The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

Jersey Economic and International Affairs Scrutiny Panel The Acceptance of Cash Payments

1st July 2024

Contact: Sir Mark Boleat, LINK Chair Emai: mboleat@link.co.uk

Mobile: 07803 377343 Classification: Public

Submitted by email: scrutiny@gov.je

Executive Summary

Cash acceptance is an important issue for consumers. It has grown in significance since the pandemic as before then, cash acceptance was almost universal and any consumer concerns were very limited. LINK has been undertaking research at a national level to investigate this for some time. However, while cash acceptance and having the option to pay in cash is very important to consumers, in their day-to-day spending habits the majority have a clear preference for paying by card or phone.

Access to cash in the UK was recently protected through the Financial Service and Markets Act 2023 and regulation by the Financial Conduct Authority. Before that, LINK on behalf of the banking and ATM industry provided voluntary protection at a good level. While the new Act does not apply to Jersey, LINK applies identical ATM criteria and access to cash across Jersey remains good. LINK's separate co-ordinating body role, assessing branch closures, does not apply in Jersey.

Any decision as to eliminate cash in Jersey would appear to be a bold one and any benefits, which would include removing the price premium cash users sometimes pay, should be carefully balanced against the experience of those who choose or rely on cash. It must also include a concerted effort to tackle digital inclusion, ensuring that those who currently choose or rely on cash are able to use the digital alternatives safely and easily and are not excluded from access to goods and services.

About LINK

LINK manages the UK's main cash dispenser (ATM) network and is a central part of the UK's cash infrastructure. It is a not-for-profit organisation with an independent Board that acts in the public interest.

LINK's network connects the vast majority of ATMs (both free and charging) in the British Isles, and allows customers of banks and building societies (card issuers) that are LINK Members to make cash withdrawals and balance enquiries with their payment card at almost every ATM. All major card issuers and ATM operators currently choose to become Members of LINK. This helps ensure that consumers in the British Isles have good free access to cash.

For some years, LINK has run an effective Financial Inclusion Programme to maintain a broad footprint of free ATMs across the British Isles. LINK also supports general community access to cash in its role as a voluntary industry coordinating body. This entails LINK assessing the impact of branch closures on communities. Where certain criteria are met, LINK recommends new cash facilities such as shared banking hubs and deposit services.

Cash is in long-term decline in the UK and LINK ATM transactions are falling by about 5% per year. LINK is managing the network through this decline in order to protect free access to cash for as long as it is needed.

The LINK network is based on a highly resilient real-time high-volume infrastructure, currently supplied by Vocalink. LINK is the network operator, and the systemic risk manager.

LINK is regulated by the Payment Systems Regulator, and by the Bank of England as a systemically important payment system and is designated as such by the Treasury (HMT). LINK has been designated by HMT as an industry co-ordination body and will also be subject to supervision by the Financial Conduct Authority.

The Acceptance of Cash Payments

The Jersey Economic and International Affairs Scrutiny Panel Jersey has launched a review into the Acceptance of Cash Payments having identified cash acceptance by businesses in Jersey as an area of interest. The review has four objectives. LINK's response below addresses each in turn.

- Explore acceptance of cash payments by businesses in Jersey

LINK undertakes regular consumer research on cash usage and acceptance. This is at a national UK level, is broken down into UK Regions, and does not cover Jersey which may have specific circumstances in which it varies from the UK. Nevertheless, the Panel may find LINK's findings of interest. It should be borne in mind that in 2022 only around 14% of consumer payments were made in cash and consumers' preferences and experiences will be against that background.[1]

Cash Acceptance

Cash acceptance has been a growing issue for some years and LINK's recent survey figures represent the high point following a trend over the last decade. LINK asked consumers in November 2023 if they had recently visited somewhere where cash was not accepted. As might be expected, not accepting cash was reported as highest in London and lower elsewhere across the UK.

- Investigate the views of consumers and businesses on the use and acceptance of cash in Jersey

LINK has also investigated consumers' preferred method of making in-store payments. Again, as might be expected given the high usage of cards, they were the most popular payment method. Using a phone is also popular and indeed likely to be seeing increasing use. However, cash remains a significant first choice for 18% of people and it should be remembered that cash is also used in situations other than in store, such as paying friends or family, paying a tradesman, or paying for an in-house service like a cleaner, gardener or hairdresser and these may not always offer card payments as an option.

However, while many consumers prefer to use card or mobile payments, when asked how important it is to have the option of using cash, these figures are much higher. 82% of people overall said having the option to pay in cash is very or fairly important compared to just 17% who said it wasn't. As might be expected, having cash as an option was most popular among older people and least important to the 25-34 age group.

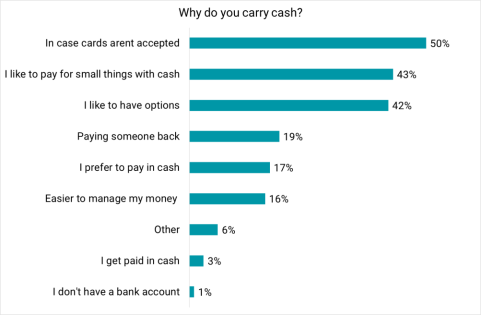

Some of this difference, i.e. between actually using cash and wanting to keep cash as an option, may be down to fear of cards not being accepted. Indeed, half of those who said they carried still cash did so as a contingency in case of lack of acceptance by a store or general failure of digital payment systems for a time.

Some of this difference, i.e. between actually using cash and wanting to keep cash as an option, may be down to fear of cards not being accepted. Indeed, half of those who said they carried still cash did so as a contingency in case of lack of acceptance by a store or general failure of digital payment systems for a time.

.

- Ascertain the availability of cash in Jersey

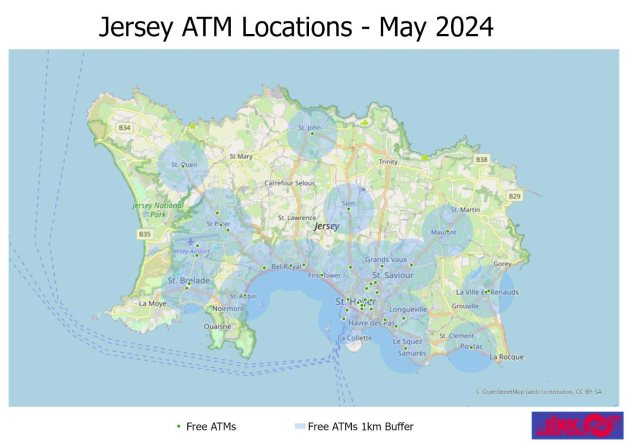

Comparing May 2024 to pre-pandemic 2019, the number of free to use ATMs in Jersey has fallen by 15% to 69 machines. This is against the value of cash dispensed, which has fallen by 51% to just under £6m during May. This compares to a reduction of 26% in ATMs across the UK and a 32% reduction in the value of cash. Therefore, the number of ATMs in Jersey has fallen less than in the UK, but the value of cash dispensed has fallen more.

As across the UK, the average withdrawal value in Jersey has been increasing post- pandemic, but the average, £106, is markedly higher than in the UK which is £89.

LINK considers that consumer cash access in Jersey remains satisfactory. A map showing the location of each ATM can be found at the end of this document. LINK applies the same criteria to Jersey as to the UK and consumers or indeed any interested body can request a cash access review through the LINK website https://www.link.co.uk/consumers/request-access-to-cash/.

LINK considers that consumer cash access in Jersey remains satisfactory. A map showing the location of each ATM can be found at the end of this document. LINK applies the same criteria to Jersey as to the UK and consumers or indeed any interested body can request a cash access review through the LINK website https://www.link.co.uk/consumers/request-access-to-cash/.

- Identify if there is a need for Government to intervene in any way, including to oblige all businesses to accept of cash or to consider phasing out cash completely.

Access to cash in the UK is protected through the Financial Services and Markets Act 2023.[2] This legislation gives cash access regulatory protections, introducing a requirement for the Financial Conduct Authority (FCA) of "seeking to ensure reasonable provision of cash access services in the United Kingdom, or a part of the United Kingdom". Through this Act, the FCA protects consumers through the Designation of financial institutions to provide access to cash and LINK as a co-ordinating body.

The FCA and the Act do not apply in Jersey. However, as noted above, LINK applies the same criteria for ATM free-to-use cash access as for the UK and will intervene if an access to cash issue is identified. This does not include LINK's separate co-ordinating body role assessing branch closures.

There is no legal protection in the UK for cash acceptance (Legal Tender has a very specific meaning relating to debt) [3]and it is left down to individuals, businesses and indeed government and other public bodies as whether to accept cash. Whether the Jersey authorities wish to intervene on a case-by-case basis, as they have with sports and swimming facilities, is a matter for them in the light of any identified issues. Looking wider, the European Central Bank has stated that it intends to ensure cash acceptance across the eurozone.[4] However, this has still to be implemented and the level of enforcement and compliance remains to be seen.

Any decision completely to withdraw cash would be a bold one and probably a world first. The needs of those who rely on cash would have to be addressed and measures put in place to ensure they can still make the payments they need. The needs of visitors and tourists visiting the island also need to be carefully considered. Lastly, history might suggest that where there is no cash or the public lacks faith in a currency or payment system, cash from other sources will fill the gap. In this case, one could envisage Sterling or the euro still circulating for person-to-person payments, a store of value or as a sort of unofficial grey economy.

Digital inclusion

The use of cash is declining and will continue to do so. UK Finance, the trade body for banks, has reported that the proportion of payments made by cash has fallen from 74% in 2000 to 14% in 2022 and it projects a further fall to 7% by 2032. Online shopping has grown massively and is particularly important in Jersey given that the small size of the island inevitably means a limited range of shops and these purchases will necessarily require payment by card. An increasing number of Jersey businesses are also moving to card only payments. They have assessed that the benefits, in terms of efficiency and security, exceed any possible loss of business. To require such businesses to accept cash would impose a significant cost on them and potentially a reconfiguring of their business practices, staff training and equipment. Where businesses do accept cash, it is not unusual for a higher price to be charged. In Jersey, for example, Liberty Bus charges £2.35 for a card payment and £2.80 for a cash payment, something which could be considered a tax on the poor, or at least on those who continue to use cash.

As we move forward, it seems increasingly likely that people who only use cash will be denied access to goods and services or will have to pay a premium. For these reasons, while maintain accessing to cash, it is equally important to promote access to digital services. A number of initiatives on this are currently being pursued. As a distinct community Jersey has scope and perhaps opportunity to be a leader in this respect. The lessons from the £100 payment to each individual as part of the post-COVID recovery merits exploring. The payment was not made in cash but rather by a pre-payment card or voucher. It is understood that take-up was almost universal and perhaps gave some people their first experience of using a card for payments generally as opposed to a card for a specific purpose.

Appendix – Map of Jersey ATM Locations, May 2024