The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

1240/5(3845)

WRITTEN QUESTION TO THE MINISTER FOR SOCIAL SECURITY BY DEPUTY G.P. SOUTHERN OF ST. HELIER

ANSWER TO BE TABLED ON TUESDAY 29TH APRIL 2008

Question

T he Minister for Social Security will table an answer to the following question asked by Deputy G.P.

Southern of St. Helier –

( a ) F u rther to my question of 1st April 2008 regarding Household Medical Accounts (HMAs) will the

Minister give the level of means assessment previously applied to Health Insurance Exemption (HIE) applicants, and list those benefits that were disregarded, along with that currently applied for Income Support (IS) in the case of households containing a single individual?

Answer

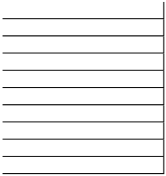

The table below sets out whether or not benefits were included in the income assessment of HIE and Income Support

Type of Benefit | Treatment under HIE | Treatment under Income Support |

Pension | Included with a fixed disregard | Included with a fixed disregard |

Social Security Benefits not otherwise listed | Included in full | Included in full |

Parish welfare | Included in full | N/A* |

Family allowance | Included with a percentage disregard | N/A* |

Maternity Allowance | Included with a fixed disregard | Included in full |

Long Term Incapacity Allowance (75% or above) | Included with a fixed disregard | Included in full |

Disability Transport Allowance | Not included | N/A* |

Attendance Allowance | Not included | N/A* |

Invalid Care Allowance | Not included | Included in full |

Child Disablement Allowance | Not included | N/A* |

Adult Disablement Allowance | Not included | N/A* |

Childcare Allowance | Not included | N/A* |

Survivor's Pension (paid to survivors under pension age) | Not included | Included in full |

Educational grants | Not included | N/A* |

* T hese benefits have all been replaced by Income Support. HIE status was only available to certain individuals:

It was available to lone parents with children under 11, who did not work more than 25 hours per week. It was available to pensioners who did not work more than 25 hours per week.

It was available to individuals with a 75% (or higher) LTIA award who did not work more than 25 hours per week

If the individual satisfied the conditions for HIE status, it was granted to a single person with an assessed income, excluding rent, of less than £145.50 per week and to a couple with up to £241.35 per week. These limits were increased for lone parents with dependant children.

Income support is available to anyone with an income below the limit set for their circumstances. As it takes account of personal circumstances, there is no single limit to receive income support. A single person, living in States accommodation at the fair rent of £143.50 per week, can have a gross income of up to £306.73 per week (if working) and £296.03 (if a pensioner) and qualify for income support. An individual with a disability or chronic illness is likely to qualify for additional assistance, which will increase the level to which benefit is paid.

Question

( b ) Can he yet confirm that all GPs will not charge the previously agreed £5 fee per visit directly to the

patient, and that this has now been agreed with GP representative bodies? Further, will he state what the average payment per visit to a GP was to be paid from an individual's HMA under the previous arrangement (with £5 direct) and whether this will change under the new arrangement, and if so how?

Answer

GPs in Jersey are independent businesses and will set their own fees, there is no statutory framework under which they are required to charge specific fees. A GP in Jersey may be a member of the Primary Care Body (formerly the Jersey Medical Society). This organisation is a non statutory professional association and membership is voluntary. The £5 consultation charge was originally proposed by GP representatives but most if not all surgeries have decided not to implement the charge.

The standard rate of saving for an HMA has been set at £0.49 per week per visit (on an annual basis). 49p per week represents £25.48 per annum, plus the medical benefit that is provided through the Health Insurance Law provides a total of £40.48 per visit.

We will monitor these rates carefully to ensure that they cover the average cost of a GP visit. GPs have historically provided a high rate of discounting within their fee structure and this needs to be taken into account when setting benefit rates.

Question

( c ) Is the Minister now in a position to confirm that where a person on IS, whether with a HMA or not,

requires home visits from their GP, the full costs of these visits is not allowed for in the calculation of the level of IS, and if so, will he assure IS recipients and GPs that these costs will be met from special payments?

Answer

If a person on income support does not have an HMA, the person is responsible for their GP costs, as they were before the introduction of income support. If the person has a serious illness requiring a number of home visits, or any other exceptional medical expenses, they can apply for a special payment under Income Support (Special Payments) (Jersey) Regulation 2007.

If a person on income support has an HMA, the level of saving will be set to match the expected number and cost of visits for that individual. As HIE was not based on an individual's clinical need, the Department does not have all the medical facts to set an appropriate rate tailored to the individual's medical need. It is necessary to have the individual's consent to obtain relevant medical facts and as such information is being gathered at present. It will thus take some time to complete this for all households with an HMA. In the meantime, individuals have been allocated a level of savings sufficient to cover 8 or 12 surgery visits per annum. This funding can of course be used in respect of a smaller number of home visits, or some combination of the two. Special payments are available for additional GP medical services.

If an individual has need of regular home visits, GPs can and are writing to the Department to confirm this need and thus the necessary arrangements regarding the HMA can be made to pay additional benefit into these accounts.

Question

( d ) Does the Minister accept that the removal of free access to a GP under HIE, which covered many

households on the lowest incomes, and its replacement with HMA rather than making these households better off under IS has made them in fact worse off?

Answer

No, those on the lowest incomes have benefited from the introduction of income support. Question

( e ) Not withstanding his answer above, will the Minister explain to members how the following example,

which typifies what Social Security actually delivers for many single people, transfers benefits to the least well off?

P r e v i o u s w eekly income = £165.76 (Invalidity Benefit).

S t a te s R e n t = £118.95 less abatement £80.43 = rent £38.52 = n e t A f te r Housing Cost (AHC) disposable income = £127.24 w it h f r ee a ccess to GP (monthly visits)

C u r re n t w eekly income = £165.76 (Invalidity Benefit)

T r a n s it io n = £80.43 split Housing £74.55 HMA = £5.88

R e n t a l p a y ment = £44.40

N e t A H C d isposable income = £165.76 – £44.40 – £5.88 = £115.44

T h is person's calculated IS is £74.62 therefore when transition support is removed in October of this year

he will be a further £5.81 worse off (before adjustment for GST and indexation). This person will have £17.61 less available to spend than he did in January.

F u ture Net AHC disposable income = £109.63

C a n t h e Minister justify a reduction of nearly 14% in this person's disposable income under Income

Support? Does this person, and many hundreds like him, qualify as one of the better off who were bound to be losers? Will he point out where, in any documentation or speech he has given to members, has he indicated that those existing on a single benefit were to be made worse off under his new scheme? Did he know that such an outcome would result from his scheme and if so, when did he know, and if not why not?

Answer

I can assure members that the example set out by the Deputy does not "typify what Social Security actually delivers" as it contains many errors and completely misrepresents the new system.

The Deputy suggests that the Income Support for this individual is £74.62. There is no explanation of this figure. The calculation of income support for a single person receiving invalidity benefit and paying £118.95p per week rent is as follows:

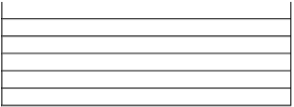

![]() Adult 83.58

Adult 83.58

Household 42.84 Accommodation 118.95 Clinical cost level 2 5.32 Total 250.69 Income 165.76 Income support benefit 84.93

Household 42.84 Accommodation 118.95 Clinical cost level 2 5.32 Total 250.69 Income 165.76 Income support benefit 84.93

In addition, Income support now provides two additional levels of personal care component that were not previously available. If this individual has a long term medical condition or disability, they are likely to qualify for one of these two new benefits.

If the individual qualified for the lowest rate personal care component, their benefit would be increased to £105.30 per week.

The question suggests that the individual is receiving transition support which will be removed in October. This is not correct. This individual is receiving Income Support at a higher rate than previous cash benefits and he will see an increase in Income support components in October 2008.

Question

( f) Is the Minister aware, and if so when was he aware, that the status of Attendance Allowance was to be

radically changed under his Income Support scheme in that this payment "for people who are severely disabled, who need constant care by day or night.. payable in addition to any of our benefits or allowances" (SS doc AA1, April 1998) is now not disregarded in the calculation for the level of IS and has therefore been effectively removed from many households?

Answer

Attendance Allowance is one of the 14 benefits that has been replaced by Income Support. As such, it no longer exists. Individuals with high personal care needs receive a personal care component under the Income Support Scheme.

Income Support has introduced 2 components that had no direct equivalent in the previous system. The personal care level 1 component provides £20.37 per week to individuals with some personal care needs and the carer's component (£41.79 per week) provides additional support to a full time carer in an Income Support household.

Question

( g ) Will the Minister point to any document or speech he has delivered to members which clearly sets out

that one of the consequences of the introduction of IS would be to remove this benefit from many households?

Answer

The States have debated propositions in relation to income support in 2004, 2005, 2006 and 2007. An RC was also published in 2004. The income support proposals have been subject to in-depth scrutiny analysis including two published reports SR 5/2006 and SR 17/2007. Public consultation has been undertaken. There are references to the replacement of disability benefits in all public documentation and each of the above States debates.

Question

( h ) In P.90/2007, Schedule 1 Part 2: Special Components B: Impairment Component, it states –

" T h e im pairment component replaces existing non-contributory disability benefits (such as Attendance

Allowance and Disability Transport Allowance) the fundamental principle in this benefit replacement is a move

from effectively a "universal" system of benefits to a targeted "means-tested" system. In a means- tested system there are no lump sums paid regardless of income and instead benefit decreases from a maximum figure as income rises until no benefit is received a t all."

W i ll t h e Minister clearly set out for members the income levels over which the means test operates and

the deduction rate applied in the case of –

(i ) a couple where one person is on attendance allowance and the other is in receipt of carers

allowance;

( ii ) a c ouple where one person is caring for a child with disability in receipt of attendance allowance? Answer

Members will be well aware that income support provides targeted benefit to low income families dependent on their income, rent and other personal circumstances. There are no fixed income levels. However, to illustrate the level of support that is available here are two examples. In both cases, a household with high personal care needs is compared with a household with no additional care needs.

- Married couple, living in onebedroom states flat:

Household A. One individual is disabled and receives the level 3 personal care component The partner cares for the disabled person.

Household B. The same married couple but without high personal care needs

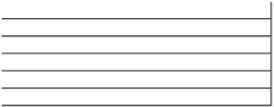

| Household A | Household B |

|

|

|

Income support components |

|

|

|

|

|

Accommodation | 143.50 | 143.50 |

Adult component | 167.16 | 167.16 |

Household component | 42.84 | 42.84 |

Personal-care level 3 component | 122.85 |

|

Carer component | 41.79 |

|

Total Components | 518.14 | 353.50 |

|

|

|

Income support benefit calculation |

|

|

Total components | 518.14 | 353.50 |

|

|

|

IS benefit payable | 518.14 | 353.50 |

This represents the maximum Income Support payable.

- Married couple, living in a three-bedroom states house, with two children,

Household A: one child has a severe disability.

Household B: The same household but with no personal care needs

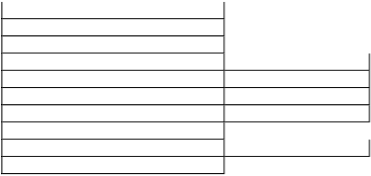

| Household A | Household B |

Income support components |

|

|

|

|

|

|

|

|

Accommodation 236.81 236.81 Adult and child components 280.00 280.00 Household component 42.84 42.84 Personal-care level 3 component 122.85

Accommodation 236.81 236.81 Adult and child components 280.00 280.00 Household component 42.84 42.84 Personal-care level 3 component 122.85

Carer component 41.79

Income support benefit calculation

Total components 724.29 559.65 IS benefit payable 724.29 559.65

As household income increases, Income Support benefit will be withdrawn until the household assessed income exceeds the Income Support components.

Question

( i) In 2006 there were 762 recipients of attendance allowance at around £400 per month. Will the Minister

inform members how many of those recipients are now in receipt of the equivalent of the personal care elements under IS and at what level of payment?"

Answer

Every individual who applied for Income Support, and previously was in receipt of attendance allowance, has been automatically allocated personal care component at level 3, with a component value of £122.85 pw, compared to a weekly value of attendance allowance of £102.63 pw. An additional component, the Carer's component (£41.79 per week) is now available to a carer looking after an individual with high personal care needs.

As members are aware, all income support households receiving income support at a rate below that of their previous benefit, are fully protected to the same level of benefit until October 2008. I gave an undertaking in the States on April 1 to produce a full report to States members on transitional benefits in May 2008 and I would like to maintain this timetable.

However, I must point out that there is an impact on officer resources which are continually diverted to answer the Deputy 's questions and address the misleading claims that they make. This may lead to a delay in the production of the report on transition.