks

• Private Patients Outpatient Department: Efficiency challenge to Outpatient Department

• Ward s reconfigured to 30 bedded wards with efficiencies in circulating areas as well as more efficient staffing ratios

- The project Critical Success Factor No.6 – "is the option likely to be affordable from both a revenue and capital perspective" was not assessed at Strategic Outline Case (SOC) but it was stated, in that business case, that it would be assessed in the Outline Business Case (OBC). However, as identified in the hearing, future revenue costs have not been fully considered in the OBC. Why is this?

a. It has been suggested that the non-inclusion of this in the OBC means there is a lack of information on the true costs of ownership of the preferred option, and means that without such information the OBC is not complaint with Green Book principles, what are your views, Minister?

The OBC includes information on revenue costs, including estimated future lifecycle costs and shuttle bus revenue costs. An update on the changes expected in Soft Facilities Management, Hard Facilities Management and utilities costs when the services are provided at the new hospital, rather than across multiple sites as they currently are, was not included in this OBC as a separate Facilities Management Business Case is currently being developed

to consider options for the future delivery of these services.

- The life cycle cost estimates for the new build option in the SOC have increased significantly, even when the building size has only increased by a smaller proportion. Why the significant increase in annual life cycle revenue costs?

a. What certainty is there that costs will not increase again for Full Business Case (FBC)?

The OBC life cycle cost was modelled on the 73,248m2 area in the RIBA Stage 2 design. However, information for the area savings associated with the opportunities for space reductions described in Question 2, were not available in time for the exercise and were therefore not included in that modelling. The lifecycle cost will therefore have reduced since the exercise was completed.

The change in the life cycle cost model SOC and OBC was proportional to the area change from SOC to the RIBA Stage 2 design. As is normal for construction projects, the design of the facility will be developed and refined with option studies to be undertaken to check value for money and affordability for both the base construction costs and project lifecycle. This is likely to lead to adjustments to the life cycle costs but, as with the construction costs, the project team is focussed on reducing costs without compromising the operation and required quality of the facility to deliver a value for money project.

- The OBC cost tables do not provide a comparison with the SOC in order that the movement in cost headings is clear and reasons explained, such as works cost up or optimism bias down. Does the Minister agree that transparent presentation and explanation of the movement would be useful to put into context for further movement during FBC stage?

a. We would be grateful if an explanation of the movements across cost headings of the SOC and OBC could be provided.

A comparison between SOC (also published in P.123/2020) costs and OBC costs has been shared with the Panel during previous briefings and tables published in the Report accompanying P.80/2021 also illustrate the changes in cost categories from SOC to OBC.

The SOC was developed before a site was approved by the States Assembly and detailed design work had begun. As surveys and designs progress, it is normal for allocations to individual cost categories to change as better cost certainty is achieved.

- The OBC references that the main works value (£406.2m), with exception of the £53.4m preliminaries allowance, is based on costs provided by the Design Delivery Partner (DDP) and validated by the cost consultant. The preliminaries are based on the cost consultant's assessment as the DDP value was not considered to be typical for this type of project. The Two Stage procurement strategy adopted and set out in

the SOC and OBC included preliminaries costs for the works. If preliminaries costs were included in initial DDP tender, why is there a disparity between DPP and cost consultant?

a. What is this level of difference in order that level of pricing risk can be understood?

Preliminaries costs were not requested or included in the tendering process that resulted in the selection of the DDP, as this preceded the development of the brief and site selection process. The DDP produced an initial forecast of their preliminaries as part of their RIBA Stage 2 cost plan, which is much higher than the cost advice the DDP had previously provided to the Government of Jersey team during the RIBA Stage 2 design process. The DDP has accepted that their costs are too high, and the parties will review and refine the preliminaries costs leading up to Full Business Case (FBC) in order to arrive at a value that represents value for money.

The variance between the DDP's and cost consultant's assessment has been shared with the Panel's advisors on a private and confidential basis, given that the information is commercially sensitive. However, our advisors would be happy to discuss further with the Panel's advisers.

- It is unclear from information provided if the costs for decommissioning the existing facilities after decant / transition have been undertaken are included in the OBC figures. Can this be clarified?

The costs for decommissioning and demolition of the existing facilities at Overdale are included in the OBC figures.

- There are three levels of cost allowances for level of uncertainty included in the OBC preferred option costs - contractor contingency equates to approximately 8%, Optimism Bias equates to approximately 6%, Client risk equates approximately 11%

- totalling £147 million.

If the clinical briefing work has been completed and the size and scale of the facility is understood, and there has been input by both an internationally experienced DDP and an experienced international cost consultant to agree the baseline costs, why is there such a high level of risk and contingency necessary as it amounts to approximately 18% of the overall project borrowing requirements?

These risk and contingency allowances represent sums that would be available to cover the variety of risks that remain to deliver the new hospital project. If risks do not materialise, however, these costs will not be incurred.

Such categories of risk and contingency allowances are typical for major hospital schemes, and other major construction projects, in accordance with major projects best practice in the UK and overseas. The assessments are all supported by modelling, and this commercially sensitive information has been shared with The Panel's advisers. The percentages as a proportion of construction and total project cost are generally in line with projects of this nature at RIBA Stage 2 design.

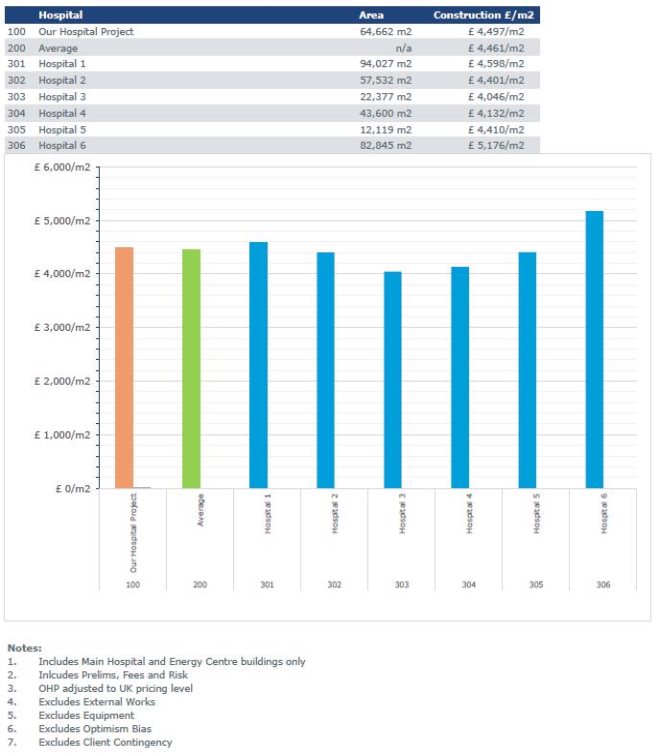

- The OBC refers to the project cost consultant undertaking a benchmarking analysis to evidence the level of costs presented are accurate and reflective of similar healthcare facilities adjusted for Jersey location factor. Excluding the Jersey factor, where does the baseline costs for the facility sit compared to reference projects elsewhere?

The projected costs for Our Hospital are comparable with other similar hospital builds.

Please see Appendix 1 for a comparison of the main hospital building and energy centre compared against similar large hospital projects, on a like-for-like basis with unique characteristics of each project removed.

Other hospital builds are anonymised due to sensitivity and confidentiality restrictions for the individual projects. However, we would be willing to discuss this in more detail in private with your advisors.

- The OBC states that inflation has been applied to the construction costs based on BCIS (UK Building Costs Information Service) inflation indices with a Jersey Factor. What is the Jersey Factor applied and how has this been assessed?

The inflation considerations for materials, labour, plant and other preliminaries associated with packages likely to be sourced in Jersey was considered as part of the base construction costs and the inflation modelling assumptions, based on inputs from the DDP and on-island consultants. Noting the commercial sensitivities around such information we are happy to review these factors and the inflation modelling approach in further detail in private with the Panel's advisors.

- What is the known or understood impact that the borrowing and proposed bond issuance will have on the Island's financial and economic situation?

The GoJ has a rating of AA-/A-1+ with a stable outlook, which in line with the rating of the United Kingdom and one of the highest credit ratings available.

The Island's credit rating influences how cheaply the Government is able to access the international credit markets. Indirectly the credit rating may also give indications to the perceived strength of the Island's financial position and stability of the local economy.

Sizable fiscal buffers are an important strength. Standard and Poor's regard the Government of Jersey's sizable liquid financial assets as a key strength to the rating. The agency applies a one notch increase to the rating as liquid assets / GDP exceed 100%, which is expected to be maintained through preservation of our reserves. Jersey has strong metrics compared to other Sovereigns with a similar rating. However, strong metrics such as a low level of debt / GDP and high proportion of liquid assets are required to offset against Jersey's small size and weak scoring for independent monetary policy.

The rating agencies' assessment of the Islands flexibility and performance profile reflects the sustainability of its fiscal balance and debt burden. A change in debt levels may put negative pressure on this profile, however the sinking fund mechanisms proposed for repayment should provide comfort to the sustainability of the debt burden. The Treasury Department consider it would be prudent to assume and be ready to accept a downgrade to A+ should the debt quantum contemplated be issued, though a downgrading is far from certain given the significant value of retained reserves, if the hospital is funded through borrowing. Our advisors have no concerns regarding investor appetite for further issuances of debt in the event of a downgrade.

At A+ the island would maintain its investment grade which is expected to continue to support confidence in the Island as a stable and fiscally prudent jurisdiction.

- Please can it be explained why the potential disposal sites or divergence of assets are out-with the scope of the Our Hospital Project?

- Would Capital receipts reduce the overall funding need for the project reducing ongoing revenue costs to service the debt?

Disposal of sites or divergence of assets have the potential to produce sizable capital receipts. However, Government never takes disposals into account when looking at project costs. The timing and process of asset disposals can be quite different to the project build making it impossible to match income with expenditure timing needs. Whilst the sites may be in current clinical use, they could be suitable for a variety of other uses such as housing, education, amenity space or key worker accommodation, for example. In addition, there is a range of requirements emerging in the Island Plan, which may inform any future use of vacated sites. For example, it doesn't make sense to dispose of a former clinical site which would then require the Government to acquire a new site to provide, say, a new primary school.

These strategic matters are not within the scope of the Our Hospital project and will be addressed by the Government of Jersey in due course, as part of its Estates Management Strategy and Corporate Asset Management approach.

- Why is there no issuance of a local bond envisaged?

This is explained in section 10.30 in the Report accompanying P.80/2021.

A Local Bond would need to be Retail Bond offered only to Jersey Residents and would incur greater cost than the Sterling Public Bond Issuance alternative in terms of the required rate paid and the costs of administration.

The total value of a Local Bond would be significantly short of that required to fund the Our Hospital Project, with bonds of this type typically not exceeding £50-200 million.

The bond maturity profile of a Local Bond would typically extend to only 3-7 years, exposing the States of Jersey to additional risk if there is a need to refinance project debt, should interest rates rise or market conditions deteriorate. Given the timeframe, debt would need to be reissued to provide a sufficient timescale to repay the outstanding debt without significant rises in tax revenue or sale of assets.

Furthermore, the GoJ does not currently have the infrastructure to manage a Local Bond. There is a requirement to have an active relationship with investors, and those investors are likely to be "unsophisticated" in investment and regulatory parlance, as they may well be first- time investors, requiring greater protection.

- What consideration has been given to the sale of certain States owned assets in order to generate cash?

Please see the response to Question 12a.

- How does the Outline Business Case account for the potential change in service demand, for example of dialyses due to increase in cases of diabetes?

The demand and capacity model is based on predicted healthcare needs to 2036. The building is being designed in a flexible way to accommodate potential changes in service delivery. In addition, the service model has opportunities for increased operational throughput and therefore an increase in demand over and above the demand and capacity model does not necessarily require the construction of additional space.

- The Panel has already received numerous submissions to this review, none have supported the plans as they currently stand. Minister what do you say to islanders who indicate that a "world class" hospital at an "eye watering" cost is not needed?

a. During the debate of P.5/2019 members of the Government argued that the rescindment of the Gloucester Street site would deliver "a new site, with a build cost that is less." What have been the factors that have led to Ministers being able to justify this reversal of outcome to themselves and to the public?

It is very difficult to make direct comparisons between the scheme put forward by the previous iteration of the project and Our Hospital. For example, there has been a significant inflationary impact on costs solely due to the passing of time.

The previous scheme involved the demolition of current space and a two phase approach to provide a new hospital. The previous scheme in hindsight and with furthering health pressures, would not meet our needs now and was shown through planning to be too tight a fit. The Our Hospital scheme adds mental health, outpatients and catering back into a single proposal which is now thought more efficient. Because Our Hospital brings together more health and care services onto one site, itis a more comprehensive scheme than the previous scheme. For example, mental health services were not included in the previous scheme and were anticipated to cost in the region of £45m in addition to the main hospital scheme costs and neither were kitchens, which are included in the Our Hospital proposed scheme. The Our Hospital Project is seeking to deliver the right hospital for Jersey which will be capable of providing health and care services to current and future generations of Islanders.

- P.80/2021 includes proposals for compulsory purchase of land or access. Has a feasible alternative site for the Jersey Bowling Club been found?

Positive discussions with the Jersey Bowling Club to identify an alternative site are ongoing.

- Dr Ashok Handa stated the cost to build the private patients facility was £10m, can the calculation to support this statement be provided?

The area of the Private Patients' facility in the RIBA Stage 2 design is circa 2,000m2. Dr Handa used £10m as an approximation based on this floor area and an indicative £5,000/m2 average construction cost – see Appendix 1.

- It was stated by the Group Director, Finance Business Partnering & Analytics, that adaptions' were made to the Green Book to reflect the specific situation in Jersey – can these adaptions' be detailed and the rationale for each of them be explained? a. Why are these not outlined in the OBC when it is clearly stated in that document that it is considered fully complaint with the Green Book and verified by such by a third party?

The OBC has been developed in line with UK HM Treasury Green Book (Green Book) guidance as this is considered best practice. The gov.uk website describes the Green Book as guidance on options appraisal and not a prescriptive methodology. Where appropriate, this best practice guidance has been tailored to the Jersey decision making context, whilst not diverting from the specific requirements of the Jersey Public Finances Manual. Specific areas where the Green Book guidance that have been tailored to a Jersey context include:

• Revenue / benefit quantification: For further detail, see response for Question 20.

• Do nothing / business as usual options not taken forward within the options appraisal. For further detail, see response to Question 19.

- Given that the Functional Brief for the new hospital was not intended to reflect only the Jersey Care Model but to fit any model of care' (OBC p70, sub-paragraph 4.6.2.1), it is not clear why only one option for the scope and size of the new hospital was shortlisted – why were alternative scopes not considered in line with the Green Book option filter framework?

A draft Functional Brief exercise was undertaken at the SOC stage to determine the minimum ground floor sizing requirements of the New Build Option. This process was primarily to support the site evaluation but also enabled a detailed review and challenge of potential functional areas which could be included in the proposed new build hospital. As such, the Functional Brief is a framework to deliver shortlisted options rather than a tool to determine which options should be shortlisted.

The longlist of options included a range of potential interventions, with a shortlisting workshop undertaken to determine which of the longlist of options were feasible options and which were not. To identify whether options were feasible, each longlist option was assessed against a set of Critical Success Factors (CSFs). The New Build Option was the only option which met all of the CSFs. It was therefore taken forward for further assessment at OBC stage.

At the OBC stage, the Employer's Requirements document, which includes the Functional Brief, was developed with the DDP as the basis for the design of the new hospital, highlighting key areas that needed to be considered in the design to achieve the CSFs and Strategic Investment Objectives. The DDP has developed their design in response to these requirements, their Concept Design report published on www.ourhospital.je summarises the progress that has been made at RIBA Stage 2 in achieving this.

- The rationale given for not including a baseline Business as Usual (BAU) option on the shortlist was that this option was not viable as the hospital would need to close in 2026 – this issue could have been addressed as a costed risk in the economic appraisal, so that the Green Book requirement for a BAU option could be met. The Strategic Case for replacing the existing hospital has been made, and the intent of questioning the rationale for not including the BAU option is not around reopening this issue, but to address the gaps in Green Book compliance and support the case for change in the OBC. Therefore, why was this approach not taken?

Also, please see the response to Question 17.

At the outset of the Strategic Outline Case work in February 2020, a long list of options was developed by Health and Community Services to consider alternatives to building the proposed New Hospital. This long-list included a Do Nothing Option (or a Business as Usual option) which assumed that a similar level of spend (circa £5m per annum) would be required to maintain the existing estate. This options appraisal process identified significant concerns with the Do Nothing Option, including:

• Estates

- The existing level of spend would not allow for services to continue to be delivered in the existing estate beyond 2026.

- Due to operational constraints, it is often very difficult to spend the money currently allocated as it is increasingly difficult to safely decant clinical areas to allow the works to be carried out

- The majority of the spend is to only keep services compliant without improving functions, especially in clinical settings

• Clinical

- The current site has significant daily operational risk. It is anticipated that by Dec 2026 the operational difficulties will be such that patient safety will become increasingly compromised.

- The existing site is old and configured with clinical adjacencies that are not up to date with modern working practices, resulting in daily operational challenges and, increasingly, patient safety risks. This has been brought to a head during the COVID-19 pandemic, with intense focus on infection control resulting in lack of service continuity.

- Patient experience is compromised within the existing site, there is no room for the provision of an effective Patient Advice and Liaison Service service, waiting rooms are unable to provide places of safety or privacy for patient presenting with complex needs or to accommodate religious or personal choices, correspondingly toilet facilities are gendered and inflexible reprovision

- Employee experience is compromised, we are unable to provision suitable training facilities to embrace technological advances for our clinical teams. Rest rooms are inadequate in size, light and access is generally poor.

- Outside space for staff is negligible

- In large part, the facilities do not meet modern day building standards. For example, the size of rooms, corridors, operating theatres and no dedicated patient drop off for the Emergency Department

- The current site provides no space for the expansion of services as a result of changes to service delivery

- With split site working for mental health services there is lack of parity of esteem between mental and physical health and reduced opportunities for multi- disciplinary and cross specialty working.

- Multiple site provision leads to significant inefficiencies in staff rostering and shared learning

As a result of the significant issues at the existing site, it was concluded that continuing with the Do Nothing / Business as Usual Option would result in the gradual reduction in health care provision from 2026 with more services being delivered off-island.

It is important to reiterate that this would not be a feasible option in an island context, where estate failure would result in the complete failure to deliver some health and care services to Islanders, which would not be clinically operationally or politically acceptable. For this reason, no further work was performed on this option.

As an alternative to the Do Nothing Option, a Do Minimum / Baseline Comparator was shortlisted which developed over the subsequent 12 months into the Baseline Comparator Option shown in the OBC.

- One of the stated reasons for not quantifying benefits was the absence of suitable baseline data, yet the OBC makes a number of references to the Jersey Care Model and the demand and capacity modelling work addressing issues such as length of stay reductions, admissions avoidance, etc – this suggests that data relating to at least some potential cash-releasing and non-cash-releasing benefits was in fact available. Can this discrepancy be explained?

As discussed with the Panel during the Public Hearing on 11 August 2021, the overall data maturity and availability is a key focus of ongoing Health and Community Services work.

Although the Panel notes that some quantitative data was available, its availability does not necessarily mean that its use in benefits calculations would have resulted in cash- or non- cash- releasing benefits being identified.

For example, using theatre throughput data would not identify where theatre sessions could be reduced – and therefore savings made – as Health and Community Services would use this as an opportunity to increase theatre activity to support Islander health outcomes.

The differences in payment models between the NHS and Jersey mean that this activity is not quantifiable in the same way as would be possible in the UK, as Jersey health budgets are set as a block budget as part of the Government Plan, not variable with the potential for increase if extra activity is achieved.

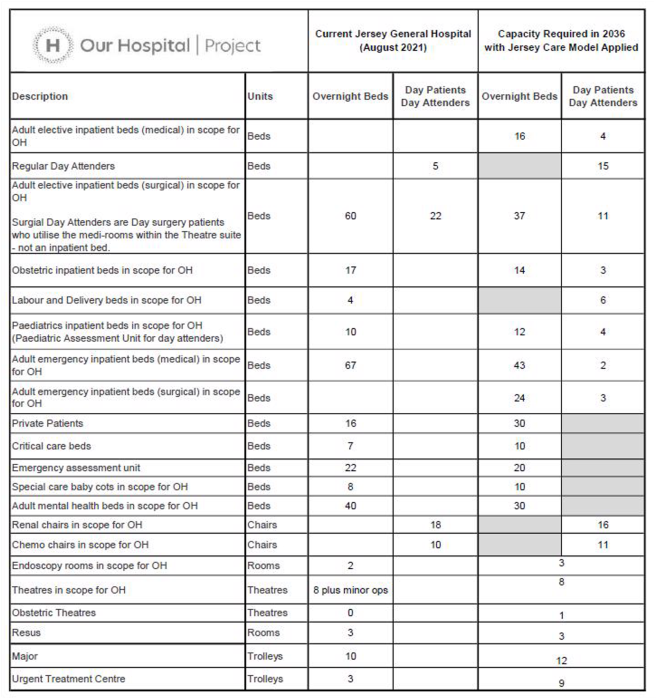

- Can you provide a comparison of the bed and theatre capacity in the plans for the new hospital with the existing bed and theatre capacity, as well as an explanation of any changes?

A comparison of bed and theatre capacity between the new hospital and existing hospital is provided in this table:

Current Jersey General Hospital Aug 2021 | New Hospital 2036 (with Jersey Care Model Applied) | ||

Overnight Beds | 251 | Overnight Beds | 246 |

Day Patients Beds | 27 | Day Patient Beds | 48 |

Theatres | 8 | Theatres | 9 |

A breakdown of the above figures is found at Appendix 2 to this letter.

- Dr Ashok Handa suggested that the infrastructure of the current Jersey General Hospital would fail in 2026, given the continued spending on the current hospital, in particular the announcement of replacement of ventilation systems, are these costs included in those ongoing costs outlined in the OBC?

Professor Handa did not suggest that the current hospital estate would fail in 2026 per se. His comment was that healthcare provision will be significantly under provided if we do not update the estate level and the clinical and operational risk by December 2026.

The hospital's estates team has implemented a tactical backlog investment plan to address the most serious and technically correctable issues, with the recognition of and reliance upon the intention to develop a new hospital. However, significant dilapidation remains and the risks to the quality of care provided become more significant as our health estate continues to deteriorate.

As noted in the response to Question 3, an update on the changes expected in Soft Facilities Management, Hard Facilities Management and utilities costs when the services are provided at the new hospital, rather than across multiple sites as they currently are, was not included in this OBC as a separate Facilities Management Business Case is currently being developed to consider options for the future delivery of these services.

Hopefully, the questions have been addressed to the Panel's satisfaction. Should you have any further queries, please do not hesitate to contact me.

Yours sincerely

Senator Lyndon Farnham

Deputy Chief Minister | Minister for Economic Development, Tourism, Sport and Culture Chair – Our Hospital Political Oversight Group

+44 (0)1534 440628 l.farnham@gov.je

Appendices

Appendix 1: Baseline costs comparison for the facility

Appendix 2: Current Jersey General Hospital bed numbers comparison with Our Hospital bed numbers

Appendix 1 – Baseline Costs comparison for the facility

Appendix 2 – Current Jersey General Hospital bed numbers comparison with Our Hospital bed numbers