The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

States Greffe

Deputy Lyndon Farnham Chief Minister

BY EMAIL

30th September 2024

Dear Chief Minister

Corporate Services Scrutiny Panel

Proposed Budget 2025-2028 Review – Written Questions

To inform the Panel's review of the Proposed Budget 2025-28, the Panel would be grateful if you could consider the following written questions and provide a formal response by no later than Friday 11th October 2024. Please note that the Panel intends to publish the response it receives on the States Assembly website.

Revenue Heads of Expenditure

- Why has the Revenue Head of Expenditure for the Chief Minister been separated to include Cabinet Office, Technology and Digital Services, and People Services in the Proposed Budget 2025-28, and what impact does this have?

- Are you confident that the 2025 departmental allocations for Cabinet Office, Technology and Digital Services, and People Services are sufficient to deliver key services and policy? If not, why?

- What funding pressures are faced by services under your remit, and how are these addressed in the Proposed Budget 2025-28?

- Are Cabinet Office, Technology and Digital Services, or People Services experiencing resourcing or staffing challenges, and how might these affect project delivery? What steps are being taken to alleviate these pressures?

a) How will identified resourcing and staffing challenges impact the delivery of projects, and what actions are being taken to address them?

- Can you provide details on the projected income earned through operations for 2025 for Cabinet Office (£380), Technology and Digital Services (£1,778), and People Services (£6,063)?

Cabinet Office

- Could you provide, in table format, the number of staff employed and open vacancies as of 30th September 2024 for:

- Ministerial Office and FOI

- Public Policy

- Housing, Environment, and Placemaking

- Governance and Assurance

- Communications

- Statistics and Analytics

- Public Health

- Safeguarding Partnership

- Care Commission

- Children's Commissioner

- Charities Commission

- Advice and Conciliation Services

- What is the rationale for the reduction of 8.0 FTE roles in 2025 for the Cabinet Office, where is this occurring and what impact will this have on employees and service delivery?

- Could you provide a detailed breakdown of Cabinet Office expenditures for:

- Staff Costs

- Other Operating Expenses

- Grants and Subsidies Payments

Technology and Digital Services

- Could you confirm the number of staff employed and open vacancies as of 30th September 2024 for Technology and Digital Services?

- What is the rationale for the 6.0 FTE role reduction in 2025 for Technology and Digital Services, where is this occurring and what impact will this have on employees and service delivery?

- Could you provide a detailed breakdown of Technology and Digital Services expenditures for:

- Staff Costs

- Other Operating Expenses

People Services

- Could you confirm the number of staff employed and open vacancies as of 30th September 2024 for People Services?

- What is the rationale for the 3.0 FTE role reduction in 2025 for People Services, where this is occurring and what impact will this have on employees and service delivery?

- Could you provide a detailed breakdown of People Services expenditures for:

- Staff Costs

- Other Operating Expenses

Corporate Portfolio Management Office and Risk

- Can you provide a detailed breakdown of the £1.539 million allocated to the Corporate Portfolio Management Office and Risk, which falls under the Department for Treasury and Exchequer but maps to the Chief Minister?

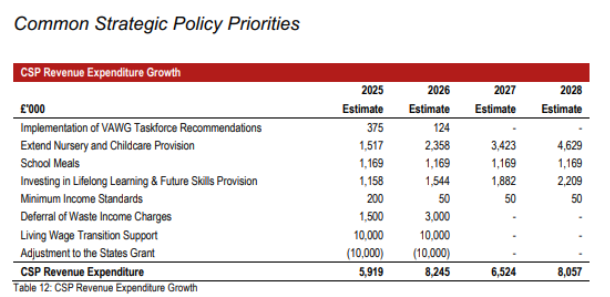

Revenue Expenditure Growth

- Can you provide an update on the spend of the additional £48 million revenue expenditure growth funding allocated for 2024 in the Government Plan 2024-27, and how any unspent funds are accounted for in the 2025 Budget?

- For 2025, approximately £38 million in revenue expenditure growth has been allocated, primarily aligned to Common Strategic Policy priorities. Can you explain the rationale for prioritising areas such as Health and Community Services (£30.5 million) and Non-ministerial and States Bodies (£2.2 million), and what effects this has on other departments or services?

- What oversight have you had over the non-ministerial revenue expenditure growth allocations, and are you satisfied with their necessity as outlined in the Proposed Budget for 2025?

a) Have you met with the Accountable Officers to discuss the rationale for revenue growth allocations for non-ministerial and states bodies?

- Can you provide a list of Revenue Growth bids presented to the Council of Ministers for the Proposed Budget 2025 that were not successful?

Efficiency and Savings

- Was the £10 million in value for money savings identified in the Government Plan 2024-27 achieved or on track to be achieved in 2024, and where were these savings made?

- Can you provide an update on the thematic and best value reviews established in 2023, and their progress in assisting departments with achieving the Value for Money targets for 2024?

- What challenges have been identified in meeting the Value for Money targets for 2024?

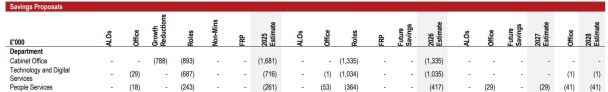

![]() Savings Proposals 2025

Savings Proposals 2025

- Can you provide further detail on where the savings will be achieved (from which sections and how) in respect of the Cabinet Office, Technology and Digital Services and People Services for 2025?

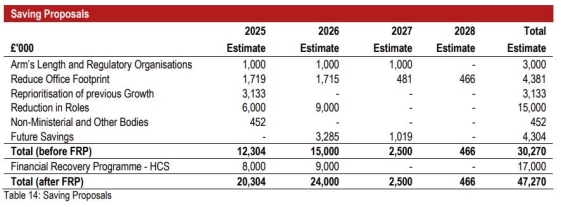

- Can you provide a breakdown for how the tabled saving proposals for 2025 will be achieved and the impact they will have?

- What specific criteria will be used in the review of Arm's Length Organisations to achieve the targeted £1 million in savings, and how will these savings be realised?

- What are the expected long-term financial benefits of consolidating office space, and how will the savings be phased over the coming years?

- How will the remaining £4 million in future savings be allocated, and what criteria will be used to determine where these savings will come from?

Capital Programme

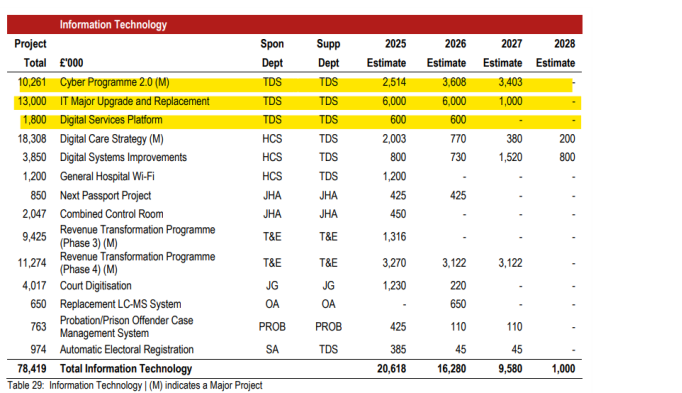

- What criteria were used to prioritise the 2025–2028 IT projects, and how will their success be measured in terms of technical performance and public service impact?

- What risks are associated with delays in delivering Major IT projects?

- Can you provide an update on the 2024 spend and progress for:

• Cyber Programme 2.0 (£1.096 million)

• Digital Services Platform (£2.194 million)?

• Will there be underspends, and how are they accounted for in the 2025 budget?

Cyber Programme 2.0:

- How will the £2.154 million be allotted in 2025 and do you believe the allocation is sufficient to meet the aims of the project 2024. What challenges, if any, have been identified for delivering on the aims this project in 2025 within the estimated allocation?

- What specific geopolitical risks are driving investment in Cyber Programme 2.0, and how does the resource allocation address emerging cybersecurity threats?

Digital Services Platform:

- This was a new Major Project in 2024, which built on prior investments in service digitisation. This is not a Major Project in this Budget and the funding allocation has been significantly reduced (halved) within this Budget for 2025 (£600 thousand) as opposed to the estimate that was allocated for 2025 within the GP 24-27 (£1,289 million), can you provide the rationale for this significant reduction in funds and the impact thereof?

- What changes were made in the re-scoping of the Digital Services Platform project, and how will this new focus impact other Government systems?

- How will the Digital Services Platform integrate with existing systems, and what benefits are anticipated from its completion?

IT Major Upgrades and Replacements:

- Why has the IT Major Upgrade and Replacement grouped head of expenditure been created for 2025, and what are the key objectives of this programme?

- What issues in aging digital infrastructure justify the £13 million investment between 2025 and 2027, and how will upgrades improve Government services and performance?

Replacement Assets and Minor Capital:

- How are replacement asset funding levels determined across departments, and what factors influence these allocations?

Yours sincerely,

![]()

Deputy Helen Miles

Chair

Corporate Services Scrutiny Panel

Proposed Budget 2025 – 2028 Scrutiny Review Corporate Services Scrutiny Panel

Terms of Reference

- To review components of the Proposed Budget 2025-2028 Proposition [P.51/2024] which are relevant to the Corporate Services Scrutiny Panel to determine the following:

- The impact of the Budget proposals on departmental budgets, savings and staffing levels.

- Whether the revenue expenditure growth, capital and other projects are appropriate and likely to have a positive impact on Islanders and Island life.

- How the proposed revenue expenditure growth, capital and other projects align with the Common Strategic Policy to deliver on the priorities, and in line with the Departments' Business Plans.

- Whether the resources allocated to revenue expenditure growth and capital and other projects are sufficient, ensure value for money and demonstrate best use of public funds.

- To assess the impact of the Budget proposals on the Consolidated Fund, Strategic Reserve Fund and Stabilisation Fund.

- To assess the expected impact on the ongoing delivery of public services, by Minister, through reprioritisation and rebalancing of Government finances.

Budget

• To examine income raising, borrowing and debt management proposals.

• To explore how spending will be funded.

• To clarify how States expenditure has materially evolved.

• To ascertain individual departmental budgets and their feasibility based on future spending.

• To examine the deliverability of capital projects.

• To consider rebalancing and borrowing plans being sufficient or excessive to meet stated aims.

• To examine the use of the Revolving Credit Facility.

Financial, economic and growth forecasts

• To examine the levels of income against expenditure.

• To examine the assumptions made for the economic forecasts.

• To explore the impact of the financial and economic forecasts in the Proposed Budget on the Stabilisation Fund.

• To explore any continued impact of emergency incidents on the financial envelope'.

Design and implementation of the Budget

• To assess reserves; their use, and how they are allocated.

• To consider how the treatment of contingencies/reserves, or any other areas of non-routine proposals have evolved in respect of the Proposed Budget.

• To consider the overall fiscal soundness of the Proposed Budget.

• To consider gender-responsive budgeting of the Proposed Budget.