The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

CITIMA, 5, Bond Street, St Helier, Jersey.

JE2 3NP

16 November, 2020.

Dear Senator Moore ,

Re: CITIMA comments on Government Plan 2021.

Thank you for the opportunity to submit these comments to your panel's review of the Government Plan.

These comments are sent on behalf of my client CITIMA, whose members comprise Fox Trading, Liberation Group, British American Tobacco, Imperial Tobacco and Japan Tobacco International.

This is a set of comments that set out the Association's position as it relates to the import and taxation of tobacco products. CITIMA remains deeply concerned by any proposed tax increases for the following reasons.

- Firstly, local consumers have a choice about whether to purchase more expensive tobacco products, or not. A significant duty increase simply makes it more likely that those consumers will purchase tobacco products from sources which do not bring tax collection.

In this scenario, it is the legal domestic market, legitimate tax-paying retailers and the Treasury itself, who will lose out.

A quick market research exercise will show that consumers can easily save at least £6.00 per pack of 20 cigarettes by doing this at current duty rates.

- Secondly, if consumers are incentivised to purchase outside of the domestic duty-paid market because of higher local prices, there is a resource implication for the already- stretched Customs team in preventing abuse.

It's not thought that the Island currently has a significant problem with tobacco smuggling, but there have been a number of high-profile cases in recent years, and the further tobacco tax is pushed up, the greater the incentive for smugglers.

- Thirdly, the increase in tobacco duty in the past has been justified on health grounds, in order to reduce demand. However, recent experience shows that the only impact of large duty increases has been to reduce demand for duty paid imported products, rather than overall consumption, with demand instead remaining relatively stable and moving increasingly to duty not-paid' channels.

That point is evidenced with the following graphics:

- This chart shows that the volume of tobacco imported, and on which duty is paid, is falling:

Source: Customs and Immigration Service.

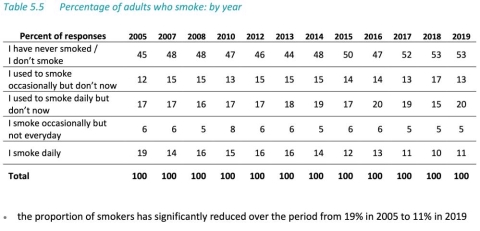

- But while the volume of duty-paid tobacco being imported has fallen by 50% since 2009, actual tobacco consumption has only declined slightly, and not by anything like the same proportions. Here's the data from States-own Jersey Opinions and Lifestyle Survey' for tobacco consumption over the same period:

Source: States of Jersey Opinions and Lifestyle Survey, 2019.

Finally, over the period between 2008 and 2018, the steeply increasing duty on a packet of 20 cigarettes has pushed up the domestic price for an average pack of 20 cigarettes from £5.03 (RRP excluding GST) to £8.45 (same basis). That is an increase in RRP, excluding GST, of 68% for the domestic consumer (figures based on 2009 and 2019 Budget Statements). This means that between 2008 and 2018, the proportion of a pack price made up of government- imposed duty has gone up from 57% to 69%.

- Fourthly, the Covid-19 Pandemic has hit many businesses hard, not least the retail trade as shops have seen a dramatic footfall reduction, due to the stay-at-home instruction, and lack of visitors. We believe the local economy needs stability rather than the uncertainty caused by drastic price increases.

In summary, we believe that the point of diminishing returns has been reached, and that large duty increases are now counter-productive, in that they don't achieve their stated health objectives.

With that in mind, we believe an impôt increase of no more than RPI + 2% over the term of the current government would be prudent and provide predictability and sustainability for excise revenues, importers and retailers.

An increase of this nature will provide less of an incentive to consumers to purchase tobacco products from non-duty paid sources, while also allowing the States to follow its agreed Tobacco Strategy and maintaining an important source of revenue for the Island.

Thank you for the opportunity to submit these comments, and please do let me know if you would welcome any further information or discussion.

Your sincerely, Chris

Chris Rayner,

On behalf of CITIMA.