The official version of this document can be found via the PDF button.

The below content has been automatically generated from the original PDF and some formatting may have been lost, therefore it should not be relied upon to extract citations or propose amendments.

Medium Term Financial Plan

General Questions arising from the Terms of Reference

- What overall expenditure limits were allocated to the Department in the 2012 Annual Business Plan for 2012, 2013 and 2014? Have the limits changed in the Medium Term Financial Plan and, if so, why has it changed?

The Panel is referred to answer 1(a) previously provided to the Chairman of the Corporate Services Panel in a letter from the Minister for Treasury and Resources of 20th June 2012:

The Panel is asked to refer to Slide 21 of the briefing pack provided to the Panel by the Treasurer at the recent briefings. For ease of reference this is reproduced below.

As can be seen from the slide there were no commitments for Treasury for 2013 and 2014 that were made in the 2012 Business Plan.

- What commitments for growth were made for the Department in the 2012 Annual Business Plan for 2012, 2013 and 2014? Have growth commitments from previous Annual Business Plans addressed the issues which prompted those requests for additional funding and, if not, why not?

See previous answer.

- What changes in staffing levels, if any, are being proposed that were not allowed for in the 2012 Annual Business Plan?

The proposed changes in staffing levels from the 2012 Annual Business Plan are the net impact of internal restructuring, CSR savings, interdepartmental transfers and growth bids. This is shown in the table below:

Treasury and Resources |

|

|

|

|

|

|

|

| |||

|

|

|

|

|

|

|

|

|

|

| |

Staffing Changes | |||||||||||

|

|

|

|

|

|

|

|

|

|

| |

| 2012 FTE | Net CSR and other changes | MTFP growth posts | 2013 FTE | Net CSR and other changes | MTFP growth posts | 2014 FTE | Net CSR and other changes | MTFP growth posts | 2015 FTE | |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Treasury & Resources |

|

|

|

|

|

|

|

|

|

| |

States Treasury | 104 103 43 7 - - | (1) | - | 103 95 40 8 - - | - | - | 103 95 40 8 - - | - | - | 103 95 40 8 - - | |

Taxes Office | (8) | - | - | - | - | - | |||||

Jersey Property Holdings | (3) | - | - | - | - | - | |||||

Corporate Procurement | 1 | - | - | - | - | - | |||||

Insurance |

|

|

|

|

|

| |||||

Pensions |

|

|

|

|

|

| |||||

|

|

|

|

|

|

|

|

|

|

| |

Total FTEs | (11) |

| - | - | - |

| |||||

- How does the Department's budget break down into service areas? How does that breakdown compare to that provided for within the 2012 Annual Business Plan?

The MTFP breakdown is at the same level of aggregation as the 2012 Annual Business Plan, with the exception of Central Allocations. Both the PECRS Pre-1987 Debt and Pre-1967 Pensioners budgets have been transferred from the Chief Minister's Department, as shown in the table below:

Service Analysis Headings | |

2012 | 2013 to 2015 |

|

|

|

|

Treasury Division | Treasury & Resources |

States Treasury | States Treasury |

Taxes Office | Taxes Office |

|

|

Resources Division |

|

Jersey Property Holdings | Jersey Property Holdings |

Corporate Procurement | Corporate Procurement |

|

|

Non-Departmental |

|

Insurance | Insurance |

| Pensions |

|

|

Central Allocations | Central Allocations |

Provision for Central Reseres | Central Contingencies |

Restructuring Costs | Restructuring Provision |

Corporate Procurement Savings Target | Central Pay Provision |

Central Pay Provision |

|

Terms 7 Conditions Savings Target |

|

|

|

- What existing services in the Department, if any, are due to be changed and, if so, how will they be changed?

There are no changes proposed. Efforts are being concentrated upon making existing service more efficient and effective, and on improving the already impressive level of cross-working within the Department. A number of examples were provided to the Corporate Services panel at the briefing given to them on 20th June. These include Procurement, Online Tax Filing, Pensions and Property.

- What will Carry Forward funding for 2012 be used for in the Department? What ongoing items, if any, have been funded through Carry Forwards?

Carry forward funding from 2012 will be used in 2013 to continue to fund the Pensions Review Project.

- What funding pressures are facing the Department and how will they be addressed?

The Panel is referred to answer 1(c) previously provided to the Chairman of the Corporate Services Panel in a letter from the Minister for Treasury and Resources of 20th June 2012.

- Which bids for growth in revenue expenditure have been taken forward? For those which have, is it proposed that they be funded from Growth expenditure; Contingency expenditure; Restructuring provision; or another source?

There is only one bid included in the MTFP. This is for Jersey Property Holdings for expenditure on H&SS property maintenance. The business case has been previously provided to the Panel but is attached again.

- Which bids for growth appear for the first time in the Medium Term Financial Plan and which relate to bids which have been made by the Department in previous years?

The prioritised growth bid for H&SS property maintenance of £630,000 in 2013, rising to £700,000 thereafter, reflects previous growth bids for increases in the base budget for property maintenance across the States portfolio.

The unsuccessful bid for £170,000 in respect of the 2015 interim property valuation follows the £300,000 sum allocated for the full valuation in 2012.

- Which bids for growth in the Medium Term Financial Plan were unsuccessful and what will be the likely impact?

The only bid for growth which was unsuccessful was for £170,000 FOR THE Interim Asset Valuation in 2015. This cost will need to be accommodated through efficiencies within the Department which will not affect service delivery.

- In which areas of the Department were CSR savings targets identified? Will the Department meet those specific savings targets? If not, in which areas will the savings not be met and what contingency plans, if any, does the Department have in place?

The Department has over achieved its CSR savings target. Savings have been delivered from a range of initiatives that have been successful in delivering a higher level of savings than targeted. Efficiency savings, managed post reductions, and changes to rents have contributed to the T&R CSR savings target.

More effective management of insurance risks under new contract terms secured in 2011 has been the main contributor to the over achievement of savings. A reassessment of insurance risk and the appropriateness of self insurance limits have enabled competitive insurance premiums to be achieved. Overall insurance savings achieved amount to £1.2 million. This exceeds the £586,000 savings target. The balance of insurance savings has been used to contribute to the corporate procurement savings target.

The table below shows the specific schemes which have been adopted to deliver T&R's CSR target.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

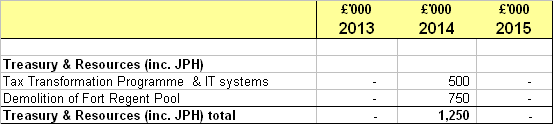

- What capital projects are proposed for the Department, both specifically for 2013 to 2015 and for the Long Term Capital Plan for 2012 to 2032?

In addition to this, there is £600,000 included in the 2012 Business Plan for Tax Transformation and IT Systems. These projects are described in the MTFP:

- Tax Transformation Programme & IT systems (£500,000 + £600,000 approved in 2012): This project is intended to implement a "Procure to Pay" purchasing system, and develop the Income Tax IT system as required by the Tax Transformation Programme.

- Demolition of Fort Regent Pool (£750,000): The pool has remained unused since December 2003. As a result, it has fallen into a poor state of repair and has become unsightly, a problem that is exacerbated by its prominent position. The estimated cost has been produced by Property Holdings. Consideration is being given as to whether this should be a revenue funded item.

There are no additional projects within the Long Term Capital Plan for Treasury and Resources.

- Have any capital projects been delayed or not provided for? No capital projects been delayed or not provided for.

- What policy changes being considered by the Department (but which have yet to be agreed and / or implemented) which could impact upon other Departments or the public?

The MTFP itself has been a major policy change which has affected all Departments. Implementation of this over the next three years will significantly improve Departments' ability to plan service delivery in a context of stable funding.

Changes being considered to the employee pension schemes (PECRS and JTSF) could also impact on Departments, for example if employer contribution rates change. Any proposed changes will, though, have regard to Departments' needs to attract suitably qualified and experienced staff from the UK if no suitable applicants are available locally.

- What new user pays' charges have been considered and which will be pursued? What increases to existing user pays' charges have been considered?

No new user pays charges are being considered. The financial value of licences granted by Jersey Property Holdings will be considered as they fall due for renewal.

- What requirement, if any, does the Department have for restructuring provision?

The table below provides an outline of the restructuring bids that have been approved. There are currently no bids under consideration or any potential future requirements.

|

|

|

|

|

|

|

|

|

| |||||||||||

|

|

|

|

|

|

|

|

|

|

| ||||||||||

|

|

|

|

|

|

|

|

|

|

| ||||||||||

|

|

|

|

|

|

|

|

|

|

| ||||||||||

|

|

|

|

|

|

|

|

|

|

| ||||||||||

|

|

|

|

|

|

|

|

|

|

| ||||||||||

|

|

|

|

|

|

|

|

|

| |||||||||||

- What sources of income does the Department have and what changes, if any, are proposed to the levels levied?

JPH has an income budget of c£5.4million for 2012. This is derived from three main sources:

Rental and FM charges to Departments £2.0m Rental and FM Charges to third parties £2.0m Fee income and general recharges £1.4m

None of the above are determined through levies'. Internal rents are currently charged on historic information.

A project is currently underway to reflect rental charges for office space at an approximate to local market rents. This will have the impact of increasing the JPH income figure and increasing departmental costs, where the rental paid for accommodation is currently nil or below market levels.

This will be reflected in changes to the respective budgets and will have a net nil' impact. The first full year of application will be 2013.

External Rents are normally charged to occupiers (licences and leaseholders) with reference to an equivalent market level. A reduced sum may be charged for charitable or community use and such variations will be subject to Ministerial approved.

Fee Income - The department generates some £1.2m income in respect of professional fees charged to capital works within JPH or for other departments (Architects, Mechanical and Electrical Design, Project Management and Clerks of Works). For major projects, these costs are set at a percentage of the contract sum. An hourly rate is charged for ad hoc works. The target is to recover costs rather than make a surplus.

The balance of £200,000 relates to a number of miscellaneous recharges and will vary from year to year.

- What funding, if any, does the Department receive from charitable or other sources in order to support the delivery of its services and for what purposes?

The Department does not receive any funding from charitable or other sources in order to support the delivery of its services

- What outstanding issues facing the Department, if any, have not been taken into account in the Medium Term Financial Plan?

Issues and challenges change. However the Department intends to manage its services within the existing MTFP cash limits by making the most efficient use of the resources available to it.

If applicable:

- What delivery plans have been developed to ensure that clear systems, action plans and success criteria are developed for the Strategic Plan priority entitled promote family and community values'?

The Treasury is very sensitive to the importance of promoting family and community values. This is of particular importance when considering tax policy, for example the extension of relief for child care costs. We are obviously unable to reveal Budget measures for future years in advance but the same principles will inform our decision making. A report on Impôts duty proposals has been provided to the Panel but is attached again to this document.

- What funding has been allocated to ensure the delivery of these plans?

No additional funding has been allocated. Promotion of family and community values is part of the Department's normal workload.