The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

19-21 Broad Street | St Helier Jersey | JE2 3RR

Deputy Helen Miles

Chair – Corporate Services

BY EMAIL

30th October 2024

Dear Deputy Miles

RE: Proposed Budget 2025 – 2028 Review – Written Questions

Thank you for your letter dated 21st October. Please see the following answers to the Panel's questions:

Revenue Heads of Expenditure

- The Treasury and Exchequer is projected to earn £4,353 million of income through operations in 2025. Please could you provide detail about the source of this income?

Income arises as a result of staff recharges within both the investment and pensions teams to their respective funds, alongside a Revenue Jersey staff recharge to the Social Security fund.

- Are you confident that the departmental allocations as outlined within the Table 5i above are sufficient to deliver the key services and policies in 2025 and, if not, why?

I am content that the allocations above are sufficient to deliver the key priorities of the Department, although some lower priority activity may be deferred or progressed at a slower pace.

- Is the Treasury and Exchequer experiencing resourcing or staffing challenges, and how might these affect project delivery. What steps are being taken to alleviate any pressures identified?

To fulfil its function, the department employs a number of professionals including specialists, whose services are in great demand both in Jersey and internationally. Recruitment can be challenging, but the department uses a number of recruitment techniques to ensure that high quality candidates are sourced.

The department is committed to reprioritising its work to fit within the available resource and expects to continue to deliver its key objectives.

- Could you provide, in a table format, the number of staff employed and open vacancies as of 30th September 2024 for:

- Finance Business Partners, Analytics and Management Information

- Finance Hub

- Revenue Jersey

- Assurance and Risk

- Strategic Finance

- Treasury and Investment Management

- Commercial Services

- Grants and Funds

- Corporate Costs

| Actual FTEs | Open Vacancies* |

Finance Business Partners, Analytics and Management Information | 57.0 | 5.0 |

Finance Hub | 64.5 | 4.0 |

Revenue Jersey | 153.0 | 5.0 |

Assurance and Risk | 17.5 |

|

Strategic Finance | 28.5 |

|

Treasury and Investment Management | 13.7 |

|

Commercial Services | 27.8 |

|

TOTAL | 362.0 | 14.0 |

*Open Vacancies are classed as only those vacant roles that are currently out for recruitment. There are no FTEs within Grants and Funds, Corporate Costs.

- Please could you provide a more detailed breakdown of the following expenditure, as detailed in the statement of comprehensive net expenditure for the Treasury and Exchequer:

- Staff Costs

- Other Operating Expenses

- Impairments

- Finance Costs

£'000 | Staff Costs | Other Operating Expenses | Impairments | Finance Costs |

Finance Business Partners, Analytics and Management Information | 4,414 | 200 |

|

|

Finance Hub | 4,243 | 1,787 | 5 |

|

Revenue Jersey | 13,238 | 925 |

|

|

Assurance and Risk | 1,755 | 597 |

|

|

Strategic Finance | 2,341 | 1,027 |

|

|

Treasury and Investment Management | 1,454 | 13,099 |

|

|

Commercial Services | 3,634 | 130 |

|

|

Corporate Costs | 293 |

|

| 1,910 |

TOTAL | 31,372 | 17,765 | 5 | 1,910 |

- What is the rationale for the reduction of 10.0 FTE roles in 2025 for the Treasury and Exchequer, where is this occurring and what impact will this have on employees and service delivery?

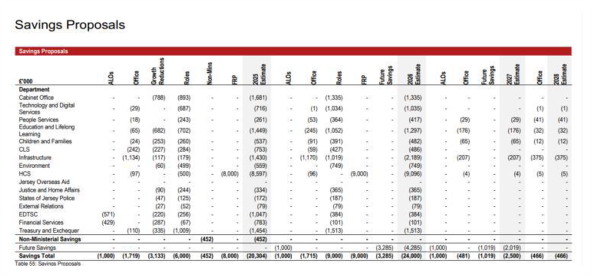

Savings proposals include £15 million to be delivered through reduction in roles by removing management layers, extraneous activity and a reduction in consultancy spend. The £15 million target has been allocated to departments based on the proportion of staff employed on a civil servant contract at grade 11 and above, the allocation seeks to protect frontline services.

The 10.0 FTE for Treasury & Exchequer reflects the anticipated reduction in roles required to meet the department's share of the £15 million targets which total £1,009,000 in 2025. Treasury will look to deliver the savings allocated to it, whilst protecting customer service and levels of collection, and continuing to deliver a high standard of financial management.

We will look to use tools such as removing vacancies or not replacing staff that leave, to minimise the human impact of the savings. We may need to reconfigure services, and will continue to look to identify extraneous activities, improve efficiency, and ensure that our processes and governance are proportionate.

Changes to Revenue Expenditure

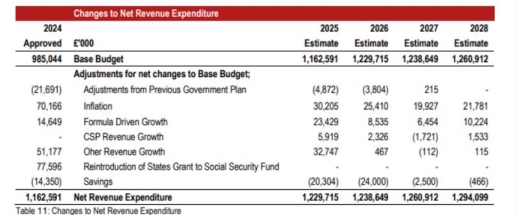

- Please can you provide the rationale for why the £10 million change in the States Grant is not displayed in the table above?

The full formula-driven uplift in the States Grant to the Social Security Fund has been shown in the "Formula Driven Growth" line. The £10 million reduction in the grant has been reprioritised to fund support during the transition to the living wage, and so the net movement is zero. This is shown in Table 12, which expands the "CSP Revenue Growth" line.

Reserve for Central Risk and Inflation

- In the Government Plan 2024-27 an allocation of £5 million was estimated for 2024 to the Reserve for Central Risk and Inflation, can you provide a breakdown of its use during 2024?

The following allocations have been made during 2024:

- Up to £290,000 for the Firearms Range Project – to meet the higher than estimated costs of the police firearms range

- Up to £3,800,000 for the acquisition of Greve De Lecq café as approved by the States Assembly in p.5/2024

In addition to the £5 million provided by the Government Plan 2024-27, the funding available in the Reserve was increased by £8.4 million through the End of Year Flexibility process.

All transfers from the Reserve are made through Ministerial Decisions that, other than in exceptional circumstances such as where commercial interests could be prejudiced, are published on gov.je.

Reserves transfers are also summarised in the Finance Law Delegation Report that is presented to the States Assembly every six months. The most recent report is R.134/2024, which includes the transfers outlined above.

- We note that no allocation in made for Reserve for Central Risk and Inflation in the Proposed Budget 2025-28, although £1 million was estimated for 2025 in the preceding Government Plan 2024-27. Can you provide detail on how this is represented in this Proposed Budget for 2025-28 for 2025 and if it is demonstrated differently, please can provide the rationale for this change?

There is no additional provision for the Capital Risk and Inflation Reserve in 2025. There is currently £9 million in the Capital Risk and Inflation Reserve, and it is intended that amounts not required in 2024 will be carried forward to 2025. In addition, capital pressures arising in the year will be met through reprioritisation within the wider programme where possible.

Value for Money Savings and Savings Proposals

- Are you able to confirm whether the Treasury and Exchequer has achieved or is on track to achieve its Value for Money savings as estimated for 2024 (£517,000). If so, can you provide a breakdown of how these savings have been achieved and, if not, could you please detail why?

Savings targets were allocated to departments in line with the agreed Government Plan, thus reducing department budgets accordingly. (Refer to Table 16 of the 2024 Government Plan). Budgets have been reduced and Accountable Officers are required to deliver within these reduced limits – i.e. delivering the savings.

All savings targets allocated have been met in full through a combination of vacancy management, reviewing and reductions in non-staff spend and reductions in spend on external resources.

- Can you update us on the actioning of the previous Panel's Amendment to the Government Plan 2024-27 in respect of monitoring of the Value for Money savings as shown below?

This recommendation will be addressed in the Annual Report and Accounts. Whilst the Value for Money programme no longer exists in its previous form, departments are required to track progress against savings targets, and report to Treasury on delivery of financial amounts.

- In respect of Tabel 55 below for the savings proposals related to the Treasury and Exchequer, can you provide further detail on where the savings will be achieved and the impact thereof on service delivery (from which sections and how) for 2025

| Value £'000 | Comments |

Revenue Jersey | 110 | Centralised Office Accommodation Property Savings |

Revenue Jersey | 335 | 20% reduction of growth allocated in the 2024 Government Plan (Tax Compliance and Customer Service) |

Treasury & Exchequer | 1,009 | Roles Saving Targets across the department Please see question 6 above |

TOTAL | 1,454 |

|

Preceding Government Plan - Update

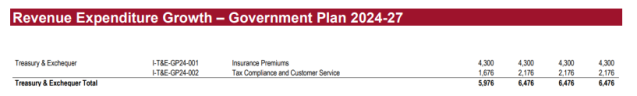

Insurance Premiums

- In the Government Plan 2024-27, Insurance Premiums of £4,3 million were allocated for 2024 and 2025. Can you update us on the spend of the £4,3 million for 2024 and can you provide detail on how Insurance Premiums are allocated within this proposed Budget 2025-28 for 2025 and whether you are confident that the allocation will provide adequate cover to mitigate any financial impact and risk under the continuing volatile conditions?

£4.3 million growth was provided for in the 2024 – 2027 Government Plan which was to support increasing renewal costs.

Insurance premiums are driven by several factors; general market conditions, size and nature of Governments risk portfolio and claims experience which makes it challenging to predict the adequacy of future budget allocations. However, following an external actuarial review of our Insurance Fund we have succeeded in stabilising insurance premiums for 2024/ 2025 by restructuring our insurance programmes to increase policy excesses. This is with the aim of reducing the volatility experienced in recent years, stabilising premium costs for the longer term and lowering the overall Total Cost of Risk to Government.

Tax Compliance and Customer Service

- Can you update us on the Tax Compliance and Customer Service workstream during 2024 and whether the objectives were met?

At the end of the third quarter, we are broadly on track to achieve the activities set out in the 2024 Compliance Programme. Some activities will (as usual with tax enquiries and investigations) have been carried over from 2023 and some will run into 2025. During 2024 we have completed our projects looking at compliance among take-away food outlets and Estate Agents. (The Comptroller does not routinely speak about the outcomes of particular projects to ensure that he does not inadvertently breach his Oath of Office which requires strict taxpayer confidentiality.)

2024 is the first year in which we have begun to use information drawn from the international procedure for Automatic Exchange of Information (AEOI) which provides us with data about assets held abroad by Jersey-resident taxpayers which can be compared with tax returns. Following a number of changes to make tax law more effective, 2024 successes include a prosecution of an employer for failure to comply with tax and social-security obligations in respect of employees.

At the end of September total revenue benefits arising from our compliance work stood at around £35 million comprising around £25 million from corrections to 2023 and earlier tax years. Revenue benefits also include other things including, for example, "Revenue Loss Prevented" from the denial or reduction in incorrect repayment claims.

It should be stressed that these are total revenue benefits arising from Revenue Jersey's compliance work and a stricter methodology is adopted for scoring additional "cash to bank" to avoid double-counting for revenue forecasting purposes. Revenue Jersey's annual compliance out-turn is subject to audit and some aspects of delivery can only be quantified in arrears.

Key Customer service objectives:

We aim to make incremental improvements to customer experience scores (Effort, Satisfaction) through the year. Improvements are being measured each quarter and compared to prior year and government wide targets:

| Customer Effort |

|

|

|

| Customer Satisfaction | |||||

| 2024 | 2023 |

|

|

|

|

| 2024 | 2023 | ||

Q1 | 3.8 | 3.4 |

|

| 70.2% | 64.7% | |||||

Q2 | 4.0 | 3.6 |

|

| 74.4% | 68.3% | |||||

Q3 | 4.1 | 3.5 |

|

| 78.0% | 65.7% | |||||

Q4 |

| 3.7 |

|

|

| 71.1% | |||||

We have participated in the first internal customer satisfaction surveys for internal stakeholders. We will be exploring and assessing options for possible improvements during Q4

Key T&E Service Performance Measures: |

| 30/9/2024 |

>50% of personal tax returns completed online | On track | 53% |

Personal tax returns - 80% assessed within 30 days (year to date) | Above target |

|

Average time to answer Personal Tax calls (year to date) (<8 mins) | On track | 7m 44s |

95% of customer calls answered (excluding Personal Tax) | Below Target | 92.7% |

90% of invoiced debt recovered within 90 days | Below Target | 80% |

80% supplier invoices paid within 30 days and average number of days | On Track | 83% |

- Can you confirm the allocation for 2025 and provide a breakdown of how the estimated funding for 2025 will be spent and what will be delivered in 2025 as a result?

Growth monies totalling £1,676,350 for 2024 were granted to provide full funding for the then establishment of Revenue Jersey personnel and to provide an 8-person intervention team. This was necessary to ensure that customer services standards were maintained at an acceptable level, international tax administration standards were met and to ensure effective compliance work could be continued. The amount originally allocated was reduced by £335,000 in accordance with the reprioritisation of previous growth.

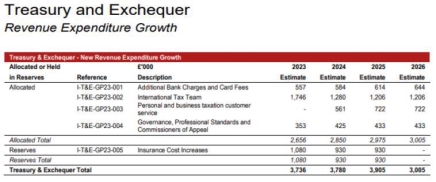

Preceding Plans allocated funding for 2023, 2024, 2025 as follows in respect of Revenue Expenditure Growth for the Treasury and Exchequer:

- For the workstreams listed above can you provide and update on the progress during 2024 and further detail on the allocations, if any, for 2025 and how those allocations will be used in 2025?

Spend on growth awarded as part of the Government Plan process is tracked on an individual line by line basis in the first year it is awarded only, in subsequent years it becomes part of the departmental base budget. These budgets continue to be utilised for the purposed awarded.

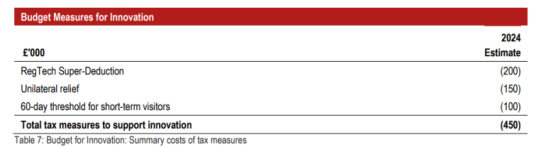

Budget Measures for Innovation and Enterprise

- The Government Plan 2024-27 proposed a new budget measure to support innovation and enterprise (supporting movement of staff and Regulatory Technology Super Deduction) can you update us on the progress of this workstream in 2024 and the expectation for 2025?

The 60-day short-term business visitors exemption has been well-received with positive feedback from stakeholders. Technical guidance and customer service support has been provided for employers and tax agents.

The RegTech Super-Deduction is being monitored and take-up will become clearer following the end of the 2024 tax year as companies file their returns in November 2025. The Super-Deduction is a pilot programme that will be reviewed based on its outcomes when these are known.

Consultations are underway on additional measures that will support Jersey's tax policy on the global mobility of staff and international competitiveness. The priority for 2025 is to remove frictions in the tax system and administrative processes to support mobile workers and their employers.

- The total cost of the tax measures was estimated at £450,0000 for 2024; how has this been monitored and the benefit been demonstrated? Can you provide some examples?

The £450,000 estimated cost of measures to support innovation and enterprise relates to personal and corporate income tax relief for the 2024 year of assessment. These returns will not be received until 2025. The company tax return has been amended to collect data on how many companies are applying for the RegTech Super-Deduction. Unilateral relief will be monitored through Personal Income Tax returns. Short-term visitors are not required to register or remit taxes, so establishing the take-up and benefit will prove more challenging; Revenue Jersey is exploring options to monitor the relief.

Excise Duties

- How have post-COVID consumer behaviour trends and long-term consumption patterns for alcohol, tobacco, and fuel impacted revenue from excise duties, and how are these trends being factored into future revenue forecasts?

Trends in volumes are considered as part of the forecasting carried out by the Income Forecasting Group. The IFG report sets out this information, and how it is factored into future forecasts.

- Can you update us on the effects of the proposal for 2024 to reduce fuel duty by 9 pence per litre on Hydrotreated Vegetable Oil (HVO) biofuel (locally renewable diesel). What was the final cost to the Exchequer (it was expected to be £85 000 in 2024) and what has the impact been on the Climate Emergency Fund? How will this impact the Exchequer in 2025?

A final cost for 2024 cannot be provided, as the year has yet to end. However, initial estimates based on actual consumption data to date have been provided.

It was forecasted that HVO imports would be 889,600 litres for 2024, the total quantity of HVO charged to excise duty to date in 2024 is 720,615 litres.

Based on figures from Q1 2023 to Q3 2024, imports of HVO fuel are predicted to increase with the overall increase for the 2024 year expected to be 2.7%. It is estimated that the gross decrease in income for 2024 is expected to be £60,000 rather than the £85,000 forecasted, the difference correlating to the increase in consumption. The increase in consumption will increase the amount hypothecated to the Climate Emergency Fund (CEF) by approximately £2,100 with the total cost to the Exchequer to be estimated to be £57,900 for 2024.

The forecast consumption for 2025 is to remain the same as for 2024. Vehicles Emissions Duties (VED)

- How were the impacts of the 2024 VED increases on vehicle sales, emissions, lower- income earners, and Government revenue assessed, and how have these findings influenced the 2025 VED proposals?

It is not possible to ascertain with any certainty whether the 2024 VED increases had a direct influence on vehicle sales, overall emissions or impacted lower-income earners. The 2024 VED increases applied an ascending increase to all non-commercial VED bands as well as created a new VED band, 1-50g, which applies to EV and hybrid vehicles that emit low levels of emissions. Full EVs are zero-rated for VED.

Road transport emission data is published for the Island 2 years in arrears as part of the greenhouse gas inventory. Figures for 2022 were published in May 2024. Road transport emissions decreased by 5% between 2021 and 2022. We expect this decrease to continue and to see the impact of the electric vehicle purchase incentive (EVPI) in the 2023 and 2024 inventories given the rapid expansion of the local EV fleet.

The decline in vehicle registrations will also play a role in reducing road transport emissions, as less cars are being imported into Jersey. Officers reviewed the vehicle registration data between 2011 and 2023 to identify any trends which would influence the rates proposed for 2025. In 2023, total vehicle registrations were 4,204. These are the lowest number of registrations since the introduction of VED in 2010. It signifies the long-term trend that registrations are declining year- on-year.

In comparing 2022 and 2023 registrations, the middle three bands (76-100g, 101-125g & 126g- 150g) had the greatest decline in registrations, whereas the lowest bands had the greatest increase in registrations indicating that consumer preference is leaning towards lower emission vehicles. There was also significant increase in electric vehicle registrations of over 55% from 2022 to 2023. The introduction of the EVPI may have influenced the increase in EV purchases.

The top 4 VED emission bands faced the largest decline between the period 2021 – 2023 signifying the increase in VED rates are having a positive outcome in reducing the registrations of the highest emission vehicles.

These vehicle registration trends provide an indication as to whether the VED Optimiser policy is influencing vehicle registrations. As the highest VED bands are declining, it would indicate that the policy is working, and that focus should be in maintaining the VED increases for the higher VED bands.

- How were the 5%, 10%, and 20% VED rate increases determined, and what impact are they expected to have on consumer behaviour, especially regarding high-emission and lower emission vehicle purchases?

The 5%, 10% and 20% VED rate increases apply to the top 3 VED bands (151-175g to 201g or more) for non-commercial vehicles, which represent the most polluting vehicles. These rates were proposed following discussion with Jersey Motor Trade Federation who suggested to have a gradual increase rather than a set multiplier across these top 3 VED bands. The Federation welcomed the decision to only increase VED for the top 3 VED bands, rather than apply increases across all non-commercial VED bands as was the case in previous years.

This decision was to provide greater discouragement for Islanders purchasing more polluting vehicles, through increasing the price of a vehicle, and to encourage them to purchase lower emission vehicles. The historical trend analysis supported this decision as Islanders were purchasing more EV vehicles in 2023 than ever before.

- How does the proposed Budget 2025-28 balance environmental objectives with economic concerns for local businesses, particularly in relation to VED increases for commercial vehicles, and what consultations were held with stakeholders?

It has been a long-standing commitment to increase VED rates on an annual basis for non- commercial vehicles. This commitment supports the wider climate emergency agenda by discouraging the importation of high emission vehicles and encouraging Islanders to purchase lower emission vehicles.

Commercial vehicles have not been subjected to the increases in VED rates over the past 3 years. VED rates for commercial vehicles have remained at 2018 rates, with the highest rate of £1,931.58 for the most polluting commercial vehicle compared to £7,937 for the most polluting non-commercial vehicle in 2023.

I have proposed to increase commercial VED rates by RPI (at 3.6pp) to maintain the rate in real terms. The modest RPI increase adds an additional £3 (lowest) to £70 (highest) to the VED emission bands for commercial vehicles. In balancing the environmental objectives with the economic concerns for local businesses, the modest VED increases support the EV Purchasing Incentive that is offering up to £4,000 to local businesses who wish to purchase a commercial EV by providing funding to pay for such grants.

It is important to note, that VED only applies to vehicles that are imported to Jersey and does not apply to businesses who purchase second-hand vehicles already registered in Jersey.

- What challenges remain in the electric vehicle supply chain, if any, and how might these issues affect future VED proposals and broader policies for encouraging EV adoption?

There have been no significant issues with the EV supply chain that have been brought to our attention. The majority of EVs are not currently subjected to VED as they have zero emissions. EVs and hybrid vehicles that are subject to VED are charged a nominal £35 per registration, which is significantly less than the VED bands for higher emission vehicles.

VED receipts are being monitored to see the impact of both the changes to VED rates and the electric vehicle purchase incentive which was launched in August 2023. Current projections are that the incentive will close by the end of 2024 with approximately 1,200 electric vehicles imported under the scheme. EVPI rate of take-up has been double initial projections meaning the incentive will close a year earlier than expected. Vehicle retailers have not had any issues meeting this demand, so we remain confident in the robustness of the EV supply chain.

Under policy TR5 of the Carbon Neutral Roadmap, Jersey is due to commence the ban on importation and registration of petrol and diesel vehicles from 2030. Officials are liaising with the UK Department for Transport to align Jersey's approach with the UK's, with respect to the Labour Government's manifesto pledge to reinstate the original 2030 date for this policy. In the period to 2030, we expect to continue raising VED rates in line with policy TR4 of the Carbon Neutral Roadmap.

From 2030, VED receipts will therefore be limited to the importation of larger and more specialist vehicles not yet captured by the proposed ban. We will work with industry to ensure it is ready for the ban and able to meet customer demand for passenger vehicles and vans captured by the ban.

If EVs continue to displace fossil fuel vehicles, it is expected that VED receipts will decline. Yours sincerely

Deputy Elaine Millar

Minister - Treasury and Resources

D +44 (0)1534 447321 E e.millar2@gov.je