The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

Information requested | Minister's response |

Total spend to date on the Hospital funding strategy To include total costs of Treasury staff time | There have been three phases to the advice received by the Treasury in relation to the Hospital funding strategy. These are detailed below in chronological order, including a description of the work undertaken and the associated costs. Funding considerations and options review (£73,012.85) |

This advice involved a number of work streams including:

needs for the construction of the Hospital.

Advice was provided between June and September 2015, with a refresh in July 2016. Independent analysis and sensitivity testing of financial assumptions (£27,672.21) | |

This advice involved:

|

| Ongoing support and preparation for new public sterling bond issuance | |||||||

included:

& Resources, the Treasurer of the States and his officers.

Additional support and ad-hoc advice (£51,642.00) | ||||||||

| This built on the proposals already provided in preparation for a public sterling bond issuance as it responded to work additional to the original advice provided arising from various sources. It covered related analysis of various alternative funding solutions presented from time to time and assisting with responses to information provided by and requests from the Corporate Services Scrutiny Panel and their chosen advisers: Opus and CIPFA. All of which were considered as additional to a usual level of detail of analysis required. In addition the Treasury sought advice on new solutions for raising finance that had not been considered as part of the original proposition and confirmation that the original proposal for a public sterling rated bond remained the optimum solution. | |||||||

Total remaining budget available for the Future Hospital project | The remaining uncommitted budget on the hospital project as at the 30th June was £16,040,140. | |||||||

How much of the increase in tax revenue in 2016 was due to an increase in the number of taxpayers in 2016? | The tax revenue recognised in the 2016 States Accounts in respect of newly registered CYB taxpayers is £4.4m. The tax revenue recognised in the States Accounts for 2016 will include receipts derived in the year from new taxpayers, registered by the Taxes Office for the first time, that are in receipt of employment income. These taxpayers will have been registered as Current Year Basis (CYB) taxpayers for ITIS and will have been paying their 2016 tax liability throughout 2016. Taxpayers that are newly registered in 2016 but who are not in receipt of earned income (this will include for example taxpayers that are self-employed or pensioners) will be registered by the Taxes Office as Previous Year Basis (PYB) taxpayers. The tax revenues of PYB taxpayers registered in 2016 will not be included in the 2016 accounts. They will pay their | |||||||

| (2016 year of assessment) tax liability during 2017. Revenue from these taxpayers will therefore be recognised in the 2017 accounts. It is important to note that the revenues recognised for newly registered CYB taxpayers will largely be based on estimated income for the year of assessment. This estimated income will, in most cases, have been provided by the taxpayer themselves at the point of their registration. It is only once these taxpayers have completed the relevant tax return (issued in the January following the year they were registered) that their tax liability for the year of assessment will be finalised. | |||||||

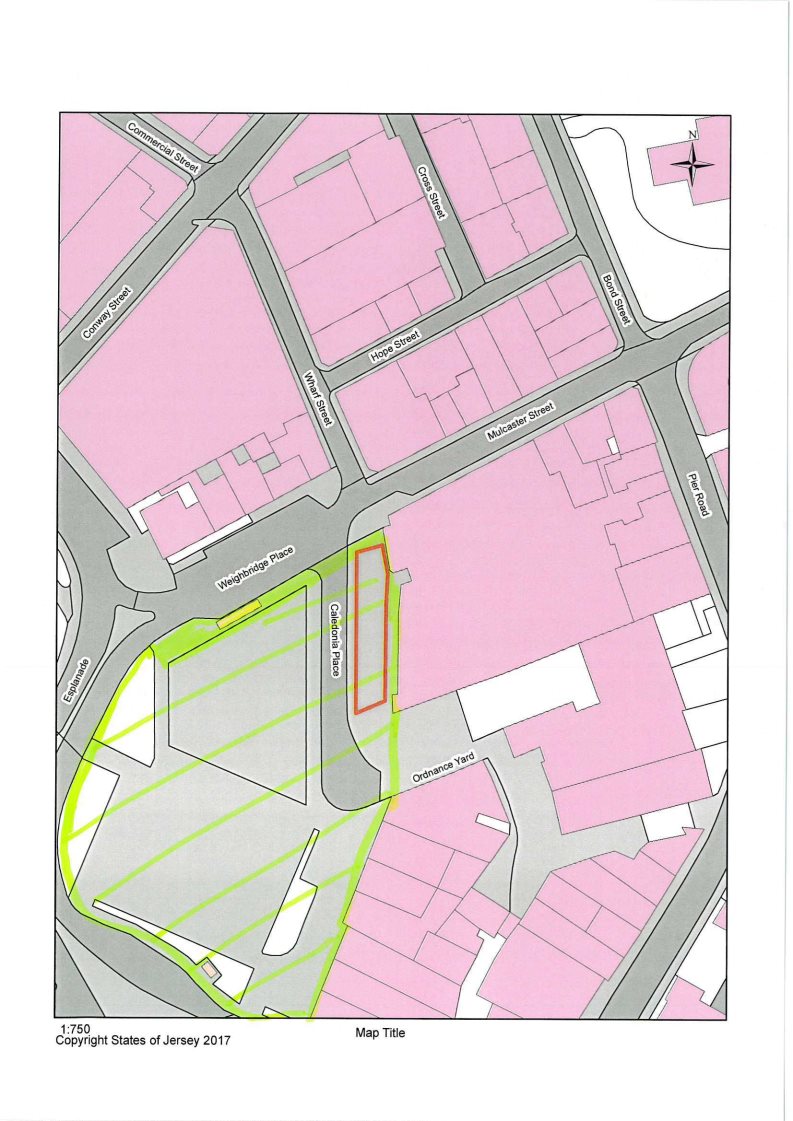

Clarification of the "Part of Public Square" listed to be sold in the States of Jersey Development Company 2016 Accounts | This is the Royal Yacht Al Fresco area as highlighted in red on the attached boundary plan. It is currently leased to the Royal Yacht and is in private use. This asset has been identified by SoJDC as appropriate for disposal to contribute towards ongoing costs. No formal proposal to agree to the sale has been presented to the Minister for Treasury and Resources and it is not anticipated that the Public will have an interest in acquiring this land. | |||||||

(Note 8). Clarify the Public Square concerned and the specific part to be sold and the reason for sale. | ||||||||

In relation to the assets held for sale as per note 8 of SOJDC 2016 Accounts; explain the | P.73/2010: "Property and Infrastructure Regeneration: The States of Jersey Development Company Limited", in its Appendix 7 sets out the "Protocols for the Transfer of assets to and from the States of Jersey Development Company." The principles contained in this state, "The States of Jersey ("SoJ") is establishing SoJDC as a development company. The prime purpose of SoJDC is to deliver regeneration projects to provide the best socio-economic benefit to SoJ. This will be in the form of enhancing the value of existing properties through refurbishment, the development of new properties, infrastructure and public realm. Regeneration assets may be retained by the Public (SoJ) or disposed of to realise capital proceeds. Property held by either Jersey Property Holdings ("JPH") or SoJDC will be consolidated within the SoJ accounts." | |||||||

reason for not complying with the exit strategy approved by the States in Appendix 5 of P.73/2010. For example, in P.73/2010, the Waterfront Hotel is listed as "Transfer to Jersey Property Holdings", however it has now been sold by SOJDC. | ||||||||

| Principles to guide policy on holding assets in the future, were set out in Section 8 of P.73/2010. This included:-

All investments held by SoJDC at the time P.73/2010 was approved by the States, were listed in Appendix 5 of P.73/2010 and a strategy for disposal identified. In the case of the assets recently sold/leases recently transferred the strategy identified is as follows: | |||||||

Investment property | Strategy | Comments | JPH position on disposal | |||||

Waterfront Hotel | Transfer to Jersey Property Holdings | Could be sold subsequently into the market subject to advice on timing of sale to maximise value, and protecting States position on subsequent reversion to higher value if hotel fails (covenant currently restricts to hotel use) | The Landlord (Department for Infrastructure') recommends the re- assignment of the lease as there are no reasonable grounds' upon which it can be refused. | |||||

| JEC substation | Transfer to Jersey |

| There is no apparent benefit for the Public acquiring |

| |||

|

|

| Property Holdings |

| the site at market value and it would therefore not oppose the proposed sale. |

|

Harbour Reach | Retain in SoJDC | It may be expedient for SoJDC to retain the asset whilst it continues to occupy it, rather than transferring to JPH and leasing back. | There is no operational use for the building and it would not recommend that it is acquired at market value by the Public. | |||

Clarification on why the annual dividend paid by SOJDC (representing car park income from the Esplanade car park as per R.7/2012) has stopped with effect from the 2016 accounting period. | In 2015 SoJDC agreed a new dividend payment profile with the States of Jersey as Shareholder covering the 5 year period between 2015 and 2019. The proposed dividend payments were as follows: 2015: £1 million 2016: £0 2017: £0 2018: £4 million 2019: £0 | |||||

| The payment for 2018 was subsequently amended to £5.8 million to reflect the increase in value that was forecast from the completion of the College Gardens development and the revised Dividend return was approved by States Members through the Medium Term Financial Plan (P.72/2015) on 8th October 2015. | |||||

Confirm the work being undertaken by the chief statistician on reconciling the taxpayer base, as per paragraph 3.4 of Work Stream 2 in R.30/2017, Review of Personal Tax. | The Tax Policy Unit expects to present its report on work with the Chief Statistician to reconcile the Personal Taxpayer Base (per Taxes Office data) to the Island's resident population (per Statistic Unit data) to the Treasury Minister by the end of September. The Treasury Minister will be happy to make the findings available to the Panel - and more widely - in due course. | |||||