The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

![]() Corporate Services Scrutiny Sub Panel (Overseas Aid Review) Written questions for Mr D Peedle, States Economic Adviser – February 2007

Corporate Services Scrutiny Sub Panel (Overseas Aid Review) Written questions for Mr D Peedle, States Economic Adviser – February 2007

- Aid is currently linked to the taxation system, but the international target for aid levels is linked to GNI. Can these two approaches be reconciled?

In the medium to long-term as GNI increases taxation receipts should also increase. In the short-term taxation receipts may fluctuate for a number of reasons that my not correlate directly with changes in GNI. For example, over the course of the 1998-2005 period the formula used has led to aid rising from 0.11% of GNI to 0.17% in 2005 although aid has not risen as a proportion of GNI in every year.

- Which countries/jurisdictions can be seen as comparable to Jersey as far as overseas aid funding is concerned and, reasons?

There is no straightforward answer to this question. Obvious comparator jurisdictions would be other small islands with a large financial services industry such as Isle of Man and Guernsey. However, that does not mean that we should not choose to compare ourselves with a wider group of countries, including much larger economies.

- How is the overall level of emergency grants fixed? What happens if there is a major emergency towards the end of the financial year, after most of the emergency funds have been disbursed? Is there any way at that stage of increasing the funds available?

I do not see how this is a question for the Economic Adviser.

- We have received a large number of submissions calling for Jersey's Overseas Aid funding to eventually be based on the United Nation's recommended level of 0.7% of Gross National Income (GNI). If Jersey were to commit to this, it would more than treble the current level of aid (in the current year, this would have been around £22 million).

- Please provide the Sub Panel with a definition of GNI.

Gross National Income is one measure of the overall size of the economy, in terms of the goods and services produced or the overall income generated.

- How is GNI calculated?

GNI is calculated by estimating the Gross Value Added (GVA - the sum of profits and earnings) of the economy and then adjusting for the net transfer of financial income from overseas. This involves subtracting the income earned in Jersey by non-Jersey owned companies/individuals and adding income earned overseas by Jersey businesses/individuals.

- Why is Jersey's GNI so high compared to other jurisdictions? Jersey's GNI per head is high relative to other jurisdictions because of its very successful economy. That is, because of the Island's ability to specialise in the export of financial services (which makes up 50% of the economy) with a very high value added per employee and import those things which it cannot produce for itself (and are generally much lower value added per employee).

- The Sub Panel has been told that as Jersey is not a "ruling state" we are not comparable to other jurisdictions aiming to reach 0.7% of GNI in overseas aid contributions. Please could you explain to the Sub Panel what makes Jersey different, and why it would be difficult for the Island to measure its overseas aid contributions in GNI?

The Jersey economy is different in a number of ways, not just those outlined in the answer to c above. Its success means the Island faces different economic trade-offs compared with most industrial countries because of its lack of spare capacity in terms of land and labour.

In theory it would be feasible in Jersey to measure Overseas Aid contributions as % of GNI. However in practice one of the main problems would be that GNI data does not come out until the September of the following year. This would mean that as of today, we would not be able to measure what proportion of GNI were Overseas Aid payments in 2006. This would only be possible later in the year in September.

- Is 0.7% of GNI feasible fiscally for Jersey?

This is a political question. The key issue is that increasing overseas aid to 0.7% of GNI in 2005 (the last year for which we have both GNI and Overseas Aid information) would have required increasing aid from £5.5m to £22m. This would require expenditure cuts elsewhere in the region of £16m or a tax increase of the same amount which would be equivalent to about 1% on GST.

- What ways could Jersey use to raise this level of funding? See answer to e above.

- What would be the economic impact for the Island if we were to commit to giving 0.7% of GNI as overseas aid?

The exact impact would be dependent on what aspect of government expenditure was cut or which form of taxation was increased to fund the increase in aid.

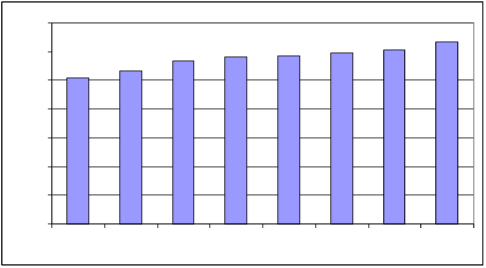

- Please provide figures (and a graph) detailing the Island's GNI over the last 5 years. Has there been a great deal of fluctuation?

Jersey's GNI 1998-2005

GNI measured in current prices, £m

3500 3170

3500 3170

2900 2930 2970 3030

3000 2660 2840

2550

2500

2000

1500

1000

500

0

1998 1999 2000 2001 2002 2003 2004 2005

Source: States of Jersey Statistics Unit

- When do you find out the final update on the Island's GNI for any given year? September of the following year.

- Why is GNI the chosen measurement used by the UN to assess jurisdictions overseas aid contributions?

I would think because it is an overall measure of the size of an economy and the income it generates. Also that in most countries GNI data is readily available and is published on a quarterly basis.

- The Chairman of JOAC has asked the Council of Ministers to consider an increase in its budget of £500,000 pa for the five years from 2008. If the States were to adopt this funding formula, how many years would it take to reach the UN's recommended level of 0.7% of GNI?

To make such a calculation an assumption is needed about future trends in GNI. To make such an assumption going forward involves a significant degree of uncertainty but it is fair to say that it is unlikely to be met within the next ten years.

- The Sub Panel has received a suggestion from a witness that the Island's overseas aid contributions should be linked to our economic growth. Please could you provide the Sub Panel with your views on this proposal, and also information detailing how this would affect the Island's overseas aid contributions?

Funding such payments through economic growth does not change the economic implications. Taxes will be higher than would otherwise have been the case or expenditure lower. Given that economic growth is needed as part of the States fiscal strategy and will be important in meeting future fiscal challenges there is no easy solution by using the fiscal improvements related to economic growth.

The extent to which this would affect the Island's overseas aid contributions would be dependent on the rate and nature of economic growth and how much of economic growth related improvements in government finances were allocated to overseas aid.

![]() Planning aid payments may prove difficult to the extent that economic growth in any one year would not be known until later the following year and that no economic growth would mean no increase in aid.

Planning aid payments may prove difficult to the extent that economic growth in any one year would not be known until later the following year and that no economic growth would mean no increase in aid.