The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

States Greffe

Deputy Ian Gorst

Minister for Treasury and Resources

BY E-MAIL

23rd October 2023

Dear Minister,

Corporate Services Scrutiny Panel Government Plan 2024-27 Review - Written Questions

The Panel is reviewing the Government Plan 2024-27 and would be grateful if you could please consider the following written questions and provide a written response by no later than 5pm on Friday 3rd November 2023 to inform the Panel’s review. Please be aware that it is the Panel’s intention to publish the response it receives on the States Assembly Website.

Income and Expenditure

![]()

- The Treasury and Exchequer is projected to have approximately £4.2 million of income earned through operations in 2024. Please could you provide detail about the source of this income?

- In a table format, if possible, please could you confirm the number of FTE (full time equivalent) roles, number of staff employed and current open vacancies as of 31st October 2023 in the following services:

- Finance Business Partners, Analytics and Management Information

- Finance Hub

- Revenue Jersey

- Assurance and Risk

- Strategic Finance

- Treasury and Investment Management

- Commercial Services

- Grants and Funds

- Corporate Costs

- Please could you provide a more detailed breakdown of the following expenditure, as detailed in the statement of comprehensive net expenditure for the Treasury and Exchequer:

- Social Benefits Payments

- Staff Costs

- Other Operating Expenses

- Impairments

- Finance Costs

Value for Money Savings

- The previous Government Plan 2023-26 identified £140,000 of value for money savings for the Treasury and Exchequer in 2023. Are you able to confirm if those savings have been made or are on track to be achieved and where savings were identified?

- The Treasury and Exchequer has targeted £517,000 of value for money savings in 2024. Please could you provide a breakdown of where the savings will be achieved?

- Our Recommendation 19 of S.R20/2022 (see below) was partially accepted, will it be actioned and, if so, how and by when?

RECOMMENDATION 19: (OVERARCHING): The Council of Ministers should undertake reporting on the impact to public services resultant of value for money savings made, with the reports being published with each Government Plan.

- Our recommendations 20 following our review of the previous Plan was rejected. It was noted in the Ministerial Response that details will be shared as part of the corporate reporting framework, can you provide this detail to the Panel?

RECOMMENDATION 20: (OVERARCHING): The Council of Ministers must ensure the monitoring process for the Value for Money Programme is included in future Government Plans to provide further transparency and accountability.

Information Technology Programme - Major Projects

![]()

![]()

![]()

- Revenue Transformation Programme (Phase 3) continues from the previous Government Plan. For this major project can you provide a breakdown of the spend to date and detail what has been achieved through the funding allocation for 2023?

- For 2024, £1,986 million has been allocated, can you provide further detail regarding how this funding will be spent and whether you are confident it will be sufficient to meet the projects aims and objectives for 2024?

- Is it the intention for Phase 3 to reach completion in 2025, considering that no further funding is allocated for 2026 and 2027?

- Revenue Transformation Programme (Phase 4) is a new major project for 2024, with a total cost estimation of £11,274 million. Can you provide a breakdown of how this funding will be spent to meet the aims of the project, whether you are confident the total will be sufficient to meet the aims and whether any concerns or risks have been identified?

- As minimal detail is provided within the Government Plan for this major project, can you provide further detail about Revenue Transformation Programme (Phase 4)?

- What will the estimated £3,230 million spend cover in 2024, can you provide a breakdown?

- What tangible impact will these two major projects have on Islanders and Island life?

Community Fund (Major Project Government Plan 2023-26)

- Can you provide a progress update on the Community Fund project for 2023 and provide detail of the work that will be undertaken in 2024?

a) What benefit, if any, has been achieved through the 2023 funding in respect to Islanders or Island life to date?

Reserve for Central Risk and Inflation

- For Reserve for Central Risk and Inflation, In the Government Plan 2023-26 an allocation of £8,1 million was estimated for 2023, can you provide a breakdown of how much of this funding has been used in 2023 and for which projects?

a) Where the funding was not fully drawn upon in 2023, how is that funding demonstrated within the Government Plan 2024-27?

- For 2024, the Government Plan 2024-27 proposes an increased allocation of £5 million compared to the estimation of £2 million for 2024 in the previous Plan, can you please provide the rationale for this change and how the amount was decided upon?

a) How confident are you that it will be sufficient to meet the project’s objectives, considering the inflation levels and continued volatility/risk in the area?

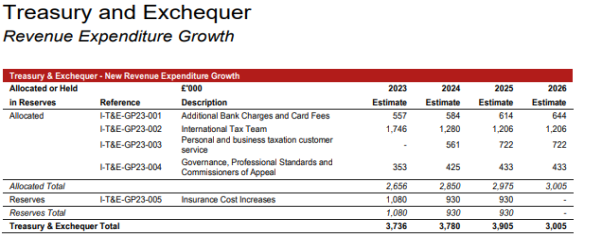

![]() Revenue Expenditure Growth – Government Plan 2024-27

Revenue Expenditure Growth – Government Plan 2024-27

![]()

![]()

Insurance Premiums

- Can you confirm whether you are confident that the £4.3 million will be sufficient to deliver the necessary requirements for 2024 and whether this will provide adequate cover to mitigate any financial impact and risk under the continuing volatile conditions?

- This is a substantial increase to the allocation estimated in the previous Plan for 2024 which covered Insurance Cost Increases (approximately £1.1 million for 2023 and £930 thousand for 2024) How was this estimate identified as an acceptable level of cover in relation to the Government’s appetite for risk for 2024?

- Can you provide detail of what services and entities the Government insures and where the highest risk is perceived?

- Where internally within the organisation risk has been identified as high, have appropriate measures been taken to mitigate these identified risks and, if so, can you provide some examples?

- Was the full amount drawn down for 2023?

- Can you provide a breakdown of how the estimated funding for 2024 will be spent?

- Do you have any concerns or anticipate any challenges in respect of this investment?

- What tangible impact will this investment have on Islanders and Island life?

- How does this investment align with the Common Strategic Policies and your Ministerial priorities?

Tax Compliance and Customer Service

- Can you confirm whether you are confident that the £1,676 million will be sufficient to deliver the necessary requirements for 2024?

- Can you provide a breakdown of how the estimated funding for 2024 will be spent and what will be delivered in 2024 as a result?

- Can you provide the rationale for the increase in estimated funding to £2,176 million for the years from 2025 through to 2027?

- Is the entire funding allocation to provide for staffing costs?

- Do you have any concerns or anticipate any challenges in respect of this investment?

- What tangible impact will this investment have on Islanders and Island life?

- How does this investment align with the Common Strategic Policies and your Ministerial priorities?

![]() Additional Revenue Programmes - Government Plan 2023-26

Additional Revenue Programmes - Government Plan 2023-26

- For the listed Additional Revenue Programmes for 2023, where estimated allocations are provided for 2024, can you confirm that these will be continued into 2024 and in line with the estimations provided for 2024?

- Please can you provide a progress update in respect of these and a breakdown of the spend to date for 2023?

- Where challenges have been identified for these to date, can you provide further detail?

Yours sincerely,

Deputy Sam Mézec

Chair

Corporate Services Scrutiny Panel