The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

19-21 Broad Street | St Helier Jersey | JE2 3RR

Deputy Sam Mézec

Chair of the Corporate Services Scrutiny Panel Morier House

St Helier

JE1 1DD

Date 21 November 2023

Corporate Services Scrutiny Panel

Government Plan 2024-27 Review Hearing – Further Information Requests

Dear Chair,

Thank you for your letter dated the 14 November 2023. As requested, please see below responses to the Panel’s queries with specific reference to my department, Treasury and Exchequer.

Current data and trends regarding mortgage pressures being felt by Islanders from Government's discussions with the banks:

See below.

Current number of Islanders being impacted by mortgage pressures:

Discussions with mortgage lenders suggest that the majority of residential mortgages are on fixed rate products that pre-date the rise in interest rates. This has been confirmed by Statistics Jersey in their Household Spending Report, 2021/2022 which shows that 73% of residential mortgages were on long-term fixed rate products.

Additionally, discussions with mortgage lenders also suggest that few mortgage holders are in arrears and mortgage lenders have reassured Ministers that they are proactively working with mortgage holders at risk of arrears.

Data that influenced deciding against halting the phased removal of mortgage interest tax relief:

It remains the Government’s view – supported by OECD research – that mortgage interest tax relief fosters inflation in the housing market.

It also runs contrary to equitable treatment of the tax system between renters and owners. It is not right to provide a relief which would be targeted only at homeowners. The Government’s policy is to support Islanders by increasing the personal tax thresholds, which apply regardless of whether a person owns their own home or rents.

Data demonstrating the shift to electric vehicle purchases in 2023 as a result of the increases to vehicle emissions duties across all bands:

Data for 2023 will be finalised after the year’s end. However, trends since the introduction of VED in 2010 to 2022 suggest that the consumer shift to electric vehicles will continue to respond positively to vehicle emissions duty (VED).

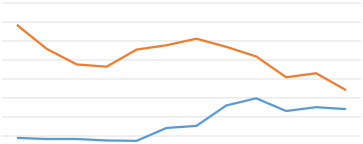

For example, VED registrations of vehicles with internal combustion engines have declined by 6.1% annually on average since the introduction of VED (Figure 1) while VED revenues have increased by 10.1% per year (corresponding to an average annual increase in duty per vehicle of 17.3%). Revenues now appear to have peaked as the shift toward the electrification of transportation in Jersey has accelerated.

Figure 1: VED receipts versus registrations

8,000 7,000

8,000 7,000

6,000 5,000

4,000 3,000

2,000 '£000 1, & no. 000registration

- ![]()

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022 Year

![]()

![]() VED receipts VED registrations

VED receipts VED registrations

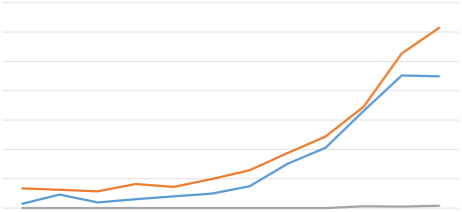

Over the same period, electric vehicle registrations have increased by 23% annually and hybrid petrol vehicles have increased by 22% (Figure 2).

Figure 2: Electric vehicle registrations

700

700

616 600 527

500 452 449 400 333426

300 244

188 206

200 129 151 100 67 4662 57 3802 4702 4999

74

104 0 109 0 0 0 0 0 0 6 5 8 0

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

![]()

![]()

![]() TOTAL ELECTRIC TOTAL PETROL HYBRID TOTAL DIESEL HYBRID

TOTAL ELECTRIC TOTAL PETROL HYBRID TOTAL DIESEL HYBRID

Determining the causal relationship between rising VED and the electric car shift is complicated by several price and income factors, most importantly that both the absolute price of electric vehicles and their relative price compared to internal combustion engine vehicles have declined, increasing demand.

However, a strong indicator that the effect is causal is that, despite constant or declining oil prices over the same period (depending on the starting point picked in the volatile 2010-2011 years) there has been an overwhelming shift toward smaller engine sizes and more fuel efficient vehicles registered in Jersey.

VED registrations (CO2) 2011-2022

3000 2500 2000 1500 1000 500 0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

![]()

![]() 0g-50g

0g-50g ![]() 51g-75g 76g-100g

51g-75g 76g-100g ![]() 101g-125g

101g-125g

![]()

![]() 126g-150g

126g-150g ![]() 151g-175g 176g-200g

151g-175g 176g-200g ![]() 201g or more

201g or more

VED registrations (CC) 2011-2022

4000 3500 3000 2500 2000

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1500 1000 500 0

2011 2012 2013 2014 2015 2016 2017 2018 2019 2020 2021 2022

![]()

![]()

![]() 0-500cc

0-500cc ![]() 501-1400cc 1401-1800cc 1801-2000cc

501-1400cc 1401-1800cc 1801-2000cc

![]()

![]()

![]() 2001-2500cc

2001-2500cc![]() 2501-3000cc 3001-3500cc Over 3500

2501-3000cc 3001-3500cc Over 3500

Further detail on VED revenue is publicly available on Statistic Jersey’s website and in the Government of Jersey’s annual accounts.

A breakdown of the revenue expenditure (how 2023 funds have been spent) in 2023 for the Healthcare Facilities:

As of 31 October, £34.3m has been spent on the Healthcare Facilities project, with a forecast to spend £45m of total £51.5m full year budget, by year end. A breakdown of expenditure to 31 October is provided below

New Healthcare Facilities Oct YTD 2023 Full Year

New Healthcare Facilities Oct YTD 2023 Full Year

2023 2023 Actuals vs 2023 £m Actuals Budget Budget Budget Project Team 0.9 1.0 -0.2 1.3 Professional and Specialist Fees 6.9 13.5 -6.6 16.2 Governance and Scrutiny 0.0 0.0 0.0 0.0 Contingency 0.0 1.5 -1.5 1.8 Total GOJ Team expenditure 7.8 16.0 -8.3 19.3 ![]()

![]()

![]()

![]() Direct Delivery Partner inc PCSA 3.1 0.0 3.1 0.0 Direct Delivery Partner Decant LQS 6.8 11.8 -5.1 12.5 Site Acquisition, Stamp Duty Fees and Planning 16.7 15.8 0.9 16.0 Client Contingency and Optimism Bias 0.0 2.3 -2.3 3.8

Direct Delivery Partner inc PCSA 3.1 0.0 3.1 0.0 Direct Delivery Partner Decant LQS 6.8 11.8 -5.1 12.5 Site Acquisition, Stamp Duty Fees and Planning 16.7 15.8 0.9 16.0 Client Contingency and Optimism Bias 0.0 2.3 -2.3 3.8 ![]()

![]()

![]()

![]() Total Construction and Associated expenditure 26.6 29.8 -3.3 32.3

Total Construction and Associated expenditure 26.6 29.8 -3.3 32.3

|

Total OHP Project expenditure |

34.3 |

45.9 |

-11.5 |

51.5 |

A breakdown of unspent reserves for 2023 and how any unspent reserves will be used in 2024:

As of 31 October, there are three reserves held in the Government Plan, the table below breaks down the current reserves position reported at the end of October.

Centrally Revenue

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]()

![]() General Held Reserves Capital £’000 Reserve Items Total Reserve

General Held Reserves Capital £’000 Reserve Items Total Reserve ![]()

![]()

![]()

![]() Government Plan Budget 16,737 43,506 60,243 8,100 End of Year Carry Forward 49,614 5,433 55,047 1,900 Total Budget 66,351 48,939 115,290 10,000 Allocations (24,544) (41,635) (66,179) - Unallocated Budget 41,807 7,304 49,111 10,000 Committed – Letters of

Government Plan Budget 16,737 43,506 60,243 8,100 End of Year Carry Forward 49,614 5,433 55,047 1,900 Total Budget 66,351 48,939 115,290 10,000 Allocations (24,544) (41,635) (66,179) - Unallocated Budget 41,807 7,304 49,111 10,000 Committed – Letters of

(4,361) - (4,361) (1,120) Comfort

![]()

![]()

![]()

![]() Committed – Ring Fenced (24,432) (6,960) (31,392) (3,000) Available Budget

Committed – Ring Fenced (24,432) (6,960) (31,392) (3,000) Available Budget ![]() 13,014

13,014 ![]() 344

344 ![]() 13,358

13,358 ![]() 5,880

5,880

After considering committed reserves including ringfenced budgets (for Assisted Home Ownership and other specific items), as well as letters of comfort, there remains £13m available revenue reserves budget and £6m capital reserves budget (central risk and inflation reserve).

As the position changes closer to year end, it is likely that unspent reserve budgets will be required to cover known overspends within Health and Community Services of up to £29 million.

Yours sincerely

Deputy Ian Gorst

Minister - Treasury and Resources

D +44 (0)1534 447321 E i.gorst@gov.je

o

o