The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

States Greffe

Minister for Treasury and Resources URGENT: BY EMAIL

19 May 2021

Dear Minister,

Office of C&AG: Estimates of Expenditure for Government Plan 2022-2025

I am responding to your letter of 30 April 2021 requesting estimates for expenditure of the Office of the Comptroller and Auditor General for inclusion in the Government Plan 2022-25.

I endorse the budgetary position as set out below. I note that the C&AG's Board of Governance is supportive of the budget proposals outlined and has no further comment to make.

Statutory arrangements in relation to estimates for the Office of the C&AG included in the Government Plan

Article 9 of the Comptroller and Auditor General (Jersey) Law 2014 (the 2014 Law') requires the States Assembly to ensure that the C&AG is provided with sufficient resources to discharge (her) functions. Amongst her functions is, by virtue of Article 11 of the 2014 Law, to ensure that an annual audit of the financial statements of the States is undertaken.

Article 10 of the Public Finances (Jersey) Law 2019 requires that the Government Plan lodged by the Council of Ministers must include, as the amount to be appropriated in relation to the operations of the Office, the amount submitted to the Council of Ministers by the Chairman of the Public Accounts Committee.

By virtue of Article 5 of the Comptroller and Auditor General (Board of Governance) (Jersey) Order 2015, the Board of Governance of the Comptroller and Auditor General must review any estimate the C&AG provides to the Chairman of the Public Accounts Committee for inclusion in the Government Plan.

Overall budget proposals

In overall terms, the C&AG is proposing to maintain the budgeted expenditure levels for 2022- 24 at the amounts previously approved by the then Acting Chairman of PAC and submitted to the Minister for Treasury and Resources. The previous approval of estimates are the amounts included in the Government Plan 2021-24 and the additional expenditure approved by the former Chair of PAC, referenced in a letter from the Chief Minister and your letter to the Acting Chairman of PAC dated 7 October 2020. This additional expenditure approval took place subsequent to the Government Plan 2021-24 but was referred to in a footnote on page 130 in that Plan:

The Acting Chairman of the Public Accounts Committee submitted, on 7th October 2020, a revised estimate of costs in 2021 for the Office of the Comptroller and Auditor General. At that date it was too late to accommodate the revised estimate and make the consequential changes within the Government Plan. The Minister for Treasury and Resources has given

assurance to the Acting Chairman that she will make the additional funding required available in 2021 from the General Reserve.'

The C&AG proposes a further inflationary uplift for the indicative expenditure for 2025.

The table below provides a reconciliation between the amounts included in Appendix 1 of your letter to me of 30 April 2021 and the previously agreed amounts:

| 2021 £ | 2022 £ | 2023 £ | 2024 £ | 2025 estimate £ |

Government plan 2021-24 | 870,000 | 888,000 | 910,000 | 932,000 | 932,000 |

Additional cost of the external audit of the States of Jersey due to change of auditors in 2020 | 64,000 | 60,000 | 62,000 | 63,000 | 63,000 |

Less: recharge to the Social Security Funds | (6,000) | (6,000) | (6,000) | (6,000) | (6,000) |

Plus: additional cost of auditor oversight | 15,000 | 15,000 | 16,000 | 16,000 | 16,000 |

Revised approved estimate | 943,000 | 957,000 | 982,000 | 1,005,000 |

|

2025 inflationary uplift to be approved |

|

|

|

| 25,000 |

Final revised estimates | 943,000 | 957,000 | 982,000 | 1,005,000 | 1,030,000 |

I would emphasise that the allocation of inflationary uplifts is essential in my view to the effective operation of the Office of the Comptroller and Auditor General in Jersey. The Office has significant contracts with inflationary increases built into the contracts. These include contracts for services from external auditors, key personnel and affiliates as well as other more general office related contracts.

Rebalancing – cost pressures and efficiency savings

The Office operates to an already tight budget compared to other audit offices and, as demonstrated in the comparative data provided in our Annual Report, offers significant value for money for the services provided.

The following extracts from the C&AG's draft 2020 Annual Report provide more context for you in respect of the value for money of the Jersey Audit Office compared with other audit offices:

Comparing performance with other audit offices

The C&AG has compared the performance of the JAO with other audit offices (see Exhibit 14). The group comprises seven audit offices from British Overseas Territories, Canadian provinces, Australian states and territories and an independent country, with populations ranging from 64,000 to 540,000. This is the same comparator group as used in each of our annual reports from 2017.

There are limitations in making comparisons because of differences in the responsibilities of the audit offices, their business models, prevailing costs in the economy, budgetary arrangements and applicable accounting frameworks. However, the overall message is consistent with those from previous years and remains that the cost of the JAO as a proportion of government is low and the JAO provides a significant volume of reports to the States Assembly at comparatively low cost.

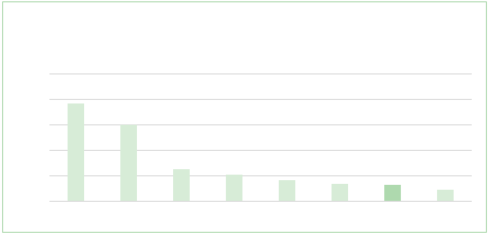

Exhibit 14: Comparison of 2020 performance with other audit offices

Exhibit 14: Comparison of 2020 performance with other audit offices

Expenditure of audit office as a proportion of expenditure of government

Expenditure of audit office as a proportion of expenditure of government

0.5% 0.4% 0.3% 0.2% 0.1% 0.0%

3 4 5 2 6 7 JAO 1

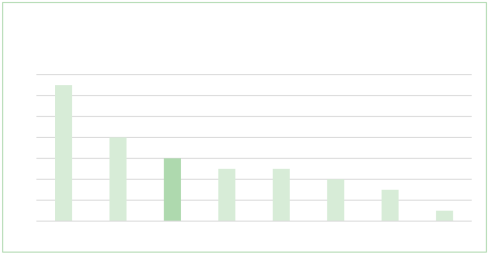

Number of reports (other than on financial

Number of reports (other than on financial

statements) issued in year

14 12 10 8 6 4

2 0

6 7 JAO 1 5 2 3 4

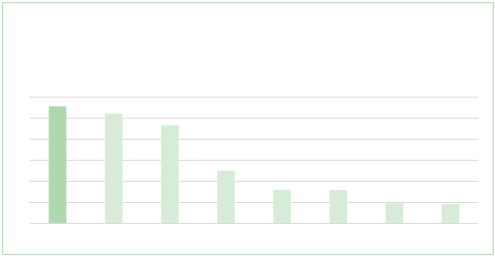

Number of reports (other than on financial statements) per 100,000 population issued

Number of reports (other than on financial statements) per 100,000 population issued

in year

6 5

4 3 2 1

0

JAO 6 3 2 4 7 1 5

Source: JAO analysis

During the Government Plan period, the Office of the Comptroller and Auditor General faces continued cost pressures. These include the following specific items:

• Hired services –the C&AG uses the services of affiliates to undertake work on her behalf. During 2020 she undertook a procurement exercise to refresh the pool of affiliates, which now offers an enhanced range of skills (such as IT and cyber skills) but at higher day rates.

• Costs of travel – the cost of each visit to the Island has increased due to a revised travel policy for the Office requiring those who travel to the Island to undertake pre- departure PCR tests. In addition, the costs of air travel and hotels have increased. The Office will continue to embrace the benefits of remote working and use of technology that we have seen during the COVID-19 pandemic as well as ensuring an appropriate presence is maintained on the Island. The C&AG has also been considering ways in which the carbon footprint of the Office can be reduced. The changes that both of these will bring to her ways of working could result in fewer flights but longer visits to the Island when visits take place. The cost of overnight hotel accommodation is often greater than the cost of a flight and this could result in an upwards cost pressure.

• Delivering effective support to the Public Accounts Committee – the PAC has set an ambitious work programme for 2021. In order to support the PAC effectively, the Office is investing more time in preparation for and attendance at PAC meetings and sub- group meetings

• Website costs – prior to 2020 it was a number of years since the Office invested in its website presence. Whilst some investment was made in 2020, there is a need for further investment in the website to make it more interactive for users and to bring it up to the standard we see in other comparable audit offices. For example, many audit offices publish short videos on their website each time they issue a report.

Despite the cost pressures I have noted above, the C&AG is not suggesting an increase in overall budgeted expenditure for the Office other than the assumption that an appropriate allocation will be made to cover general inflationary pressures in 2025 as it has been in the period 2021-24. She is confident she can make further efficiencies in the way in which her Office works through a greater use of technology. Her intention is to seek to use these efficiencies to balance off the majority of the other cost pressures outlined above.

I note there is some demand for the Office to be more proactive in the way in which it works with stakeholders to share best practice. The C&AG is not requesting additional resources at this stage for a more proactive work programme in this area, but is planning to carry out preliminary testing in 2021 to ascertain what demand there might be for a more proactive service and the potential cost implications.

Capital projects

The C&AG is not planning any capital projects during the Government Plan period.

Yours sincerely,

Deputy Inna Gardiner , Chair, Public Accounts Committee