The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

19-21 Broad Street | St Helier Jersey | JE2 3RR

Deputy Sam Mézec

Chair of the Corporate Services Scrutiny Panel Morier House

St Helier

JE1 1DD

Date 6th November 2023

Corporate Services Scrutiny Panel Government Plan 2024-27 Review - Written Questions

Thank you for your letter dated 23 October 2023. As requested, please see below responses to the Panel’s queries with specific reference to my department, Treasury and Exchequer.

Income and Expenditure

- The Treasury and Exchequer is projected to have approximately £4.2 million of income earned through operations in 2024. Please could you provide detail about the source of this income?

The £4.2 million represents internal income from recharges of services to other Governmental departments and funds, including pensions administration, treasury and investment management and other central treasury administrative services.

- In a table format, if possible, please could you confirm the number of FTE (full time equivalent) roles, number of staff employed and current open vacancies as of 31st October 2023 in the following services:

- Finance Business Partners, Analytics and Management Information

- Finance Hub

- Revenue Jersey

- Assurance and Risk

- Strategic Finance

- Treasury and Investment Management

- Commercial Services

- Grants and Funds

- Corporate Costs

Please see below table detailing budgeted FTE, number of staff employed and current vacancies.

|

|

Budgeted FTE (as per 2023 Gov Plan) |

Updated FTE 2023 |

Actual FTE |

Vacant FTE |

|

Finance Business Partners, Analytics & Management Information |

59.0 |

70.00 |

58.0 |

12.0 |

|

Finance Hub |

63.5 |

65.5 |

62.9 |

2.6 |

|

Revenue Jersey |

140.5 |

149.1 |

127.6 |

21.5 |

|

Internal Audit |

6.0 |

6.0 |

4.8 |

1.2 |

|

Strategic Finance |

35.3 |

32.3 |

30.5 |

1.8 |

|

Treasury and Investment Management |

17.0 |

17.0 |

16.7 |

0.3 |

|

Commercial Services |

53.0 |

44.0 |

31.8 |

12.2 |

|

Grants and Funds |

NIL |

|

|

|

|

Corporate Costs |

NIL |

|

|

|

|

Total |

374.3 |

383.9 |

332.3 |

51.6 |

|

|

|

|

|

|

|

Assurance and Risk (excluding Internal Audit – provided above) |

17.8 |

- |

14.5 |

3.3 |

Assurance & Risk sits under the Cabinet Office in 2023 (excluding Internal Audit which sits within T&E)

The budgeted FTE has been adjusted to that detailed in the 2023 Government Plan to reflect the most accurate position, including in year growth bids, additional posts which are other government departmentally funded and the exclusion of unfunded posts. All in year growth bids that have resulted in increases to the approved FTE’s have been appropriately approved through the submission of a business case and increases in roles which are funded directly by other government departments have been appropriately approved in year by Accountable Officers and have been reflected in the 2024 Government Plan alongside those increases that are part of GP24 growth bids.

- Please could you provide a more detailed breakdown of the following expenditure, as detailed in the statement of comprehensive net expenditure for the Treasury and Exchequer.

- Social Benefits Payments

- Staff Costs

- Other Operating Expenses

- Impairments

- Finance Cost

Please see below breakdown of the statement of comprehensive net expenditure, by individual service area for 2024 estimates. The social benefits payments include the States grants to both the Social Security and Long-Term Care funds.

Please see below breakdown of the statement of comprehensive net expenditure, by individual service area for 2024 estimates. The social benefits payments include the States grants to both the Social Security and Long-Term Care funds.

|

|

Statement of Comprehensive |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||||||||||||

|

Net Expenditure |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

||||

|

|

|

FBP's, Analytic s & Manage |

|

Fina |

Reven |

Assura |

Strate |

Treasury & Investm |

Comme |

Grant |

Corpo |

|

|

||||||||||||||||||||||

2024 Estimate ment nce ue nce gic ent rcial s to rate

Informat Jerse Finan Manage Service

£'000

![]() ion Hub y & Risk ce ment s Funds Costs Total

ion Hub y & Risk ce ment s Funds Costs Total

Revenue

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]() Levied by the States of Jersey - - - - - - - - - - Earned through operations 196 2,346 214 41 35 1,182 175 - - 4,189 Total revenue 196 2,346 214 41 35 1,182 175 - - 4,189 Expenditure

Levied by the States of Jersey - - - - - - - - - - Earned through operations 196 2,346 214 41 35 1,182 175 - - 4,189 Total revenue 196 2,346 214 41 35 1,182 175 - - 4,189 Expenditure

94,92 Social benefit payments - - - - - - - 94,921 -

1 30,69

Staff costs 4,564 3,868 12,105 2,194 2,930 1,492 3,546 - -

9 17,32

Other operating expenses 82 1,490 1,119 724 529 12,955 248 - 181

8 Grants and subsidies payments - - - - - - - - - - Impairments - 5 - - - - - - - 5 Finance costs - - - - - - - - 884 884

|

Total expenditure |

4,646 |

5,363 |

13,224 |

2,918 |

3,459 |

14,447 |

3,794 |

94,921 |

1,065 |

143,8 37 |

|

|

Net revenue expenditure (near cash) |

4,450 |

3,017 |

13,010 |

2,877 |

3,424 |

13,265 |

3,619 |

94,921 |

1,065 |

139,6 48 |

|

|

Depreciation and amortisation |

- |

- |

1,400 |

- |

- |

- |

- |

- |

- |

1,400 |

|

|

Net revenue expenditure after depreciation |

4,450 |

3,017 |

14,410 |

2,877 |

3,424 |

13,265 |

3,619 |

94,921 |

1,065 |

141,0 48 |

|

Value for Money Savings

Value for Money Savings

- The previous Government Plan 2023-26 identified £140.000 of value for money savings for the Treasury and Exchequer in 2023. Are you able to confirm if those savings have been made or are on track to be achieved and where savings were identified?

A piece of work was undertaken in late 2022 / early 2023 by the departmental SLT team which identified areas of both staff (using vacancies) and non-staff spend that could be utilised recurringly to meet this allocated value for money targets.

- The Treasury and Exchequer has targeted £517.000 of value for money savings in 2024. Please could you provide a breakdown of where the savings will be achieved?

A further piece of work will be required later this year / early 2024 to identify recurring opportunities to meet the target allocated as part of the 2024 Government Plan process.

- Our Recommendation 19 of S.R20/2022 (see below) was partially accepted, will it be actioned and, if so, how and by when?

RECOMMENDATION 19: (OVERARCHING): The Council of Ministers should undertake reporting on the impact to public services resultant of value for money savings made, with the reports being published with each Government Plan

The Government previously reported on rebalancing savings and delivery in the corporate financial reporting and in the annual report. Accountable officers are responsible for ensuring that savings are delivered in their overall cash-limit as well as any potential risks to service delivery which they should include in their performance reporting.

The reporting for non-cashable gains and service improvements is being developed.

- Our recommendations 20 following our review of the previous Plan was rejected. It was noted in the Ministerial Response that details will be shared as part of the corporate reporting framework, can you provide this detail to the Panel?

RECOMMENDATION 20: (OVERARCHING): The Council of Ministers must ensure the monitoring process for the Value for Money Programme is included in future Government Plans to provide further transparency and accountability.

The recommendation was rejected as the Government Plan was not considered the appropriate vehicle for monitoring delivery of the agreed targets for the coming Government Plan period.

Information Technology Programme - Major Projects

- Revenue Transformation Programme (Phase 3) continues from the previous Government Plan. For this major project can you provide a breakdown of the spend to date and detail what has been achieved through the funding allocation for 2023?

The spend to date is £6.123 million; with total cost estimated at £9.425 million by the end of 2025. (See Table 27, page 71 of the Government Plan).

In 2023 the funding has achieved the following outcomes (–

• further preparatory work (7 system enhancements) relating to Independent taxation

• delivery of Economic Substance for Partnerships into taxation system (mandatory international requirement due in 2023)

• support for live Revenue Management system (RMS) – 54 enhancements and bug fixes. Examples here would include items such as implementing legislative changes such as High Value Residents Regime 5 and 2024 allowances and thresholds

• testing version 2 of the Revenue Management System which would include Contributions Functionality – over 230 new features tested to be implemented for project live

• online services and Continuous Improvement – amongst others these would include

- Improvements and launch of the online 2022 Personal Income Tax Return and preparing for the 2023 Personal Income Tax Return

- Functional improvements to the online “GST Return” and requirements for Overseas traders

- Launch “GST registration” online service

- Design, build and launch “Ceased trading” online service

- Design and build “Register as an Employer” online service

- Enhancements to Employer and Agents portal

- Enhancements to Personal Tax Enquiry form

- For 2024, £1.986 million has been allocated, can you provide further detail regarding how this funding will be spent and whether you are confident it will be sufficient to meet the projects aims and objectives for 2024?

The funding is based on Revenue Jersey’s Business Case and remains the Comptroller’s best estimate of what is needed to complete the third phase. It includes -

• Continued monies to support the live taxation system, RMS,

• A team of 5 subject matter experts / intelligent customer function of tax officers,

• A professional contract manager to renegotiate the supplier support contract that expires in 2024,

• Programme and project management

• A stakeholder engagement officer and budget to support implementation of change initiatives

• A team of 3 business analysts to define and test requirements and SOPs

• Support of an officer for the business governance team to provide training and data privacy

• Support to M&D to provide for technical infrastructure design and build and a dedicated systems analyst

• External security testing (combatting cyber risks)

- Is it the intention for Phase 3 to reach completion in 2025, considering that no further funding is allocated for 2026 and 2027?

Yes.

- Revenue Transformation Programme (Phase 4) is a new major project for 2024, with a total cost estimation of £11.274 million. Can you provide a breakdown of how this funding will be spent to meet the aims of the project, whether you are confident the total will be sufficient to meet the aims and whether any concerns or risks have been identified?

a) As minimal detail is provided within the Government Plan for this major project, can you provide further detail about Revenue Transformation Programme (Phase 4)?

Phase 4 of the Revenue Transformation Programme sees negotiations for renewal of 2 key revenue systems: “AEOI Man” and “RMS”.

AOEI Man (the Government system interfacing with OECD systems to facilitate exchanges of tax information globally) requires significant adaptation for 2025 onwards arising from changes in international-tax requirements agreed at the OECD (including for example, new obligations to report on “crypto-assets”). The contract with the current supplier is also undergoing re-negotiation (to be finalised early in 2024) and will begin to encompass some of the more-recent innovations in the international arena including, for example, work to implement the extension of the Economic Substance Law to partnerships and trusts and some preliminary work related to OECD “Pillars 1 and 2” (although further business cases are likely to be made in future years fully to address the needs of Pillars 1 and 2).

RMS (the Revenue Management System) is the principal system which supports administration of our domestic tax laws and collects the majority of Government income. The funding proposed in the Government Plan reflects the cost of renewing the underlying support contract (which expires in 2024) for a further period and continuing to add capabilities further to support tax administration. The investment also continues to fund annual software changes to support routine annual Budget changes, for example to tax thresholds and allowances.

Funding is based on Revenue Jersey’s Business Case and remains the Comptroller’s best estimate of what is needed to maintain progress with modernising our tax system and administration while also meeting our international obligations. The Government remains committed to funding Revenue Jersey appropriately to meet its statutory functions and to ensure that Jersey meets its international treaty commitments.

9b) What will the estimated £3.230 million spend cover in 2024, can you provide a breakdown?

For 2024, £985.000 relates to RMS maintenance and the remainder relates to AEOI Man.

- What tangible impact will these two major projects have on Islanders and Island life?

Further investments (capital and revenue) in the reform of Jersey’s tax laws and their administration (Revenue Jersey) aim to create a modern tax regime for Jersey consonant with international best practice and a tax administration which is regarded as world-class for its size and scope. This fundamentally supports Jersey’s economy; the health of our International Finance Centre; and will continue to improve customer experience for everyone in Jersey who interacts with the tax system.

We aim to improve services for taxpayers (digital and other) so that meeting their tax obligations become increasingly simple (for example through the continued development of online services and increased take-up of online filing).

An effective, fully functioning tax administration is increasingly important in maintaining the health of our economy, particularly supporting the International Finance Centre through the work Revenue Jersey undertakes to meet Jersey’s international tax-treaty obligations (for example, in respect of worldwide information exchange to counter offshore tax evasion and Economic Substance requirements).

The revitalisation of tax-compliance work over the last few years (with further investment proposed in this Plan) is equally important in helping to ensure that everyone pays their fair share of taxes due under the law, creating a level playing field for businesses and maintaining public confidence in the fairness of administration of the tax laws.

An efficient and effective tax administration assures the States Assembly that the tax revenues from existing tax statutes are being optimised.

Community Fund (Major Project Government Plan 2023-26)

- Can you provide a progress update on the Community Fund project for 2023 and provide detail of the work that will be undertaken in 2024?

a) What benefit, if any, has been achieved through the 2023 funding in respect to Islanders or Island life to date?

Funding has been removed from the Government Plan 2024-2027, and as such work on the fund has been cancelled. None of the allocation in 2023 has been spent.

Reserve for Central Risk and Inflation

- For Reserve for Central Risk and Inflation, In the Government Plan 2023-26 an allocation of £8.1 million was estimated for 2023, can you provide a breakdown of how much of this funding has been used in 2023 and for which projects?

No allocations have currently been made from the Reserve for Central Risk and Inflation. A Letter of Comfort for £1.1 million is in place for Connect and the Minister for Treasury and Resources is considering further allocations for:

- Orchard House – up to £2.0 million

- Elizabeth Castle – up to £1.6 million (this funding is to accelerate the implementation of the project and results in a reduction in spend previously planned for future years)

- Regulation Improvement to Digital Assets – up to £0.4 million

a) Where the funding was not fully drawn upon in 2023, how is that funding demonstrated within the Government Plan 2024-27?

The balance of £5 million included in Government Plan 2024-27 is predicated on funding from 2023 that is not forecast to be drawn upon being made available to finance the Reserve in 2024.

- For 2024, the Government Plan 2024-27 proposes an increased allocation of £5 million

compared to the estimation of £2 million for 2024 in the previous Plan, can you please provide the rationale for this change and how the amount was decided upon?

The Fiscal Policy Panel’s (FPP) Economic Assumptions are used to inform inflation provisions in the Government Plan. International inflationary pressures have proved more persistent than previously forecast. In its reports of March 2023 and July 2023, the FPP forecast higher rates of inflation for 2023 and 2024 than had previously been assumed in its earlier forecasts. There are range of economic risks that could again cause inflation to exceed forecasts. Accordingly, we have chosen to increase the central provision for risk and inflation, though it should be noted that the Reserve has decreased from £8.1 million in 2023 to £5 million in 2024.

a) How confident are you that it will be sufficient to meet the project’s objectives, considering the inflation levels and continued volatility/risk in the area?

There are a number of significant international pressures on prices from new and continuing geopolitical risks, to the ongoing process of adjustment to post-Brexit trade relationships and changes to complex global supply chains to increase resilience. In this context, it is inevitably difficult to forecast inflation rates with a high degree of confidence. To address the risk to the Capital and Projects Programme, departments were encouraged to rebase cost assumptions for their projects. This has necessitated increases to budgets for a number of projects, particularly those due to begin delivery in 2024. Increases to the Reserve for Central Risk and Inflation have been made alongside this rebasing work.

While it is important to ensure steps have been taken to provide for the uncertainty of the current economic climate, it is also crucial that funds are not unduly tied up when they could be put to more productive uses for the benefit of Islanders. During 2023, the forecast rate of inflation moved from 6.7% when the Government Plan 2023-26 was lodged to 10.8% in July 2023. Despite this marked increase, only £3.4 million is forecast to be drawn down from the Reserve for Central Risk and Inflation this year. Given this experience it is considered that a provision of £5 million coupled with work that has been undertaken by departments to, where possible, reflect revised prices in project budgets strikes the right balance between providing for ongoing risk to project budgets and the need to ensure funds are not unduly tied up in reserves.

Insurance Premiums

- Can you confirm whether you are confident that the £4.3 million will be sufficient to deliver the necessary requirements for 2024 and whether this will provide adequate cover to mitigate any financial impact and risk under the continuing volatile conditions?

I am as confident as I can be at this stage that this funding will be sufficient to cover the increasing costs of our insurance programme. Our two main insurance renewal dates are at the end of May and September each year and the projections are based on our 2023 experience along with advice from our insurance broker as to the state of the underlying markets. Given that the renewal dates for 2024 are after the Government Plan approval there is an obvious risk that adverse changes in market conditions may further affect the insurance premiums, but those currently unknown risks are difficult to quantify at this time.

- This is a substantial increase to the allocation estimated in the previous Plan for 2024 which covered Insurance Cost Increases (approximately £1.1 million for 2023 and £930 thousand for 2024) How was this estimate identified as an acceptable level of cover in relation to the Government’s appetite for risk for 2024?

The Government’s appetite for risk remains largely unchanged for 2024 and beyond, the increase in allocation is largely driven by the volatile market conditions that you refer to above and the impact of some significant claims that we have recently had to make against our policies.

- Can you provide detail of what services and entities the Government insures and where the highest risk is perceived?

The placement of general insurance covers “the Government of Jersey, the States of Jersey, Non- executive and Legal departments, nominated States Owned Entities and their subsidiaries & nominated Arm’s Length Organisations and their subsidiaries”. We can add other public authorities or bodies as required.

The policies cover risks pertaining to motor, property, liability, specific Ports or Jersey items, personal accident and travel, marine craft, school trips and travel and medical malpractice. Purely in terms of the length of time a claim takes to initiate and the potential for significant cost I would suggest that the highest risks could be perceived as being around medical malpractice.

- Where internally within the organisation risk has been identified as high, have appropriate measures been taken to mitigate these identified risks and, if so, can you provide some examples?

The Government’s Corporate Risk Register makes a clear distinction between risks - something that might happen that could affect the Government of Jersey’s strategic objectives and issues. Issues are risks that have materialised and are happening now. These therefore have a higher priority. Both risks and issues are reviewed regularly in terms of their performance against their existing control environment and the organisation’s identified risk appetite. These are reviewed in Departmental Risk Committee meetings at Senior Leadership Teams and the Executive Leadership Team.

Examples of issues include: an issue around insufficient capacity in children’s care settings to meet demand and complexity of need. Insufficient capacity means that children requiring care and protection may need to be supported in unregistered care settings. CYPES and wider Government has stated a low-risk appetite in this respect and this activity would be in breach of Regulation of Care law.

Areas of focus and mitigation include increasing the number of children’s homes and places; providing additional care settings such as foster care and connected care. Two additional homes have already been established in 2023 and additional foster carers are in process of recruitment.

In addition, funding requests were submitted as part of the government planning process and funding provision has been provided in the Government Plan 2024-27.

Another example is the need for further assurance around clinical governance in HCS as identified in recent reviews resulting in potential patient harm, legal action, litigation and reputational damage and an increase in Medical Malpractice claims.

In response to the Clinical Governance Report of Secondary Care (2022) by Prof Hugo Mascie- Taylor , the Minister for Health and Social Services lodged a proposal for an advisory board to oversee HCS’ operational and clinical governance performance and related improvement plans. The proposition was agreed by the States Assembly and the first meeting of the new board was held in public in October 2023. The board will also oversee the improvement plans of additional reports and audits that were undertaken by external bodies, for example, Royal College of Physicians; Comptroller and Auditor General.

An example of a high risk is around Cyber threats. The Government of Jersey’s risk appetite for a cyber-attack is described as low, which means that it does not have an appetite for the risk materialising. As such it has invested in Cyber Security Programmes over recent years, increasing resilience in a number of areas, including infrastructure and security operations. However, the threat of cyber-attacks continues to rise on a global level.

- Was the full amount drawn down for 2023?

The full amount of funding for 2023 was drawn down.

- Can you provide a breakdown of how the estimated funding for 2024 will be spent?

Almost all of the funding will be required for the increasing cost of insurance premiums that we expect to face during future years. A small element of the funding requested may be used towards implementation of the updated Insurance Strategy if required (see question 22).

- Do you have any concerns or anticipate any challenges in respect of this investment?

As I have alluded to earlier in my response, our two main insurance renewal dates are at the end of May and September each year, which presents some challenges to finalising an accurate budget given the impact that external and currently unknown factors can have on insurance markets between now and those renewal dates. Those risks may present a challenge to the additional investment being requested but I am confident, based on what I know at the present time, that the funding should be sufficient.

- What tangible impact will this investment have on Islanders and Island life?

Investment in insurance plays a fundamental role in protecting islanders against insurable risks and can be an enabler for economic development. By having a well-funded insurance programme in place Islanders can confidently go about their daily lives knowing that when they interact with Government, we have mitigated our known risks to the best of our ability. Whether that be attending a hospital appointment, sending their children to school or visiting a Heritage property as a leisure activity.

Insurance acts as a buffer against unforeseen events. It provides certainty, protection and support in unexpected circumstances and reduces Government’s potential losses and risks, particularly overcoming natural disasters that are often beyond our control.

- How does this investment align with the Common Strategic Policies and your Ministerial priorities?

In my Ministerial Priorities, I have made a commitment to review the Government’s insurance strategy. I will shortly be approving a revised strategy which will develop a Total Cost of Risk approach to support our broader risk management strategy – this is more aligned to industry standards.

As I have referenced above, having adequate insurance in place helps Islanders go about their daily lives in confidence. I could make the case that, in some way or other, the insurance programme therefore supports all seven Ministerial priorities for change.

Tax Compliance and Customer Service

- Can you confirm whether you are confident that the £1.676 million will be sufficient to deliver the necessary requirements for 2024?

Revenue Jersey continues to recruit and, as outlined by the Comptroller at the CSSP hearing in October, can face challenges in competing both domestically and internationally for people with the necessary capabilities to undertake some of its work. The 2024 funding estimate is prudent given that but you will see from the funds provided for 2025 onwards, that we anticipate fully staffing Revenue jersey for future needs in 2025. It should be noted that further funding may be needed for pay bill in future years but that is contingent upon the outcome of the international negotiations on OECD Pillars 1 and 2.

- Can you provide a breakdown of how the estimated funding for 2024 will be spent and what will be delivered in 2024 as a result?

The estimated funding for 2024 relates to pay bill: some further recruitment and maintaining existing levels of staffing in Revenue Jersey in some areas which hitherto have been temporarily funded. The 2 key priorities are 1) to keep improving customer services (where good progress is being made, as reported at the last CSSP public hearing); and continuing to revitalise Revenue Jersey’s tax-compliance activities. As you can see from my answer to Deputy Mezec’s WQ.254/2023, the revitalisation of tax-compliance work since 2016 is continuing to see additional tax revenues rise annually. With the further investment proposed in this Plan, the Comptroller of Revenue expects to produce additional tax revenues of £31.5 million annually over the period (see page 47 of the Proposed Government Plan).

- Can you provide the rationale for the increase in estimated funding to £2.176 million for the years from 2025 through to 2027?

In line with the commitments, I made in my Ministerial Priorities, I have worked with Revenue Jersey to ensure that it is appropriately resourced to meet its statutory functions and to deliver good levels of customer service to islanders. The increase funding represents both an increase in staffing but also eases existing pressures on pay bill arising from the costs of recruiting tax specialists internationally which the Comptroller has mentioned in CSSP hearings previously.

The demands on Revenue Jersey have continued to grow both to work with Ministers to reform the tax system (eg PYB abolition and Independent Taxation both of which have increased resource demands) and to implement new international-tax obligations such as Economic Substance Law and a growing network of partner jurisdictions with which we share tax information annually.

- Is the entire funding allocation to provide for staffing costs?

Yes.

- Do you have any concerns or anticipate any challenges in respect of this investment? As has been the case previously, recruitment can be difficult at both ends of the spectrum. Recruiting front-line revenue officers who serve the majority of islanders can be problematic when in competition with the International Finance Sector. That said, we continue to make good progress. International competition in recruiting higher-level tax specialists to support some of the more technically-complex work of Revenue Jersey (for example, in support of the IFC and OECD/EU negotiations) can be stiff. Revenue Jersey continues to make headway by using the services of specialised international head-hunters.

- What tangible impact will this investment have on Islanders and Island life?

Per my response to Question 10 above, further investments (capital and revenue) in the reform of Jersey’s tax laws and their administration (Revenue Jersey) aim to create a modern tax regime for Jersey consonant with international best practice and a tax administration which is regarded as world-class for its size and scope. This fundamentally supports Jersey’s economy; the health of our International Finance Centre; and will continue to improve customer experience for everyone in Jersey who interacts with the tax system.

We aim to improve services for taxpayers (digital and other) so that meeting their tax obligations become increasingly simple (for example through the continued development of online services and increased take-up of online filing).

An effective, fully functioning tax administration is increasingly important in maintaining the health of our economy, particularly supporting the International Finance Centre through the work Revenue Jersey undertakes to meet Jersey’s international tax-treaty obligations (for example, in respect of worldwide information exchange to counter offshore tax evasion and Economic Substance requirements).

The revitalisation of tax-compliance work over the last few years (with further investment proposed in this Plan) is equally important in helping to ensure that everyone pays their fair share of taxes due under the law, creating a level playing field for businesses and maintaining public confidence in the fairness of administration of the tax laws.

An efficient and effective tax administration assures the States Assembly that the tax revenues from existing tax statutes are being optimised.

- How does this investment align with the Common Strategic Policies and your Ministerial priorities?

The health of our tax system and of Revenue Jersey underpin all of the Common Strategic Priorities. Most of the income available to Government to fund the Strategic Priorities (and most public services) is collected by Revenue Jersey. The revitalisation of Revenue Jersey’s tax- compliance activities is demonstrating that additional tax revenues can be achieved from its compliance work, and it is right that Government invests in that to ensure that everyone is getting their tax affairs right and paying their fair share of taxes under the law.

My Ministerial priorities for 2023 and 2024 included ensuring that Revenue Jersey and other customer-facing parts of Treasury & Exchequer were properly equipped to serve islanders and we have discussed this at previous public hearings. I am pleased to consolidate for the longer term some of the funding which revenue jersey has previously had on a temporary basis and am satisfied that this will enable the department to maintain and further improve the services it provides to islanders.

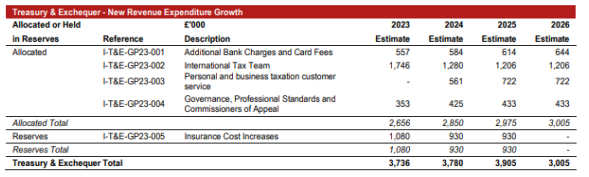

Additional Revenue Programmes Government Plan 2023-26 30.

- For the listed Additional Revenue Programmes for 2023, where estimated allocations are provided for 2024, can you confirm that these will be continued into 2024 and in line with the estimations provided for 2024?

The additional costs for the International Tax Team are to augment the existing Team with specialist officers to address the requirements imposed by the OECD in respect of their Pillars 1 & 2 initiatives. Recruitment to these posts is well underway and the posts will be required for the foreseeable future.

In respect of the personal and business taxation customer service, a Team of 13 was recruited in 2021 on temporary contracts to address the backlog of work that has accumulated. This work was originally estimated to take 3 years to complete, ending in the first quarter 2024. However, the volume of work has increased and to meet both the demand and to minimise the risk of a backlog recurring, these posts were changed to permanent.

To meet international standards, which are subject to regular Moneyval reviews, the governance posts established are required to ensure the standards are met. Moreover, the few staff employed in this area provide a service to the wider T&E Department, for example, performing the duties of Data Protection Officer for the Department. The systems used to administer the international requirements have to be continually adjusted to take account of changes made in international tax rules.

The focus of the work on professional standards has been to ensure that Revenue Jersey Staff have the knowledge to discharge their duties efficiently and effectively. However, previously training in the Jersey Tax Laws was “on the job” and lacked academic rigour. A Jersey Tax Qualification moderated by City & Guilds has been introduced with professional training provided by Highlands College. It is envisaged that there will be a requirement for training every year but the numbers taking the course will vary.

Every year there are some appeals against an assessment to tax. The supporting service of Clerk has for many years been provided by a local Law firm with general administration supported by Revenue Officers. This funding provides for the (independent) Commissioners of Appeal to be supported by a Clerk under the supervision of the Judicial Greffier and in doing so ensures that a clearer ethical wall exists for the administration of tax appeals.

For these reasons stated above, it is confirmed that the allocations will be required in 2024 and beyond and remain in line with the original estimations.

- Please can you provide a progress update in respect of these and a breakdown of the spend to date for 2023?

|

|

Spend to date £ |

Progress Update |

|

Additional Bank Charges and Card Fees |

557.000 |

Fully spent |

|

International Tax Team |

45.000 |

3 new members of staff have been recruited in what has proved to be a very challenging market, with significant competition from other jurisdictions. Work has been ongoing in identifying and preparing for the changes in international tax. |

|

Personal and business taxation customer service |

Commences in 2024 |

The work of this Team has continued throughout the year and is now part of the routine business of Revenue Jersey. The original funding from 2021 ends at the end of the 1st Quarter 2024. |

|

Governance, Professional Standards and Commissioners of Appeal |

236.000 |

The Governance Officers and money allocated is spent. The amount drawn down by the Commissioners of Appeal is variable, depending on the number and complexity of the cases appealed. |

- Where challenges have been identified for these to date, can you provide further detail?

Recruitment for the International Team has been challenging due to the small number of appropriately qualified and experienced people available and very strong competition for their services internationally (from other jurisdictions and the private sector).

The volume of work is placing a considerable amount of pressure on the Personal and Business Taxation Teams. This is anticipated to increase further with the introduction of Independent Taxation for couples, which is expected to increase the number of returns to process by up to approximately 15.000.

Yours sincerely

Deputy Ian Gorst

Minister - Treasury and Resources

D +44 (0)1534 447321 E i.gorst@gov.je