The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

1240/5(4061)

WRITTEN QUESTION TO THE MINISTER FOR SOCIAL SECURITY BY DEPUTY G.P. SOUTHERN OF ST. HELIER

ANSWER TO BE TABLED ON TUESDAY 16th SEPTEMBER 2008

Question

Will the Minister identify for members the following data on the costs of Income Support (IS) -

- the total sum spent on the previous benefits and support systems replaced by IS, broken down into individual benefits;

Answer

The total sum spent on the previous benefits and support systems replaced by IS, broken down into individual benefits, is a matter of public record as set out in the 2007 Report and Accounts (R.59/2008) and the 2008 Business Plan ( P.93/2007)

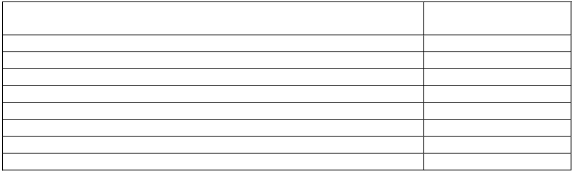

Extract from 2007 Report and Accounts (R.59/2008) £

HIE (States contribution) 1,441,460 Non native welfare / re care 6,674,956 Native welfare / res care 10,825,607 Family allowance 5,832,088 Attendance allowance 4,301,639 Disability allowance 1,191,251 Childcare allowance 630,938 Disability transport allowance 6,812,027 Milk at a reduced rate 385,628 Total 38,095,594

Extract from 2008 Business Plan (P.93/2007) £

Extract from 2008 Business Plan (P.93/2007) £

Rent rebate and abatement 23,936,000 Educational allowances 200,000 Home study grants 450,000 Additional res care costs 1,500,000 Transitional protection 9,700,000 GST protection 1,750,000 Winter fuel payment system 560,000 Total 38,096,000

These figures include administration costs.

Question

- the estimates for the total sum to be spent on IS broken down by components; Answer

The total benefit budget for 2008 is £77,049,100. This is made up of the sum of the figures above plus an allowance for inflation on the Social Security 2007 benefit budget. This budget covers Income Support between February and December and legacy benefits in January. The Income Support budget is not broken down by components as each household receiving Income Support receives an individual benefit depending not just on the components but also on the income of the household.

Question

- the overall sum delivered in the first 6 months of operation of IS; Answer

The expenditure recorded for February – July inclusive totalled £36,488,000.

Question

- the costs of adjustments already made to the IS scheme (to accommodate Attendance Allowance etc) and the extensions to transitional support and other proposed changes;

Answer

I repeat my statement made to the House on 3 June, 2008 :

"In September 2007, a paper describing the transition process and the calculation of protected payments was circulated to all Members. At that time, it was explained that it was impossible to provide accurate costings of the transition process until the number and make up of claimants eligible for transition was settled, shortly after the introduction of Income Support.

Accurate costings for transition have now been completed. Together with my Department, my Assistant Minister and I have considered these costings and I am announcing today that, within the existing budget provided by the Treasury and Resources Minister, we will extend the 100% protection for all claimants from this October until 27 January 2009, which will be a full year since the introduction of Income Support."

In summary, there is no additional budget needed in respect of the transitional arrangements already announced.

Additional transitional protection until October 2009 is proposed within Amendment 4 to the Annual Business Plan (P.113/Amd 4). As stated in the amendment the additional cost is £2.17 Million in 2009.

The annual cost of other enhancements announced in my 3 June Statement is as follows:

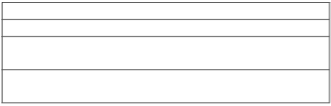

Enhancement Estimate of Annual Cost

Enhancement Estimate of Annual Cost

Adjust definition of lone parent £300,000

Provide PC3 to children without reference to parents £190,000

income

Provide minimum of PC1 for all IS claimants with No additional budget required – just a change 100% LTIA award in the application process

Amendment 4 to the Annual Business Plan (P.113/Amd4) also includes a proposal to increase Cold Weather Payments, at an estimated annual cost of £150,000 .

Question

- the total costs of GST support and annual uprating; Answer

The total costs of GST support and annual uprating are a matter of public record (P93/2007, P.89/2008) respectively.

Question

- the source of the sums referred to in d) and e) above? Answer

The sums in (d) and (e) come from the Income Support budget approved by the States last year and the 2009 estimates which will be considered in the debate of the Annual Business Plan for 2009.