The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

1240/5(4015)

WRITTEN QUESTION TO THE MINISTER FOR TREASURY AND RESOURCES BY DEPUTY G.P. SOUTHERN OF ST. HELIER

ANSWER TO BE TABLED ON TUESDAY 15th JULY 2008

Question

In answers given to members on 1st July 2008, the Minister advised that the yearly GST bill paid by the average household will be £626, but as this would only yield approximately £23 million if multiplied by the 37,500 households in Jersey, will he explain to members how he expects to reach the GST revenue target of £37 million excluding the finance sector?

Answer

The explanation is relatively straightforward, and the model used for the GST revenue projections has been in the public domain since early 2005. The Crown Agents final report issued in February 2005 provided the methodology, key assumptions, limitations and projected revenue yield for a simple GST system.

The report can be downloaded from http://www.gov.je/TreasuryResources/Tax/Tax Proposals.

This first model has been revised and refined each year since to take into account any changes in tax liability (approved by the States) and the availability of more relevant/recent data. It can be seen that the total GST yield is derived from a number of sources and not just the two (domestic consumption/households and financial services industry) that have been identified above.

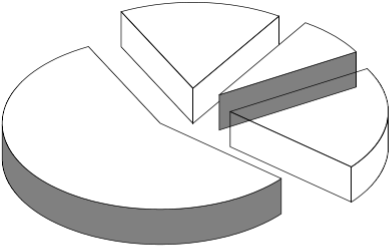

This is perhaps easier to understand from the illustration below:-

Estimated GST Yield (£ million)

visitor expenditure £6.8

irrecoverable input tax

irrecoverable input tax  £3.1

£3.1

![]() financial services £8.0

financial services £8.0

household consumption £23.2

This current model shows an estimated total GST yield of £41.1 million and takes into account the most recent data available from the Income Tax Office (2006 reported incomes) and the Tourism Department (2007 visitor expenditure).

I should add that the original estimate of between £40 – 45 million which was based on the simple GST design concept has been adjusted to take into account a reduction of the tax base as a result of further exclusions (mainly exemptions) which have subsequently been debated and approved by the States.