The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

Deputy Helen Miles

Chair, Corporate Services Scrutiny Panel By email

25th October 2024

Dear Deputy Miles ,

Thank you for your letter regarding the proposed Budget 2025-2028. The answers to your 38 questions are provided below.

- Why has the Revenue Head of Expenditure for the Chief Minister been separated to include Cabinet Office, Digital Services, and People Services in the Proposed Budget 2025-28, and what impact does this have?

The revenue heads of expenditure have been split out for the purposes of transparency. They show, for the benefit of Members and the public, the amounts spent on each of these different areas (the Cabinet Office, Digital Services, and People Services).

At a practical day-to-day level, these budgets are managed individually by budget holders within each Head of Expenditure, so splitting them out in the 2025 Budget does not have a material impact, it simply shows them separately.

That said, it will mean that monies allocated to any one of these Heads of Expenditure can only be spent within the Head of Expenditure, unless there is a public Ministerial Decision from the Treasury Minister transferring budget. That ensures transparency around the use of these budgets.

- Are you confident that the 2025 departmental allocations for Cabinet Office, and Digital Services, and People Services are sufficient to deliver key services and policy? If not, why?

The Council of Ministers is focused on delivering the Common Strategic Policy, while curbing the growth of the public sector. To ensure that the Government operates within a prudent and balanced budget, savings were identified from non-frontline functions, including the Cabinet Office.

After careful consideration of the impact, the Council of Ministers is satisfied that the resources provided will be sufficient to deliver the essential services and policies across the three Heads of Expenditure. This requires a process of prioritisation that includes removing unfunded and aspirational projects in these areas.

The Cabinet Office savings will be met through a combination of vacancy management, reductions in the use of consultants and an external recruitment freeze. Such savings will result in the Cabinet Office being able to focus on doing fewer things, better. For example, the legislative programme will be resized to a realistic level; the 115 potential Laws and Regulations on the initial long list will be prioritised to focus on the number that can actually be delivered. Once finalised, this list can be shared with the Scrutiny Panel and will be published as part of the Cabinet Office Departmental Plan.

Digital Services is working with Departments to define the core services and provide defined Service Level Agreements to ensure the focus is on essential needs. This process of prioritisation has already sought to reduce the number of digital projects from a long list of 343 to approximately 100.

In terms of People Services, there has been significant work undertaken to right size the departmental headcount, so that the team can now focus on the delivery of recruitment and vacancy management, as well as getting the basics right. Resources have been focused on understanding the candidate experience and designing effective resourcing campaigns.

- What funding pressures are faced by services under your remit, and how are these addressed in the Proposed Budget 2025-28?

In general, funding pressures arise from a disconnect between the resources provided and the services expected. In devising the draft Budget 2025-28, the Council of Ministers reviewed the Corporate Risk Register and the Community Risk Register to ensure that Tier 1 risks would still be addressed proportionately. For example, cyber security was identified as a risk and resulted in investment continuing as agreed in the previous Government planning cycle.

However, the main driver of funding pressures within the Cabinet Office has been identified as the proliferation of unfunded projects. The remaining funding pressures will be reduced by setting realistic and transparent expectations of our services, including publishing the legislative programme and statistical outputs in advance.

- Are Cabinet Office, Digital Services, or People Services experiencing resourcing or staffing challenges, and how might these affect project delivery? What steps are being taken to alleviate these pressures?

There are no significant resourcing or staffing challenges that would hamper the revised expectations of project delivery in each Head of Expenditure area. As noted above, it is a case of focusing delivery on the hpriority projects only.

- Can you provide details on the projected income earned through operations for 2025 for Cabinet Office (£380k), Digital Services (£1,778k), and People Services (£6,063k)?

Cabinet Office | £'000 |

|

Jersey Care Commission | £379 | Fees from healthcare professionals, regulated activities, individuals, and premises. |

Safeguarding Partnership Board | £1 | Training recharges |

Total | £380 |

|

People Services | £6,063 | Property rental income within Key Worker Accommodation, alongside some minor internal staff recharges |

Digital Services | £1,778 | Internal recharging of departmental specific technology licensing and TETRA mobile radio services (a mixture of both internal and external), alongside recharges for the primary care system to GP's & Clinicians |

- Could you provide, in table format, the number of staff employed and open vacancies as of 30th September 2024 for:

Cabinet Office | Actual FTEs | Vacancies |

Care Commission | 18.3 | 1 |

Charities Commission | 1.68 | 0 |

Children's Commissioner | 6.68 | 2 |

Communications | 28.2 | 0 |

Governance and Assurance | 12.2 | 2.8 |

Housing, Environment and Placemaking | 15.7 | 1 |

Ministerial Office and FOI | 29.8 | 1 |

Public Health | 48.82 | 11.5 |

Public Policy | 35 | 3 |

Safeguarding Partnership Board | 8.6 | 0.6 |

Statistics and Analytics | 17.5 | 4 |

Total | 222.48 | 28.12 |

*There are no Government of Jersey employees working for the Advice and Conciliation Services (JACS).

- What is the rationale for the reduction of 8.0 FTE roles in 2025 for the Cabinet Office, where is this occurring and what impact will this have on employees and service delivery?

Savings proposals include £15 million to be delivered through reduction in roles by removing management layers, extraneous activity and a reduction in consultancy spend. The £15 million target has been allocated to departments based on the proportion of staff employed on a civil servant contract at grade 11 and above, the allocation seeks to protect frontline services.

The 8.0 FTE for the Cabinet Office reflects the anticipated reduction in roles required to meet the department's share of the £15 million targets which total £893k in 2025. This will be achieved through a combination of vacancy management and reduction in the use of consultants. The impact on employees and service delivery will be mitigated through the prioritisation of services.

- Could you provide a detailed breakdown of Cabinet Office expenditures for:

- Staff Costs

- Other Operating Expenses

- Grants and Subsidies Payments

2025 Estimate | |||

£'000 | Staff Costs | Other operating expenses | Grants and subsidies payments |

Ministerial Office & FOI | 2,525 | 897 | - |

Public Policy | 3,720 | 869 | 33 |

Housing, Environment and Placemaking | 2,316 | 290 | - |

Executive and Governance | 531 | 24 | - |

Communications | 2,399 | (33) | - |

Statistics and Analytics | 1,789 | 127 | - |

Public Health | 5,004 | 1,779 | - |

Safeguarding Partnership | 647 | 138 | - |

Care Commission | 1,677 | 469 | - |

Children's Commissioner | 708 | 272 | - |

Charities Commission | - | - | - |

Advice & Conciliation Services | - | - | 473 |

Total | 21,316 | 4,832 | 506 |

- Could you confirm the number of staff employed and open vacancies as of 30th September 2024 for Digital Services?

![]() ]

]

Actual FTEs Open Vacancies

Digital Services 194.9 1

- What is the rationale for the 6.0 FTE role reduction in 2025 for Digital Services, where is this occurring and what impact will this have on employees and service delivery?

The rationale was an apportionment of the overall savings target required from Cabinet Office. In the proposed Budget 2025-2028 the target is to save six full-time equivalent roles in Digital Services in 2025. No specific roles are identified in relation to this reduction as the preference is to achieve the target through natural staff turnover. To meet the overall revenue budget targets, other savings are expected to come from reductions in consultancy spend and a review of non-staff budgets, and to remove unnecessary systems that are high cost.

- Could you provide a detailed breakdown of Digital Services expenditures for:

- Staff Costs

- Other Operating Expenses

2025 Estimate (£'000) | Staff Costs |

|

Digital Services | 19,282 | 22,286 |

- Could you confirm the number of staff employed and open vacancies as of 30th September 2024 for People Services?

|

| Actual FTE' | Vacancies |

People Services | 156.5 | 4.8 | |

- What is the rationale for the 3.0 FTE role reduction in 2025 for People Services, where this is occurring and what impact will this have on employees and service delivery?

The role reduction for 3.0 FTE, reflects the anticipated reduction in roles to meet the share of the £15 million targets allocated to People Services, totalling £243k in 2025. Resources are being reprioritised to support departments to deliver the CSP priorities and savings. We have re-allocated resource into recruitment, talent management and the management of vacancies across Government. There should be no negative impact on service delivery.

- Could you provide a detailed breakdown of People Services expenditures for:

- Staff Costs

- Other Operating Expenses

2025 Estimate (£'000) | Staff Costs | Other operating expenses |

People Services | 11,520 | 8,650 |

- Can you provide a detailed breakdown of the £1.539 million allocated to the Corporate Portfolio Management Office and Risk, which falls under the Department for Treasury and Exchequer but maps to the Chief Minister?

2025 Estimate (£'000) | Staff Costs | Other operating expenses |

Corporate Portfolio Management Office | 719 | 502 |

Risk Management | 318 | - |

Total | 1,037 | 502 |

- Can you provide an update on the spend of the additional £48 million revenue expenditure growth funding allocated for 2024 in the Government Plan 2024-27, and how any unspent funds are accounted for in the 2025 Budget?

The proposed Budget 2025-2028 includes a £3.1 million reduction to the £51 million of revenue growth funding that was ultimately approved in the previous Government Plan. Departments are currently forecasting to spend £46 million against growth items by the year end. Underspends (after taking into account growth reductions) will be considered as part of the year end process depending on total actual spend against budgets across all departments.

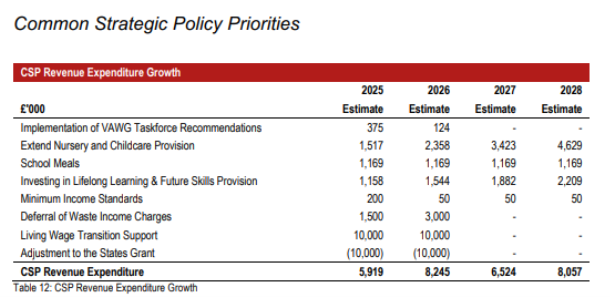

- For 2025, approximately £38 million in revenue expenditure growth has been allocated, primarily aligned to Common Strategic Policy priorities. Can you explain the rationale for prioritising areas such as Health and Community Services (£30.5 million) and non-ministerial and States Bodies (£2.2 million), and what effects this has on other departments or services?

The Budget 2025-2028 has prioritised funding for healthcare deficits to maintain healthcare services to Islanders.

Health and Community Services have forecast a deficit of £24-29 million in 2024, driven by several factors including activity increases in high-cost, low- volume services and treatments, pressures in tertiary care and non-pay inflation in excess of budgets.

With respect to non-Ministerial Departments, estimates are not put forward by the Council of Ministers. The Council of Ministers must insert in the Budget whatever estimates are provided by the non-Ministerial Departments (see response to Question 18, below).

- What oversight have you had over the non-ministerial revenue expenditure growth allocations, and are you satisfied with their necessity as outlined in the Proposed Budget for 2025?

Under article 10 of the Public Finances (Jersey) Law, the Council of Ministers must include budget submissions from non-ministerial bodies in the Government Plan. These were submitted and discussed at Council of Ministers workshops during the development of the Budget, alongside business cases received for additional budget requests.

As part of the development of the Budget, the Treasury and Resources Minister wrote to all non-ministerial bodies informing them that there would be no revenue growth process for departments outside of the Common Strategic Policy objectives. As part of this process non-ministerial bodies were requested to contribute to savings targets and identified £0.5 million of savings to deliver in 2025.

a) Have you met with the Accountable Officers to discuss the rationale for revenue growth allocations for non-ministerial and states bodies?

Communication with non-ministerial bodies was via letter and through their Head of Finance Business partnering. Business cases were provided to the Council of Ministers and reviewed as part of the budget workshops; no face- to-face meetings took place.

- Can you provide a list of Revenue Growth bids presented to the Council of Ministers for the Proposed Budget 2025 that were not successful?

During the development of the Common Strategic Policy, the Council of Ministers agreed their priorities and their approach to curb the growth in the public sector and reprioritise budgets. Accordingly, Ministers agreed not to run an open bidding process for revenue expenditure growth items during the development of the Budget. Specific revenue growth funding was only considered where necessary to meet CSP objectives.

This means there will be a greater focus on the prioritisation of existing budgets to deliver Ministers' objectives and meet any pressures. Focusing efforts on spending existing budgets well, rather than on developing proposals that would drive further growth in the cost of the public service.

- Was the £10 million in value for money savings identified in the Government Plan 2024-27 achieved or on track to be achieved in 2024, and where were these savings made?

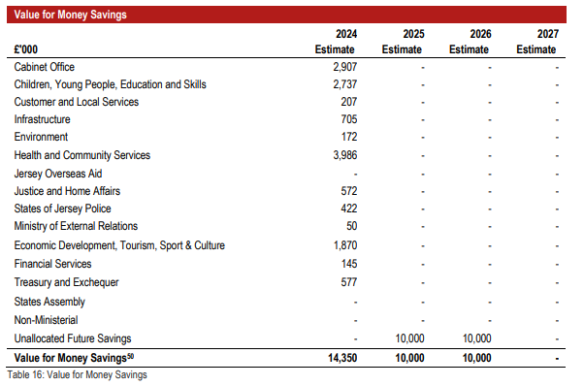

Savings targets were allocated to departments in line with the agreed Government Plan, thus reducing department budgets accordingly. (Refer to Table 16 of the 2024 Government Plan). Budgets have been reduced and Accountable Officers are required to deliver within these reduced limits – i.e. delivering the savings. The actual target was increased to £14.3 million following amendments to the proposed plan.

As at the end of August, departments had achieved savings of £9.6 million. The balance of savings will need to be delivered before the end of the year. As budgets have been reduced, any shortfall would need to be met from within the departmental budget.

As at the end of August, departments had achieved savings of £9.6 million. The balance of savings will need to be delivered before the end of the year. As budgets have been reduced, any shortfall would need to be met from within the departmental budget.

What has been done to deliver savings and curb public expenditure?

Department Chief Officers, working with their respective Ministers, are responsible for ensuring they have a plan in place to deliver the savings agreed. As an indication of the themes that have been agreed across all Departments, they are:

o Reprioritised growth budgets, thus reducing commencement of too many new initiatives,

o Reducing reliance on consultants and other third-party labour (interims and agency staff) and thus curbing spends on this relatively expensive resource,

o Staff vacancy freeze from August this year until March 2025. A new approval process has been introduced so that front-line posts may still be appointed to where necessary.

o Departments are assessing what activities they need to undertake to align with agreed corporate priorities and key services while avoiding extraneous or unnecessary tasks and activities.

What is the current position in respect of savings delivery?

Please see answer above.

- Can you provide an update on the thematic and best value reviews established in 2023, and their progress in assisting departments with achieving the Value for Money targets for 2024?

There has been a change in Government since the reviews were established in 2023. The new Council of Ministers has instigated a change of emphasis in the delivery of savings towards practical and deliverable initiatives that will curb public expenditure. There also remains a strong focus on delivering the savings previously approved for 2024.

The thematic reviews have informed actions taken in year (2024) and in those set out in the proposed Budget. The overarching theme has been to address the question of right-sizing Government, which has informed the following:

• Reduction in Growth budgets and new initiatives – reprioritised to release capacity and budget.

• Capital programme deliverability – in recent years departmental spend has lagged behind the available budget, due to both internal and external

challenges such as only having finite resources to manage numerous projects simultaneously, or the capacity of the local construction industry. Since taking office earlier in 2024, the Council of Ministers has recognised these limitations and sought to reprioritise and reprofile projects in the current year and in the considerations for the proposed Budget for 2025- 28. While there is further work to do on the longer-term capital plan, the Budget proposal makes significant strides towards a more manageable and fully deliverable programme.

• Use of Consultants and contractors – as previously stated to the Panel and publicly, the Government is committed to reducing the reliance on consultants and third-party labour, such as agency and interims. The aforementioned actions will make a significant contribution in reducing the need to draw on external consultants and third-party support. However, there will be times when it is necessary to draw on specific external expertise and knowledge, although these should be more exceptional than has perhaps become the case recently.

• Vacancy Management – departments have been carrying a number of vacancies, often for some time, which has served to deliver an amount of savings on an annual basis. However, savings are required on a recurrent basis. Senior managers have been asked to commit to more sustainable resourcing and pay budgets. Vacancies over six months old have been removed from Connect People, thus removing this annual budget- balancing process.

• Focus on removing extraneous activity – in order to curb public expenditure and prioritise resources, Departments, in discussion with their Ministers, have been asked to cease unnecessary activities and consider what are reasonable delivery timeframes for lower priority tasks. They have used a framework (referred to as the MoSCoW' approach) which facilities consideration of "What we Must do, Should do, Could do and Won't do" and then to assess the implications of deprioritising or stopping such activities.

• Health & Community Services – the 2024 Government Plan recognised the ongoing challenges in HCS with additional deficit funding. A team has been in place to deliver the Financial Recovery Plan for health and this continues to be an area of focus. Ensuring that that there is a clear understanding of cost drivers and a plan to bring the department's budget under control across all categories of spend and income. In the current recovery plan, there has been focus on high value contracts, areas of volatile spend as well as workforce (e.g. recruitment and resource planning to reduce use of agency and locums).

- What challenges have been identified in meeting the Value for Money targets for 2024?

- Price inflation - through periods of relatively higher inflation there can be cost pressure challenges. Price pressures are not necessarily experienced across the board but may be more challenging in certain sectors or products. Global supply and demand may also exacerbate price pressures.

- Changing circumstances - impacting the original assumptions which underpinned assumptions.

- Project/initiative slippage – delays can occur for a number of reasons including but not limited to: resources, competing priorities, stakeholder buy-in and support.

Savings Proposals 2025

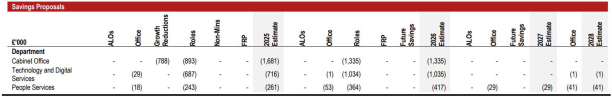

- Can you provide further detail on where the savings will be achieved (from which sections and how) in respect of the Cabinet Office, Digital Services and People Services for 2025?

Digital Services

To meet the overall revenue targets, Digital Services are reviewing non-staff budgets with a goal to remove unnecessary systems that are high cost.

People Services

People Services has reduced its reliance on consultants, reviewed the priorities to align with the CSP and reorganised to be more operationally focused. Savings will be made via vacancy management and by talent management and career development within People Services.

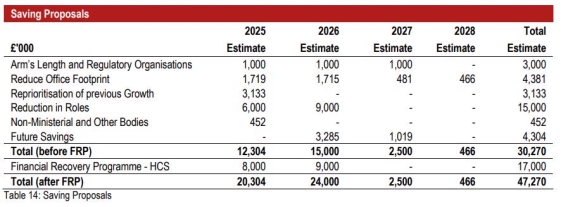

- Can you provide a breakdown for how the tabled saving proposals for 2025 will be achieved and the impact they will have?

Please see the response to Written Question 322/2024, answered by the Treasury Minister, which outlines how the saving proposed for 2025.

- What specific criteria will be used in the review of Arm's Length Organisations to achieve the targeted £1 million in savings, and how will these savings be realised?

This £1m of savings has been allocated to the Department for the Economy and then allocated pro-rata to the Minister for Sustainable Economic Development (MSED) and the Minister for External Relations (MER). The pro-rata sums were determined by reference to the current year grants paid across a number of non-regulatory arms length organisations under each Minister.

It has been agreed that MER will reduce the grant funding available to Jersey Finance Limited from 2025 onwards by £429,000, this representing the MER share of the £1m savings.

The MSED will seek £571,000 of savings through a rationalisation of activities conducted by Jersey Business Limited and Digital Jersey Limited. The Minister will also continue to challenge grant funding across his wider portfolio to ensure prioritisation of activity and value for money.

- What are the expected long-term financial benefits of consolidating office space, and how will the savings be phased over the coming years?

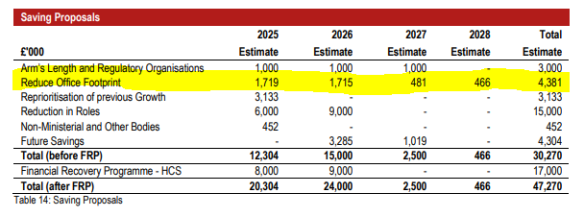

Benefits include reducing on-going revenue costs, namely estate running costs. Lease costs will be released over a number of years. The savings profile can be found on page 47 of the Budget, as below:

- How will the remaining £4 million in future savings be allocated, and what criteria will be used to determine where these savings will come from?

The remaining £4 million of savings will be allocated in the next proposed Budget and will be determined based upon the financial envelope and resources available. The Council of Ministers considered that these savings will be achievable given the size of overall expenditure budgets of £1.2 billion.

Capital Programme

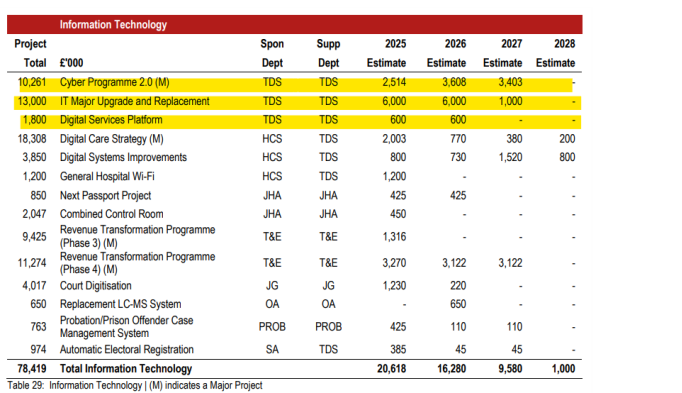

- What criteria were used to prioritise the 2025–2028 IT projects, and how will their success be measured in terms of technical performance and public service impact?

The IT dependent change projects listed above were prioritised by departmental needs as part of the Budget planning process.

- What risks are associated with delays in delivering Major IT projects?

Delaying the delivery of Major IT projects will ultimately result in not achieving the outcomes listed in the business cases for each project. These outcomes may include the mitigation of risks and contribute to delays in delivery of activities aligned to the Corporate Strategic Priorities.

- Can you provide an update on the 2024 spend and progress for:

• Cyber Programme 2.0 (£1.096 million)

- Improvements to IT General Controls (ITGC) around core financial systems.

- Configuration Management System implementation with early scope to cover secure operations for the new government HQ.

- Identity Management analysis for end-to-end improvement of all identity related systems and processes for delivery 2025-2026

- Programme roadmap planning and design work in preparation for execution 2025-2027.

- Establishing Programme Governance

• Digital Services Platform (£808k)

This funding has been used to:

- Develop the Customer and Appointment Management feature that will be used to support citizen booking appointments at the Government building in Union Street

- Knowledge transfer to GoJ Development team

- Digital Registration Card Enhancements

- Enhancements to:

Service Catalogue

Infrastructure & Security

Customer Dashboards

- Will there be underspends, and how are they accounted for in the 2025 budget?

Digital Services Platform

The Digital Services Platform programme is forecasting to meet budget in full (forecast 30 September).

Cyber Programme 2.0

The Cyber Programme 2.0 is forecasting an underspend of £129k (forecast 30 September) due to a delay in onboarding external service providers, A request for an end of year flexibility to allow the budget to be carried forward, into the period it is required to be spent, will be made.

- How will the £2.154 million be allotted in 2025 and do you believe the allocation is sufficient to meet the aims of the project 2024. What challenges, if any, have been identified for delivering on the aims this project in 2025 within the estimated allocation?

Funding is to be allocated across these workstreams:

• Operational security enhancements

• Asset and Configuration Management improvements

• Identity and Access Management improvements

• Information Lifecycle Management improvements

The £2.154 million allocation is sufficient to meet the 2025 aims of the programme.

- What specific geopolitical risks are driving investment in Cyber Programme 2.0, and how does the resource allocation address emerging cybersecurity threats?

It is widely recognised that the risk of cyber attacks has been increasing against individuals, businesses and governments globally as digital technology and expertise develop. The risks for cyber attacks are by nature very broad and unpredictable and the Cyber Programme 2.0 is enabling the Government to increase the measures in place to provide protection to public services

Digital Services Platform

- This was a new Major Project in 2024, which built on prior investments in service digitisation. This is not a Major Project in this Budget, and the funding allocation has been significantly reduced (halved) within this Budget for 2025 (£600,000) as opposed to the estimate that was allocated for 2025 within the GP 24-27 (£1,289 million), can you provide the rationale for this significant reduction in funds and the impact thereof?

The rationale was part of a wider review of digital project investment across the Government as part of the Budget planning process. The priority was to invest in IT infrastructure that requires important maintenance, upgrades and replacements to protect front line services..

As context, the Digital Services Platform (DSP) is part of the Digital Government Platform (DGP) now in development and is managed by the related DGP programme with a goal to provide citizens with access to the new platform in Q1 of 2025 and continue to increase the services and available functionality in line with the objectives and goals of the CLS Transform Project.

- What changes were made in the re-scoping of the Digital Services Platform project, and how will this new focus impact other Government systems?

As part of re-scoping activity, the team moved to focus its scope on only the delivery of the Customer and Local Services (CLS) Transform programme. This means reducing the items on the roadmap to what is needed to ensure CLS Transform is successful and focus on ensuring the implementation partner can utilise the platform.

- How will the Digital Services Platform integrate with existing systems, and what benefits are anticipated from its completion?

The Digital Government Platform is being integrated into other Government systems using a standard approach that is reusable and as part of our plan to simplify our overall Government IT systems landscape. The first phase will enable citizens to have an improved approach to accessing their own data and to create the foundation for an improved approach across other Digital Services as and when priorities drive those improvement.

IT Major Upgrades and Replacements

- Why has the IT Major Upgrade and Replacement grouped head of expenditure been created for 2025, and what are the key objectives of this programme?

High priority IT incidents at the beginning of 2024 that affected several departments and public services highlighted the underlying IT estate, including the applications, network and infrastructure had not been sufficiently invested in to keep up to date. Given these issues the Government Chief Information Officer initiated a review which could then be used to inform the required remediation work. The review showed there are areas that are end of life' across applications, infrastructure and networks.

The programme will be run in four projects, with the following key objectives:

Applications

• A modernised application portfolio with improved performance, security, and user satisfaction.

• Decommissioning of the JDE archive platform, reducing maintenance costs and freeing up resources.

Infrastructure

• Storage, back-up and compute environments migrated to new hardware with an update cycle ensuring all servers will be kept current.

• Storage and backup architecture will be designed to ensure components are able to be changed dynamically, removing the need for lengthy rebuilds which impact delivery of public services.

• Data centres will be synchronised to ensure more resilience and reducing down time for affected public services, should there be an issue with one data centre.

• A pre-production and development test environment will be developed to enable new system testing, improving the way testing is done and reducing the risk of introducing system changes without sufficient end-to- end testing.

Network

• A redesigned and more efficient network architecture through consolidated approach and removal of old technology.

Cyber

• Optimise the processes to ensure efficient and secure management of user identities when staff join, move department or leave the organisation.

• Optimise Asset Management and Configuration Management Database (CMDB) and supporting processes and tools. This will provide a more comprehensive visibility into all IT assets and their configurations, which will improve the management of changes in the IT environment.

- What issues in aging digital infrastructure justify the £13 million investment between 2025 and 2027, and how will upgrades improve Government services and performance?

The issues identified expose the organisation to several major business risks due to the ongoing likelihood of public services being disrupted by IT system outages.

These outages are due (but not limited) legacy issues. Applications that are no longer supported or have reached end of life pose significant risks. They lack updates and technical assistance, making them costly to maintain.

- Compatibility Issues - Legacy applications become less compatible with modern infrastructure, software, and hardware. This therefore reduces overall resilience.

- Maintenance Challenges - Maintaining and supporting outdated applications becomes increasingly costly. The cost to maintain increases as availability of skilled personnel who understand legacy technologies declines over time.

- Regulatory Compliance - Legacy systems may not comply with current data protection laws, privacy regulations, or accessibility standards. Non-compliance poses legal and reputational risks.

- Dependency on Vendor Support - When an application reaches its end of life', vendor support ceases. The Government of Jersey is relying on such systems and faces challenges in obtaining assistance during emergencies.

Specifically, in each area the following issues were identified and require remediation:

Applications: Over 950 have been identified so far in the applications register across Government.

Infrastructure: A proportion of the IT storage capability in GoJ data centres are approaching end of life. Lack of documentation in some areas and procedures not fully up to date.

Network: A high proportion of the 150 buildings in the Government of Jersey estate have cabling deployments below the minimum standard required to support Gigabit Ethernet (1Gb), and faster Wi-Fi speeds up to 100Gb. This means sites have to be upgraded to support the new more mobile ways of working of the civil service. Also, two-thirds of the network hardware (storage units, network switches, Wi-Fi access points, routers and firewalls) need replacing.

Replacement Assets and Minor Capital:

- How are replacement asset funding levels determined across departments, and what factors influence these allocations?

Digital Services has an ongoing annual capital budget for asset replacement. This budget is to cover IT related asset replacement. In 2019, £1m was received by the then Modernisation and Digital Department, with a further £5m recurring approved in the Government Plan 2020. In the Government Plan 2022, this was reduced to £3m in 2022 and 2023, and further reduced to £2.5m in 2024 and 2025.

Replacement asset funding is not apportioned on a departmental basis since it is utilised for the remediation of technical debt in relation to hardware, which covers infrastructure such as servers, networking equipment and end user devices on an asset management lifecycle basis which is mainly shared IT infrastructure across multiple departments.

Please accept my apologies for the delay in reply. Please do not hesitate to get in touch if you require further clarification..

Yours sincerely,

Yours sincerely,

Deputy Lyndon Farnham

Chief Minister

19-21 Broad Street | St Helier | Jersey | JE2 3RR